Let’s talk personal loans. They’re like a financial superhero swooping in for the rescue when you need a quick fix for those unexpected expenses or large purchases. But listen closely; paying on time is vital, especially in Singapore.

If you miss a payment or two, the consequences are harsher than a drill sergeant on steroids. Curious to know what happens if you’re unable to keep up with your personal loan repayments in Singapore? Keep on reading and embark on this journey of financial repercussions.

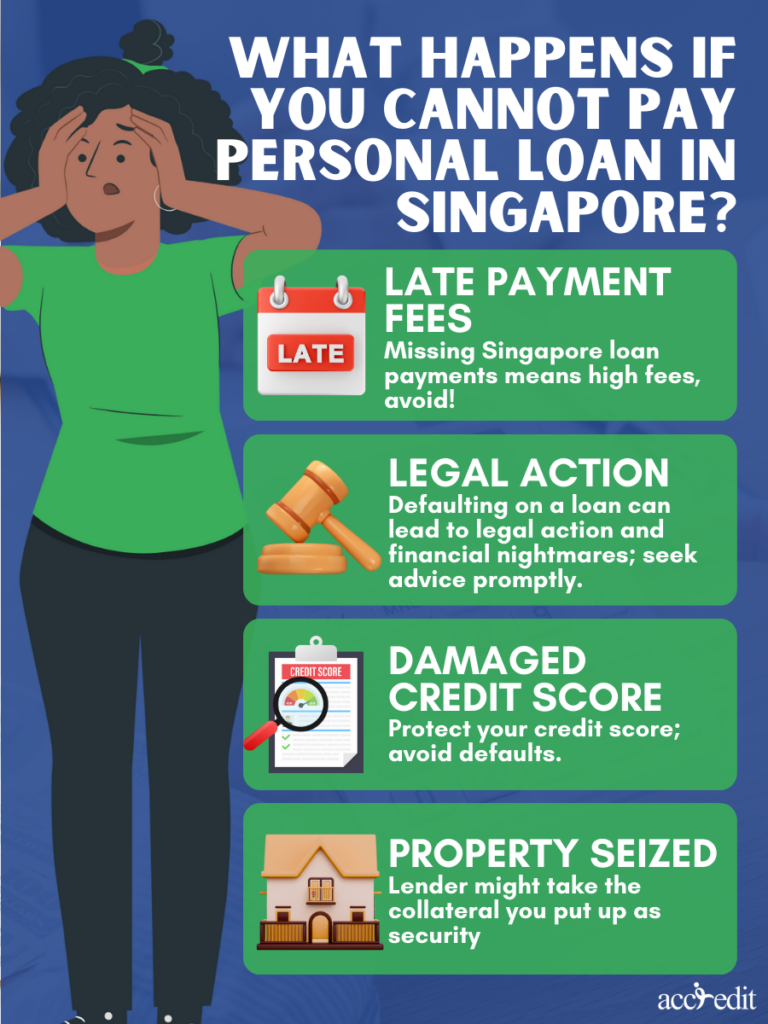

Late Payment Fees

You’re trying to pay off your personal loan in Singapore, but due to some unforeseen circumstances, you miss a payment. No biggie, right? Wrong! You’ll be charged a late payment fee from most lenders, which can rapidly stack up, making it more difficult for you to pay off your loan. These late payment fees can vary from a fixed sum to a percentage of your loan balance, piling on to your already-existing financial woes. Don’t let the cost of delaying personal loan payments drain your wallet.

Legal Action

We get it; defaulting on your personal loan can happen to the best of us. However, your lender may not be too forgiving and could resort to legal action to recover their funds. Brace yourself for extra fees, court costs, and the potential of a damaged credit score. Don’t let yourself become trapped in this financial nightmare. Seek legal advice promptly to resolve the situation. You don’t want to let legal troubles lurk around the corner and hit you with their full force.

Damaged Credit Score

Your credit score is more than just a number; it’s a symbol of your financial responsibility. A high credit score can unlock doors to countless financial opportunities like getting approved for loans and credit cards. Unfortunately, defaulting on your personal loan payments in Singapore can quickly become your Achilles heel. As if that weren’t bad enough, this can make it tough to earn credit in the future. Avoid making bad decisions that will hurt your credit score and instead adopt preventative measures.

Property Seized

Taking out a secured personal loan requires you to put your valuables at risk. If you default on your loan payments, your lender might take the collateral you put up as security. Knowing so, don’t let a secured personal loan become a one-way ticket to financial turmoil. Be sure you’ll be able to make the monthly payments and have a strategy in place to protect your assets before committing.

