It’s easy to comprehend that acquiring a good education in Singapore can be expensive. The different fees range from fees, textbooks and living expenses. Many people consider taking out education loans in Singapore to ease the financial burden of academics and lifestyle.

But first, before bravely pursuing an educational loan in the country, it’s critical to understand the loan completely. Also, it doesn’t hurt to compare the various types of loans accessible in Singapore.

In this article, you’ll learn the basics of schooling loans. You’ll also obtain information on eligibility criteria, the application process, tips for choosing the right loan and prime benefits attainable.

What are Education Loans?

Education Loans Singapore is specifically designed to assist students with the finances connected to their education. These expenditures that students in Singapore need financial assistance from banks, financial institutions, and licensed moneylenders are typically for their living expenses, books, miscellaneous fees, personal expenses, overseas studying, and tuition fees.

Undergraduates and students pursuing tertiary education courses who are Singapore citizens or Permanent Residents may apply for the education loan. These include diploma, undergraduate, postgraduate, and other specialist courses offered mainly by universities, polytechnics, and private education institutions.

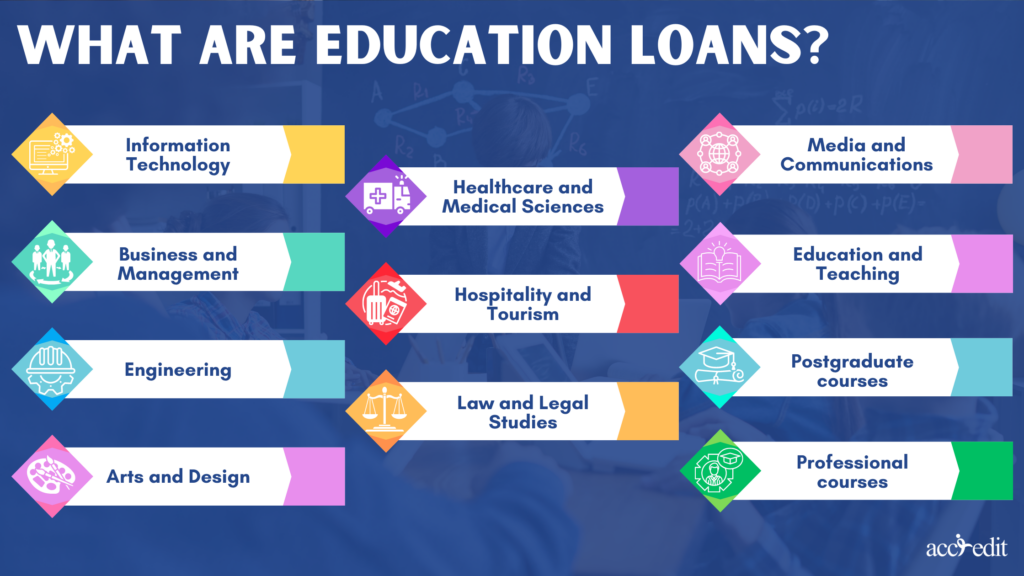

Some courses may need to be eligible for the loan. Currently, the popular methods eligible for this type of loan in Singapore are:

- Information Technology

- Business and Management

- Engineering

- Arts and Design

- Healthcare and Medical Sciences

- Hospitality and Tourism

- Law and Legal Studies

- Media and Communications

- Education and Teaching

- Postgraduate courses such as Master’s or PhD

- Professional courses like Chartered Financial Analyst (CFA), Association of Chartered Certified Accountants (ACCA), Project Management Professional (PMP), Certified Information Systems Security Professional (CISSP), and Certified Public Accountant (CPA)

Students must remember that these courses and their eligibility may vary from one financial institution to another. As a result, researching and confirming the financial institutions’ criteria and requirements before applying for an education loan is the most suitable approach.

Secured and Unsecured Education Loans

Education loans in the country are either secured or unsecured, which depends on the financial institution proffering the loan choice.

