Have you ever felt like a child in a candy store, overwhelmed with all too many personal loans or high-interest banking options? Or maybe you’re like a tourist lost in the busy streets of Chinatown and cannot decide which gastronomic delight to try first? Don’t worry; here’s your essential guide to the crème de la crème best bank account in Singapore.

Pull up a chair, and let’s chat, because this is your gateway to financial nirvana.

Best Bank Account in Singapore: Dance to the Lion City’s Financial Heartbeat Rhythm

Remember, Singapore is to banking what Newton is to gravity. The Lion City is a pioneer, a forerunner, and a true heavyweight champion.

Being Asia’s financial hub, it’s not a place where money sleeps soundly. It’s a world where cash dances to the beat of economy and innovation.

But, with so many lions roaring in the lucrative urban jungle offering personal loans and banking services, how do you choose the best ones?

How Do You Like Your Money – Sunny Side Up or Scrambled?

Choosing the best bank account in Singapore is like ordering eggs at your favourite cafe.

Do you prefer it sunny side up or scrambled?

Do you want to serve it with a sprinkle of interest returns or investment opportunities? To make your dining more pleasant, let’s dish up the details on the best bank account in Singapore.

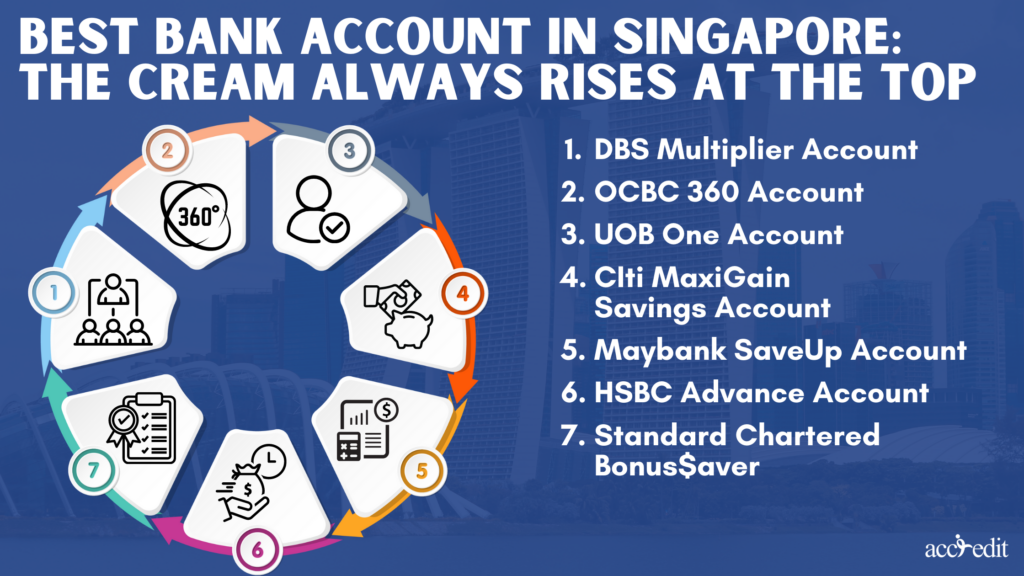

Best Bank Account in Singapore: The Cream Always Rises at the Top

DBS Multiplier Account:

Okay, be honest. Who would not love a bank account that can multiply your money?

The DBS Multiplier is no run-in-the-mill account. In truth, it’s the financial world’s superfood, as it offers a high-interest rate, which scales up with your account’s activity.

It’s flexible, accommodating a variety of income streams and transactions. It’s like you own bespoke jeans that fit perfectly regardless of weight.

OCBC 360 Account:

It’s a known truth that OCBC doesn’t just give you any account because it grants you a financial fitness regimen!

Picture it as your personal finance trainer and what you genuinely need to enhance your financial literacy. As you train, acquire bonus interest for credit card spending, insurance, investments, and more!

It’s your ultimate financial gym master, with the delightfully enticing smoothie of perks!

Standard Chartered Bonus$aver:

Do you like Swiss chocolate or a Swiss Army knife?

Regardless, the most important thing is it’s Swiss, and the account yields high interest and a credit card rolled into one! So, you now have a bank account that doubles effectively as a rewards-rich credit card.

Let’s be real. It’s the kind of the best bank account in Singapore James Bond might use.

UOB One Account:

Do you want a trustworthy and reliable financial friend? If that’s the case, UOB One Account is the friend who will always have your back. It’s beneficial when you appreciate the “set-and-forget” banking experience.

With its simple, tiered interest rate system, it’s the world of banking’s big red “Easy” button. And yes, it is the comfort food of banking – always there, always satisfying.

CIti MaxiGain Savings Account:

Do you fancy a savings account that pumps up the volume of your finances?

From its tiered interest system that accelerates each month like a Ferrari hitting its stride on the Marina Bay Street Circuit, the Citi MaxiGain Savings Account isn’t your average garden-variety savings account.

It’s your favourite marathon runner who never seems to run out of the stream. Stick with it, and see how your savings will go the extra mile.

Maybank SaveUp Account:

Have you ever seen a chameleon blend into its surroundings? Well, that’s how the Maybank SaveUp Account is. It’s the banking industry’s chameleon and changes colour according to your needs.

The more banking and financial products you engage with, the more interest you enjoy. It’s like a loyalty program that only keeps improving daily.

HSBC Advance Account:

Think about a happy, healthy, protective, and loyal golden retriever. Does the picture make you feel safe, warm, cosy, and well-protected?

That’s the HSBC Advance Account for you! It’s the financial buddy that’ll reward you for your steadfastness.

The more you deposit in your account, the more it fetches the rewards. It’s like getting that extra scoop of ice cream because you’re a loyal customer at your favourite dessert shop!

Which Best Bank Account in Singapore Roars the Loudest?

Each of the best bank accounts in Singapore has its unique features. Think of it like how each hawker centre in Singapore has its signature dish.

But which among these banking titans is worth entrusting your hard-earned cash with? That will ultimately depend on what makes your financial palate sing.

Also, remember that the key to financial success isn’t only about choosing the best bank account in Singapore per se; it’s about choosing the best bank account for you!

A Personal Touch with Accredit Advantage

Since you’re choosing the best bank account in Singapore for personal loans and other financial products and services, you should know a fun fact.

Banks aren’t the only ones in town that can loan you money. Yeah, you read that right! In truth, if you’re looking for a more tailored and personalised touch, why not consider Accredit?

Accredit is among Singapore’s best-licensed moneylenders and is like that friendly neighbourhood hawker who knows precisely how you love your Char Kway Eeow.

It offers personal loans with reasonable interest rates and flexible repayment terms. You can get the funds you need faster than an F1 pit crew changes tires. That’s Accredit for you.

Embrace the Power to Choose the Best Bank Account in Singapore

Picking out the best bank account in Singapore or deciding to take out a personal loan can be like feasting at a Peranakan buffet. A trick you can do is get a taste of everything before you set out on your favourite dish!

So, do your research, understand your financial needs, and then dive into the economic buffet in Singapore that your palate prefers. You’re no longer a spectator in the financial Colosseum but a gladiator.

The information in your arsenal will help you prepare and face the financial lions head-on.

Remember to embrace the power to choose. It’s always in your hands. Make your money dance to your tune. After all, you are the star of your financial show, aren’t you?

Of course, remember to share the good news when you find the perfect and best bank account in Singapore, which makes your monetary heart sing like an opera singer. Because, after all, sharing is caring, right?