As the prediction on the inflation rate in Singapore hits an average of 4.3% for the year, many Singaporeans, permanent residents, and foreigners are doing their best to make ends meet. The alternative solution for living and working in the country often leads to applying for a loan. But do you have to worry if is personal loan interest tax deductible?

In this article, you will dive deeper into the details of unsecured loans and taxes in Singapore. Also, uncover which loans incur tax deductibles and if there are deductions for an unsecured loan’s interest tax.

What is a Personal Loan?

Before diving further into the tax implications of personal loan interest in Singapore, you must understand more about an unsecured loan.

A personal loan in Singapore is unique and diverse from the other loans accessible in the country. For one, it’s the primary choice for easy and feasible funds.

As a result, the cash collected is mainly put to good use. In particular, communities in Singapore apply for unsecured loans specifically to purchase necessities like food, clothing, and rent or for situations that need financial assistance.

It’s also a viable loan option when obtaining extra funds for weddings, emergencies, or other significant events.

Unsecured Personal Loan

Another variable which enables Singaporeans, permanent residents, and foreigners faster accessibility to a personal loan is due to its credit nature. It is categorised as an unsecured loan.

It’s a considerably risky lending option because it does not entail borrowers to come up with collateral. Thus, proving its contradictory approach compared to a secured loan that legally compels debtors to produce a means of insurance such as vehicles, properties, and other forms of assets.

What happens to the personal loan interest tax when you take out an unsecured loan?

Personal Loan Interest in Singapore

Loans, interest, and taxes are nothing new to Singapore. It’s Asia’s financial hub. With a sturdy and powerful economy, you can rest assured its financing background is outstanding.

Unsecured loans are among the leading financial assistance arranged by banks or financial organisations like licensed moneylenders. An unsecured loan’s interest rate in Singapore varies mainly on several factors. These are the borrower’s creditworthiness or credit score, loan amount, income, and repayment period.

Typically, an unsecured loan has higher interest rates than other loans accessible in the country. For instance, the unsecured loan interest rate is higher than home and car loans because it is an unsecured debt without collateral securing the loan.

Singapore’s current personal loan interest rates range from around 3% to 48% annually. It varies mainly on the borrower’s creditworthiness and lender. The legal lenders you may apply for unsecured loans from are traditional banks and licensed moneylenders.

Personal Loan Interest Rate Calculations

In Singapore, there are specific calculations for obtaining the personal loan’s interest rate. Here are the following methods utilised:

- Flat interest rate: It’s a calculated-based interest rate on the initial loan amount. It remains consistent and constant throughout the loan’s tenure. It’s also a method that could result in higher total interest payments.

- Reducing balance interest rate: It’s another calculated-based interest rate on the outstanding loan balance. It’ll decrease whenever you repay the unsecured loan. It’s an approach that could lead to lower total interest payments.

Lenders Granting Personal Loans in Singapore

If you plan to apply for an unsecured loan in Singapore, you must ensure you do it with the best financial service providers. There are many lenders in the country, but traditional banks and licensed moneylenders are the top lenders you may approach.

Banks offer unsecured loans to their clients. Among the primary requirements borrowers must fulfil is taking a S$1,000 minimum loan amount, with a 3% to 10% interest rate per year. The maximum loan amount may go up to four times the borrower’s monthly wage or S$200.000, whichever is lower among the two.

Licensed moneylenders in Singapore are considered the prime option when taking an unsecured loan. The Ministry of Law duly authorises these lenders. The personal loan interest rate is high, from 1% to 4% monthly.

Licensed moneylenders can offer up to six times the borrower’s monthly wage.

