Is your mind set on getting a personal loan in Singapore? If yes, then you should make your first move by checking the eligibility criteria.

This is the most important step for you since most loan providers prefer borrowers who have the financial means to repay the loan. So, to get you started, treat this article as your very owed borrower’s checklist as you scroll along.

Eligibility Checklist for Singaporeans and PRs

In Singapore, personal loan options are open to citizens and permanent residents of legal borrowing age, provided they earn a minimum annual income of $30,000. However, some lenders may extend loan options to individuals earning as low as $20,000 p.a.

- Age: 21 to 65 years old

- Minimum yearly salary requirement of banks: S$30,000

- Minimum yearly salary requirement of licensed moneylenders: Less than S$10,000

Eligibility Checklist for Foreigners

Unfortunately, foreign tourists in Singapore do not qualify for personal loans. However, if you’re a foreign national who has been employed in the country for a considerable amount of time, particularly if you hold an Employment Pass, you are eligible to apply for a personal loan.

- Age: 21 to 65 years

- Pass Type: Employment Pass (1-year validity)

- Minimum yearly salary requirement of banks: S$40,000 to S$60,000

- Minimum yearly salary requirement of licensed moneylenders: Less than S$10,000

List of Documents You Must Prepare Before Applying for a Personal Loan

If the qualifying criteria vary from one lender to another, then the same holds true for the list of documents. To streamline the application process, gather the following items for your personal loan application.

- Proof of Identity: NRIC, Passport, EPass

- Proof of Address: Telecommunication bill, Local utility bill

- Proof of Employment: Job offer letter, Employment contract, Employer letter

- Proof of Income: Bank statements, CPF, NOA, computerized payslip

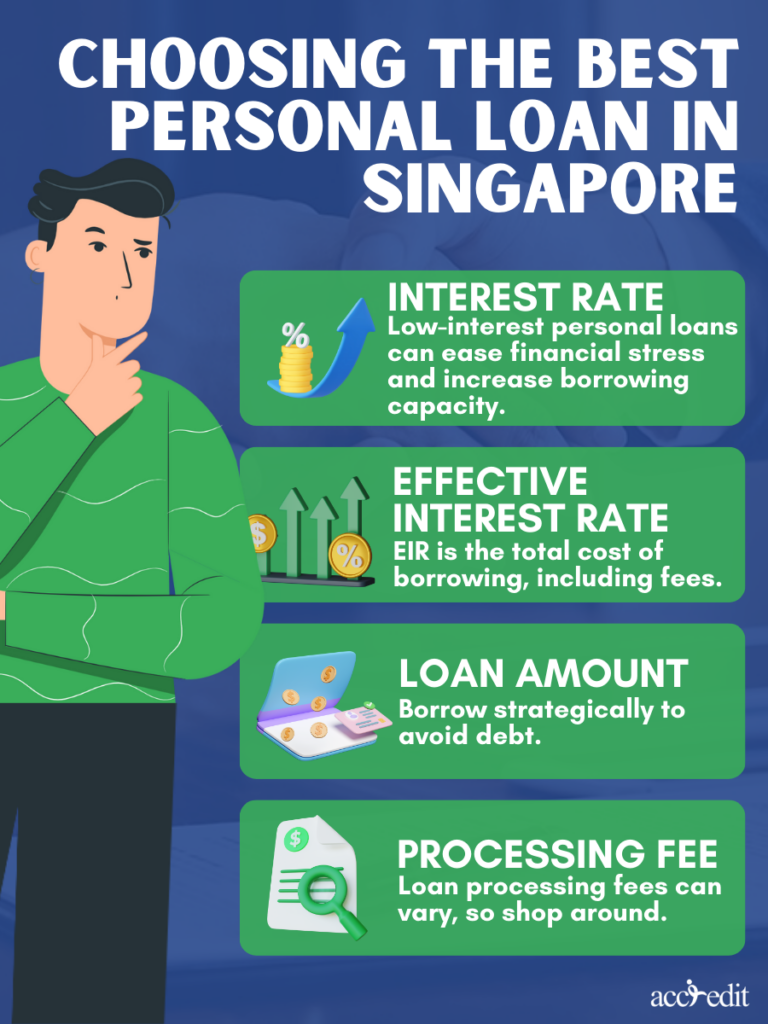

Choosing the Best Personal Loan in Singapore

When choosing a personal loan in Singapore, there are several factors to consider:

Interest Rate

Securing a personal loan can be an excellent solution for those who need funds quickly. However, it’s important to consider the cost of borrowing money, which is commonly referred to as interest rates. Interest rates can significantly impact your financial situation and should be carefully considered before taking out a loan.

