Can you borrow money in Singapore? It may have crossed your mind even when you have no plans to borrow any cash.

With an open mind, you understand that some circumstances may require you to loan some money. Since you’re not fully aware of the steps on how to borrow money in SG, it’s time to level up.

Can You Borrow Money in Singapore?

Are you a Singapore Citizen, Permanent Resident, or foreigner with a working pass?

If you answered yes, you could borrow money in Singapore, especially from a moneylender. But the truth is there’s more to it than one’s nationality.

Specific policies must be followed and complied with when getting a personal loan or other loan options in Singapore.

Before borrowing money from a lender, you must gain knowledge of the moneylending industry you’re getting into, especially since there are licensed lenders and “ah long” you should be aware of.

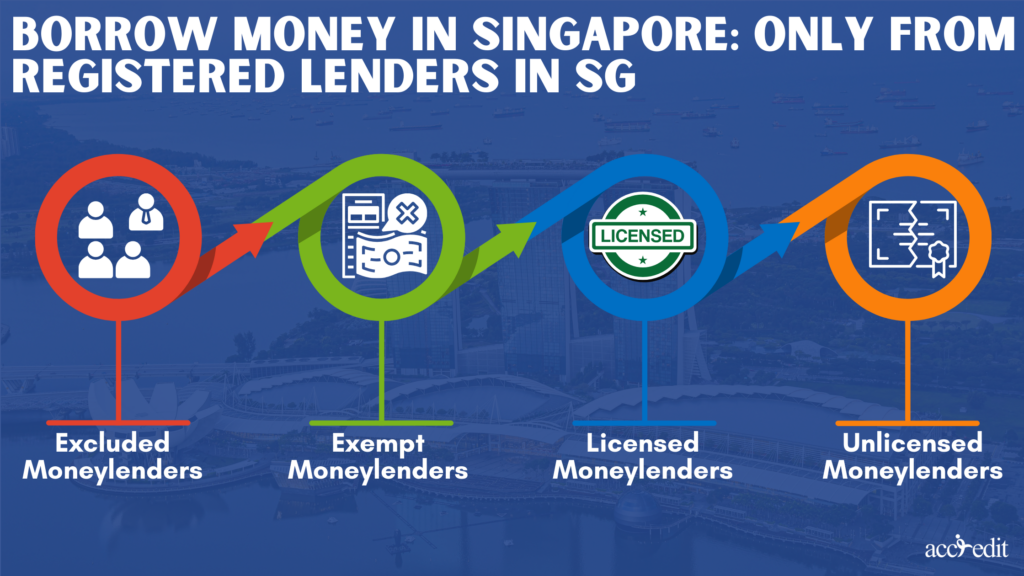

Borrow Money in Singapore: Only From Registered Lenders in SG

Singapore has three classifications of moneylenders: excluded, exempt, and licensed.

Excluded Moneylenders

- Corporations, companies, or empowered individuals complying with the Moneylenders Act.

- Licensed, registered, approved, and regulated by the relevant authority.

- Credit societies are registered under the Co-operative Societies Act.

- Licensed pawnbrokers.

- Employers provide loans exclusively as employment benefits.

- Lenders extend funds to accredited investors.

- Lenders serving corporations, trustees or trustee-managers, limited liability partnerships, and trustees of real estate investment.

Exempt Moneylenders

- Individuals or groups who have applied to the Registry of Moneylenders for exemption based on sections 35 or 36 of the Act.

Licensed Moneylenders

- Licensed moneylenders are the most common and recognized operators in the moneylending business.

- They must pass a moneylender’s test and obtain the necessary licensing for their business locations, management, and staff.

- Licensed moneylenders strictly concede with the Singapore Moneylenders Act, and you may access their details from the Registry of Moneylenders.

Unlicensed Moneylenders

- Borrowers should exercise caution regarding unlicensed moneylenders, known as “ah longs” or loansharks. These individuals often cause confusion and problems for borrowers and should be avoided.

You shouldn’t borrow money in Singapore from a lender claiming to be registered but isn’t on the Registry list.

Unlicensed lenders will release funds for your needs yet inflict soaring high-interest rates and fees. They could harass you when collecting their funds.

It’s not worth the trouble.