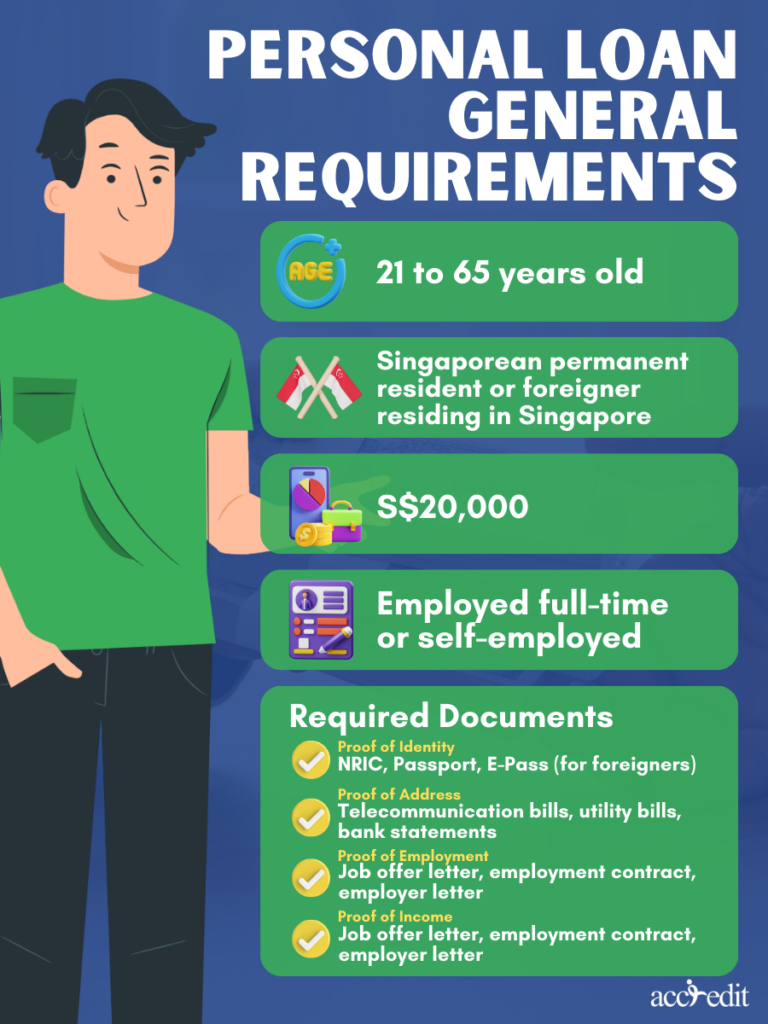

Personal Loan General Requirements

When applying for an unsecured loan, a debtor’s credit score and history will undergo analysis and evaluation. When banks see a low credit score, they often decline the borrower’s request for a personal loan.

But, licensed money lending companies are more forgiving in credit scores. As a result, anyone who doesn’t have an impressive credit history may be granted an unsecured loan.

The credit score is a typical indication financial institutions use to calculate the interest rate for an unsecured loan. Other types of fees are also included. Also, here are some specific eligibility criteria and additional requirements for Singapore’s loan:

- Eligible applicants: You have to be a Singaporean Citizen, Permanent Resident, or foreigner with a valid working pass and employment pass.

- Age: The personal loan age requirement is at least twenty-one years old and not a day older than sixty-five.

- Income: You have to present a minimum income of S$20,000 annually. Also, provide your income tax statements or latest payslips. You may prepare your bank statements for the past three to six months.

- Employment status: You must have stable employment or a steady source of income to guarantee loan repayment. Provide an employment letter or CPF statements.

- Proof of identity: When applying for an unsecured loan, you should present your passport of NRIC

Taxes in Singapore

For the taxes, there’s only one tax authority in the country. It is the Inland Revenue Authority of Singapore or IRAS.

IRAS updates and provides crucial information and assistance in matters of taxes in Singapore.

The primary information that IRAS dispenses revolves around miscellaneous taxes and tax returns. The tax returns should be submitted by paper every year, and the due date is on the 15th of April. For e-Filing, the due date is on the 18th of April.

People residing and earning a living in Singapore are all considered tax residents. And commonly, the taxes urged on are distinct incomes, expenses, donations, and personal reliefs when relevant.

What is an Interest Tax?

An interest becomes available for taxation when it is acquired from cash deposits to finance companies, banks, and other entities of financial businesses.

In Singapore, there is non-taxable and taxable interest.

Non-taxable interests are mostly deposits with finance businesses, companies, and banks approved and licensed in Singapore. Or, debt securities such as bonds are not applicable when owned through a partnership or trading business’ inventory. And foreign resources from foreign firms or companies which pay the interest

Taxable interest is accessible from deposits with finance companies and banks that are non-approved or not licensed within the country. Other interest taxes attainable are from pawnshops, loans to persons, and companies. Debt securities via owned partnerships or trading business inventory. And the refund of an employee’s CPF excess contributions.

Taxable Interest in Singapore

In Singapore, the interest becomes taxable under specific circumstances. It’s when the interest income is solely sourced within the country or derived from Singapore.

When it comes from foreign-resourced, the interest develops into a taxable income through remittance. Or when the income is supposed to be transmitted into Singapore.

