Borrowing money in Singapore isn’t only a matter of a handshake and a promise. It relies on understanding a world of rules, intricacies, and bureaucracy. It’s pretty intriguing and could be unnerving, but don’t worry; we’ll reveal licensed money lender conduct and its truths to you now.

Moneylending in Singapore

Moneylending in Singapore isn’t a fad. It’s a form of financial tradition since its industry began in the 1800s.

Today, it’s handled by the Ministry of Law in Singapore with exceptional branches of legislation and regulations from the Moneylenders Act and Registry of Moneylenders, particularly with a licensed money lender conduct.

Each of the conduct beat, each sway tells a story. Comparable to each transaction, each loan has a tale woven sophisticatedly like the precise beats of the traditional percussion ensemble. So, whether you require cash for education, buy a home, or start a small business, learning and understanding the moneylending land is imperative before pursuing it.

So, are you ready to prance around and unthread the exceptionally fascinating world of money lending? Here, you’ll also uncover the conducts you can’t ignore and why it’ll benefit you greatly.

Licensed Money Lender Conduct and the Legislation Loom

Have you seen Peranakan Beadwork? Wouldn’t you agree that it’s incredibly vibrant and eye-catching?

The beadwork relies on elegant and elaborate stitching to form its tantalizing patterns. It’s akin to the domain of moneylending in Singapore woven together with threads of legislation. Why’s the legislation the loom in this tale, you ask?

As you wouldn’t want your precious beadwork to unravel and scatter around, a financial system without the snug fit of regulations and rules would likely fray at the seams.

Singapore’s Moneylenders Act and the accompanying Moneylenders Rules serve as these threads. They form the warp and weft of the licensed money lender conduct on personal loans and loan products, ensuring lenders operate within the confines of the law. You can feel assured that all registered lenders will maintain the ethical standard that secures lenders and borrowers.

Singapore’s lawmakers entwine the tapestry with extraordinary consideration and care. They also regularly update the laws to guarantee borrowers like you acquire the best protection from unlawful lending practices.

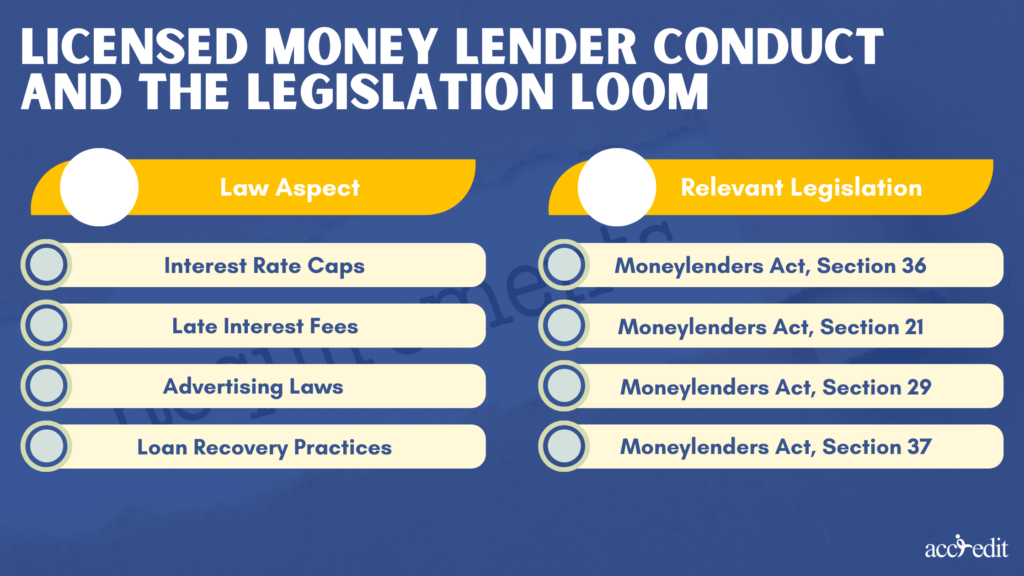

Here’s an illustration of the laws associated with the licensed money lender conduct:

| Law Aspect | Relevant Legislation |

| Interest Rate Caps | Moneylenders Act, Section 36 |

| Late Interest Fees | Moneylenders Act, Section 21 |

| Advertising Laws | Moneylenders Act, Section 29 |

| Loan Recovery Practices | Moneylenders Act, Section 37 |

Interest Rates: The Crimson Bead of a Licensed Money Lender Conduct Necklace

Imagine the legendary crimson bead in the traditional Peranakan necklace, capturing eyes and hearts with its splendid allure. Interest rates play the crimson bead’s role in the dazzling ensemble of financial terms.

They’re the cost of borrowing. The price that you must pay for the privilege of using the moneylender’s business funds for financial assistance. But why do the loan’s interest rates hold such attraction?

Like how the crimson bead influences the necklace’s overall aesthetics, interest rates from 1% to 4% maximum prominently affects your loan’s total cost; it’s among the notable licensed money lender conduct.

Take note, different moneylenders may offer you diverse rates, and acknowledging these distinctions is critical to assuring that your financial ‘necklace’ isn’t simply stunning but also indulgently wearable.