Secured loans require the borrowers to provide collateral like fixed deposit accounts or real estate property. For unsecured loans, collateral is no longer requested, but the borrowers must have a co-signer or guarantor to guarantee repayment.

Education Loans Singapore Coverage

Everyone deserves the best education there is. Thus, financing businesses in Singapore opt to proffer this specific loan to assist students with their financial issues related to their studies.

But the coverage isn’t solely about the student’s tuition fees and books. In truth, the education loan is relatively comprehensive.

Here is the current coverage accessible under the education loan:

Tuition Fees:

The tuition fee is possibly the most significant and widely-known expense associated with one’s education. These fee rates increase as students wish to acquire and accomplish higher education opportunities.

On average, a student’s total tuition fees from a four-year general course within local universities may cost between $22,500 to $54,000 for a Singapore Citizen. Students without subsidies must pay between an estimated $96,000 to $180,000.

Taking out a loan can cover partial costs or as much as 100%, that’s useful for paying tuition fees.

Books and Miscellaneous Expenses:

Every student in the country must have books and access to materials and rooms associated with their curriculum. As a result, these are additional expenses that students have to pay.

A student’s expenses are equipment, textbooks, course materials, and laboratory fees. These are a few, but they considerably belong to the education loan coverage.

Aside from the textbooks and course materials, laboratory fees can be expensive. A student who wants to thrive in their studies has to gain access to these, particularly specialised equipment and facilities.

Miscellaneous fees don’t have a fixed rate expense. It varies extensively between the student’s chosen course and institution.

However, an estimated cost for the books and additional miscellaneous expenses students shoulders would range between a few hundred to thousands of dollars annually. The textbooks would cost $50 to $250 for a single course, while the lab fees may cost a few hundred to thousand per semester.

It can be an expensive financial situation for a student. But, students must gain access to these for their future to thrive. Thus, taking an education loan is reasonable and must be pursued.

Living Expenses:

Another vital factor a student requires in Singapore is a well-rounded and safe living situation and environment.

The education loan may cover the living expenses if a student wishes to acquire this but needs additional funding. Students’ common yet essential living expenses include food, housing or accommodation, transportation, and personal expenses.

From these, accommodations or housing gains are the most significant expense students have to bear, particularly when students opt to live within university housing or the city’s most popular areas nearest the universities.

Here are some estimated student housing rental costs in Singapore:

On-campus university residence halls:

A student’s rent fees for staying in these residence halls in universities or polytechnics range around SGD 250 to SDG 700 a month.

It depends highly on the room type, whether it’s a single room with shared bathroom facilities. This cost less than larger, air-conditioned rooms with their bathrooms. It’s the same with rooms with only basic furnishing as a fully-furnished room with additional amenities.

The leasing expenses also vary according to the facilities available for a student living in residence halls. These facilities provided by the institutions may range from study areas, recreational facilities, swimming pools or gyms, and communal kitchens.

HDB Flats in Singapore:

Students may live in the Housing Development Board (HDB) while studying. The rent fees vary depending on the living choice of the student. For instance, a room inside a shared HDB ranges from SGD 400 to SGD 800 monthly. Renting the whole HDB flat typically costs from SGD 1,500 to SGD 2,500 monthly.

The amenities and facilities accessible from HDB flats vary in type and location. The most basic facilities are the bathroom, kitchen, living area, and bedrooms. Additional amenities like washing machines, air-conditioning, and internet connection are also attainable.

Private Hostels and Dormitories:

These housings are ideal for students who prefer basic to high-end facilities. The rent fees are usually around SGD 500 to SGD 1,500 per month.

The accessible facilities and amenities from these housing are furnished rooms, air-conditioning, Wi-Fi access, laundry facilities, common areas like lounges, kitchens, and study rooms, and well-rounded security measures, including key card access and security cameras.

Not all private hostels and dormitories in Singapore have the same amenities and facilities. Thus, students should research their options and evaluate their needs and budget.

