Whether people like it or not, financial crises arise in the most unconventional time. Exciting times have come when people have become curious about the Singapore Moneylending Act and the lending industry. People are keen to counter monetary concerns through diligence and discipline when handling personal finances.

It’s a mindset and framework that can lead to financial security even when managing finances can be challenging. True enough, the inflation rate and taxes these days do not seem favourable, and people search for effective methods to ease their financial worries; the desire for knowledge is evident.

For individuals who find an opportunity in moments of crisis, it is possible to establish and proffer moneylending services to those in need. However, a person or a group cannot simply decide on putting up their moneylending services whenever or wherever they like. Because if they did, they would have to face severe punishments imposed by the Singaporean Parliament.

Singapore and its Laws

Singapore is known as a country that is strict with its laws and regulations. The country’s parliamentary system focuses on improving the country’s lifestyle, education, culture, and economy and reaching new heights partly due to diverse legislation.

Singapore’s parliamentary system roots in the Westminster Model. It continues to evolve over the years to accommodate the growing desires and necessities of the Singaporean communities and country.

It’s also the case where moneylending activities in Singapore are under strict regulations. The punishments enforced when proven to participate in unlicensed moneylending operations are gravely penalized according to the law.

The law which protects Singaporean citizens, permanent residents, foreigners in the country, and moneylenders are the Moneylending Act.

What is the Singapore Moneylending Act?

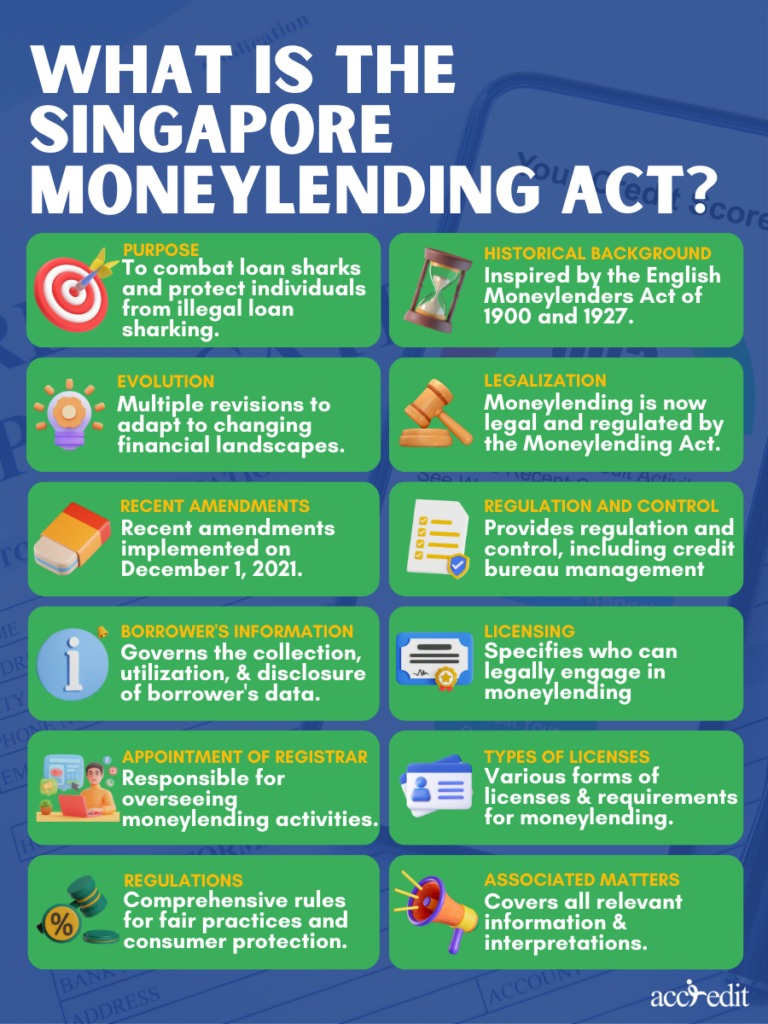

The Singapore Moneylending Act is a social legislation with the initial purpose of curtailing loan sharks and their loansharking activities.

It was enacted in 1936 in Singapore and was known as the Moneylenders Ordinance Cap 193, 1936 Ed. The inspiration behind it was the English Moneylenders Act of 1900 and 1927. The creation intends to save those vulnerable to extortion from a specific class in the community called moneylenders.

When someone was called a moneylender, it was considered an offensive term. Nonetheless, changes have continued to happen in the country since those times. Now, moneylending in Singapore is legal and supported by the Moneylending Act.

The Moneylending Act or Moneylenders Act 2008 has gone through many revisions. And the most recent amendments were accomplished on the 1st of December 2021 and implemented on the 31st of December 2021.

The Act is the regulation for moneylending, with its designation and control over a credit bureau, along with the collection, utilisation, and disclosure of the borrower’s information and personal data and for associated matters.

