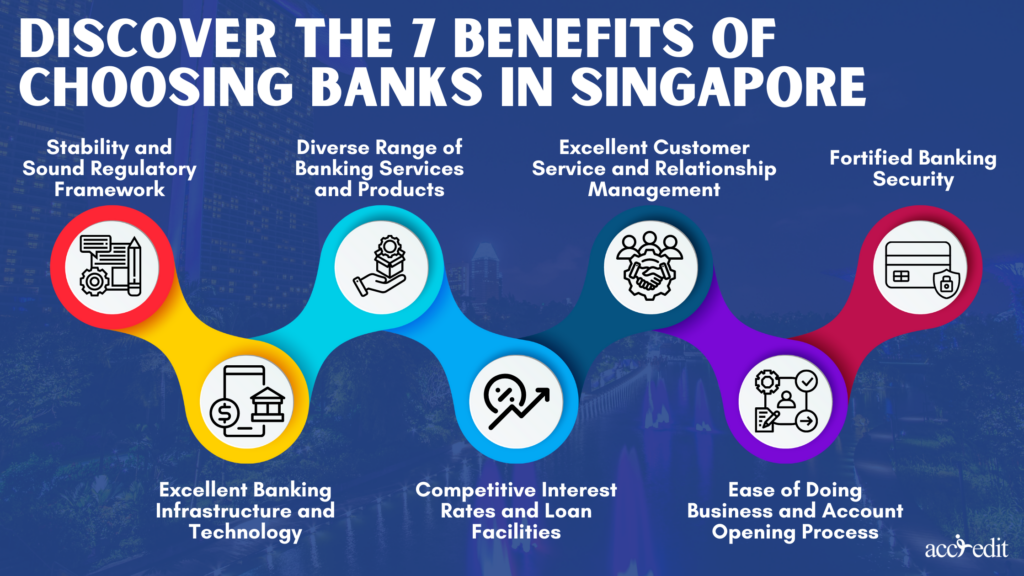

Singapore, a bustling financial center, has become a go-to destination for people and businesses worldwide. Picking the right bank is paramount when it comes to handling your money matters. Thankfully, banks in Singapore present a plethora of advantages that make them a top-notch option for all your banking requirements. In this piece, we’ll delve into the 7 enticing benefits of selecting Singaporean banks. These valuable insights will empower you to make a well-informed choice.

1. Stability and Sound Regulatory Framework

Let’s talk about something important—your hard-earned cash. We all want stability when it comes to our money, right? Well, Singapore has got you covered. They’ve got this rock-solid regulatory system in place, backed by a reputation for financial integrity. The folks at the Monetary Authority of Singapore (MAS), which is like the country’s financial superhero, make sure that banks play by the rules.

They’ve got these strict regulations that keep things in check. And you know what that means? It means you can sleep easy, knowing your deposits are safe and sound. Singaporean banks go the extra mile to maintain financial stability, which makes them a super reliable choice for all your banking needs.

2. Excellent Banking Infrastructure and Technology

When it comes to banking, Singapore is a force to be reckoned with. Their banking infrastructure is seriously impressive, and they’re all about staying ahead of the curve with their cutting-edge technology. Picture this: online banking platforms, mobile apps, the whole shebang. Singaporean banks go the extra mile to make your life easier. Think seamless transactions, instant updates, and round-the-clock access to your accounts. With their digitized banking services, managing your finances becomes a breeze. No stress, just smooth sailing.

3. Diverse Range of Banking Services and Products

You won’t believe the diverse range of banking services and products Singaporean banks have in store for you. They’re all about meeting your unique needs, whether you’re looking for personal banking solutions or specialized services for your business. With everything from wealth management and private banking to corporate financing and trade services, they’ve got tailored solutions that perfectly fit the bill. No matter your goals, they’ve got the financial tools to help you get there.

4. Competitive Interest Rates and Loan Facilities

Listen up, because this one’s important: the interest rates you get can make or break your financial game. Lucky for you, banks in Singapore know how to bring the heat. They offer super competitive interest rates on deposits, savings accounts, and loans. Choosing a Singaporean bank means you get to ride the wave of favorable interest rates, giving your savings the best shot at growing big.

And hold on tight, because it doesn’t stop there. These banks also provide a whole range of loan facilities to support both your personal and business dreams. Whether you’re looking to snag a home loan, a business loan, or any other type of financing, Singaporean banks have got your back with sweet terms that match your borrowing needs.

5. Excellent Customer Service and Relationship Management

Customer service is an absolute game-changer when it comes to banking. And you know what? Singaporean banks take it to a whole new level. They excel in delivering excellent customer service and top-notch relationship management. Their focus is all about you, the customer. They prioritize personalized service that meets your every banking need with absolute precision. You’ll have dedicated relationship managers by your side, ready to offer tailored advice and support, helping you navigate your financial journey like a pro.

6. Ease of Doing Business and Account Opening Process

Let’s talk about how Singaporean banks make your banking life a breeze. Opening an account with these banks? Piece of cake. They’ve made sure the whole process is smooth sailing and hassle-free. You won’t be drowning in paperwork either, thanks to their simplified documentation requirements. And hey, they even offer digital options, so you can get onboarded without breaking a sweat. That same ease of doing business carries through your entire banking journey, making it super convenient to handle your finances. No headaches, just pure simplicity.

7. Fortified Banking Security

Now, let’s talk about something that’s absolutely crucial when it comes to your hard-earned cash: security. And boy, do Singapore banks know how to fortify it! Think about it: heavyweights like DBS Bank, OCBC Bank, and United Overseas Bank not only have the reputation of being the safest banks in Asia, but they also grabbed the top three spots in the prestigious Global Finance rankings of 2022. When it comes to keeping your funds safe and sound, these banks are the cream of the crop. So rest easy, knowing that your money is in the hands of the absolute best in the biz.

The Final Verdict

When it comes to banking, Singaporean banks have got it all figured out. They offer a bunch of advantages that make them stand head and shoulders above the rest. With a solid regulatory framework and cutting-edge technology, managing your money becomes a piece of cake. These banks have a wide range of services tailored to fit both individuals and businesses, plus they offer competitive interest rates and loan options.

But that’s not all. Their customer service is top-notch, providing personalized assistance whenever you need it. And the best part? Opening an account is a breeze, thanks to their streamlined process. Oh, and let’s not forget about security. Singaporean banks take it seriously, making sure your funds are safe and sound.

All in all, choosing banks in Singapore means you get stability, convenience, a variety of options, great rates, excellent service, seamless transactions, and ironclad security. It’s pretty clear that they’ve got everything you need for all your banking needs.

Introducing Accredit Moneylender: Your Reliable Source for Hassle-Free Personal Loans

Now that you’re well aware of the advantages of opting for a bank in Singapore, let’s shift our focus to another player in the game: licensed moneylenders. And in this corner, we have Accredit Moneylender, your go-to source for seamless personal loans in Singapore. They’re licensed, which means they’ve got the green light to operate, and boy, do they deliver.

Imagine this: you’ve got an unexpected home renovation on your hands or a dream wedding to plan. That’s where Accredit Moneylender swoops in, providing speedy approvals and fair interest rates to help you tackle these financial hurdles. No more holding back or stressing out about money matters.

Take control of your circumstances and embrace the convenience and speed that Accredit Moneylender brings to the table. Say goodbye to financial worries and hello to a brighter future.