If you’re in Singapore and on the lookout for a financing option, personal loans are a hot pick. Picture this: you need to fund a big purchase or consolidate some debt. A personal loan is looking mighty fine – quick, convenient, and all that jazz.

But hold up; there’s a looming issue we have to address first: the processing fee. Don’t fret, though – this article is your go-to for all the deets on personal loan processing fees in Singapore.

What is a processing fee?

The processing fee is a fee charged only once to cover the expenses of managing and processing your loan application. Think of it as a toll fee that grants you access to the bridge of loan processing. It compensates the lender for various services, including credit checks, loan document preparation and review, and other related tasks.

Although the processing fee may seem like a minor expense, failing to acknowledge it could significantly impact your total loan costs and loan repayment amount. Therefore, it is essential to consider this fee when evaluating the overall cost of your loan.

How much is the processing fee on personal loans in Singapore?

When it comes to personal loans in Singapore, processing fees are standard practice. However, the fees can vary depending on the lender. Banks typically charge a processing fee between 1% to 3% of the loan amount, with a maximum cap of $200. In comparison, licensed moneylenders have the liberty to impose much higher processing fees, reaching up to 10% of the loan amount.

| Lener Type | Processing Fee Range |

| Banks | 1% to 3%; maximum cap of S$200 |

| Licensed Moneylenders | Up to 10% |

Is the personal loan processing fee refundable?

In Singapore, the processing fee for personal loans cannot be refunded, regardless of whether your loan application gets declined. This fee encompasses the expenses related to administering a loan application, and it’s crucial to incorporate it into your calculation when evaluating the complete borrowing expenditure.

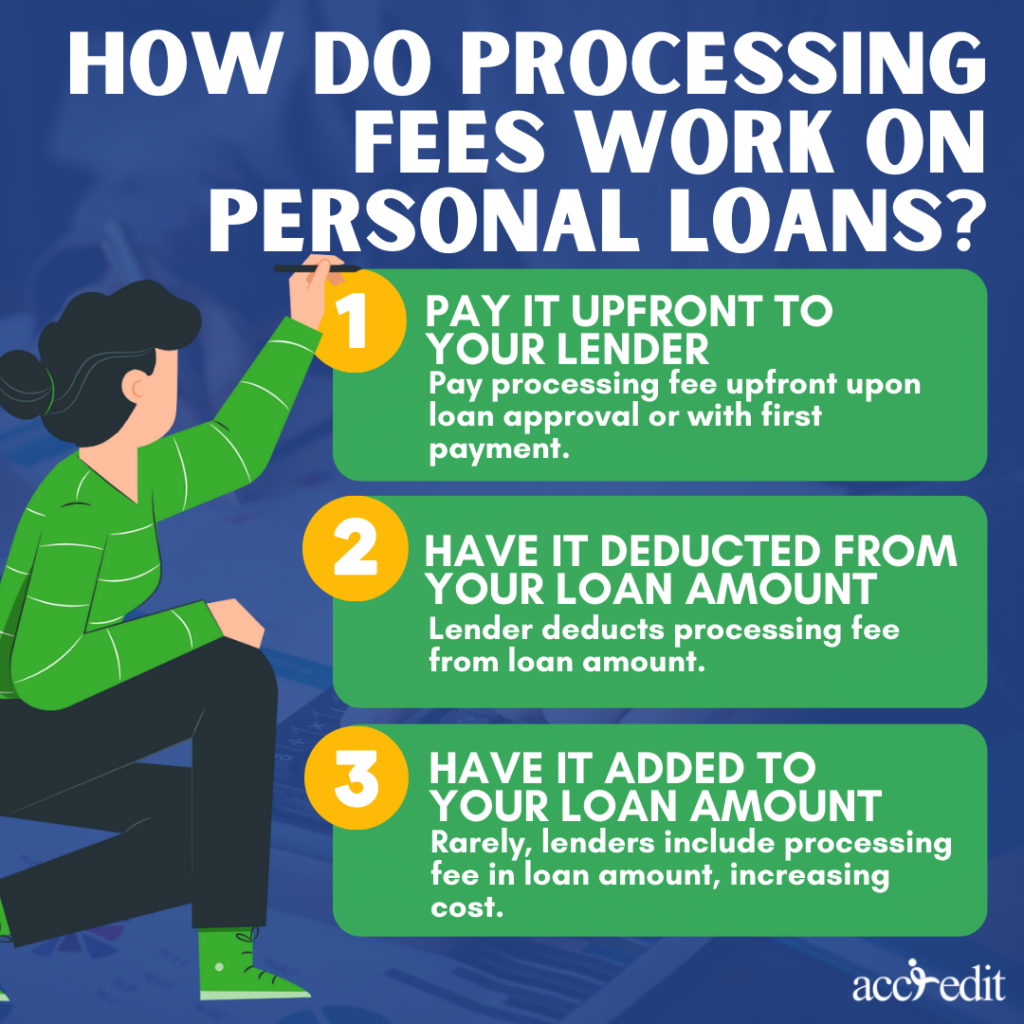

How do processing fees work on personal loans?

