Moneylending in Singapore is gaining much attention, mainly due to economic challenges. It’s the same predicament individuals in Singapore have experienced over recent years, pushing them to find a resolution.

The inflation rate hits a 4.3 percent average. The taxes are currently high. When a financial crisis arises, a standard resolution is to apply for a personal loan from a moneylender in Singapore.

Traditional Conditions for Fast Loan Application in Singapore

Various loans are available for people working and living in Singapore, such as housing, vehicle, education, etc.

But, regarding a reliable and easy-to-access credit transaction, an unsecured loan offers the most suitable outcomes.

Financial institutions and traditional banks do give their clients access to unsecured loans. Yet the process may be far more demanding than a borrower would anticipate.

Credit Score

For one, the credit score requirements or impressive credit history is exceptionally high. Borrowers must have higher credit points beyond 1,000, preferably reaching a 2,000 credit score.

An individual’s credit score and history reveal their financial situation and whether they can repay the debt. Or are not at high risk of defaulting on a loan.

Collateral

The financial institutions’ apprehensions are understandable as an unsecured loan is vastly risky because it does not entail any form of collateral or asset that borrowers must submit.

It contradicts a secured loan operation that requires collateral, thus making the loan process much quicker, with more significant amounts of loan privileges.

Collateral also ensures low-interest rates from the loan. People who can’t comply with these primary loan requirements must find an alternative option, specifically, moneylending in Singapore.

What is a Moneylending Business in Singapore?

What alternative option could someone pursue in Singapore who doesn’t have a high credit score or collateral?

Well, the licensed moneylending industry is growing exponentially in Singapore. These lending businesses offer a routine operation almost parallel to banks and financial companies with distinctive differences, particularly on stringency regarding loan eligibility and requirements.

A moneylending business provides goods, supplies services, and grants cash to their borrowers. It’s a company that grants unsecured loans primarily subject to a higher interest rate within a remarkably brief timeframe. The repayment debt structure is mostly through monthly instalments.

Financial institutions or banks offer their clients loans but are different types of moneylenders.

Is Moneylending Singapore a Legal Financing Institution?

Yes, moneylending Singapore businesses are legal financial institutions. In truth, the Singapore Parliament passed a new Moneylenders Act 2008.

The Moneylenders Act 2008 signifies the country’s progressive approach to strengthening the regulations intended for the moneylending industry to keep up with the modern credit economy.

In addition, the Act further defines that all moneylending activities must follow the Ministry of Law’s regulations. Every operation should be in a modernised system with a reliable regulatory framework that guarantees security.

In these companies, a moneylender facilitates most face-to-face and online transactions.

What is a Moneylender?

A moneylender owns and manages their moneylending business. The lending business abides by the Moneylenders Act and utilises their money for capital and grant loans their borrowers need.

Because of this, these businesses opt to lend a small sum of money with a higher interest rate than traditional banks or financial institutions.

As the law permits, a moneylender must explain all the loan terms and conditions to their borrowers. The guidelines should be clear and understood by the borrower. The information all borrowers need that moneylending businesses should supply are representations within the contract about interest rate charges, repayment schedules, and applicable fees.

Also, to guarantee the legitimacy of the transaction between the borrower, and the licensed moneylender, the latter has to provide the former with the loan contract’s copy.

Who Regulates Licensed Moneylenders in Singapore?

The Ministry of Law, the Registry of Moneylenders in Singapore, regulates licensed moneylenders in the country. The mission and vision are to offer a trusted legal system, pursue justice, the rule of law, and services, and guarantee a secure and efficient licensed moneylending industry.

It aims to focus on and disperse relevant laws and regulations to ensure citizens know about the country’s moneylending legislation.

In addition, from the Registry of Moneylenders, Singaporean citizens, Permanent Residents, and foreigners may obtain the complete list of licensed moneylenders in Singapore.

Interest Rate Capping Licensed Moneylenders Charge in SG

The Ministry of Law stipulated on the 1st of October 2015 that moneylenders may only be permitted to charge a maximum interest rate of 4% monthly to their borrowers.