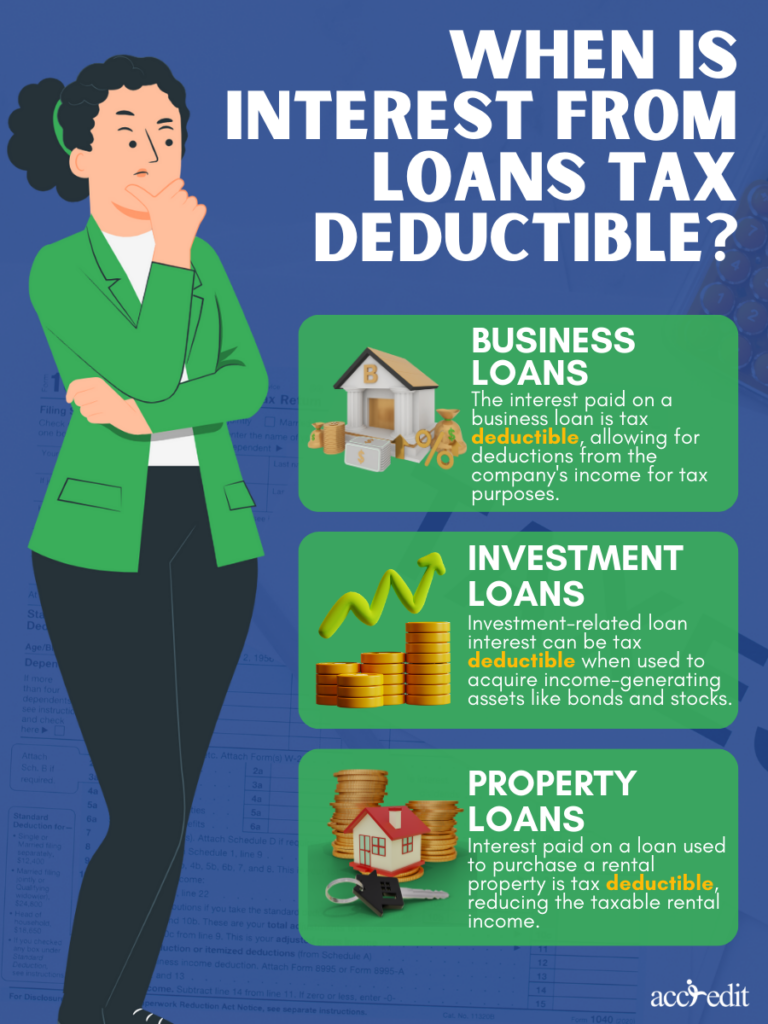

When is Interest from Loans Tax Deductible?

Tax deductions in Singapore vary, depending on whether it’s for corporate or individual categorisations. There are indeed specific situations when the loan’s interest becomes tax deductible.

Every payment or income received from properties are taxable in Singapore and needs ITR declaration. A type of loan that’s present for properties are housing loans. The tax-deductible is solely applicable to expenses rather than interest.

Thus, it applies to certain loans taken for income-generating activities or business intentions. Here are some examples of deductible interest expenses in Singapore:

- Business Loans: The business loan’s interest is tax deductible. When you take a loan to finance your company, the interest payment can be deducted from the business’ income or tax purposes.

- Investment Loans: Taking out a loan to invest in income-generating assets, such as bonds and stocks, the interest could be tax deductible. It’s because the purpose is to acquire investment income, which is considered in alignment with tax purposes.

- Property Loans: A loan made to buy a property for rental intentions becomes aligned for tax. The interest paid for the property loan is deductible from the rental income.

It’s worth remembering that specific conditions and rules apply to each type of deductible interest expense. Thus, you should consult a professional.

On the other hand, you may reach out to the Inland Revenue Authority of Singapore (IRAS). IRAS can grant guidance on specific interest tax situations.

Is Personal Loan Interest Tax Deductible?

Personal loans are unsecured forms of the credit line. Banks and licensed moneylenders grant lesser cash than other loans because it does not require any collateral or additional assets.

Initially, for an unsecured loan, the sum paid in interest is calculated by utilising the amount subject to the loan, interest rates, and the payment period. In Singapore, personal loan interest is not tax deductible.

You won’t claim any interest or tax relief reduction for loans because personal loans are recognised as non-business expenses. Thus, the interest paid for unsecured loans is not eligible for tax deductions.

But there’s an exception to the rule. When the funds from a granted unsecured loan are intended for an income-producing project, such as certain businesses, or investments, the interest payments will be assumed to become tax deductible.

By the Finance Companies Act in Singapore, all the interest deriving from any person and getting deposits via a legitimate, and approved financial organisation or bank, is exempted from tax.

Tax Exemption in Singapore

Tax exemption is similar to a tax deduction but not entirely the same as tax exemption offers a specific or fixed computation of deduction. It would also depend on your present tax bracket regarding the amount of the impact on a person’s tax liability.

Singapore’s Tax exemptions refer explicitly to particular types of income that are not subject to tax. The country has no general tax exemptions aligned for loan interest.

Nevertheless, interest income earned from Singapore’s traditional banks and financial companies is tax-exempted for individuals.

Understand Personal Loan Interest to Borrow Responsibly

Personal loan interest in Singapore is not tax deductible. Understanding the loan’s interest rate and calculation can assist you in borrowing responsibly.

It’s also crucial for you to know about taking out other loans that may be tax deductible. By comprehending and acknowledging the system, you become prepared to handle the loan purpose, mainly for personal or income purposes.

Don’t hesitate to consult a financial advisor or tax professional for more personalised advice when getting a loan or seeking methods to save on taxes.