There are different ways in which processing fees work. Either pay it when you get your loan or pay it along the debt repayment. To give you the whole picture, here are three ways how it’s done:

#1 Pay it upfront to your lender

You can pay the processing fee upfront when your loan application gets approved. Either the time you receive the requestion funds or pay it together with the first loan payment.

#2 Have it deducted from your loan amount

In this case, your lender takes out the processing fee from your loan before giving it to you. With that, you can expect you won’t receive the full amount of your requested loan. To better understand this scenario, here is an example:

You happen to borrow an amount of S$5,000 with a 3% processing fee. Your lender will take away the processing fee from your loan, and what’s left is the total amount of S$4,850.

Computation:

S$5,000 x 3% = S$150 (processing fee)

S$5,000 – S$150 = S$ 4,850 (loan amount)

#3 Have it added to your loan amount

On rare occasions, some lenders add the processing fee to the loan amount. So unlike the second scenario, you will still get the same loan amount you requested. However, the total cost of your loan will be higher, for example:

Borrowing S$10,000 with a 4% processing fee will result in an additional S$400 added by the lender. This will bring the total amount you’ll pay for the loan to S$10,400.

Computation:

S$10,000 x 4% = S$400 (processing fee)

S$10,000 + S$400 = 10,400 (loan amount)

Note: The processing fee is not the only factor that computes the total loan amount. There are others to consider, such as:

- Loan Amount

- Loan Tenure

- Interest Rate

Compare the processing fee from personal loan providers

In this list, you can check out the processing fee of each bank. Here you can mostly spot banks that won’t charge you a processing fee. Feel free to compare one another and pick the best one for you.

| Personal Loan | Processing Fee |

| HSBC Personal Loan | S$0 |

| SCB CashOne Personal Loan | S$0 |

| CIMB CashLite Personal Loan | S$0 |

| UOB Personal Loan | S$0 |

| Citi Quick Cash Loan | S$0 |

| OCBC Personal Loan | S$100 |

| DBS/POSB Personal Loan | 1% processing fee |

| Maybank | 2% processing fee |

| Bank of China | 3% or S$150 processing fee |

Comparison Shopping is the Key to Getting the Best Personal Loan

When searching for a personal loan in Singapore, it’s important to look beyond just the processing fee. You’ll want to carefully consider other key terms, such as the interest rate, repayment tenure, and loan amount to ensure you’re getting the best deal possible.

| Personal Loan | Interest Rate | Minimum Annual Income | Maximum Loan Amount | Loan Tenure |

| HSBC Personal Loan | 4% (EIR 7.5% p.a.) | S$30,000 | 90 or 95% of the approved credit limit | Up to 7 years |

| Standard Chartered CashOne Personal Loan | 3.48% (EIR 7.99% p.a.) | S$20,000 | 4X monthly income & capped at S$250,000 | Up to 5 years |

| CIMB CashLite Personal Loan | 3.38% (EIR 6.38% p.a.) | S$30,000 | 90% of the approved credit limit | Up to 5 years |

| UOB Personal Loan | 3.99% (EIR 7.49% p.a.) | S$30,000 | 95% of the approved credit limit | Up to 5 years |

| POSB/ DBS Personal Loan | 3.88% (EIR 7.9% p.a.) | S$30,000 | 4X monthly income or 10 x monthly income if earn S$120,000 | Up to 5 years |

Thoughts

When considering a personal loan, it’s essential to take note of any additional expenses, including processing fees. Why? Because grasping the ins and outs of the process is key to obtaining a comprehensive understanding of your loan’s total expenditure. Some banks charge up to 3% of their processing fees, with licensed moneylenders up to 10%. However, some lending institutions offer no processing fee, which is a good deal.

Accredit Moneylender: Get a Personal Loan with Processing Fees of up to 10% of the Loan Amount

Understand the ins and outs of personal loan processing fees? Great, it’s time to get started with Accredit. Their personal loan options allow borrowing up to six times your monthly income, with processing fees of up to 10% of the loan amount. With Accredit, applying for a loan is a breeze, and you’ll receive your cash quickly. Don’t let financial worries hold you back any longer.