Hey there, savvy Singaporeans! If you’re looking to lay a solid financial groundwork while borrowing from a money lender, we’ve got you covered. Building credit is not only important, but it’s also totally doable, even when you’re taking out loans. So, let’s dive into this financial adventure together and discover how you can establish credit while borrowing from a money lender in Singapore!

Grasping the Basics

Alright, before we jump headfirst into the intricate world of credit building, let’s start with something crucial: knowing the distinction between licensed and unlicensed money lenders right here in Singapore. Now, the licensed ones, they’re the good guys who play by the government’s rules. They’ve got their acts together, keeping everything above board. But those unlicensed lenders? Well, they march to their own beat, often resorting to questionable tactics. So, if you want to stay on the safe side and avoid any unexpected roadblocks, it’s always wise to stick with the licensed crowd.

Oh, and here’s a handy tip for you: take a moment to acquaint yourself with the government’s regulations and the interest rates set for licensed lenders. Getting a grasp of these details will give you the upper hand to make informed decisions and find the perfect money lender that fits your needs like a glove.

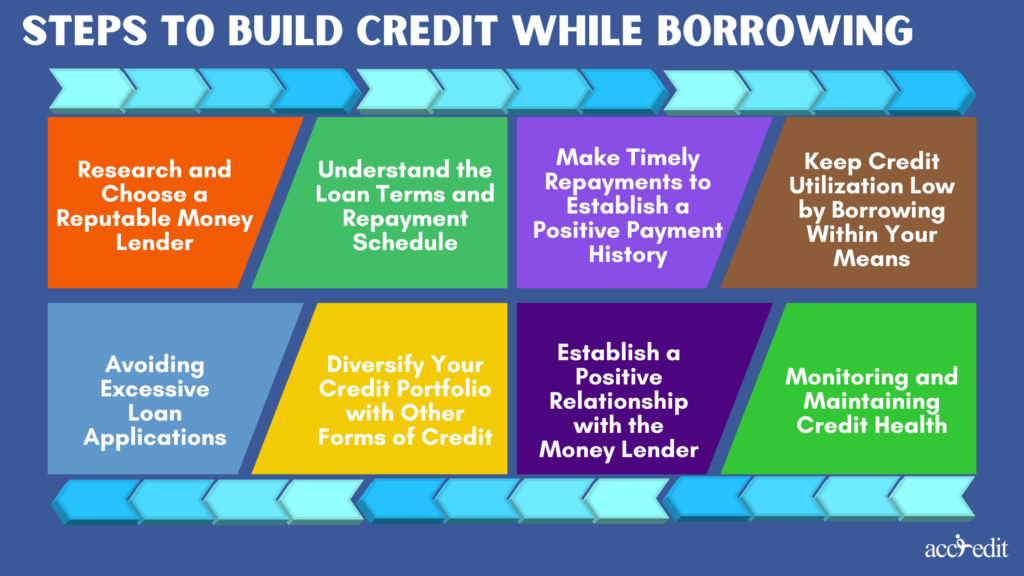

Steps to Build Credit While Borrowing

1. Research and Choose a Reputable Money Lender

If you ever find yourself in need of some extra cash and the thought of turning to a money lender crosses your mind, it’s essential to make a smart choice. Take a moment to delve into the subject and find a trustworthy money lender who can assist you while also improving your credit score. Look no further than Accredit Moneylender – a beloved option that has captured the hearts of numerous Singaporeans. Accredit provides a range of credit solutions, such as personal loans, business loans, and short-term loans, catering to your diverse needs.

2. Understand the Loan Terms and Repayment Schedule

Now, when you’re thinking of borrowing money from those folks who lend it out, spare a moment to dive into that loan agreement. Take a closer look at the nitty-gritty: the interest rates, the dates you gotta pay up, and any sneaky fees lurking in the shadows. Armed with this know-how, you’ll be equipped to make shrewd decisions and steer clear of nasty surprises.

3. Make Timely Repayments to Establish a Positive Payment History

In the grand tapestry of credit-building, there exists a pivotal thread that holds great power: establishing a positive payment history. Picture this—by making your repayments with clockwork precision, you’re showcasing your dependability and fiscal prudence, casting a spell on your credit score. To weave this enchantment, enlist the aid of reminders, automated payments, or nifty payment apps that keep you on the straight and narrow, ensuring your payments arrive on time. Through this unwavering consistency, your credit profile shall gain strength, propelling you towards a brighter financial horizon.

4. Keep Credit Utilization Low by Borrowing Within Your Means

When it comes to taking a loan, it’s crucial to exercise prudence and avoid plunging into overwhelming debt. The secret lies in borrowing within your means, ensuring that you don’t bite off more than you can chew. Keep your credit utilization ratio on the down-low, meaning utilize only a fraction of your available credit. Showcasing responsible borrowing habits and refraining from pushing your credit limits to the max will not only impress future lenders but also enhance your financial standing.

5. Avoiding Excessive Loan Applications

While it’s crucial to delve into suitable loan choices, bombarding lenders with numerous applications in a short span can set off alarm bells. You see, every time you apply for a loan, it triggers a credit inquiry. Now, these inquiries can make lenders wonder if you’re financially shaky. So, rather than going on a loan frenzy, be discerning in your choices and think twice before hitting that application button. By adopting these savvy tactics and sticking to smart money management, you’ll gradually construct a solid credit foundation.

6. Diversify Your Credit Portfolio with Other Forms of Credit

When it comes to establishing credit, don’t limit yourself to just borrowing from moneylenders. It’s wise to mix things up and explore other avenues of credit. Think about getting yourself a credit card or taking out a personal loan from a conventional financial institution. By embracing a diverse range of credit sources, you demonstrate your capability to handle different financial obligations. This, in turn, can have a favorable influence on your credit score and overall financial credibility.

7. Establish a Positive Relationship with the Money Lender

When it comes to dealing with your money lender, fostering a positive connection is key. Building a strong relationship is like laying the foundation for your credit journey. If you find yourself facing financial difficulties or foresee challenges in meeting repayments, don’t hesitate to communicate with your money lender. They may have temporary solutions or alternative repayment plans that can help. Open and honest communication prevents unnecessary hurdles and shows your dedication to fulfilling your responsibilities.

8. Monitoring and Maintaining Credit Health

Lastly, let’s talk about keeping your credit health in check. It’s like tending to a garden – you need to monitor and maintain it regularly. Don’t worry, it’s not as tedious as it sounds.

First things first, consider using credit monitoring services. They’re like your personal watchdogs, keeping an eye on your credit scores and reports. This way, you’ll always be in the know about any changes or discrepancies that might pop up. It’s like having a loyal sidekick who alerts you to any potential credit villains.

Next up, responsible debt management is key. Think of it as juggling your financial obligations but in a graceful and controlled manner. Avoid piling up too much debt – it’s like adding unnecessary weight to your already heavy load. Instead, make it a priority to pay your bills on time. This way, you’ll earn a reputation as a reliable and trustworthy borrower.

Wrapping Up

Kudos to you! You’ve now got the know-how and the necessary tools to cultivate your credit score while taking out a loan from a Singaporean money lender. Keep in mind, though, that it’s crucial to do your homework and select a trustworthy lender, just like the folks over at Accredit Moneylender. Take the time to comprehend the loan conditions, stay on top of your repayments, and exhibit responsible financial behavior. By adhering to these guidelines and tried-and-true methods, you’ll pave the way for a sturdy credit foundation and unlock a world of better financial prospects down the road.