The regulation regarding the maximum interest rate duly applies notwithstanding whether the loan was secured or unsecured and despite the borrowers’ income.

What happens if borrowers need cannot repay the loan in time?

Borrowers failing to submit their loan repayments on time is not new in the moneylending industry. Moneylenders may charge a maximum rate of late interest of 4% monthly. It’s to guarantee moneylenders get legal protection and borrowers gain fair services.

It’ll be applicable for each month since for the late repayment.

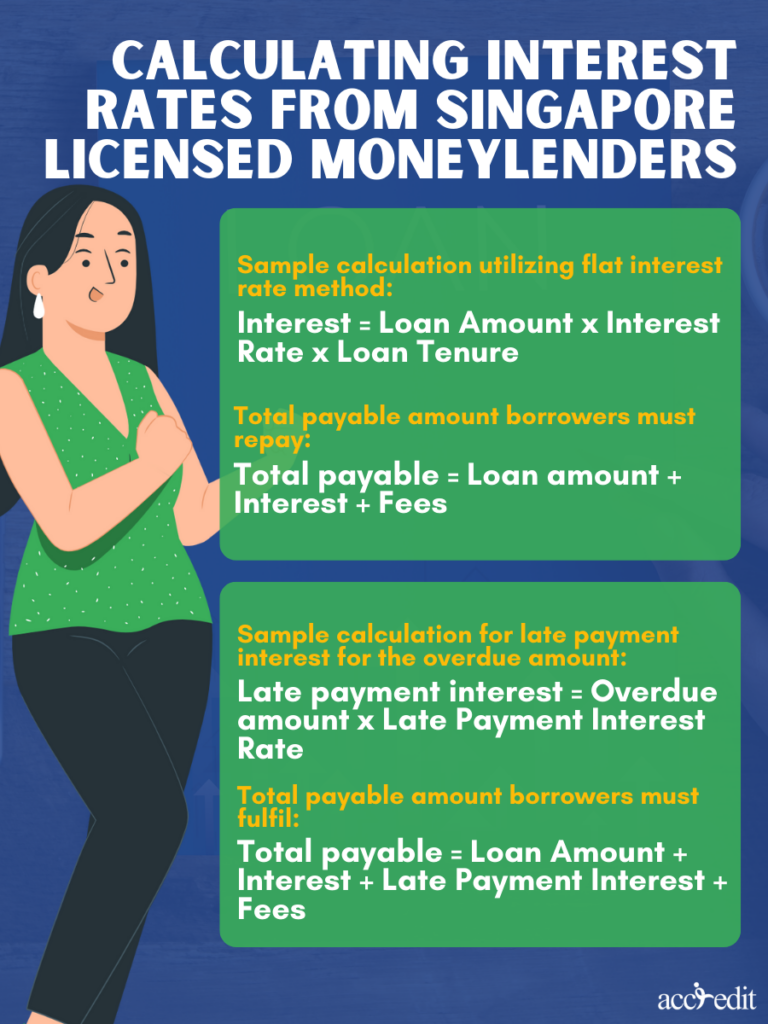

How to compute the Interest rates from licensed moneylenders in Singapore?

The personal loan interest rates licensed moneylenders in Singapore charge are from the principal amount.

Sample calculation utilising flat interest rate method:

Interest = Loan Amount x Interest Rate x Loan Tenure

Total payable amount borrowers must repay:

Total payable = Loan amount + Interest + Fees

When it comes to late interest, it’s a different approach. It’s only chargeable on a specific amount that late. As a result, the licensed moneylender can’t levy on outstanding amounts but has not reached their repayment dues.

