Money is essential in many situations. The problem is you may not have the extra funds to cover such expenses. You wonder if you can borrow from an unlicensed moneylender in Singapore.

The rising inflation rates and taxes are the dilemmas many people in Singapore often face. Many feel desperation and anxiety knowing traditional banks’ stringent regulations and policies. Some financial institutions in Singapore offer loans, but you’re unsure where you can go.

In this article, you’ll learn the crucial information on unlicensed moneylenders. Here, you’ll understand the essential details on moneylending in Singapore, threats and unfavourable results with unlicensed moneylenders, and where to acquire a legally regulated loan in Singapore.

Can You Borrow From an Unlicensed Moneylender in Singapore?

You cannot legally borrow money from an unlicensed moneylender in Singapore. It means you could borrow cash from these predatory moneylenders.

But the law notably prohibits you from doing so. These moneylenders must comply with specific authorisations stipulated by the Moneylenders Act or the Ministry of Law.

The Ministry of Law with the Registry of Moneylenders specifically and legally states that individuals without licenses to operate in the moneylending Singapore industry are illegally carrying their businesses.

Transiting with these illegal lenders would cause problems for you and your finances. The risks are exceptionally high.

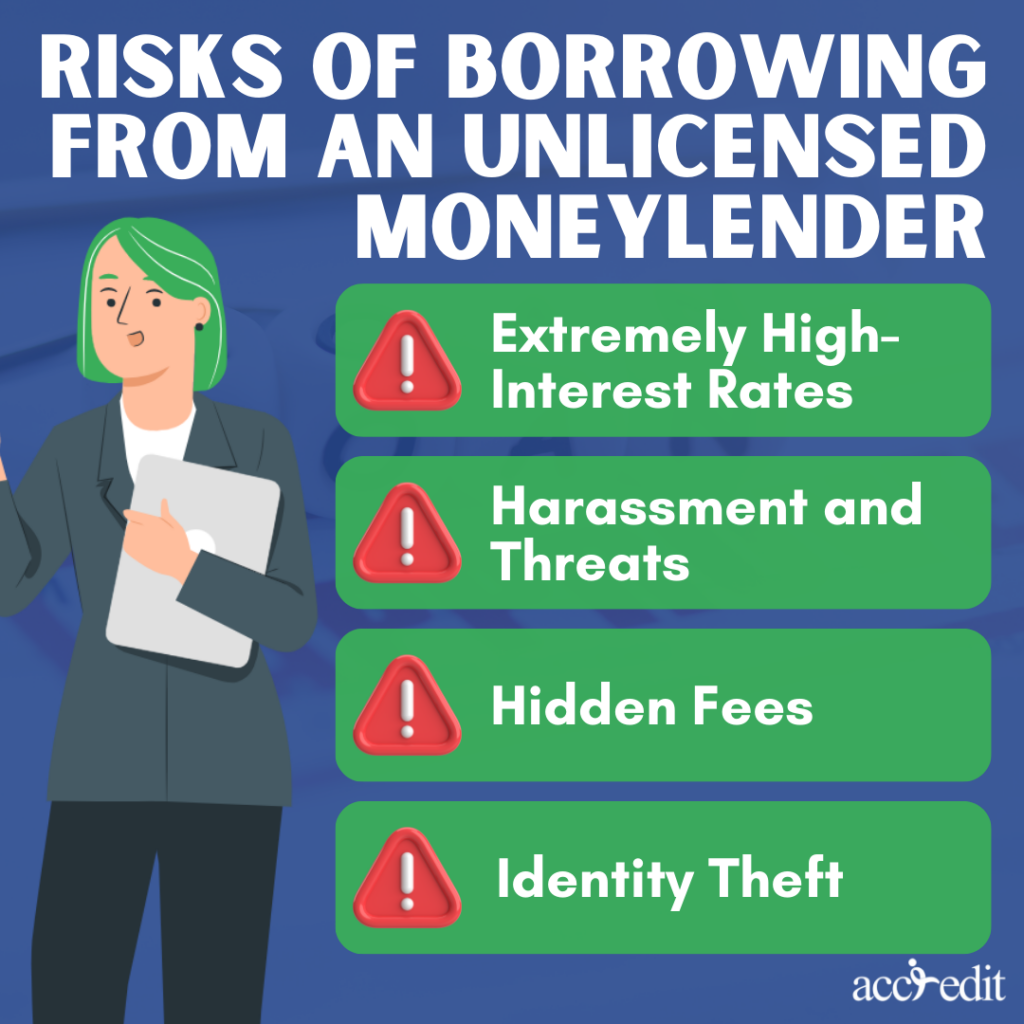

Risks of Borrowing from an Unlicensed Moneylender in Singapore

Moneylending in Singapore has been around for many centuries. It’s a lending industry that’s a legal business in the country. Unlicensed moneylenders operate outside the legal system, leading to severe risks and consequences for borrowers like you.

