Sometimes, traffic lights are fascinating because it gives Singapore’s roads a festive look, but there’s more to it too! It’s comparable to the Registry of Money Lenders Singapore backstory.

Unlock the efficient hacks to mastering moneylending in SG with further details of the Registry. So, let the course begin!

The Emergence of the Registry of Money Lenders Singapore

What can you say about the Ministry of Law?

Well, for any Singaporean and non-Singaporean individual in the Lion City, you know it is stern with its ordinances and regulations. That’s perfectly fine, knowing that it serves best when hot to ensure the safety of every person in the city-state.

But did you know its role is not only to impose laws in Singapore?

In truth, it can give birth to diverse divisions that will be of great use to all borrowers in Merlion Island. The Registry of Money Lenders Singapore was born from the Ministry of Law’s vision. It first took its life-changing breath back in the 1950s.

Why, you ask?

It’s to help borrowers like you choose only the regulated licensed moneylenders in SG. They are also proficient in watching the comings and goings in the moneylending playground. With it, you have the assurance of experiencing smooth and safe transactions between lenders and borrowers.

What other attributes does the Registry have to offer?

The Registry in the Moneylending Industry

Let’s say you have found yourself on the financial chessboard, and it seems you cannot win the match. Hold on, and wait a moment!

Sometimes, the first glance at your financial responsibilities can be scary but do not despair. You have lenders you can call on. They are the rooks, bishops, knights, and even the queen.

The Registry of Money Lenders Singapore is the king. Without the king, the game is soon over, right?

Just so that the Registry’s vital to keeping the moneylending game fair and square above board. The Registry doesn’t just keep a list of names; it’s also a custodian of trust in the lending empire. It’s also the best when protecting the integrity of the marketplace while maintaining a borrower-friendly environment.

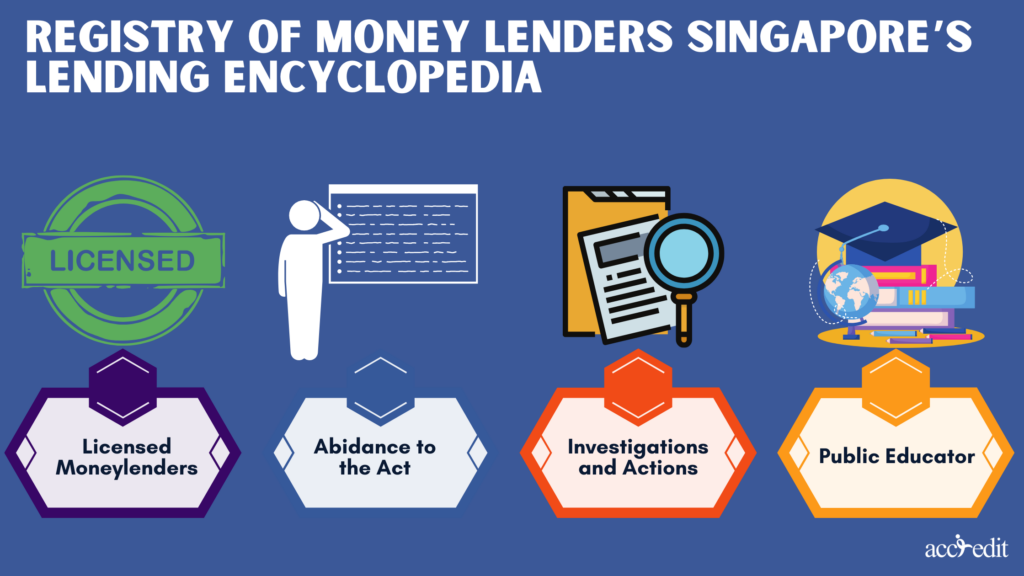

Registry of Money Lenders Singapore’s Lending Encyclopedia

To be clear, how does the Registry benefit you, the borrower? You might be surprised because it’s quite a lot!

You may even think of the Registry as your favoured collection of lending encyclopaedia. With that, you know it’s packed with great value. You must learn about legal lending in SG.

And if you’re wondering what this ‘lending encyclopaedia’ contains, you need to check each page right now:

- Licensed Moneylenders:

So, you need a personal loan today, but the bank’s closed? With the comprehensive list of all licensed moneylenders in Singapore, you no longer have to stress. Once you’ve seen the most suitable licensed moneylender like Accredit in the list, you know they’ll abide by the decrees of the Singapore Moneylenders Act.

If a lender isn’t on this specific list, they’re not playing by the rules!

- Abidance to the Act:

A headmaster is quite stern; that’s a fact, and the Registry is the identical match. It ensures that every licensed moneylender abides by the regulations of the Moneylenders Act.

- Investigations and Actions:

What if you find yourself in the intimidating encircling of loan sharks, or maybe a legal lender breached the Act? It’s an unfortunate situation to be in; that’s the truth.

Yet, you don’t need to lose sleep in such a circumstance as the Registry doesn’t sit idle if any legal and illegal lender steps out of line. It investigates complaints. They’ll instantly take appropriate action.

- Public Educator:

Have you ever genuinely required a crash course in borrowing? The Registry of Money Lenders Singapore provide all the vital and relevant resources. They’ll also lend advice, become a public educator to borrowers, and protect your interests.

Like an educationally fulfilling and well-stocked informative encyclopaedia, the Registry covers all your lending needs from top to bottom.

Your Bodyguard: The Registry and You

Who doesn’t want a superhero watching over them, primarily when a potentially risky situation arises?

These are the moments when you cannot help but walk on eggshells, especially when it comes to moneylending, however, when you have the Registry behind you. It’s like a personal bodyguard.

How does it shield you from the lending baddies in Singapore, you ask?

- Verifies:

What should you do when you need personal loans or other financial products in Singapore? You can only cross-check your possible legal lender against the Registry’s list. You can proceed with your loan transaction once you see their names, like Accredit.

If they’re not, run like you’ve seen a durian about to fall on your head!

- Protection vs Unjust Lending Methods:

If you notice that the lender you’re working with shows dodgy moves like imposing more than a 4% interest rate per month or administrative fee exceeding 10% and others, the Registry will step in.

They will investigate the complaint as thoroughly as possible without missing any loophole. The Registry shall bring them to justice.

- Information & Assistance:

The Registry isn’t just your trusty shield, it’s also your most reliable guidebook. Through its efforts to educate, it offers crucial information and advice to help you become a wise, responsible, and savvy borrower.

- Help Against Harassment:

Unlicensed moneylenders or ‘loan sharks’ unfortunately exist in Singapore. They can cause so much havoc to one’s financial goals.

If you’re a victim, do not lose hope. Report to the Registry today through their page or 1800-2255-529.

The Registry is like the personal bodyguard you’ve always wanted, chiefly through your moneylending dealings.

Registry of Money Lenders Singapore: Your Key to Safe Borrowing

In a world of complexities, it’s refreshing to have something straightforward, correct? The Registry of Money Lenders is that trustworthy friend and bodyguard in finance. It may appear like a simple list, but it’s a crucial guide to secure and reliable lending ventures in SG.

So, the next time you search for a personal loan or other financial products, verify their details on the Registry. You will easily find Accredit there. After all, won’t you feel the assurance knowing that there’s an indisputable institution committed to confirming your borrowing adventure is smooth and safe?

As you fully understand the Registry’s role and relevance in Singapore, nothing’s holding you back from becoming a responsible and intelligent borrower. You’ll be a true ace! Dare to say; it will be a happy borrowing day for you!