Private Apartments and Condominiums:

Other famous accommodations students in Singapore prefer private apartments and condominiums.

These living choices have added privacy and exclusivity, a high level of security, and spacious living areas. Amenities students can enjoy are gyms, swimming pools, and outdoor recreational places. It’s also close to central areas of the city, close to public transportation, entertainment venues, and shopping centres.

The general renting fees for private apartments and condominiums may range from SGD 1,500 to SGD 4,000 per month, depending on size, location, and facilities. Students must remember to set a budget for utilities like water and electricity, as these are not included in the monthly rental fees.

Food costs:

The total food costs may depend on the student’s eating habits and preferences. These days, hawker centres have meals which cost about SGD 4 to SGD 6. Mid-range restaurants may range from SGD 20 to SGD 30.

Transportation expenditures:

Even if students live within the polytechnic or university, they have to travel outside too. The estimated monthly cost of a public transport pass is around SGD 90 to SGD 120.

Overseas Study:

Education loan Singapore also covers overseas study, which proffers a student to obtain higher education abroad. It’s notable that overseas studying can be costly. One option accessible for students to pay for tuition fees, travel, living expenses, and other personal expenditures is taking out an education loan.

The amount of loan receivable will depend on the student’s course of study, the country where they’re studying, course duration, and the financial status of the student’s family.

These are the primary coverage students may gain access to financial assistance from an education loan. Now, which types of loans are available in Singapore that students could apply for?

Types of Education Loans Available in Singapore

Individuals studying in Singapore can apply for this particular loan in the country. There are various types of education loans that students may choose from.

If you’re currently a student seeking the best loan that suits your studies and other needs, you’re in the right place.

Here are the accessible loans for students in Singapore:

Government-Backed Education Loans:

The Singapore government offers various loan schemes for student’s finance their studies, such as:

Government Study Loan

The purpose of the government study loan is to grant financial assistance to students experiencing trouble financing their tertiary education.

Eligibility Criteria:

- Singapore Citizen or Permanent Resident

- Enrolled in full-time courses of study and approved by the local or overseas institutions

- Have a gross monthly household earning of not more than SGD 2,700

The total loanable amount may exceed 90% of Singaporeans’ subsidised tuition fees. It’s subject to a max of SGD 20,000 per academic year with an estimated interest rate of 4% per annum.

The repayment period for this particular loan is up to 20 years. It’ll commence a year after graduation.

Tuition Fee Loan (TFL)

It’s the type of loan that local banks typically offer. Its purpose is to assist students in paying their tuition fees.

Eligibility Criteria:

- Student must be either a Singapore Citizen or Permanent Resident

- Enrolled on a full-time diploma course, undergraduate or postgraduate courses at certified institutions

The total loanable amount or the subsidised tuition fees is up to 90%. It’s also subject to a max of SGD 15,000 per academic year. The annual interest rate is 4% with a repayment period of up to 20 years and will begin six months after graduation.

Education Loans

Local banks offer education loans to assist students in paying for living fees and other education-related expenditures, like equipment and books.

Eligibility Criteria:

- Students must be Singapore Citizens or Permanent Residents.

- They’ve enrolled in full-time diploma, undergraduate, or postgrad courses at authorised institutions.

- Earning a gross income of at least SGD 1,500 per month if they’re not working or if they’re not a part-time worker

The loanable amount accessible from the financial product ranges up to SGD 150,000. It’s subject to the bank’s assessment of whether the borrower has good to excellent creditworthiness. Interest rates vary on the bank but mostly range from 4% to 5% per annum.

The repayment period varies on the bank. However, the available length of repayment terms is from one year to ten years.

Overseas Student Programme Loan (OSPL)

These loan schemes are purposely for Singapore students who want to study abroad. This loan covers living expenses, tuition fees, and other education-related expenditures.

Eligibility Criteria:

- Singapore Citizens or Permanent Residents accepted into full-time diploma or undergraduate courses at certified institutions abroad.

