So, you’ve landed in the Lion City and are searching for some dollar signs to fuel your Singaporean dream, eh? Or perhaps, you’re a native considering a foray into the maze of loans. Thus, you’re wondering how you compare money lenders in the buzzing city-state, as complex and diverse as plates of Singaporean cuisine.

Well, dear reader, do not fret. In this article, you’re going to have the best guide. It’ll be your ‘881’ journey – the ‘8’ steps of comparing, the ‘8’ laws every borrower in Singapore must know, and the ‘1’ undeniable truth about borrowing in Singapore.

So, hop on this Money Lending MRT and get your tour underway.

Know Thy Law: The Moneylenders Act

First, Similar to knowing a vault’s security details, you must comprehend the laws governing money lending in Singapore before comparing money lenders. Every licensed lender in the Lion City may deliver personal loans and other monetary products.

While the Moneylenders Act is the master blueprint, every lender must be familiar with it, and borrowers should know it. It spells out your rights as borrowers with the limits on what licensed money lenders can do.

For instance, they are capping the interest rates. It also ensures that lenders should never resort to abusive recovery methods.

Thus, you can rest assured you’re legally protected. But be cautious, though; some lenders do not follow the Act. It’s your first step in dodging the spiky treacherous teeth of unlicensed lenders lurking in Singapore’s depths.

So, you have to assess the Act and choose and compare money lenders in Singapore, as you have diverse options to select from.

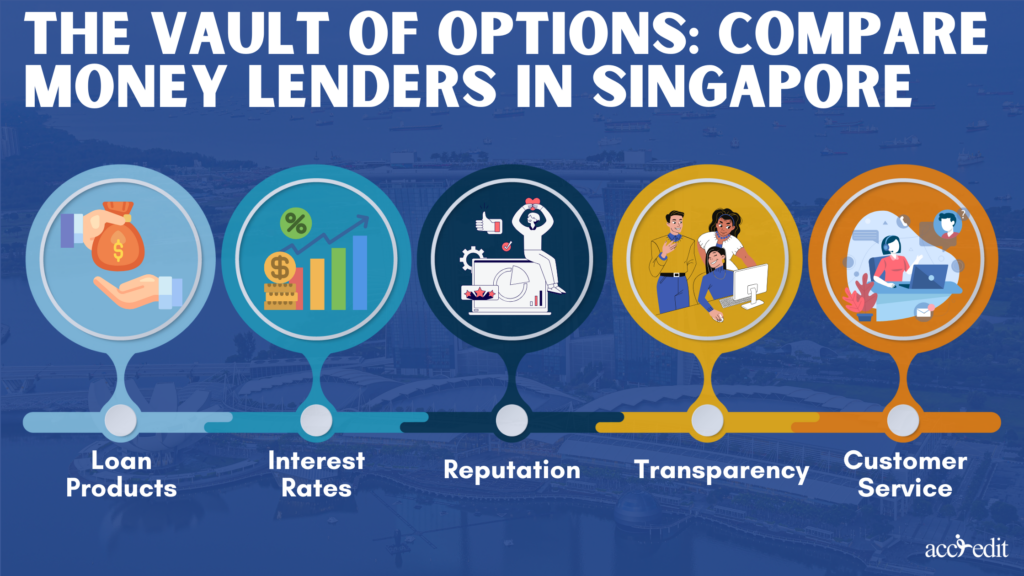

The Vault of Options: Compare Money Lenders in SIngapore

Welcome to the vault of options. Or, call it the marketplace. Today, Singapore has over 150 licensed money lenders in the city-state. Each has unique features and benefits to grant a distinctive blend of loan products.

As a result, borrowing from a lender can be challenging, mainly if you’ve never borrowed from a lender before. But remember, it’s your financial future behind the pursuit.

Thus, it’s your rule.

To compare money lenders effectively, you must consider the following:

Loan Products:

Does the lender deliver the type of loan you need?

It may range from payday loans, business loans, foreigner loans, and debt consolidation to personal loans. All of which are exceptionally imperative to each borrower’s financial needs.

