Singapore, your Lion City, offers residents like you a diverse moneylending universe. Whether you’re a seasoned entrepreneur looking to expand your venture or an everyday Singaporean or non-Singaporean faced with sudden financial emergencies, it can fit you. No worries because non bank money lenders vs. licensed money lenders open various loan options to meet your needs.

These are among the major players in the moneylending field. Comprehending their differences can assist you immensely in pursuing more conscious and financially sound decisions. It’s time for you to get deeper into the gradation of contrasts that sets these two apart.

What are Non-Bank Money Lenders?

Non bank money lenders or non-bank financial institutions (NBFIs) have a substantial slice of Singapore’s economic scene. Unlike Singapore’s traditional banks, they do offer a host of financial services – including loans, such as:

- Personal Loans

- Property Loans

- Car Loans

- Business Loans

In addition to these loans, they also grant investments and insurance. However, they don’t hold a banking license. NBFIs are corporations like insurance companies, mortgage lenders, or money transfer services.

They’re critical in filling the monetary gaps, providing services not frequently offered by conventional banks.

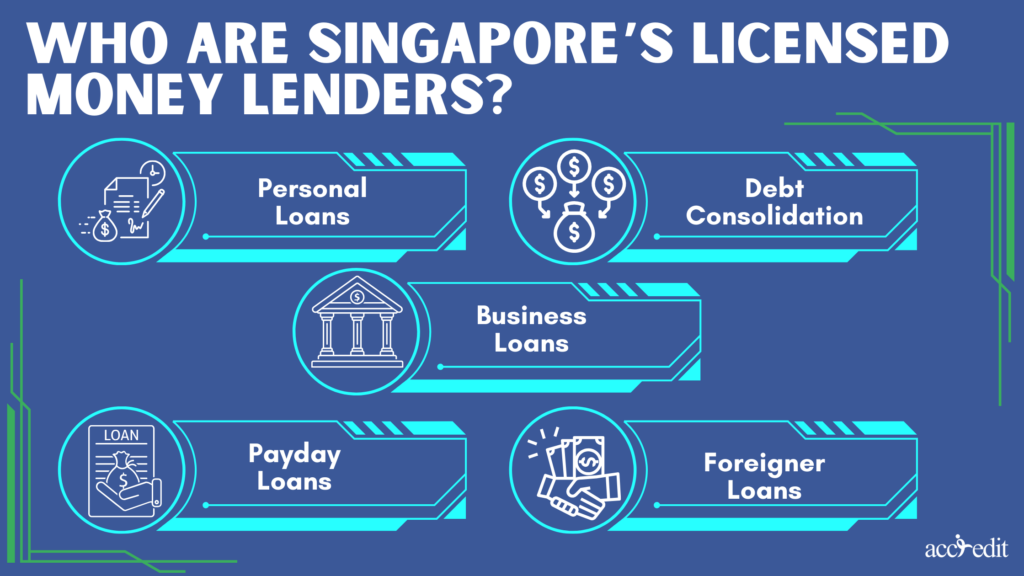

Who are Singapore’s Licensed Money Lenders?

In contrast, licensed money lenders are more often individuals or businesses that provide unsecured loans to consumers, particularly the following:

- Personal Loans

- Payday Loans

- Business Loans

- Foreigner Loans

- Debt Consolidation

Licensed leaders are not massively involved in insurance or investments, unlike non bank money lenders. Their primary operation is to grant loans to individuals who may not qualify for traditional bank loans. In Singapore, they’re under regulation by the Moneylenders Act under the Ministry of Law.

Non Bank Money Lenders vs Licensed Money Lenders’ Intricate Lending Processes

As a borrower, it’s crucial to understand the specifics behind Singapore’s financing industry, as it’s broad. It’s apparent with non bank money lenders vs. licensed money lenders. The lending mechanisms of NBFIs vs licensed money lenders demand going into the particulars.

NBFIstypically necessitate extensive paperwork and detailed credit checks. It’s because their loans frequently involve more significant amounts and more extended repayment periods. They also demand collateral at most times – valuable assets such as cars or properties – to victoriously secure the loan.