The loanable amount is up to 90% of the subsidised tuition fees. There’s also an additional allowance for living expenses.

The estimated interest rate payable is 4.5% annually after the student completes their course. Repayment terms start six months after graduation with a repayment period of up to 20 years.

Bank Education Loans

The local banks in Singapore also proffer bank education loans. Students may consider this as an additional option aside from government-backed schooling loans. The coverage of the loan is paying for tuition fees and living expenses.

Eligibility Criteria:

- To become eligible for the loan, the student must be a Singapore Citizen or Permanent Resident.

- A student needs to clarify if there are age limits regarding the education loan.

- Must be enrolled in a specific course or institutions

- The student has to have a good to excellent credit score. Plus, they must meet the bank’s income and employment requirements, such as proof of enrollment and identification documents.

- Banks may require a co-signer or collateral to get an education loan from a bank.

This particular loan scheme can cover 100% of the borrower’s tuition fee, with an estimated annual interest rate of 4.35%. The repayment period can last up to twenty years.

Personal Loans

Banks and licensed moneylenders in Singapore grant the personal loan to their borrowers for various purposes. In many cases, parents or guardians or students do seek personal loans to utilise them to finance education-related expenses.

Due to its flexibility, borrowers only need to fulfil criteria and requirements to obtain the funds for one’s education needs.

Eligibility Criteria:

- Applicants must be at least twenty-one (21) years old and not more than sixty-five (65) years old.

- Singaporean Citizens, permanent residents, and foreigners with valid employment passes may apply for a personal loan to fund education.

- Singapore citizens and permanent residents must have an annual salary of SGD 30,000.

- Foreigners should present proof of a minimum annual salary of SGD 45,000.

- A good credit history and a good to excellent credit score are necessary.

The possible amounts accessible from personal loans may range between SGD 1,000 to SGD 100,000. Interest rates may vary on the bank or licensed moneylender, but the general range would be 3.5% to 10% per annum for banks and up to 48% per annum for licensed moneylenders. Repayment terms would be one to seven years, and disbursement takes a few working days after loan approval.

Licensed Moneylenders Education Loans

The Ministry of Law regulates all registered moneylenders in the country. These financing businesses are permitted to proffer education loans to their borrowers.

Eligibility Criteria:

- The borrowers must be Singapore citizens, permanent residents, or foreigners with valid work permit or work pass.

- They have to be at least twenty-one years old.

- They should be enrolled in a part-time or full-time accredited educational institution.

Requirements:

- Identification proof and documents such as passport or NRIC

- Proof of income and employment

- You must present proof of enrolment in certified and accredited educational institutions.

- Additional documents required by licensed moneylenders like proof of residence, bank statements, and others

The loanable amount that borrowers may gain access to from a licensed moneylender education loan ranges from $3,000 for those enrolled in private education institutions. On the other hand, students enrolled in local or overseas government-subsidised institutions may acquire as much as $5,000 in total.

As regulated by the Ministry of Law, licensed moneylenders may only impose a maximum interest rate of 4% per month. The maximum repayment period is about twelve months for each education loan applied and granted to the borrower. Repayment terms can be made per month or quarterly.

Choose the Right Education Loans in Singapore for Your Future

It’s a fact that various education loans are available to a student in Singapore. However, the task can be considered challenging and daunting at first sight.

When choosing the right education loan, consider various factors like loanable amounts, interest rates, and repayment periods. Getting a loan requires an individual to bear financial responsibilities, and an education loan in Singapore could last up to twenty years.

Thus, assess your financial needs and abilities to repay the loan before applying for the loan. It’s also better to have additional sources for education funding, like grants, scholarships, and part-time jobs, that can assist with paying educational expenses to lessen the loan’s amount.

Aside from one’s health, education is another valuable and helpful wealth. So, you must be sure about your course, loan choices, and life priorities, as these will help you shape your future.

Are you ready for your future? Click here to apply for a loan for your education needs today!