Ah, Singapore – it appears like only a tiny red dot. A red dot that punches above its weight on the world stage, much like the lead character to your favoured underdog story, wouldn’t you agree? In this grand tale of scouring the red dot for loans and other financial products, you’ll meet the authorised money lender in Singapore.

Can the fascinating character of an authorised money lender surprise you? Yes, it will certainly, and you’re in for a colourful treat as you uncover the finest lending scene.

Looking Through the Glass: Authorised Money Lender Singapore’s Historical Set

The island nation is quite an impressive view. It isn’t only beautiful to those who see it. In truth, everyone learns the historical setting of Singapore primarily upon transformation from a simple fishing village into a thriving and prosperous metropolis.

Similar to the Little Red Dot changeover, the transformations are stunningly spectacular from yore’s contemptible and notorious loan sharks to these days’ authorised money lender Singapore. It’s a story that reads like a fascinating and famous “Singapore: Unlikely Power” chapter.

Loan Sharks:

In Singapore’s early days, specifically in the 1800s, money lending came. There were reliable lenders, yet unfortunately, some operate within the murky realm. Those who function illegally are known as unregulated lenders and exploit people experiencing financial despair.

Today, unlicensed money lenders still lurk in the shadows. They still target vulnerable individuals by reaching their victims through text messages and unsolicited calls. The interest rates and charges are soaring high, and these Ah Longs will also resort to corruptible and unethical schemes when demanding their dues.

Yet, as the Little Red Dot star continued to shine, so did the need for an organised, well-regulated, and transparent financial system. With the recognition of the crucial importance of protecting its citizens and inclusive community, thus the Singaporean Parliament and its Ministry of Law created the Moneylenders Act.

Thus, was the influential dawn of authorised money lenders in Singapore granting personal loans and other financial products.

An Authorised Money Lender Singapore Duties to the Rules of Law

The rules of the Moneylenders Act are accessible; that’s the truth. And you don’t have to get a law degree for it! To fully understand an authorised money lender’s legal and financial duties, you’ll catch a crucial glimpse of its lawful foundation.

It’s a tight ship, sealed and orderly, and pursues a rigorous schedule.

The Singapore Parliament enacted the Moneylenders Act, serving as the strong and reliable backbone of the moneylending industry’s regulatory framework. The Act sets the specific rules and stipulations that authorised money lenders in Singapore abide by, efficiently protecting both lenders and borrowers.

Under the watchful eye of MinLaw, the legal lenders of Singapore should obtain their licenses before operating their businesses. They must adhere to strict policies and concede with the code of conduct.

Through the Act, borrowers won’t have to worry about unethical lending techniques, and every legal lender must operate within clear limitations.

Still, with the Act’s policies accessible to many, many have expressed worries regarding the moneylending industry. It must be because of the many misconceptions that have to be demystified.