Sample calculation for late payment interest for the overdue amount:

Late payment interest = Overdue amount x Late Payment Interest Rate

Total payable amount borrowers must fulfil:

Total payable = Loan Amount + Interest + Late Payment Interest + Fees

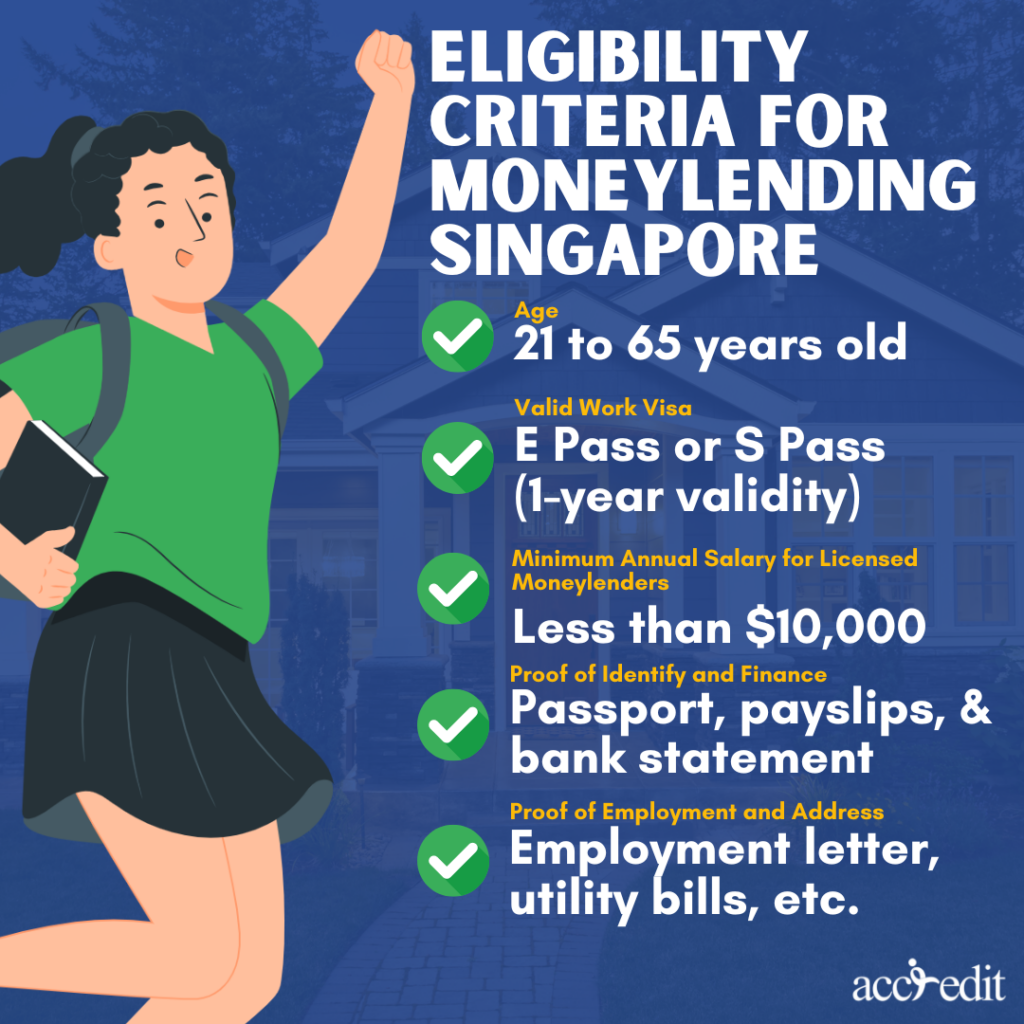

Eligibility Criteria for Moneylending Singapore

Singapore’s known for its colourful and unique inclusive community. Different people with diverse backgrounds live in the country in harmony, regardless of cultural and heritage history.

When applying for a financial product, like a personal loan from Moneylending Singapore, considers the borrower’s nationality status.

Singaporean citizens, Permanent Residents, and even foreigners can borrow from a licensed moneylending company in Singapore.

Maximum Loan Amount for Singapore Citizens and Permanent Residents

Since the loan an individual wishes to borrow is considered unsecured, there are specifications to the maximum amount allowable.

For certified Singapore Citizens and Permanent residents earning an annual income below $10,000, the total amount is $3,000.

As these individuals provide proof of achieving a minimum of $10,000 and less than $20,000, they may obtain the maximum amount loanable of $3,000.

However, if the borrower’s annual income is at least reaching $20,000, then they are allowed to attain a maximum sum of six times their monthly income.