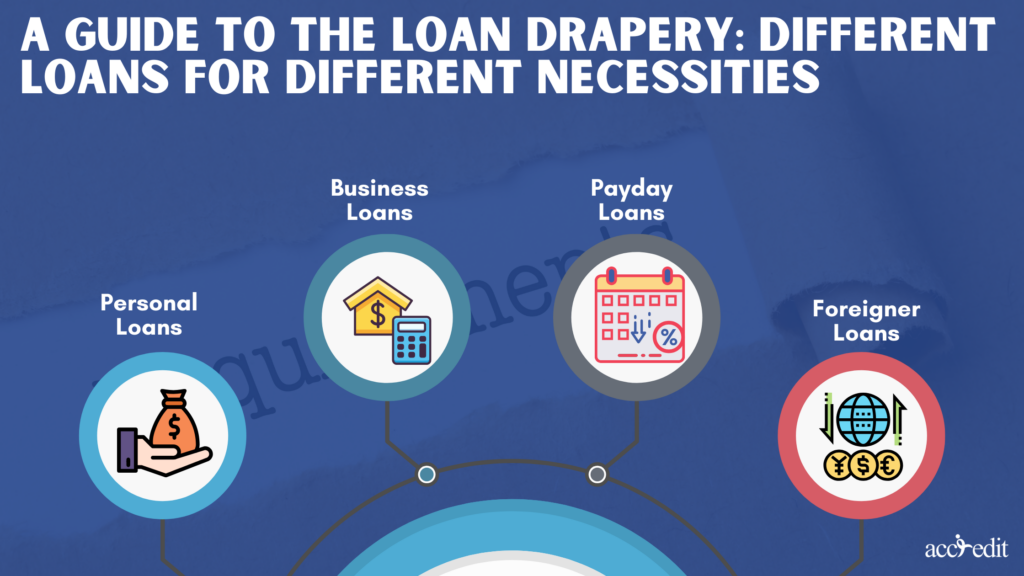

A Guide to the Loan Drapery: Different Loans for Different Necessities

Among the many licensed money lenders conduct, it’s granting eclectic loans as the splendid beads that form Singapore’s traditional works of art. Each serves a unique purpose, from personal loans representing the basic black-white beads to business loans. Recognizing the variety of loans is akin to acknowledging each bead’s role in a masterpiece.

You must pick the beads based on the pattern you wish to create; comparably, the loans are based on your necessities. There are the following:

- Personal Loans

- Business Loans

- Payday Loans

- Foreigner Loans

Etc., each with its distinguishable ‘shape and size.’ Comprehending their extraordinary aspects can assist you in designing your monetary beadwork with grace and wisdom.

Licensed Lenders vs. Loan Sharks: Pearls and Pebbles

In the spectacularly broad financing scenery, it’s vital to characterize between the pearls or licensed money lenders and pebbles or the loan sharks. But what could set these two apart?

Licensed money lenders are like pearls formed within the tight clasp of regulations and the licensed money lender conduct. They are authorized to operate as per the Moneylenders Act and follow the stringent rules that effectively shield borrowers like you.

On the contrary, loan sharks or unlicensed money lenders, much like deceptive pebbles that one could mistake for precious gems, function beyond the Singaporean laws. They often use unfair and unjust means to disburse funds and recover loans.

So, while pearls and pebbles could lie close on the ocean bed, remember – not everything that glitters is a pearl. In the following chapters, you’ll further unthread the beads and stones and venture into their implications for borrowers like you.

Licensed Money Lender Conduct and Repayment Plans

Every loan has a repayment plan setting its pace, like every dance requiring a specific rhythm to flow gracefully. The licensed money lender’s payment procedures mainly outline how you’ll return the borrowed cash, choreographing your monetary dance.

Lenders acknowledging the repayment terms, whether a fixed monthly installment or a more flexible scheme, would ensure that licensed money lender conduct remains in the beat.

Be cautious because a missed step, much like a missed payment, will result in a 4% maximum late interest rate and $60 late payment fees. Both these figures may easily disrupt your entire monetary performance, leading to economic strain.

Transparency: The Clear Bead in the Licensed Money Lender Conduct Mosaic

What value would a bead have if it hid its true colors?

The same applies to the lending process. Transparency is the clear bead in your monetary mosaic, assuring you that the lender is open about every term, condition, charge, and rate.

It allows borrowers like you to see the bigger picture with a clearer vision, helping you make better-informed decisions. After all, you wouldn’t purchase a bead without inspecting its quality, right?

Borrower’s Rights: The Golden Beads of the Financial Garland

Do you know you’re not simply a borrower but also a rights holder?

Yes, you are, especially in the financial garland. Borrower’s rights are the golden beads of the licensed money lender conduct. These are incredibly precious and worth all efforts to safeguard.

From receiving a copy of your loan contract to not being charged with unreasonable interest, your rights are enshrined in the Moneylenders Act. Knowing and acknowledging your rights encourages you to string together a financial arrangement that is legal and fair.

The Final Bead in Your Licensed Money Lender Conduct Necklace of Knowledge

As you string the final bead in your licensed money lender conduct knowledge necklace, you will realize that acknowledging and gaining awareness on the matter is more challenging than it seems. It’s the process that every borrower in Singapore can master, a beautiful necklace you can proudly wear.

Remember, the secret lies in becoming more aware of the patterns, beats, and beads and selecting the preferable partners wisely, such as Accredit, confirming a memorable monetary prance.

So, will you remember your necklace and dance the next time you borrow from a licensed money lender? Take a moment to appreciate the beadwork and take steps aligning precisely to your needs with a licensed money lender’s conduct in mind.

Borrow wisely, and borrow well!

Accredit Licensed Money Lender: The Ace of Conduct

As per the law, Accredit Licensed Money Lender, we will grant comprehensive information on loan types, including personal, payday, lifestyle financing, and credit counseling assistance.

We will guarantee interest rates won’t surpass 4% monthly and financial assistance within the legal framework, thus shining with the brilliance of a finely cut diamond. We, Accredit, will enhance your financial vista with its sturdy and ethical lending methods.