It’s not an exaggeration to say that securing a lower interest rate can make all the difference. A lower rate can alleviate the financial stress of repayment and offer flexibility during lean times. Furthermore, a decreased rate can increase your borrowing capacity, allowing you to access more funds than anticipated

Effective Interest Rate (EIR)

The Effective Interest Rate (EIR) is the real number you need to know. This all-important figure accounts for expenses like processing fees and administrative charges that can inflate the cost of borrowing.

Avoid unpleasant surprises and unnecessary expenses by focusing on the EIR. With a little research, you can secure a loan with the most affordable EIR available, putting money back in your pocket and giving you the satisfaction of a savvy financial move.

Loan Amount

When seeking financial aid, it’s natural to desire the largest possible loan amount. However, the optimal solution may not be the highest sum, but rather the one that meets your precise needs.

Borrowing excessively can result in a considerable burden of debt, leading to significant financial consequences. Instead, employing a strategic approach to borrowing can diminish avoidable debt and provide a positive outlook on your financial future.

Processing Fee

A processing fee might appear when applying for a loan, as reimbursement to lenders for examining your loan application. The payment is a one-time expense, aiming to compensate for assessing your qualification for the loan.

While some lenders might not require a processing fee, it’s advisable to scout around to discover the ideal loan package. If a lender does ask for a fee, it’s critical to include that in your budgetary considerations.

Top Personal Loans in Singapore for 2023

Are you ready to secure a personal loan? If so, it’s time to weigh your options. Check out our top picks for the best personal loans in Singapore, boasting competitive rates and flexible terms to suit your needs.

| Personal Loan | Interest Rate (p.a.) | EIR (p.a.) | Minimum Yearly Income | Maximum Loan Amount | Processing fee |

| CIMB CashLite Personal Loan | 3.38% | 6.38% | S$30,000 for Singaporeans/PRs | 90% of the credit limit | S$0 |

| Citi Quick Cash Personal Loan | 3.45% | 6.5% | S$30,000 for Singaporeans/PRs S$42,000 for foreigners | 90% of your credit limit | S$199 |

| HSBC Personal Loan | 4% | 7.5% | S$30,000 for Singaporeans/PRs S$40,000 for foreigners | 90/95% of the credit limit | S$0 |

| UOB Personal Loan | 3.99% | 7.49% | S$30,000 for Singaporeans/PRs | 95% of the credit limit | S$0 |

| Standard Chartered Personal Loan | 3.48% | 7.99% | S$20,000 for Singaporeans/PRs S$60,000 for foreigners | 4x monthly income; capped at S$250,000 | S$199 |

| DBS/POSB Personal Loan | 3.88% | 7.9% | S$20,000 | 4x monthly income | S$100 |

| OCBC Personal Loan | 5.43% | 11.47% | S$20,000 for Singaporeans/PRs S$60,000 for foreigners | 4x monthly income | S$100 |

Accredit Moneylender: Your Solution to Quick Personal Loans in Singapore

If you’ve had a recent bank loan application decline, either because of a low annual income or a bad credit score, no need to worry. There are other viable options, and one of them is Accredit. This licensed moneylender provides personal loans to qualified borrowers who are at least 21 years of age and make an annual income of S$10,000 or less. With Accredit, you can get your hands on a personal loan in no time.

| Borrower’s annual income | Singapore Citizens and Permanent Residents | Foreigners residing in Singapore |

| Less than S$10,000 | S$3,000 | S$500 |

| Between S$10,000 to S$20,000 | S$3,000 | S$3,000 |

| Greater than S$20,000 | 6 times the monthly income | 6 times the monthly income |

Thoughts

Determining your eligibility for a personal loan holds great importance in securing loan approval. To better your chances, it’s crucial to satisfy the requirements of the lender. Once you’ve fulfilled these prerequisites, it’s time to weigh your options by scrutinizing factors such as interest rates, EIR, loan amounts, and processing fees among different moneylenders. As a responsible borrower, ensure that you borrow within your means and refrain from overextending your finances.