Do personal loans affect credit scores? It’s a crucial question for many in Singapore and one that deserves exploration. A personal loan will certainly have an impact on your credit score, but whether that impact is a boost or a setback is up to you and your loan management strategies. So, are you ready to explore the intricate dynamics of personal loans and credit scores? Let’s delve in.

A Clear Definition of Personal Loans and Credit Scores

A personal loan and a credit score are two financial concepts that are important for every borrower to understand.

Personal loans, an unsecured form of borrowing, offer individuals the opportunity to secure additional funds for personal expenses like home renovations, education costs, or medical bills.

Meanwhile, credit scores serve as a numerical evaluation of an individual’s creditworthiness, taking into account factors like payment history, credit utilization, credit history length, and type of credit accounts.

Do Personal Loans Affect Credit Scores?

Curious minds want to know – does securing a personal loan in Singapore have an impact on your credit score? The simple answer is a resounding yes. However, the nature of that impact is solely within your control, and contingent on the management techniques employed for your personal loan.

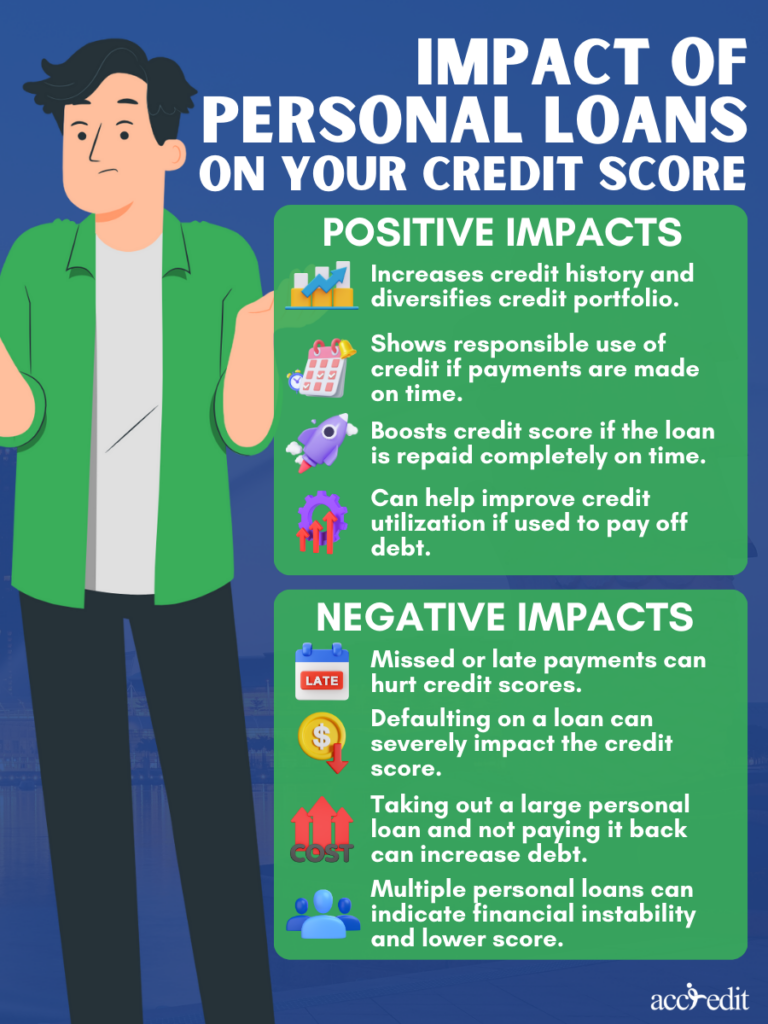

Understanding the Impact of Personal Loans on Your Credit Score

The measure of your financial credibility, your credit score, holds great significance in your monetary pursuits. It takes into account a multitude of aspects like your credit utilization, payment history, and types of credit accounts owned. Opting for a personal loan can significantly influence your credit history.

A personal loan, a form of debt, can work wonders for your credit score provided it is handled responsibly. Making timely payments in full on your personal loan highlights your financial prudence and worthiness to future lenders.

However, recklessness in managing a personal loan can lead to a financial catastrophe. Defaulting or missing payments on your loan can cause a sharp plummet in your credit score. Therefore, it is of utmost importance to handle your personal loan cautiously and recognize its impact on your credit score.

Strategies for Minimizing the Negative Effect of Personal Loans on Credit Scores

To keep your personal loan from turning into a double-edged sword, consider these tactics for minimizing the impact on your creditworthiness.

Strategy 1: Avoid Taking on Too Much Debt

Before securing a personal loan, take a step back and assess your current financial landscape. Be exact about the amount you truly require to borrow. An overextended loan balance can wreak havoc on your credit utilization, causing your credit score to suffer. By being strategic and intentional about the amount you borrow, you can steer clear of credit damage and optimize this financial opportunity.

Strategy 2: Pay Off Your Loan Quickly

Short-lived loans with smaller balances leave a lighter footprint on your credit score compared to long-term loans with substantial amounts. Taking a proactive approach and paying off your personal loan quickly not only saves you from paying excessive interest but also reduces the impact on your credit utilization, thereby positively affecting your credit score.

Strategy 3: Pay Off Outstanding Debts First

The accrual of multiple outstanding debts can raise your credit utilization, thereby lowering your credit score. By taking a proactive approach and paying off a portion of these debts before seeking a personal loan, you can enhance your credit score and open the door to loan opportunities with more favorable terms and rates in the future.

Strategy 4: Make on-time payments

By consistently making full and on-time payments on your personal loan, you not only avoid missing repayments but also prove your creditworthiness to lenders and credit bureaus, resulting in a positive impact on your credit score. Remember, consistency and reliability in paying your debts is a crucial factors in determining a strong credit score.

Strategy 5: Seek help from a financial advisor

If navigating the ins and outs of personal loans and their impact on credit scores seems overwhelming, turn to the guidance of a financial advisor. These experts can provide valuable insights and help you make smart decisions about your finances, ensuring your credit score stays strong even with a personal loan in play.

Thoughts

The impact of personal loans on credit scores in Singapore can be significant, but with strategic action, it can be mitigated. Timeliness in payments, smart debt management, and paying off existing debts before embarking on a new loan journey are just a few tactics to help keep your credit score intact. Empowering yourself with knowledge about the relationship between personal loans and credit scores is crucial in making informed financial decisions in Singapore.

Accredit Money Lender: Your Solution to Improving Your Credit Score

Looking to boost your credit score? Turn to Accredit Money Lender for your personal loan needs. Our streamlined application process allows for quick approval, so you can start paying your bills on time and watch your credit score soar. Our short-term loans are ideal for those in need of quick cash, regardless of credit history. Don’t let bad credit hold you back any longer.

Take the initiative towards financial freedom and avail of our reputable loan services.