It’s unsafe to get involved with unlicensed moneylenders. Here are several reasons why it’s risky having a business with them:

- Extremely High-Interest Rates: Singapore’s illegal moneylenders can charge extremely high-interest rates. It can exceed 20% per month! The situation leads to an unmanageable debt burden.

- Harassment and Threats: These illegal lenders are severely aggressive. They use aggressive tactics to collect your debt. They’ll be harassing or threatening you or your colleagues and family.

- Hidden Fees: These lenders are notorious for hiding charges from their borrowers, mainly administrative or processing fees. This’ll increase the borrowing costs and may disrupt your budget and financial situation.

- Identity Theft: Unlicensed moneylenders target your data. Your personal information is a critical factor in most transactions in Singapore. They’ll likely demand your SingPass login details or NRIC numbers, the expected target. They’ll utilise your data to commit identity theft.

Unlicensed Moneylender’s Traits

Unlicensed moneylenders or ah longs operate in shadows. So, borrowers like you must be vigilant at all times. It can be challenging to identify them. They sometimes create fake websites to act like licensed moneylenders.

Here are some traits unlicensed moneylenders show, which includes:

- No physical offices or shops you can visit upfront.

- Unsolicited WhatsApp messages or SMS offering loans.

- Lacking license numbers on their advertisements or loan agreements.

- Requiring borrowers to pay fees to activate or process faster loan approval.

- Demanding borrowers to sign a blank or incomplete loan agreement.

Once these red flags are present, you must drop your transaction immediately. Borrowing from unlicensed moneylenders falls under a criminal offence. The laws cannot protect you effectively since you’ve breached the regulations.

You can’t or shouldn’t borrow from ah longs or unlicensed moneylender. What’s your best option?

Borrow from Accredited Moneylenders in Singapore

Moneylenders are individuals or groups whose business focuses on lending money to their clients or borrowers. The maximum amounts these moneylenders usually grant for loans are smaller than banks and other monetary institutions.

Although the total loan sum doesn’t equate to businesses in the banking industry, it is considered a riskier business industry. Because of the risks associated with moneylending, the Moneylenders Act has since regulated a reasonable fixed interest rate, fixed fees, charges, and loan caps to guarantee the business’ integrity and protect the borrowers in Singapore.

According to the Act, Singapore’s moneylenders are excluded, exempt, and licensed moneylenders.

Excluded Moneylenders

- These are any person or body that has been given the approval, licence, has registered, and regulated through the Act of Parliament to lend money by the Act or under any written law that is either authorised or permitted or not prohibited to lend money in the country.

- Pawnbrokers are licensed under the Pawnbrokers Act 2015, and credit societies are registered under the Co-operative Societies Act 1979.

- Individuals who lend money only to accredited investors from the Securities and Futures Act 2001 section 4A.

- People who lend money purposely for the benefit of employment.

- Individuals who lend money only to trustees or trustees-managers, corporations, limited liability partnerships, and real estate trustees for real estate investment trusts purposes.

- For individuals who desire to acquire the classification as an excluded moneylender may refer to the Moneylenders Act section 2. In addition, seeking legal advice would help applicants to comprehend whether their businesses fall under the excluded moneylender category.

Exempt Moneylenders

These are the moneylenders in Singapore who can lend money through an exemption provided under sections 35 and 36 from holding a licence.

The Moneylenders Act section 91 stipulates the exemption of one’s business from every provision of the same Act. The application has to be sent to the Ministry of Law’s Registry of Moneylenders with details prepared for;

- Write up on the applicant’s recent business activities

- Applicant’s profile which can include moneylending or related business experiences

- Grounds for appealing the exemption

- ACRA issued a copy of the applicant’s Business Profile

- Applicant’s contact details like telephone and fax numbers

- Borrowers’ profiles

- Fees and interest charges that the applicant plans to charge

- Exemptions sought on detailed descriptions of every activity

- Exemption draft scope to which the Registry would consider the applicant’s request

- Fees to become an exempt moneylender would range between $1,000 to $4,000 annually, with a validity period of up to three years.

Classifications of exempt moneylenders are;

- Carrying on moneylending in Singapore and granting consumer or personal loans to borrowers

- Giving loans as a moneylender in Singapore for those specified current business activities of the applicant

- Carrying on moneylending business to people associated with the applicant’s business or related activities

Licensed Moneylenders

- These individuals or groups can lend money with their license acquired from the Registry of Moneylenders by passing all the tests required by the law.

- The functions of moneylenders and their moneylending businesses are similar to financial institutions and banks, primarily in granting the loans the borrowers requested.

- Late payments by borrowers are subject to a proactive approach by licensed moneylenders through sending important notifications and reminders. Legal methods are in order when borrowers fail to pay the funds they owe the licensed moneylenders in Singapore.

- Licensed moneylenders are strictly prohibited by the Moneylenders Act to disrespect or harass their borrowers. These actions are equivalent to jail time, fines, and being struck by the cane when the perpetrators are found guilty of such acts.

