Imagine opening a great novel entitled “The Rule of Money Lending” and stumbling upon a fascinating plot of financial jungles, lending heroes, and villainous loan sharks. In the heart of this specific story, the mighty Lion City – Singapore – reigns, creating a robust system of laws against illegal money lenders that would make even Tom Bingham nod in approval.

Laws Against Illegal Money Lenders: The Battle Against Illegal Money Lending in the Lion City

As you enter this unique financial saga, you shall face the renowned Singapore’s Moneylenders Act. Mind you, it isn’t only a regulation.

It’s a forcefield that guards its citizens against the financial savagery of loan sharks. Loan sharks, in your monetary drama, are the plot twists with malicious intent – surprising, detrimental, and harmful.

With the Act in the perfect place, illegal money lenders face severe consequences, such as the following:

- Penalties could go as high as a S$300,000 fine

- The jail term can be up to four years

- Up to six strokes of the cane

With these, you know that the unyielding system of Singaporean law isn’t joking around. Thus, your best defence as an innocent borrower knows the signs.

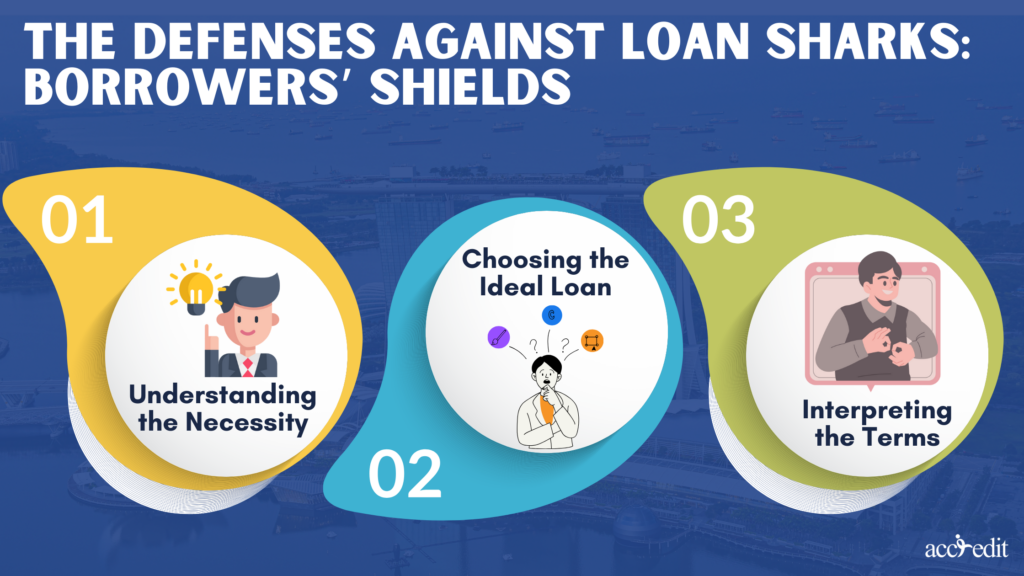

The Defenses Against Loan Sharks: Borrowers’ Shields

Do you feel worried that you may not escape the jaws of these loan sharks?

You no longer have to worry, dear friend, because it’s not all gloom and doom. Just as every gripping tale has its heroes, your financial story also showcases effective defences against these loan sharks.

Here are some of the noteworthy protective shields you can use when necessary:

Reading the Cues:

Illegal lenders may resort to tactics that you may notice red flags popping out. These approaches are such as not explaining the terms and conditions thoroughly.

In the unfortunate event of falling prey to a loan shark, borrowers have the right to acquire the best legal assistance. If that’s the case, you can always contact legal authorities. They won’t even provide you with the contract’s copy. Awareness is your first line of defence.

Legal Assistance:

These are your Registry of Moneylenders and Singapore’s Police Force. You may also seek legal assistance from Singapore’s best moneylending law firms. They’re your knight in shining armour in these particular circumstances.

Public Awareness Campaigns:

These are like the town criers of yore, spreading vital information to fortify the populace against loan sharks. When you stay informed, you remain protected.

Furthermore, loan sharks are nowhere in the Registry of Moneylenders or other licensed lender directories. Their license may have been revoked, or they must still pass the test.

As a result, checking out the lenders’ details and license number is another way to protect yourself from unlicensed moneylenders’ clutches.

Licensing the Lenders: Singapore’s Strict System

Are you ready because the plot thickens even more, specifically in the licensed money lenders’ realm?