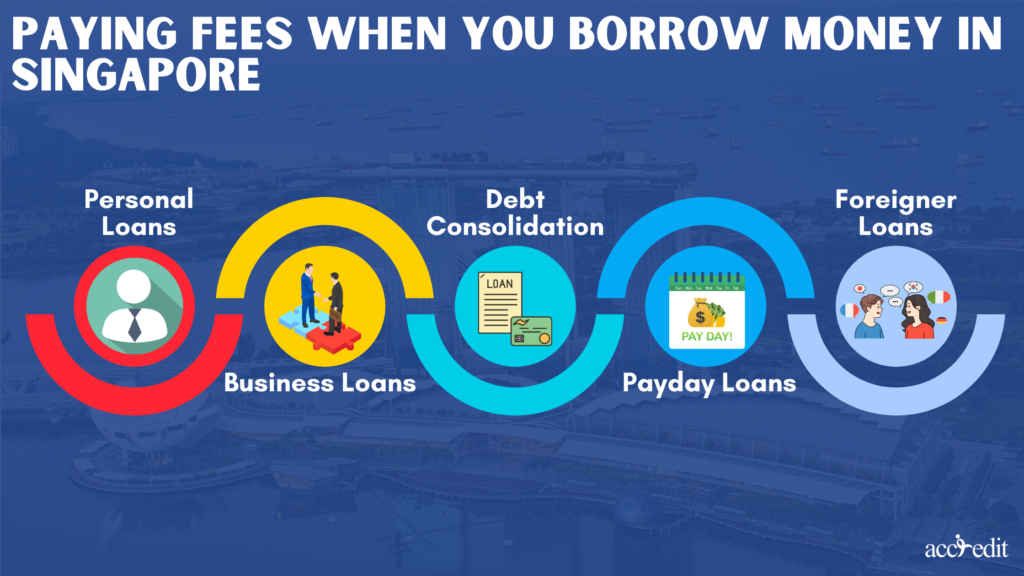

Paying Fees When You Borrow Money in Singapore

A moneylender in Singapore is diligent in their profession and responsibilities under the Moneylenders Act and Rules. Due to their legal obligation, a moneylender in the country cannot and will not do any actions that may lead to a borrower’s confusion or affect the moneylending industry or business in an unfavourable light.

Licensed moneylenders in Singapore allow borrowers to get funds by applying for the following:

- Personal Loans

- Business Loans

- Debt Consolidation

- Payday Loans

- Foreigner Loans

Among the lawful responsibilities a moneylender in Singapore has to fulfil is administering the limits or loan caps on interest rates and fees when you borrow money in Singapore are:

4% interest rate:

An interest rate is the base charge borrowers must pay back to the moneylender in Singapore. It is the percentage taken from the loan principal.

Other financing service providers in the country have different charges when it comes to interest rates. But, when you borrow money in Singapore from a licensed moneylender, it is a 4% maximum interest rate and fixed.

A moneylender cannot alter the percentage to their liking as it is against the Moneylenders Act and Rules. If the moneylender you have a loan transaction with attempts to modify the interest rate, whether higher or lower, you can file a report against them to the Registry of Moneylenders.

10% administrative fee:

You’ll be subjected to paying the administrative fee when borrowing money from personal loans and other financial products in Singapore. It is a regulation connected to moneylending in Singapore.

Apart from the 4% interest rate, you must shoulder the 10% administrative fee. Upon comparing the two, the 10% administrative fee seems a lot bigger than the interest rate.

It’s a one-time charge only, and it is taken from the loan principal.

Late interest fees:

Sometimes, borrowers would unintentionally get involved in monetary concerns and couldn’t pay up on the agreed schedule between them and the moneylender. Moneylenders in Singapore comprehend that circumstances like these do happen and are, at times, unavoidable.

For licensed moneylenders in Singapore to gain additional compensation for missed payments, the Moneylenders Act has implemented a 4% late interest fee. It is billable for every month that a borrower has missed.

Before borrowing money from a moneylender, you must understand that late interest fees would be among your accountability. This way, you avoid committing late payments and free yourself from the additional interest rate charges.

Late fee charges:

In addition to the 4% late interest fees, another charge awaits a borrower for having missed repayments. It is the late charges. According to the Moneylenders Act, a licensed moneylender in Singapore can charge a late fee of $60. The amount should be the stipulated sum.

A moneylender who tries to surpass the limited late fee charges to a borrower may be called to court and punished when found guilty.

