Borrowing money is like crafting a piece of pottery, isn’t it? Each step must be measured and purposeful, just as each touch on the potter’s wheel. So, it’s natural for you to search for the supreme money lender in Singapore near you, especially when financial issues arise.

Creating a vessel that won’t crumble under pressure requires thought and intuition. Are you ready to complete a fantastic piece of art and finish your monetary problems? If that’s the case, begin your journey now!

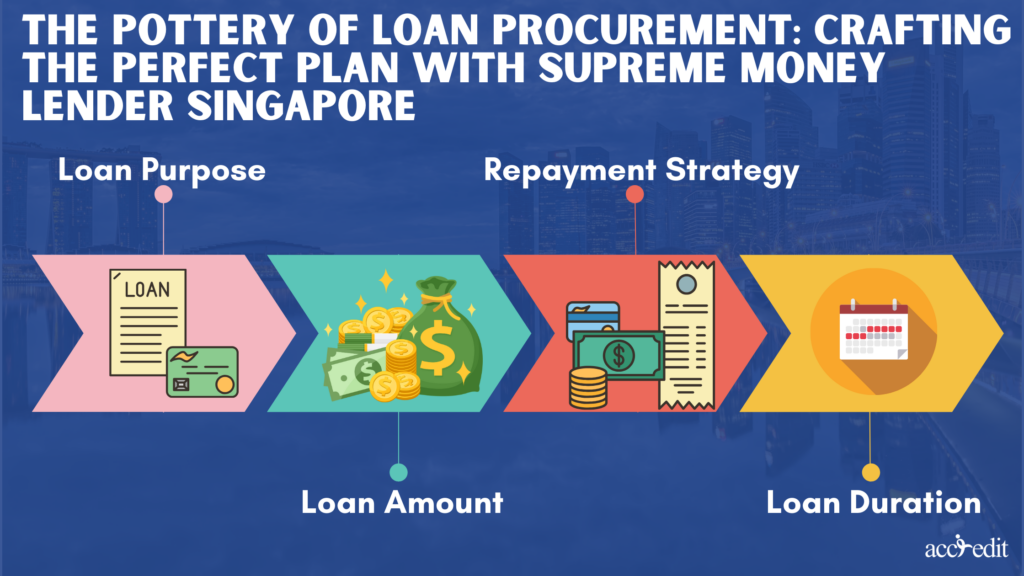

The Pottery of Loan Procurement: Crafting the Perfect Plan with Supreme Money Lender Singapore

Think of yourself as a potter. It isn’t right to start spinning the wheel without a vision, correct? As it’s crucial not to venture into the lending world unprepared.

You wouldn’t want to end up with a warped vessel, now would you?

To begin the loan procurement process from a licensed money lender in Singapore near you, you have to define the following:

Loan Purpose:

Do you seek a money lender in Singapore near you for a personal loan?

Or is this for a business startup, a real estate investment, or debt consolidation?

Your loan’s purpose will guide your search for Singapore’s top money lenders, as some specialise in specific loan types.

Loan Amount:

How much cash do you particularly need?

Per the Moneylenders Act, Singaporean and non-Singaporean borrowers may borrow up to specific loan amounts. It will rely primarily on your income, so present all necessary documents like proof of income, identification, residence, bank statement, and employment proof.

Thus, when you find a money lender near you, you only need to borrow an amount you can comfortably repay.

Repayment Strategy:

How will you repay the loan?

Do you have a steady income or depend on unreliable sources like sales or commissions?

Or do you have other debts to service, family expenses or school fees?

Understanding your income flow and financial status is crucial before you search for the best money lender in Singapore. It’s a wise decision, too, since you know how to repay your loan without problems or fall late on your dues.

Loan Duration:

How long do you need the loan?

A shorter-term loan usually has a higher monthly repayment but lesser interest overall.

Like a professional potter appraising the clay, take the time to understand your circumstances and make a plan. Only then can you shape the perfect vessel to your terms and capacity.

Carving Out the Details: Understanding the Money Lender Singapore in Your Vicinity

Choosing a money lender in Singapore is like carving a sculpture – precision is the key. Here’s a checklist to guide your financial craving knife:

Licensing:

Does the Singaporean Ministry of Law license the lender?

Unlicensed lenders can be dishonest, often leading borrowers into debt traps. It’s not the ideal situation you will find yourself in.

Thus, check the Registry of Moneylenders to confirm the lender’s license and legitimacy.

Interest Rates:

What rates do licensed money lenders in Singapore offer?

Remember, the law in Singapore caps the interest rate at 4% per month. It’s the maximum number that legal lenders should abide by.

Reviews:

Reviews from the money lender’s previous clients would grant you a glimpse of the truth about their experience.

Once you have chosen a lender that’s nearest you, check for reviews. Whether positive or negative, it’ll give you a chance to balance if the lender you chose is legitimate and other information crucial to your transaction.

Transparency:

Are the lender’s terms and conditions clearly outlined and easily understood?

If so, then you can trust this lender near you. Because they focus on providing you with precise services that borrowers like you deserve the best.

The right money lender in Singapore can shape your financial future. It’s essential to carve out the details as meticulously as possible. It’s for you to avoid problems in the future.