The Singapore Moneylending Act comprises all information and interpretations people may need regarding matters or individuals connected to moneylending activities.

It further lays down who can legally operate or proffer similar moneylending in Singapore, such as banks, financial institutions, and moneylenders.

From the Moneylending Act, legal details on the Appointment of Registrar, different forms of licences, regulations, etc.

Types of Moneylenders in Singapore

The Moneylending Act specifies moneylenders as individuals with a moneylending business or who advertise or announce themselves associated with the business. Furthermore, it could be regardless if these individuals have or do not have possessions of property or money acquired from different sources besides lending money.

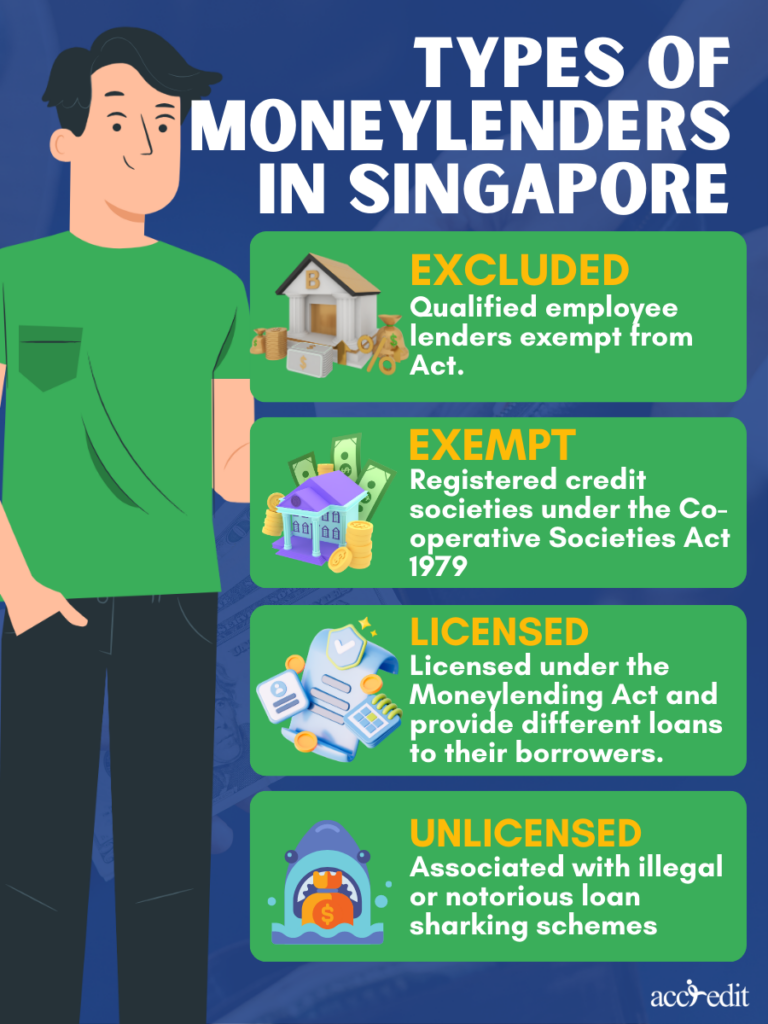

There’s also a transparent definition regarding individuals or groups deemed as “excluded moneylenders” and “exempt moneylenders’, and licensed moneylenders are the only ones given the authority to proffer moneylending services to borrowers.

Excluded Moneylenders

According to the Singapore Moneylending Act, these are businesses or individuals with due qualifications to operate lending services. They grant loans to their employees as a final part of their employment contract.

They are exempted from the Moneylending Act and don’t require licensing but may legally grant loans to their employees.

Exempt Moneylenders

These lenders do exist in Singapore. They’ve attained the exemption from holding a licence under the act sections 91 or 92. The businesses in this lending classification are registered credit societies under the Co-operative Societies Act 1979. Singapore’s licensed pawnbrokers belong to this lending category.

These businesses are under various laws and regulations, so the licensing requirements differ from Singapore’s licensed moneylenders.

Licensed Moneylenders

These organisations or individuals are licensed under the Moneylending Act and provide different loans to their borrowers. Licensed moneylenders in Singapore follow the Ministry of Law’s regulations and must commit to them, including the interest rates and fees cap.

Different loans are accessible from licensed moneylenders are various and comprehensive. Each fits the needs of their borrowers. Here are the various loan types licensed moneylenders in Singapore grant:

- Personal Loans: These loans can grant financial assistance to borrowers in meeting personal financial requirements, such as paying medical expenses, home renovations, car repairs, or consolidating debts.

- Payday Loans: These are the ideal loans for short-term uses when covering immediate monetary obligations until the upcoming salary.

- Business Loans: These types of loans fit the requirements of business owners in Singapore. It’s specifically taken to fund business operations, manage cash flow, purchase equipment, or expand the business.

- Renovation Loans: A borrower may apply to finance projects for home renovations.