So, to build a legitimate company to lend money in Singapore, it is essential to follow the Moneylenders Act and become a licensed moneylender.

Loan Types from Licensed Moneylenders

Licensed moneylenders in Singapore are under regulations by the Ministry of Law and Registry of Moneylenders. All legal moneylenders follow the Moneylenders Act, which protects and respects borrowers like you and registered lenders.

Among the regulations you may expect are the different types of loans accessible from a licensed moneylender. The loan products are various to meet your financial needs.

Licensed moneylenders in Singapore offer these types of loans, including:

- Personal Loans

- Foreigner Loans

- Payday Loans

- Business Loans

- Debt Consolidation Loans

Licensing Process for Moneylenders in Singapore

Applying to lend money in Singapore is accessible via visiting the Ministry of Law’s Registry of Moneylenders. All individuals and groups interested in being part of the moneylending in Singapore have to pass several tests.

The tests are the Moneylender’s Test, where applicants and the Test-Qualified Manager must pay a non-refundable fee of S$130.

A Test-Qualified Manager’s role in moneylending in Singapore guarantees all regulations and laws under the Moneylenders Act and Rules. These are followed by those considered professional financial service providers in the country.

Singapore’s Licensed Moneylenders and Moneylending

As soon as licensed moneylenders have completed the necessary tests, prepared and filed documents, and enlisted in the Registry of Moneylenders, these people or groups may grant loan requests to you as their clients or borrowers.

The advantage of choosing a legal moneylender in Singapore is its competitive market, allowing you to request loans even on weekends. Many often encounter financial problems when banks or financial institutions are not available. Because of situations like these, moneylenders in Singapore become a primary choice to seek financial assistance regardless of the day.

In addition to this, licensed moneylenders in Singapore can process and grant loans in less than a day. You must provide the necessary documents to ensure a fast and efficient loan process.

Maximum Loanable Amount from Licensed Moneylenders:

The licensed moneylender’s responsibility is to offer financial assistance to the people working and living in Singapore. The qualified borrowers under the regulations of the Moneylenders Act are Singapore Citizens, Permanent Residents, and foreigners residing in the country.

The maximum loanable amount is a regulation for the Act to limit instances of overborrowing and prevent moneylenders from going overboard with loan grants.

The maximum loanable amount from personal loans shall be based on your annual income, such as;

- Annual income is less than $10,000. A Singapore Citizens and Permanent Residents’ maximum loanable amount is $3,000. Foreigners residing in Singapore can get $500.

- Singapore Citizens, Permanent residents, and foreign work pass holders with at least $10,000 and not exceeding $20,000 can borrow as much as $3,000.

- Individuals living and working in Singapore with an annual income of at least $20,000 have a maximum loanable amount of six times their monthly income.

Interest Rates and Fees:

Choosing a licensed moneylender in Singapore guarantees regulated interest rates and fees. On October 1st, 2015, the Moneylenders Act stipulated fixed numbers about interest and fees to borrowers.

Nonetheless, even with its fixed structure, the profits attainable are worthwhile. See the fixed caps below.

- The charges for the one-time administrative fee are up to 10% only of the principal loan. It should not go beyond that specific percentage.

- The interest rate is 1% to a maximum of 4% monthly.

- Late payments would lead to a late interest rate of 4% monthly.

- Late fees are $60 monthly and must be, at most, the specific amount.

These are the current interest rates and fees licensed moneylenders in Singapore impose on their loans. To obtain further clarification on such charges, cautiously and carefully read the loan terms and conditions.

If you notice some issues or slight illegal lending activities, you must report them to the relevant authorities.

Reporting Unlicensed Moneylender and Moneylending Activities

What should you do when you come across or possibly suspect the lender you’re working with could be engaging in illegal moneylending activities? You must report them to the relevant authorities.

Contact the National Crime Prevention Council’s X-Ah Long or the anti-loansharking hotline at 1800-924-5664. File a complaint or report with the Singapore Police Force online, i-Witness, or to the police station nearest your location.

Reporting ah long or unlicensed moneylenders help protect you and others from their illegal moneylending activities. Remember that anyone who breaches the Moneylenders Act shall be penalised for this legal error when proven guilty.

The punishment for guilty groups or individuals is paying fines between $30,000 and $300,000, facing jail time for up to four years and may obtain six strokes of the cane.

Unlicensed Moneylender vs Licensed Moneylender

Regardless of your current financial situation, you should avoid borrowing from an unlicensed moneylender. Imagine you seek them to borrow cash, but they will only give you high-interest rates and hidden fees.

You won’t have peace of mind. They’ll continue to harass and threaten you.

The lending practices they do are entirely illegal. If problems arise, you only gain poor dispute resolution as they operate beyond the government’s legislation.

Choosing a licensed moneylender in Singapore is best, as the laws will protect you to your full potential. The loan amount, interest rates, fees, and loan agreement are transparent. You become aware of the total loan amount and your loan responsibilities.