Interest Rates:

What are the interest rates across different lenders?

As per the Moneylenders Act, it should be between 1% to 4% monthly. Yet remember, dear borrower, the lower it is, the better.

Reputation:

For a tech-savvy borrower, you should take advantage of the opportunity to do further research. When it comes to money lending, you can check online reviews and testimonials.

Nonetheless, take online reviews with a pinch of scepticism. Find a friend or family member who may recommend the best-licensed lender with which they’ve had the privilege to have a loan transaction.

Transparency:

A good and reliable lender is transparent about their fees, rates, and penalties.

Customer Service:

Good customer service is among the most genuine hallmark of a reputable lender. So, compare the reputation or news you’ve heard about a licensed money lender, and see which one you prefer the most.

With the proper means of comparison, you shall find the most suitable lender and evade the loan sharks. And as your final safety measure, don’t forget to cross-verify with the Registry of Moneylenders.

And it would be best if you remembered to consider the Credit Bureau Singapore or the Moneylenders Credit Bureau.

CBS and MLCB to Compare Money Lenders

Many borrowers may have missed the memo, but you shouldn’t miss out on understanding how the CBS or MLCB may affect your loan experience. Your credit score is crucial before borrowing from any licensed lender.

As a result, you have to contact the Credit Bureau Singapore or the Moneylenders Credit Bureau to acquire your basic credit report. It’s an imperative key that provides an overview of your creditworthiness. Every legal money lender in Singapore will consider this when deciding whether to grant you a loan and at what interest rate.

What must you do here? Simple:

Check Your Score:

For a reasonable fee, you can acquire your credit report from CBS. It’ll grant you an idea of your credit standing before applying for a loan.

Understand the Report:

Your CBS or MLCB credit record contains a credit score, a four-digit number summarising your credit risk. Take note that when you have a higher credit score, the lower you are a credit risk.

Use It as Leverage:

If you have a good credit score, use it as leverage when negotiating loan terms.

The Great Escape: Repayment Plans

Now, for the great escape! In your loan adventure, it will be your repayment plan. A well-structured repayment plan can ease your debt burden and help you clear the debt traps laid by loan sharks.

The methods you must do are:

Assess Your Financial Situation:

Comprehend your monthly income to gauge how much you can afford. It’ll be the best approach to evaluate the overall loan costs and other financial responsibilities you must accomplish that you can afford to repay monthly.

Choose the Right Plan:

Money lenders grant diverse and proper repayment plans. Some licensed lenders may require monthly repayments but may also be in a more fixed arrangement. On the other hand, others may present a more flexible repayment arrangement.

Negotiate:

Do you consider yourself a wise negotiator?

If you are, know that you can negotiate with your chosen lender regarding the repayment terms. Even if you aren’t an ace negotiator, feel free to get suitable terms to ensure you can pay your debt without issues.

If the lender you’re working with does not allow such an option, remember you always have 150 other licensed money lenders in the Registry to pursue, like Accredit.

Compare Money Lenders’ Last Act: Loan Contract

Finally, the last Act is to become a pro of when to compare money lenders. It’s possible the moment you understand your loan contract. It means that acknowledging every word and comma in this document is essential.

If something’s unclear, seek clarification. It’s always better to be safe than sorry.

To make sure you get only the best deals, remember to:

Read Cautiously:

Read the loan contract carefully. If there’s something you cannot quickly grasp, don’t hesitate to ask.

Check for Hidden Charges:

Be wary of hidden charges or terms not previously discussed.

Sign Wisely:

Only sign the contract once you fully understand and agree to all terms. If you feel uncomfortable with written details, seek to negotiate the contract or search for another legal lender.

Ultimately, comparing money lenders in Singapore is all about doing your homework. Recognising and acknowledging the laws, knowing your rights, and pursuing knowledgeable decisions are crucial.

Remember, you’re not alone in this. Resources and organisations are ready to assist you with this venture, and Accredit is a lender that’ll help you. Go forward to your chosen path in the exciting world of money lending together.

Be a pro that you are!