Envision this: You’re an ant on a leaf, floating down the SIngapore River, clinging on as the financial currents of life bob you about. Would having a friendly hand to steady your leaf be lovely? Welcome to the world of an ethical money lender pursuing the honest money lending approach.

They’re the life preserver in every Singaporean and non-Singaporean turbulent financial sea—the financial hand when your leaf hits a choppy wave.

But are there any more details you have to know about what these money lenders genuinely are? Find all the secrets revealed below!

Ethical Lender: An Exemplary Journey From Back Alleys to Boardrooms

Once upon a time, the term “money lender” was then only a whisper. It was mentioned in hushed tones, conjuring up images of ominous figures luring in shadowy back alleys in the 1800s.

Not anymore! Today, Singapore has the best and most renowned ethical money lender. They’re as far from the archaic portrayal as the Esplanade is from a simple fishing village.

The journey of these money lenders has the same ascension in Singapore, from a modest port city to a shimmering global hub, which is one of transformation and evolution—fuelled by implementing the Moneylenders Act in 2008 and fortified by the Moneylenders (Amendment) Act 2010.

Money lenders have since found themselves in a new era of regulations and scrutiny. A generation that many borrowers applaud as they champion fairness, respect, and integrity above all else.

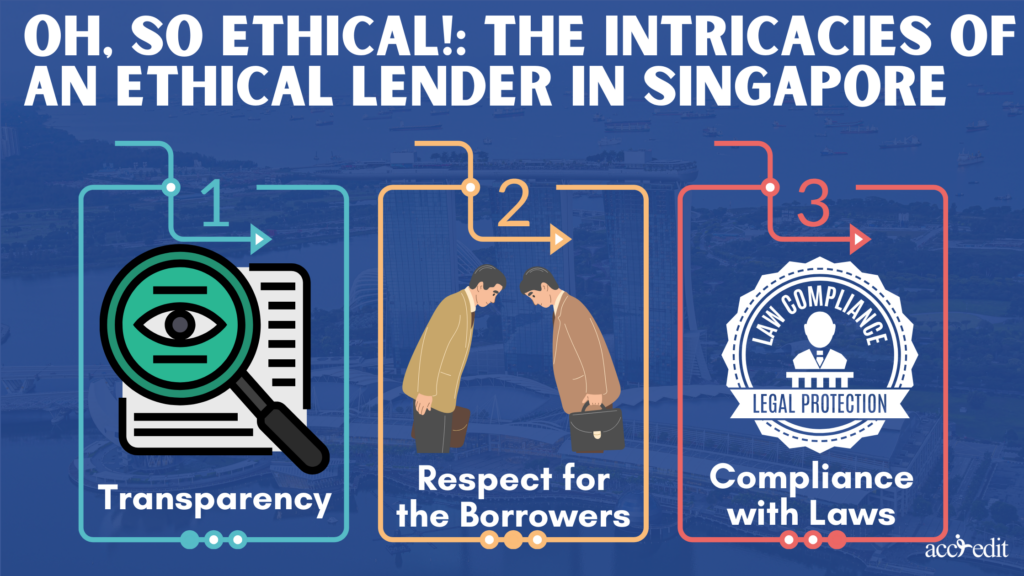

Oh, So Ethical!: The Intricacies of an Ethical Lender in Singapore

When you hear the word “ethical”, it isn’t only about referring to a money lender who remembers your name and asks about your kids. An ethical money lender, dear reader, is more the same as a stalwart officer upholding Singapore’s Code of Ethics.

Singapore’s ethical money lenders are authorised and licensed to lend and provide personal loans and other monetary products. They’re all enlisted in the Ministry of Law’s Registry of Moneylenders.

In addition to such features, they also prioritise:

Transparency:

Comparable to Singapore River’s crystal clear waters, everything is out in the open – no hidden charges or terms tucked away in the fine print.

Respect for the Borrowers:

An ethical money lender doesn’t see borrowers as walking dollar signs but as a fellow citizens steering through the financial ebb and flow.

Compliance with Laws:

Every single and licensed ethical money lender in Singapore complies with the Ministry of Law’s Moneylenders Act. They are a borrower’s guiding light, just as the statutes of the Lion City govern your actions.

You can instantly see the compliance and professional etiquette that licensed lenders show. It’s entirely in contrast to how unlicensed lenders or loan sharks operate. Thus, you should never fall into illegal lending activities as it’ll be a disastrous turn of events you must never go through.

So, borrowers like you will see that ethical lenders benefit your life better.