- Education Loans: It’s the ideal debt opportunity for borrowers in need of financial assistance for education-related expenses, whether it be textbooks, living expenses, and tuition fees.

- Bridging Loans: These loans help property owners bridge the financial gap between buying and selling a property.

- Debt Consolidation Loans: The ideal loan choice for borrowers needing to consolidate multiple debts into one payment. It helps streamline borrowers’ finances and effectively reduces total interest payments.

Unlicensed Moneylenders

Unlicensed moneylenders are usually associated with illegal or notorious loan sharking schemes, significantly affecting Singaporean communities, authorities, and the economy. They operate without valid licenses and are not duly registered with the Ministry of Law.

Their charges for interest rates and fees are often too high, and they engage in illegal debt collection practices that are gravely unethical. Borrowing from these unlicensed moneylenders is illegal. It could also lead to severe monetary and legal consequences that borrowers may face.

Differences Between Unlicensed and Licensed Moneylenders

The efforts of the Ministry of Law, Singapore Police Force, and other authorities have proved effective in educating and encouraging people to report their experiences when subjected to illegal moneylending acts.

Nevertheless, ensuring the optimum safety of all Singapore citizens, permanent residents, foreign borrowers, and licensed moneylending businesses is a priority. Thus, it is essential that Singapore communities highly comprehend the differences between unlicensed and licensed moneylenders.

Here are the specific differences between these lenders in Singapore:

Singapore Moneylending Act Advertising Regulations

Licensed moneylenders will advertise their services with the legal recommendations of the Ministry of Law that are only on their business’ official website, outside of their office, or in business directories or Yellow Pages.

Unlicensed moneylenders go beyond the recommended advertisement restrictions and often send mass SMS to their targets via WhatsApp and other social media platforms. Furthermore, they’re brazen enough to invite targets to get or grant loans even when victims didn’t apply.

Singapore Moneylending Act Interest Rates Cap

Licensed moneylenders do not demand an extremely high-interest rate. They are allowed the maximum interest rate chargeable of 4% per month. Late payments are charged with a maximum interest rate of 4$ per month for every month of late payments.

Illegal moneylenders initially offer low-interest rates. But, when they have acquired their victim’s personal data, threats and higher interest rates ensue. According to some reports, the interest rates charged by unlicensed moneylenders could rise from 10% to 20%.

Singapore Moneylending Act Ethical Practices Regulations

The law does not allow licensed moneylenders to act harshly towards their borrowers. Whether it be late payments or other payment concerns, licensed moneylenders in Singapore may only send notifications and reminders. Nevertheless, the court of law will become involved if the licensed moneylenders seek legal assistance to return the funds they have lent the borrower.

Illegal moneylenders in Singapore are called Ah Longs and actively exhibit loan sharking schemes. These would often lead to borrowers being harassed and stalked. Illegal moneylenders sometimes physically hurt their victims and threaten them to get payments. In many cases, loan sharks go through extreme scandalous and unlawful lengths of modus operandi to ultimately tarnish and vandalise the borrower’s properties or burn them.

In addition, every licensed moneylender in Singapore is indicated in the complete list accessible from the Registry of Moneylenders. The list includes the licensed moneylender’s business name, address, contact number, and email address or website. So, it’s easier to filter through which are legal or illegal moneylenders in Singapore.

Moneylenders Rules 2009

The Moneylenders Rules 2009 derives from the Singapore Moneylending Act 2008 section 37 and is authorised by the Ministry of Law. It is in still implemented since the 1st of March 2009

The Moneylenders Rules comprises the legal definitions with regards to a business loan that’s granted to a borrower who falls under the categorizations of either:

- A company under the Companies Act 1967 or other previous legislation with a business with at least one year in its industry shall be granted the loan.

- A legitimate limited liability partnership carrying their business for at least a year

- An individual who carries their enterprise under the business name so long as they are registered may be granted the loan upon at least proof of one-year operations.

Other scopes incorporated in the Moneylenders Rules are excluded persons, revolving credit loans, forms and applications, etc.

Singapore Moneylending Act Vital for Informed Decisions

The Singapore Moneylending Act isn’t only about laws and regulations. It’s a comprehensive guideline that educates and regulates licensed moneylenders and individuals on ethical lending practices in the country. Moreover, individuals can fully protect themselves by understanding the nature of lending business, legal interceptions, and response to illegal activities.

The provisions of the Moneylending Act enhance the power of the Registry of Moneylenders regarding moneylender licensing. Borrowers may call the Registry at 1800-2255-529 if any lenders do not comply with the Act. It also refines the Moneylending regime, amendment of contracts, and other noteworthy changes to further accomplishments.

Borrowers keen on knowing whether the lender has duly licenses may refer to the Ministry of Law’s website, search for the Registry of Moneylenders, and verify the lender’s licence and status. Thus, borrowers must understand, comply with, and diligently remember the Moneylending Act.

The Singaporean communities have legislation they can rely on about moneylending in Singapore and make informed and conscious lending decisions.