In our fast-paced world today, it’s crucial to effectively manage our finances to ensure a secure financial future. And one essential tool that can greatly assist in achieving this is none other than a savings bank account. In Singapore, having a savings bank account comes with a variety of features and advantages that can truly support your financial security and help you reach your financial goals. So let’s delve into the key features of a savings account in Singapore and discover the multitude of benefits it brings to individuals like yourself.

Feature of Saving Account in Singapore

When it comes to saving accounts in Singapore, there’s a bunch of cool stuff that banks have come up with to make your banking experience super smooth and easy. Let’s dive into some of the important features:

- Pay and Get Paid: With a savings account, you can easily receive payments from others and make your own payments hassle-free. It’s like having a convenient money hub right at your fingertips.

- Online and Mobile Banking: Access to Internet banking and mobile banking is a major perk for savings account holders. You can manage your account, check balances, and handle transactions all from the comfort of your phone or computer.

- ATM Debit Cards: Banks offer nifty ATM debit cards to savings account holders. These little wonders let you withdraw cash, make purchases, and do all sorts of handy things whenever you need them.

- Freedom to Withdraw: While the interest rates on savings accounts might not be sky-high, they do give you the freedom to withdraw funds whenever you want (within a monthly limit, though). It’s your money, and you have the power to access it when you need it.

- Stay in the Loop: Banks got your back with transaction alerts. They’ll send you handy updates via SMS and email, so you’re always in the know about what’s happening with your account. It’s like having a personal banking assistant keeping you informed.

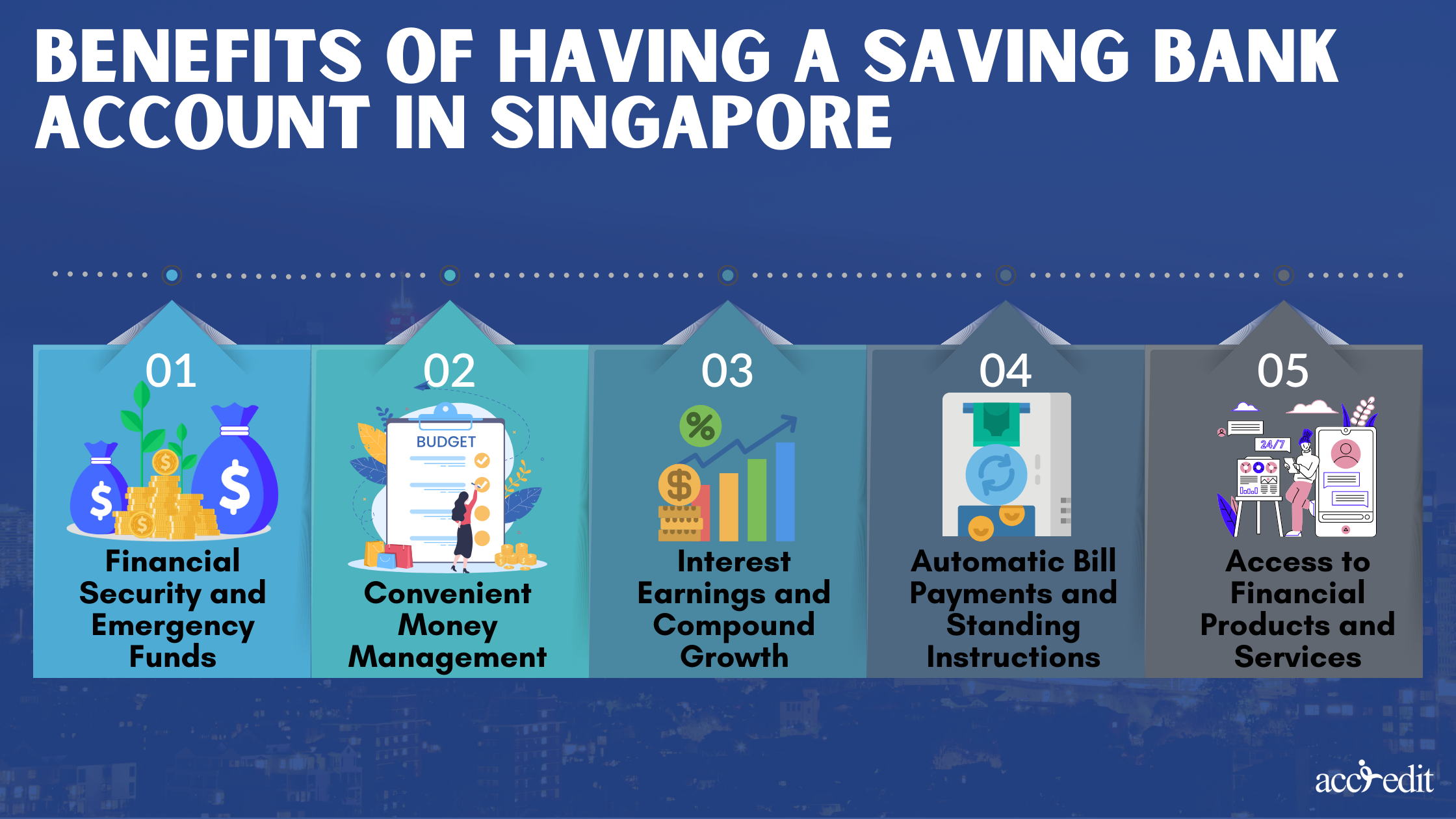

Benefits of Having a Saving Bank Account in Singapore

Now that we’ve checked out what this bank account offers, let’s dive into the awesome advantages of having a savings account in Singapore. These perks can empower you to manage your money better and create a stable future for both yourself and those dear to you.