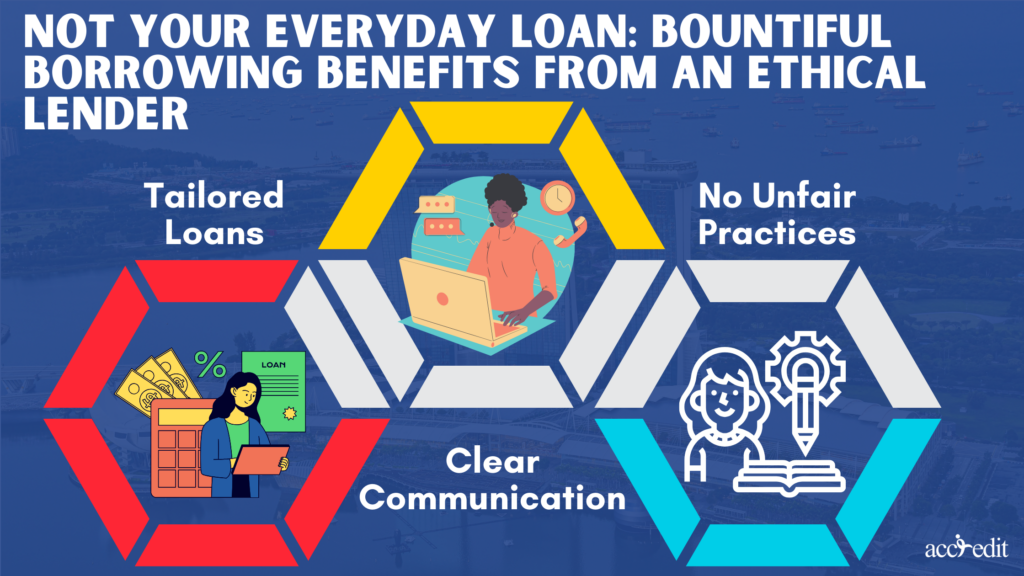

Not Your Everyday Loan: Bountiful Borrowing Benefits from an Ethical Lender

Ethical money lenders are fresh Marina Bay air if you’re accustomed to traditional banks’ staid, cookie-cutter offerings. They understand that every borrower is as unique and special as the Denizens of the energetic hawker centres.

The advantages borrowers like you will acquire are the following:

Tailored Loans:

Singapore has the most considerate ethical money lenders. They do not believe that all loans are one-size-fits-all.

Like the bespoke suit, they’ll tailor the loans to your unique financial circumstances.

Clear Communication:

Like the specific rules of your local hawker centres, no ethical lenders provide clear terms and conditions.

No Unfair Practices:

Dealing with an ethical money lender would be like boarding an MRT – you won’t have to worry about unexpected bumps along your journey.

Thus, what are the loans you can borrow from these prime lenders?

Variety is the Spice of Debt: Loan Options from an Ethical Lender

As your beloved hawker centres deliver a dizzying array of cuisines, ethical money lenders grant a broad spectrum of loan choices tailored to meet unique needs. Even Singapore’s most delicious food selections appeal to different taste buds, and other loans cater to distinct monetary circumstances.

Personal Loans:

Are you searching for a fund source no matter what happens?

Then personal loans are the dependable go-to for all. These loans may be utilised to assist Singaporean and non-Singaporean borrowers in gaining relief from personal expenses, whether home or car repair or medical bills.

Payday Loans:

Did you find yourself suddenly low on cash?

You don’t have to stress because ethical lenders may approve your payday loan application. These loans are short-term solutions to help you manage till the next payday.

It’s the quick bite to tide you over.

Business Loans:

The loan fits perfectly as a hearty zi char, nourishing your business’ growth and expansion.

Foreigner Loans:

Picture this as your internationally renowned and acknowledged food brand. It’s a loan customised specially for ex-pats and foreign workers in Lion City because everyone deserves a financial helping hand.

Knock, Knock, Who’s There?: The Loan Process and Requirements for Borrowing Ethically

Obtaining a loan from an ethical money lender is as constructed as a well-planned MRT route, with clear signages and particular stops along the way.

Step 1 – Initial Application:

It’s the perfect moment to start pursuing a loan from an ethical money lender. It will involve selecting the type of loan that suits your preference most reasonably.

Step 2 – Documentation:

Time to serve up the ingredients! You must present necessary documents such as proof of income, residence, and your passport or NRIC.

Step 3 – Assessment:

When you fill-up all the necessary details in the application, pass it to your chosen lender and wait for the review. The lender will then assess your financial situation. A licensed and ethical lender will do it carefully to ensure you’ll acquire only the befitting your status.

Step 4 – Approval and Contract:

Once your loan gets the green light, a contract outlines the terms and conditions.

Step 5 – Disbursement and Repayment:

Finally, the best part – feasting! The licensed lender will wire the loan amount to the account you’ve included in your application, and you will venture on your repayment trip.

A New Dawn with the Ethical Lender

In conclusion, the ethical money lender in Singapore is a well-choreographed ballet, where every step is taken with precision, grace, and a deep understanding of the dance. From your needs to the regulations that guarantee fairness, every aspect works together to create a trustworthy lending landscape that is as dynamic as it is secure.

So, whether you’re a Singaporean or non-Singaporean, know you have a trusted partner in your financial journey. Because in Lion City, ethical lenders like Accredit are institutions and a community committed to fostering a fair and respectful lending culture.

And isn’t that something that will make you feel luckier in this city you call home? Thus, contact Singapore’s licensed money lender, Accredit, for your financial needs.