Securing a personal loan in Singapore is simple, but grasping the intricate world of interest rates is another story. To score the best deals, you must understand the factors that affect personal loan rates, know the average rates in Singapore and learn smart strategies. Don’t be left in the dark about interest rates – this article has got you covered. Get ready to see beyond the veil and crack the code of interest rates.

Singapore Personal Loans: What are Interest Rates?

Interest rates are more than just a number when it comes to personal loans in Singapore. They’re a crucial factor in determining the cost of borrowing. While interest rates are commonly expressed as a percentage of the loan amount, there’s more to the story than that.

Factors such as loan duration, credit score, income, and debt-to-income ratio can all affect the interest rate of a personal loan. By taking these into consideration, you can gain a comprehensive understanding of the loan’s actual cost.

How do interest rates work on personal loans in Singapore?

Interest rates are a fundamental aspect of personal loans in Singapore. In most cases, lenders offer fixed annual rates for personal loans and mortgages. This means you can plan your monthly payments without worrying about sudden changes to your interest rate.

But watch out, as some lenders may offer variable interest rates, which can be a gamble. These rates are influenced by market conditions, so if interest rates increase, your monthly payments could go up too. This can make it challenging to plan and manage your finances.

What’s the typical interest rate range for personal loans in Singapore?

Personal loan interest rates in Singapore may range widely. Interest rates range from 3.5% p.a. to 10.8% p.a., depending on the lender. The cost of borrowing might be substantially lower if promotional rates were offered. But remember that the advertised quality isn’t always the quality you get. The interest rate you wind up paying depends on how your particular lender calculates it.

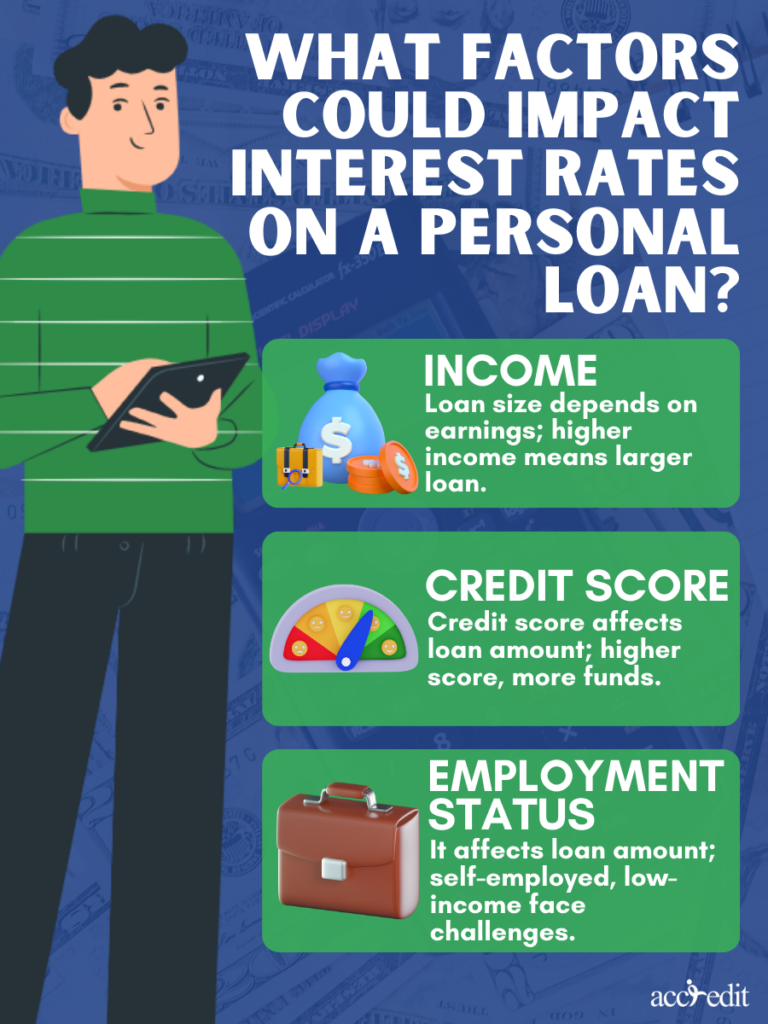

What Factors Could Impact Interest Rates on a Personal Loan?

Income

Your income is a critical factor that lenders consider when assessing your personal loan application. It’s a straightforward concept – a higher income often results in a lower interest rate. Why? Because lenders want to ensure that you have the financial capacity to repay the loan on time. If you earn a good salary, lenders are more likely to offer you a loan with favorable terms and a lower interest rate. This is because you’re viewed as a lower-risk borrower and are more likely to repay the loan on time.

Credit Rating

When it comes to personal loans, your credit rating holds the key to approval. It’s a reflection of your financial standing and signals to lenders how reliable you are at repaying debts. In essence, it’s a risk indicator that gauges the likelihood of you defaulting on a loan. If your credit score is poor, it could be due to a history of late or missed payments, which can make lenders hesitant to approve your loan application. This can lead to fewer options for securing a loan at a reasonable interest rate, leaving you with limited choices.

Employment Status

Lenders view full-time employees as reliable borrowers who are more likely to repay their debts. As a result, they may offer them lower interest rates than those with an unstable job history. On the flip side, if your work history is irregular or you work part-time, lenders may consider you a higher-risk borrower. This may result in a higher interest rate, as lenders look to minimize their risk when lending to those with unstable incomes.

Personal Loans in Singapore: Top Picks for 2023

If you’re on the hunt for a personal loan in Singapore, you know that finding the right one can be a daunting task. Fortunately, we’ve taken care of the legwork and put together a list of the best providers with competitive interest rates for 2023.

| Personal Loan | Interest Rate |

| Accredit Personal Loan | Up to 4% per month |

| HSBC Personal Loan | 4% (EIR 7.5% p.a.) |

| SCB CashOne Personal Loan | 3.48% (EIR 7.99% p.a.) |

| CIMB CashLite Personal Loan | 3.38% (EIR 6.38% p.a.) |

| UOB Personal Loan | 3.99% (EIR 7.49% p.a.) |

| DBS/POSB Personal Loan | 3.88% (EIR 7.9% p.a.) |

| OCBC Personal Loan | 5.43% (EIR 11.47% p.a.) |

Which personal loan should you get in Singapore?

If you’re searching for the lowest personal loan interest rate in Singapore, HSBC Personal Loan is a noteworthy option. With a competitive interest rate of 4% (EIR 7.5% p.a.), it’s definitely one to keep an eye on. If fast cash disbursement is a top priority, explore Standard Chartered CashOne and POSB/DBS Personal Loan, which offer immediate loan approval and cash disbursement.

While traditional banks provide loans with favorable terms and conditions, Accredit is an option for low-income earners, providing loans with interest rates of up to 4%. When choosing a personal loan in Singapore, dedicate the time and effort to discover the optimal solution for your financial situation.

Insights to Maximize Your Personal Loan Benefits

Personal loans can transform your financial situation, but to make the most of them, it’s crucial to grasp how interest rates function and how they impact your loan. Fortunately, with the right guidance, you can make intelligent choices that will lead to optimal outcomes. Don’t let interest rates deter you from accessing the funds you require.

Equipped with the right knowledge, you can seize control of your financial destiny and capitalize on the full potential of a personal loan. And with Accredit by your side, finding the right loan that fits your budget and requirements is easier than ever. So why wait any longer?