Maximum Loan Amount for Foreigners in Singapore

The Ministry of Law and the Ministry of Manpower have released their joint statement that foreigners living in the country are subject to the latest self-exclusion framework and aggregate loan caps. It shall apply to foreigners with Work Passes, Short Term Visit Passes, Long Term Visit Passes, Student Passes, and Dependant’s Passes. Yet foreigners staying in Singapore temporarily or visiting as tourists are not qualified to borrow money from licensed moneylenders.

The total amount doesn’t differ entirely from the Singaporean Citizens and Permanent residents allowable sum for foreigners who plan to borrow from licensed moneylending companies.

Singapore’s foreigners earning from $10,000 and less than $20,000 may acquire a $3,000 loan amount approval.

When the annual income reaches at least $20,000, foreigners may be eligible to get six times the monthly salary.

But when foreigners only have less than $10,000 a month, they’d only be permitted to have $500.

What happens when a foreigner makes an illegal transaction with an unlicensed moneylender?

Work pass holders who genuinely had a loan agreement from these sources will face punishments such as MOM notifying the employer and ultimately revoking their work pass. Extradition and prohibition of further employment opportunities in Singapore ensue.

Unlicensed and Licensed Moneylending Singapore

Moneylending Singapore continues to grow, and along with it, the issues associated with unlicensed moneylenders and their victims also progress. But when does a borrower uncover the true identity of the moneylender they’re speaking with? What are the green and red flags to watch out for?

Unlicensed moneylenders are known as Ah Longs or loan sharks. These individuals can be tricky and ruthless when harassing their victims. They have specific target markets to prey on, which usually belong to the categorisation of habitual gamblers or workers who earn a low income.

The authorities have disseminated all their efforts in educating the public concerning the specific modus operandi of these individuals.

Licensed and Unlicensed Moneylenders’ Specific Behaviours

As such, the Ministry of Laws Information for Borrowers guide discusses the specific behaviours of unlicensed money lenders.

And unlicensed moneylenders are likely to:

- Reach out to the victims through WhatsApp with a link.

- Contact through social media or WhatsApp. It’s their method to communicate as it’s cheaper and more accessible for Ah Longs to target more victims at once

- They always ask for upfront payment to process or activate the borrower’s loan.

- They lure in their victims by promoting an extremely low-interest rate.

- Ask getting the information on NRIC cards and other personal identifications or documents. They’ll also urge the victims to take photos of all these crucial personal details.

- Give victims the Note of Contract is either incomplete or blank.

- Ask for the victim’s SingPass user ID with the password.

Licensed moneylenders DO NOT:

- Encourage any transactions to commence with the borrower to be strictly based online.

- Reach out to their clients by sending out telemarketing services via SMS.

- Harass their borrowers for personal data information, as they honour the Personal Data Protection Act 2012 (PDPA)

- Forcibly get a borrower’s information, as the process only permits them to ask for the borrowers’ basic details. Then they’d connect with The Moneylenders Credit Bureau (MLCB). It is the central archive of borrowers’ loan and repayment data and records with other licensed moneylenders.

- Keep any information from the borrower. They will divulge all necessary details regarding the loan contract, interest rates, fees, repayment schedules, etc.

- Withhold the principal loan amount for any reason.

- Hide their business’ identity. For this reason, borrowers can easily verify the authenticity of a licensed moneylender based on the Registry of Moneylenders’ complete list accessible on the Ministry of Laws website. Borrowers may check the licensed moneylender’s business, licence number, and contact details.

Moneylending Singapore Awareness Protects Borrowers

When a borrower notices or realises the irritating behaviour of a supposed licensed moneylender or has experienced particular illegal practices, reporting immediately with proof is critical.

Contacting the Registry at 1800-2255-529 can offer them the assistance they need.

And when a moneylender has involved a borrower in unjust practices, the latter may deal with the issue via Small Claims Tribunal or the Court under the Consumer Protection (Fair Trading) Act. All complaints against moneylenders are taken with serious intent and will undergo thorough and unbiased investigation.

Moneylending in Singapore is an industry with its share of unfavourable elements, contributing to the country’s significant excellence. Filter licensed moneylending companies that abide by the Moneylenders Act and Rules.