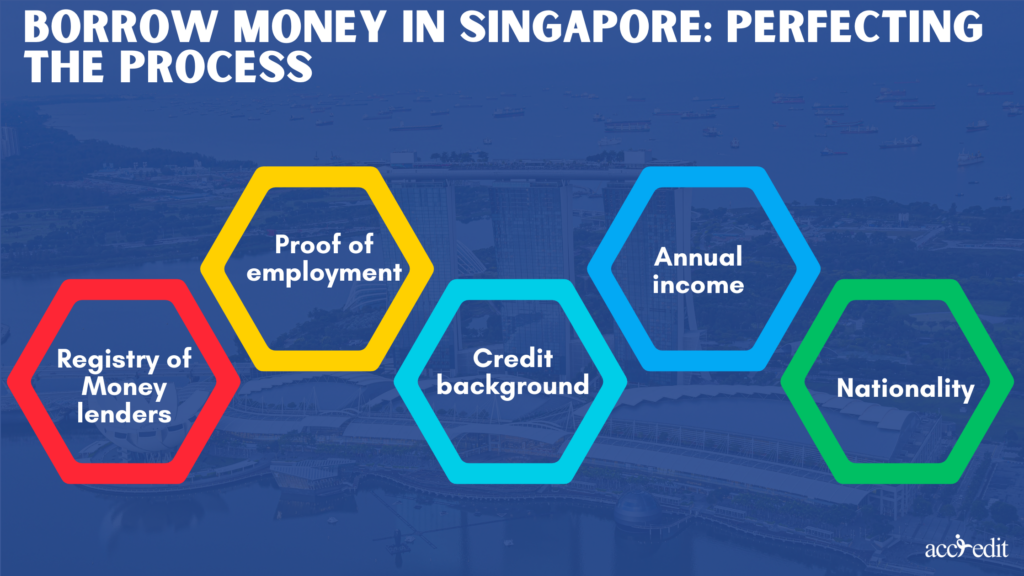

Borrow Money in Singapore: Perfecting the Process

It’s essential to go through the necessary steps on the borrower’s evaluation to borrow money from a moneylender. But first, you have to check which licensed moneylender is closest to your area and visit the business via the website or the office.

Registry of Moneylenders:

The Registry of Moneylenders is the body that regulates the policies and oversees the Moneylenders Act in Singapore. Every moneylender in the country who has earned their licences will be encoded to the Registry of Moneylender’s comprehensive list.

The list is accessible via the Ministry of Law – Registry of Moneylenders website. The attainable information is the licensed moneylenders in Singapore and their business names, address, contact number, website and licence numbers.

Proof of employment:

You can borrow money in Singapore from a licensed moneylender when you have a valid proof of employment. The period you have to work with the company has to exceed six months to become eligible.

Credit background:

A person or business credit background can become the deal maker or deal breaker when attempting to borrow money from moneylenders in Singapore.

The Credit Bureau Singapore (CBS) has enforced the credit score in Singapore’s finance industry since 2002. The credit score and risk grade are concurrent with one another. A licensed moneylender in Singapore can quickly assess your credit background through the Moneylenders Credit Bureau (MLCB).

Borrowers with an AA risk grade and a 2000 credit score are low-risk borrowers. Those with an HH risk grade and a 1000 credit score are high-risk debtors. But, regardless of this history, a licensed moneylender may forgive the previous assessment so long as the current salary of the borrower is decent.

Annual income:

Another requirement for your qualification to borrow money from a moneylender is your proof of income or annual income. You have to show decent yearly earnings to get higher chances of approval and acquire a much better maximum loan amount. You have to give proof of the following;

- Below $10,000 annual salary

- $10,000 minimum and below $20,000 yearly income

- At least $20,000 annual salary

Nationality:

Singapore celebrates its inclusive and unique blend of communities. The country has an incredible mixture of culture, tradition, and heritage. Thus, it is often filled with exemplary festivities that are breathtaking and historical.

And one’s nationality can be an advantage in matters of loaning cash. You can borrow money in Singapore from a moneylender with the help of your nationality, whether you’re a Singaporean Citizen, Permanent Resident, and foreigner working and living in the country.

Can You Get the Max Loan Amount from Moneylender?

Yes, most definitely. For a borrower to acquire the max loan amount from the moneylender, it’s essential to show proof of one’s nationality and annual income, as it’ll be the basis for the loan cap.

$500 Max Loan Amount

For a foreigner in the country earning an annual salary of below $10,000, it’s possible to acquire a $500 max loan amount from a moneylender in Singapore.

$3,000 Max Loan Amount

A Singapore Citizen and Permanent Resident earning below $10,000 can borrow a max loan amount of $3,000 from a moneylender.

In addition, a Singapore Citizen, Permanent Resident, or foreigner living and working in the country which earns a minimum of $10,000 and below $20,000 may also take a $3,000 max loan amount.

Six Times Monthly Income Max Loan Amount

A borrower who’s either a Singapore Citizen, Permanent Resident, or foreigner residing in the country, gaining a minimum of $20,000 a year, can borrow six times the monthly income.

Confidently Be A Responsible Borrower

A borrower’s purpose for getting a loan varies extensively. In many situations, a person seeks a licensed moneylender because of the efficient and fast loan service compared to other businesses.

Even though taking out a loan from a moneylender is easy, it doesn’t mean one should abuse the opportunity. Borrow money in Singapore from a moneylender only when in need, not when in want.

So, when you truly have to borrow money in Singapore with a trustworthy and reliable licensed lender, start your journey here!