Licensed money lenders, on the other hand, operate differently. Their loans are unsecured, like personal loans, meaning you no longer have to supply collateral. The lending process has lesser stringent application requirements, making them a preferred choice for people needing fast cash or those with poor credit scores.

Approval Alchemy: The Expedited Journey with Licensed Money Lenders

Licensed money lenders have many praises for their swift approval process. In comparison, banks and non bank money lenders may take days or weeks to process loan applications. Singapore’s licensed money lenders can usually do it within an hour.

Its speedy approval time is crucial for borrowers who need urgent financial assistance, making licensed money lenders a go-to for emergencies.

Non Bank Money Lenders vs Licensed Money Lenders Regulatory Raincheck

Non-bank and licensed money lenders are under the laws and regulations of the Singaporean government, though the extent varies.

NBFIs are regulated by the Monetary Authority of Singapore (MAS), ensuring they adhere to a high standard of operations. But, their regulations are less stringent than those overseeing licensed money lenders.

Licensed money lenders are under the direct regulation of Singapore’s Ministry of Law. These lenders are bound by the Moneylenders Act, which explicitly stipulates maximum interest rates, standards for loan agreements, and fair advertising practices. It means you’re under extensive legal protection as a borrower from a licensed money lender.

Interest Inquisition: The Tale of Two Rates

Regarding loans, interest rates are substantial when selecting between non-bank and licensed money lenders. The NBFIs or non bank money lenders mostly have a lower interest rate, but it comes with rigorous application procedures and a demand for collateral.

Comparatively, licensed money lenders tend to have higher interest rates attributable to the higher risk they undertake but not requiring collateral and the speed at which they process loans. But, the Moneylenders Act caps their interest rates at a 4% maximum, ensuring they can’t charge beyond a legally stipulated limit.

Non Bank Money Lenders vs Licensed Money Lenders Boundaries in Loan Sizes

Due to legal restrictions, licensed money lenders in Singapore usually cater to borrowers requiring smaller loan amounts. For instance, for a borrower earning less than $20,000 annually, the loan cap is $3,000. This limit increases proportionally with income.

NBFIs can deliver larger loans due to their substantial financial backing, and their loans are secure against assets. Its feature might make NBFIs more suitable for borrowers seeking large loans, such as business or property loans.

Credit Scores’ Influence

It’s time to take a stroll down credit lane. When borrowing money, one’s credit score plays a starring role. It’s especially true with NBFIs, whose approval relies heavily on credit history.

If you’ve got a stellar record, they roll out the red carpet. If not, doors might close.

But what about licensed money lenders? They’re also interested in your credit history, but it’s not the be-all and end-all. They’re more inclined to look at your current loan repayment ability.

Bad credit? No problem! You can still get the green light at a higher interest rate.

Non Bank Money Lenders vs. Licensed Money Lenders Services Showdown

Now, what about the buffet of services on offer?

NBFIs tend to boast a diverse platter. They dish up everything from mortgage loans, insurance policies to investment services. They’re the one-stop shop for an array of financial needs.

They can also afford more flexibility regarding loan types and repayment terms.

How about licensed money lenders? They stick to their speciality – loans. But while they may not offer as comprehensive a menu, they excel in accessibility and speed.

So, if you’re after a financial a la carte, NBFIs non-bank money lenders might be your pick. But for that quick, easy access to cash, licensed money lenders are your number one go-to.

The Ultimate Decision – NB Money Lenders vs Licensed Money Lenders

Ultimately, choosing between non bank money lenders vs licensed money lenders comes down to your unique needs, monetary health, and preferences. If you’re seeking a more considerable loan amount, armed with your robust credit score, and aiming for secured loans, then NBFIs could be your best.

Nevertheless, if you aim for speed, accessibility, and personal service rank higher, a licensed money lender like Accredit could be the right choice for you. Accredit Licensed Money Lender is reputable in the lending industry. Embodying quick approvals, transparency, and sound customer services – qualities that define the lender you need the most.

Keep in mind understanding such differences is just the first step. Take your time to research, consult professionals, and make informed decisions to ensure your financial expedition is successful.

My friend, the choice is genuinely yours. Choose wisely, and financial stability is yours!