1. Financial Security and Emergency Funds

Life has a funny way of surprising us, throwing unexpected expenses our way when we least expect them. That’s why it’s crucial to have a little stash of cash tucked away for those rainy days. Imagine this scenario: picture yourself driving through the streets of sunny Singapore, enjoying a smooth ride in your dependable car. Suddenly, out of nowhere, one of your tires blows out, leaving you stranded by the roadside. Not exactly a pleasant situation, right?

You could panic and scramble to figure out how to pay for those expensive repairs, or you could take a deep breath and relax, knowing that your savings account has your back with an emergency fund ready and waiting. It’s like having a safety net that brings peace of mind, ensuring that you have a cushion to rely on when unforeseen circumstances come knocking.

2. Convenient Money Management

Ever thought about how convenient it would be to handle your finances effortlessly? Well, with a savings bank account, that dream becomes a reality. You can effortlessly deposit your earnings, keep tabs on your spending, and keep a close eye on your savings. Thanks to the wonders of online and mobile banking, you can even stay up to date with your account balance and transactions in real-time.

Picture this: you’re strolling through the lively streets of Singapore, when suddenly, you stumble upon an irresistible sale at your go-to boutique. Your heart races with excitement, and you’re faced with a split-second decision. But instead of fretting over whether you’ve got enough cash, you simply whip out your smartphone, check your bank balance then and there, and voila! With the peace of mind that comes from convenient money management, you can happily indulge in that fabulous dress without a single worry.

3. Interest Earnings and Compound Growth

Another compelling reason to open a savings account in Singapore is the opportunity to earn interest on deposited funds. Singaporean banks often present enticing interest rates, enabling individuals to expand their savings.

The concept of compound interest, wherein interest is earned not only on the initial amount but also on the accumulated interest itself, amplifies the capacity for savings growth. This opens up avenues to fulfill enduring financial aspirations, including financing education, acquiring a residence, or preparing for retirement.

4. Automatic Bill Payments and Standing Instructions

Let’s dive into a nifty feature that numerous savings accounts in Singapore offer: automatic bill payments. It’s like having your very own personal aide who handles all your bill payments, leaving you free to tackle the important stuff in your life.

Picture this: You arrive home after a tiring day at work, and your phone buzzes with a notification reminding you that your electricity bill needs to be settled by tomorrow. Normally, you’d have to remember to log in to your online banking, input the payment details, and click that submit button before the deadline. It can be quite bothersome, especially when you’re already drained.

But here’s the game-changer—automatic bill payments allow you to set up standing instructions in your savings account. This means you grant your bank permission to deduct the required amount for your utility bills, insurance premiums, and other regular expenses straight from your account. Say goodbye to fretting about missed due dates or incurring late payment fees!

5. Access to Financial Products and Services

When it comes to managing your money, having a savings account can open up a whole new world of financial options. It’s like having a key that unlocks a treasure trove of possibilities. With a simple banking connection, you gain access to a wide range of financial products and services that can help you achieve your goals.

Think of a savings account as your personal gateway to financial freedom. It’s not just about saving money; it’s about expanding your horizons and exploring the many tools available to grow your wealth. From loans to credit cards, from investments to insurance, the choices are abundant. This access brings flexibility and expands horizons to a myriad of financial tools that can further enrich wealth management and financial strategizing.

The Bottom Line

A savings bank account brings a host of advantages that can greatly improve your financial well-being. It gives you a comforting sense of security, enabling you to build up a safety net for unexpected expenses. Plus, with the convenience of online and mobile banking, keeping tabs on your finances and making smart choices becomes a breeze.

But that’s not all! By having a savings account, you also get the chance to earn interest and witness your savings grow through the power of compound growth. On top of that, automatic bill payments simplify your financial obligations, guaranteeing that you never miss a due date.

Furthermore, a savings account opens up doors to a range of financial products and services, expanding your options for effective money management. All in all, a savings bank account is an invaluable tool that supports your financial goals and sets the stage for a more secure future.

Rely on Accredit Moneylender to Safeguard Your Finances and Find Peace of Mind

Planning for a stable financial future is a smart move, especially in Singapore. Having a savings account is a step in the right direction. But let’s be real, unexpected expenses can throw us off track. What if those costs exceed our savings?

That’s where Accredit Moneylender steps in as the go-to choice for fellow Singaporeans facing such situations. As a prominent player in Singapore’s lending industry, we offer a range of services to support you. Whether you need business loans, debt consolidation options, short-term credit solutions, or our highly sought-after personal loans, we’ve got you covered.

Take control of your finances and find peace of mind by relying on Accredit Moneylender. Don’t let unexpected hurdles disrupt your financial stability. Explore our services today and secure your financial well-being.