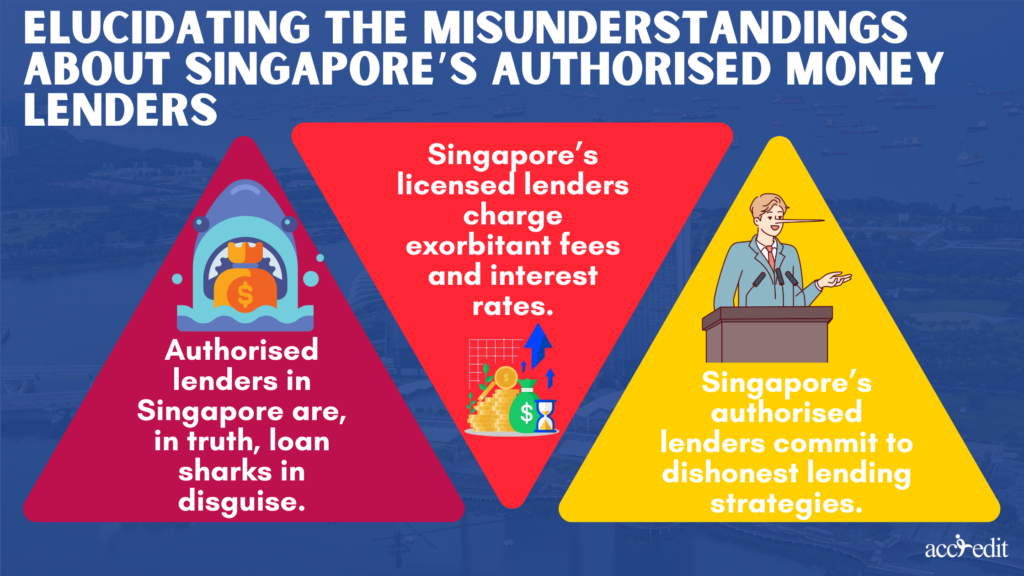

Elucidating the Misunderstandings about Singapore’s Authorised Money Lenders

Have you ever heard about the former Changi Hospital plagued with unrest souls?

Most of the stories come from rumours, and same with the tale, there are countless misunderstandings about authorised money lenders in Singapore that require disproving. Be ready to peel back the curtains of doubt and look at the realities, and here they are:

#1: Authorised lenders in Singapore are, in truth, loan sharks in disguise.

The reality is much different. Loan sharks operate outside the jurisdiction; licensed money lenders are regulated entities and follow devotedly to the Act, like Accredit. Authorised lenders grant legal and fair financial assistance to clients in need.

#2. Singapore’s licensed lenders charge exorbitant fees and interest rates.

Legal lenders indeed charge higher interest rates and fees than traditional banks. Still, it’s subject to capping set by the Ministry of Law. The maximum interest rate licensed lenders charge is 4% monthly, while late fees are $60 maximum, 10% administrative fee, and 4% late interest rate.

The capping ensures that fees and rates remain within reasonable and appropriate limits.

#3. Singapore’s authorised lenders commit to dishonest lending strategies.

Every authorised lender in Singapore abides by the code of conduct, which prohibits unethical lending procedures. Thus, borrowers like you can anticipate crystal clear and transparent loan terms, avoid coercion or harassment, and observe the proper debt collection approaches.

Dispelling the common misconceptions, you understand that Little Red Dot’s lenders are authorised and play a vital role in the Singaporean economy. They’re not the villainous characters most people presume but are the regulated guardians of the city-state.

Discern the Unauthorised from the Authorised Money Lender Singapore

Like every product and even Singapore’s Bak Kut Teh, you must distinguish the real from the inauthentic versions. It’s similar to discerning a legitimate money lender can be a challenge.

But, no worries, there are some specific tips you can apply. It’s straight from the Singaporean auntie’s guide to sniffing out the fakes:

- Affirm their license with the Ministry of Law’s Registry of Moneylenders.

- An honest lender will never ask for upfront payment.

- They cannot promote through unapproved channels like cold calls or text messages.

- Invariably present a clear contract and detailed explanation of terms.

Singapore’s legal lenders will provide the best financial assistance you require. You don’t have to search far, though, as Accredit’s details are accessible at the Registry.

Moreover, with an authorised money lender Singapore services, they help boost the city state’s economy through diverse loan products such as;

- Personal Loans

- Business Loans

- Foreigner Loans

- Debt Consolidation

- Payday Loans

With licensed lenders, many small businesses boost their companies, bridge personal financial gaps, and foster economic equality.

Dealing with an Authorised Moneylender Singapore – The ‘Lee Kuan Yew’ Way

So, there you have it – a successful trip through Singapore’s fantastic world of an authorised money lender. Remember, approach borrowing like the great Lee Kuan Yew would approach governance. Be informed, seek transparency, stand firm, and, when needed, negotiate like your life depends on it.

After all, you’re moving forward with the authorised money lender in Singapore shouldn’t be as challenging as most people think it is. Who knows? With your right choices and the alright licensed lender, like Accredit, your monetary journey may be as rewarding as that first succulent bite to your financial freedom.

You don’t have to dread the borrowing process. Instead, see it as a part of the Little Red Dot’s process, a lending path filled with discipline, pragmatism, and the prospect of financial triumph.