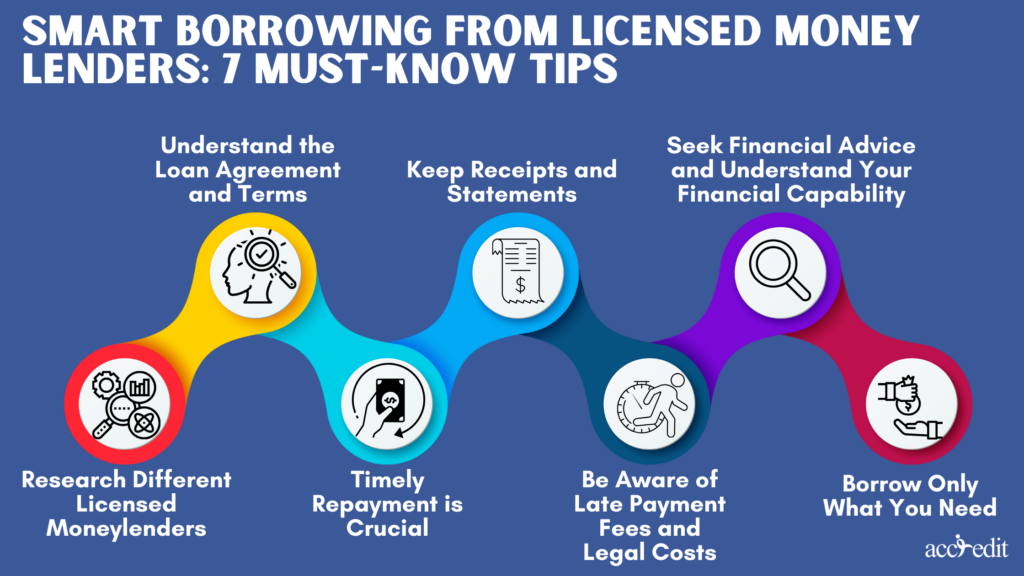

Are you caught in a financial maze and thinking about borrowing money from licensed moneylenders in Singapore? Before you dive in, it’s vital to grasp the borrowing process and key factors to consider. This ultimate guide will spill the beans on seven essential things you must know before getting a loan from licensed moneylenders. Armed with this knowledge, you’ll be equipped to make responsible financial choices and enjoy a smooth borrowing journey.

1. Research Different Licensed Moneylenders

Not all licensed moneylenders are cut from the same cloth. To find the perfect fit for your needs, embark on a quest to explore and compare various lenders. Take a stroll through the interest rates, repayment terms, customer reviews, and the lender’s reputation. Don’t just settle for the first tempting deal that beckons you like a hawker stall on a busy street. Be an explorer and make an informed decision by venturing into the world of licensed moneylenders.

2. Understand the Loan Agreement and Terms

Before you sign your name on any loan agreement, take a magnifying glass and scrutinize the terms and conditions. Make sure the moneylender hands you the right amount of the loan principal, and that they don’t pocket more than 10% of it as an upfront fee. Pay close attention to the repayment terms, including the frequency of instalments, interest rates, and any sneaky hidden fees. Unravel the secrets of the terms, so you’re not ambushed by unexpected charges later on.

3. Timely Repayment is Crucial

When dealing with licensed moneylenders, remember that time is of the essence. Pay your loan instalments on time like a clock ticking to avoid getting slapped with late payment fees and extra charges that multiply like a colony of ants. Set up reminders or automate your payments to ensure you never miss a beat. By being a responsible borrower, you’ll keep your financial scorecard shining and foster a harmonious relationship with the moneylender.

4. Keep Receipts and Statements

Transparency is key when it comes to financial transactions. Every time you make a repayment towards your loan, the moneylender should provide you with a receipt. Make sure to check the receipt for accuracy, including your name, the amount paid, and the date of payment. It’s important to retain these receipts as evidence of your payments. Additionally, request a statement of account twice a year (in January and July), and comb through it meticulously for accuracy. By maintaining a record of all your loan transactions, you can navigate any discrepancies that may emerge.

5. Be Aware of Late Payment Fees and Legal Costs

Beware of the lurking dangers when it comes to late repayments. Moneylenders are entitled to charge a fee not exceeding $60 for each month you delay payment. To escape these additional traps, fulfill your repayment obligations on time. And if, by ill fortune, the moneylender must resort to legal means for loan recovery, they may unleash the Kraken of legal costs as ordered by the court. Stay ahead of the game by being proactive with your repayments, dodging unnecessary expenses, and maintaining a solid financial standing.

6. Borrow Only What You Need

In the land of loans, it’s easy to get lured into borrowing more than you need, especially when loan approvals are as plentiful as famous Singaporean hawker food stalls. But exercise restraint and borrow only what you truly require. Remember, every loan comes with a price tag—the interest rates. By borrowing only what’s necessary, you can minimize the weight of those interest charges over time. Analyze your financial situation with a discerning eye and determine the exact amount you need to satisfy your requirements without drowning in debt.

7. Seek Financial Advice and Understand Your Financial Capability

Before you embark on any borrowing expedition, consider seeking counsel from financial experts or credit counseling agencies. These sages possess the wisdom to enlighten you and help you evaluate your financial capability. Understand your income, expenses, and existing financial commitments to ascertain whether taking on a loan is the right path for you. By seeking guidance from these financial gurus, you’ll gain the power to make informed decisions and avoid unnecessary financial turbulence.

Accredit Moneylender: Your Trusted Partner in Financial Solutions

Looking for a trustworthy companion to help you with your financial needs? Look no further, because you’ve found us – Accredit Moneylender! We’re here to be your reliable partner in finding efficient and dependable financial solutions. We’re shaking things up in the lending industry right here in Singapore, and we can’t wait to show you why we’re different. Check out what sets us apart:

- Streamlined Application: Swift and hassle-free process leveraging technology.

- Reduced Waiting Time: Say goodbye to long waits with our speedy approvals.

- Tailored Repayment Terms: Flexible plans that fit your financial capabilities.

- Ministry of Law Compliant: We follow regulations, and interest rates are capped at 4%.

- Trustworthy and Responsible: We guide you honestly and responsibly.

- Dedicated Loan Specialists: Personalized guidance and support.

The Bottom Line

Remember these key points when borrowing from licensed moneylenders in Singapore: research and compare lenders, understand loan terms, stay organized with repayments, be aware of fees, seek financial advice if needed, and borrow only what you truly need. Trust Accredit Moneylender for reliable service and dedicated assistance. Choose us for the financial solutions you need.