Among the laws against illegal money lenders is the licensing system. Here, Singapore’s authorities play the role of a stringent and high-standard critic. They’ll meticulously evaluate each character before they’re allowed to enter the moneylending industry.

The licensing process is like a rite of passage for every potential lender, who must prove good character before they may deliver personal loans and other financial products. They should also present a transparent monetary background and overall record. Only those who have victoriously gone through unscathed in the maze of tests and met the criteria can emerge as triumphant licensed lenders.

These are your trusty and professional legal money lenders, ready to present and deliver ethical and regulated services to borrowers like you.

Ethical Practices Encouraged Among Licensed Lenders

The tale would only be complete with applauding the heroes of this specific story – the licensed money lenders. The laws against illegal money lenders not only set exceptionally high barriers against wrongdoers.

Moreover, it also encourages ethical lending approaches among legal money lenders. They are your heroes who will uphold the moral code that suits your financial requirements.

In addition, these legal money lenders must be completely transparent about the loan terms and conditions. They should responsibly explain the complete details regarding repayment plans, fees, and interest rates to borrowers.

They are indeed the protagonist in this moneylending tale, and they won’t hesitate to guide you safely through your financial trips. They’re also undoubtedly helpful when you require diverse loan choices.

Your Options with Licensed Lenders: More Than Only a Chapter

Now, let’s turn the page to explore further the offerings of licensed money lenders. No matter the genre you prefer, they have everything you necessitate within their financial library. They’ll put forward a broad spectrum of loan types, each with distinctive features and benefits.

Business loans, foreigner loans, payday loans, and personal loans sustain the noteworthy monetary chronicle of many borrowers.

You must present proof of employment, income, and residency to qualify for these loans. Each loan has its storyline, with a clear beginning which is the application; the middle and that’s the processing; and the end, which is the repayment plan.

One stands out immediately among the many licensed lenders in the Registry of Moneylenders or Credit Associaton of Singapore. It’s Accredit.

Accredit: Your Unfailing Guide

Now, you shall meet Accredit – Singapore’s licensed money lender, as your trusty and unfailing guide to your successful financial journey. It’s a legal lender armed with a map and a torchlight. Accredit steps onto your stage as the quintessential guide, assisting borrowers like yourself through the complexities of lending laws.

It is committed to ethical methods and customer services to meet customer satisfaction, thus becoming a commendable example for many other lenders. Like your most favoured diligent author, they will stick to the rules, creating a harmonious story within Singapore’s lending laws and boundaries.

Fundamental Singaporean Laws Against Illegal Money Lenders

As you reach the tale’s climax, you must wonder what these laws against illegal money lenders and boundaries are. Here’s a summary of the key and fundamental “chapters” every Singaporean and non-Singaporean borrower like you should bookmark within your knowledge library:

Moneylenders Act:

You may say it’s the backbone of every lender and borrower in Singapore. It’s especially significant for outlining the complete ‘dos and don’ts’ of Lion City’s money lending industry.

Interest Rate Regulations:

The law ensures no lender can overcharge with the cap set on the interest rates of 4% maximum per month. With regulations like these, you won’t be scammed by any loan sharks.

Loan Contracts:

The law makes sure that every contract detail and information isn’t concealed. It should be as clear, transparent as a crystal, and fair to the borrower.

Unfair Practices Act:

It’s another layer of protection against any unethical practices, such as harassment, cold calling, unfavoured text messages, abuse and more.

If you do require additional assistance or wish to report an illegal lender, contact the Singaporean Police through ‘999’ or the National Crime Prevention Council’s X-Ah Long hotline at ‘1800-924-5664’, or the Registry of Moneylenders at ‘1800-2255-529’.

Remember, for every beloved and valued borrower, there’s always help in the bibliotheca of Singaporean laws.

Laws Against Illegal Money Lenders: The Finale

Your exploration of Singapore’s laws against illegal money lenders has been quite an adventure, hasn’t it? It’s similar to flipping through a compellingly intriguing novel; you’ve delved into the depths of regulations. You also explored the courageous role of licensed money lenders, braved the threats of loan sharks, and learned about the crucial protective shields of borrowers.

But remember, dear readers, comparable to any good novel, the understanding and interpretation of these laws can also evolve. So, keep your knowledge updated and stay financially savvy. Moreover, walking with a guide like Accredit is better as you continue your adventure.

In the grand scheme of your monetary story, wouldn’t you agree that while loan sharks add undesirable thrill, the steadfast rule of law guarantees a happy ending?