Ways to Avoid Defaulting on Personal Loans

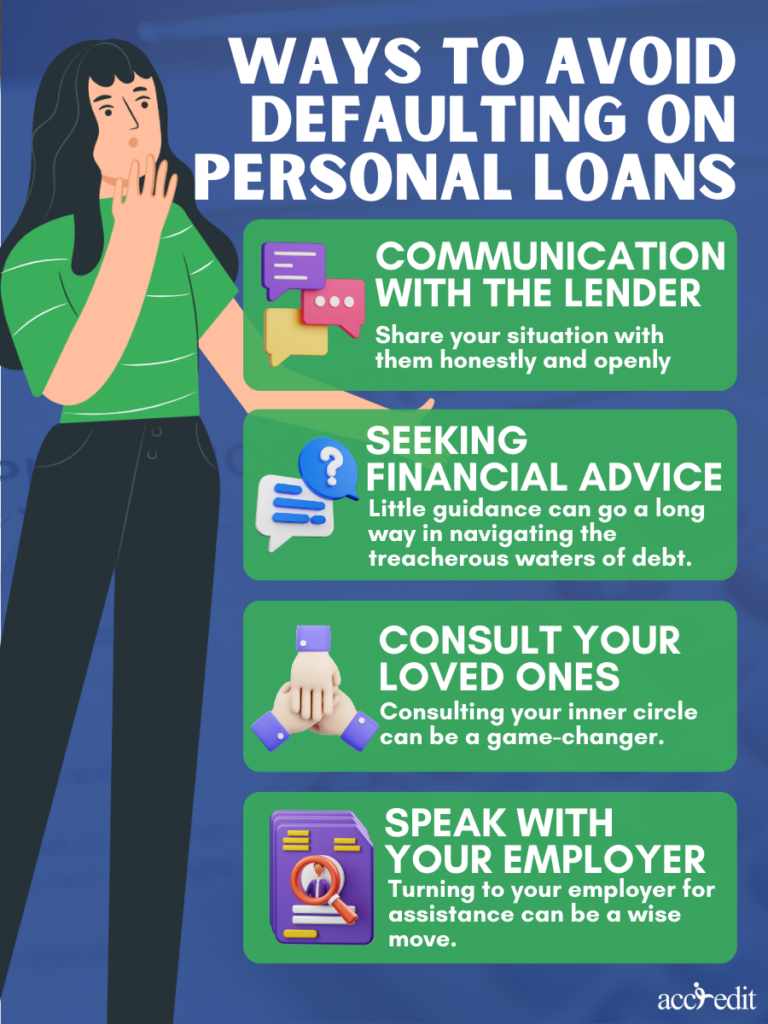

Communication with the Lender

When it comes to repaying your loan, don’t be afraid to establish communication with your lender. Don’t keep your financial predicament in the dark. Instead, share your situation with them honestly and openly. You may be astonished by the assistance that they can extend to you. Your lender could tailor-fit a payment scheme to meet your unique circumstances or even suggest a loan restructuring option to alleviate your debt burden.

Seeking Financial Advice

When debts become a burden, seek the wisdom of financial counselors. These counselors are experts at crafting tailored debt management strategies to bring you back to the sunny side of life. Singapore boasts many such resources, including credit counseling services and debt management programs. Remember, a little guidance can go a long way in navigating the treacherous waters of debt.

Consult your loved ones

When the chips are down and you find yourself grappling with financial troubles, consulting your inner circle can be a game-changer. Your trusted confidants, be they family members or close comrades, can offer an indispensable mix of both financial and emotional support when you need it most. Telling a trusted relative about your financial woes might get you a sympathetic audience and a fresh perspective, potentially unveiling options for resolving your situation.

Speak with your employer

In times of financial adversity, turning to your employer for assistance can be a wise move. Your employer could be a valuable partner in your financial journey, as some of them extend salary advances to employees in need. These advances can alleviate the burden of your financial predicament by providing an immediate cushion of relief. Reach out to the HR department to learn more about the advanced policies of your employer and unlock this invaluable benefit.

Thoughts

Meeting your personal loan obligations on time is paramount to dodge the negative aftermath of loan defaults. Late payment fees, legal penalties, loss of property ownership, and a compromised credit score are some of the potential outcomes that await those who fail to repay their loans.

If you’re grappling with mounting debt, it’s crucial to open lines of communication with your lender and seek professional financial guidance to carve out a personalized debt management roadmap. Taking swift action can help you regain control of your financial situation and avoid the hazards of loan default.

Experience Hassle-Free Loan Repayment with Accredit Moneylender

When it comes to securing personal loans in Singapore, finding a reliable provider can be a challenge. Luckily, Accredit Moneylender has got you covered. Our efficient approval process coupled with our competitive interest rates makes accessing the necessary funds a breeze. Moreover, our flexible repayment options are tailored to meet your specific needs, giving you the freedom to pay back your loan on your own terms.

Eliminate the burden of loan repayment from your life. Put your trust in Accredit Moneylender and discover the tranquility of uncomplicated loan repayment.

Visit our website now to apply for a loan and discover more about our services.