Weaving Your Safety Net: Protecting Yourself from Loan Sharks

As a skilled weaver interlaces threads to form a sturdy fabric, you must weave a robust safety net against loan sharks or unlicensed money lenders. Here’s what you must know:

High-Interest Rates:

Legitimate money lenders will adhere to the maximum interest rates set by Singapore’s Ministry of Law Moneylenders Act.

Loan sharks will demand more than 4% interest rates per month. It can sometimes reach more than 20% interest, so be mindful of what a nearby lender offers you.

Illegal Practices:

Loan sharks, or “Ah Long”, often use intimidation and harassment to abuse and manipulate their victims to pay up. These practices are illegal.

Thus, even if the lender you have contact with is nearest your area but does all these approaches and more, it’s time for you to change lenders right now!

Unsolicited Contact:

If a lender contacts you without prior engagement, be wary. Legitimate money lenders in Singapore don’t use intrusive marketing tactics.

Always focus on weaving your safety net well and choose legal money lenders at your side. Knowing these details will protect you from the explosive situation of borrowing.

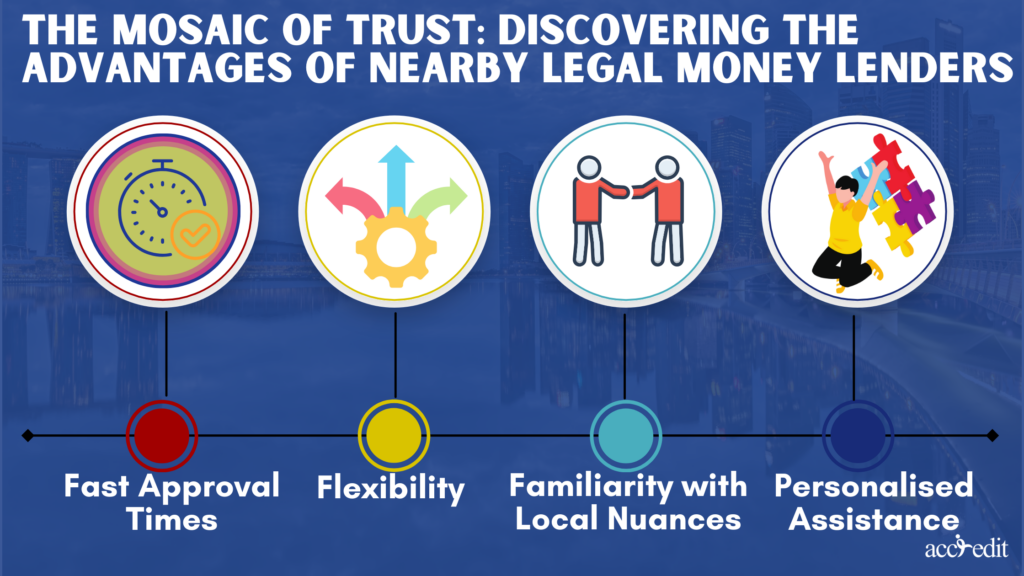

The Mosaic of Trust: Discovering the Advantages of Nearby Legal Money Lenders

Selecting a local and legal money lender is like creating a mosaic. No matter how small, each tile makes the whole image that fits your financial needs.

Here’s what your mosaic could look like:

Fast Approval Times:

Local lenders often have speedier approval times compared to big banks. It can be within the same day of your loan application.

Flexibility:

Smaller lenders are typically more flexible, making negotiating terms that suit you easier.

Familiarity with Local Nuances:

Local lenders have an in-depth understanding of the local financial landscape, enabling them to provide more suitable options.

Personalised Assistance:

You are not just another account number in the money lending industry of Singapore. In truth, you are a valued customer.

Thus, legal money lenders in Singapore, like Accredit nearest you, focus on granting you the best-personalised service for every financial situation.

Framing Your Masterpiece: The End of Your Borrowing Journey with Legal Money Lender Singapore Near You

The search for a legal money lender near you is like a work of art and must be appreciated once completed. Look back and contemplate – have you learned about your financial capacities?

Do you feel more confident about cruising financial terrain? And, most crucially, would you consider this journey an artful monetary masterpiece?

As you’ve kneaded the clay, carved the details, woven your safety net, and appreciated the mosaic. It’s time to seal your artistry of searching for a legal money lender in Singapore near you. You can envision it similarly to how Batik paintings are full of wax.

Always review your options, and search for the supreme legal money lenders at the Registry of Moneylenders. In addition, assess the Moneylenders Act regarding seeking lenders, especially when evaluating the loan terms and agreement.

As you do all these, it grants you a closer step towards securing your loan with Accredit. Remember, your financial trip is as unique as your artistic monetary choices. It’s always your masterpiece to create.

Bonus Chapter: Accredit

Singapore’s fantastic financial panorama, Accredit, shines the brightest with a reputation of trust, professionalism, and fairness. Considering Accredit in searching for “money lenders near you” might guide you towards a bright and secure future.

And there you have it! An artisan’s guide to finding the best legal money lenders near you. Now, it’s time to pick your tools and create the financial masterpiece you’ve been dreaming about.