UCO Bank Singapore emerges as a magnetic financial institution in the busy jungle of the Lion City, where skyscrapers adorn the horizon and innovation fuels progress. With its intricate and rich tapestry of tradition and modernisation, the bank continues to captivate the attention and hearts of Singaporeans seeking a banking experience like no other.

Be ready because you’re about to go on an exciting journey while exploring the vibrant banking universe of UCO Bank, where financial assistance and services are served with strategic economic intelligence and endless opportunities intertwine.

UCO Bank: The Origin

In 1943, the United Commercial Bank rose from its mould and became the Indian public sector bank from Kolkata.

The conception of organising a bank was by an eminent Indian industrialist during the 1945 Quit India Movement. In Kolkata, it set out its headquarters. G.D. Birla, the mastermind of the United Commercial Bank Limited, became the chairman, and soon, more branches in India were opened.

UCO Bank Singapore’s Inception

UCO Bank wasn’t able to dodge the Second World War. In truth, the bank suffered much economic damage due to the war, that’s also shared with many banks in the same industry.

Nevertheless, the war didn’t dampen the wise and strategic approaches of the management to push forward despite incurring many issues from World War II. the fact is, UCO pushed on and even opened several branches overseas.

Among these notable branches is the UCO Bank Singapore, which opened in 1951. The “Little India’s” Serangoon chapter occurred in Lion City’s financing industry in 1959.

Is UCO Bank Singapore fully licensed?

Yes, it is! It’s a Full-Licensed Bank with a Domestic Banking Unit, and an Asian Currency Unit, all authorised by the Monetary Authority of Singapore.

The UCO Bank Singapore initially rented the premises at the Raffles Quay area, now the notable Raffles MRT Entrance. And in 2018, a merger occurred, as the Serangoon Branch was united with the UCO Bank Singapore’s main branch.

Thus began the bank’s legacy in Merlion City, which spanned several decades. Thanks to its reputation as a trusted financial institution, it’s now among the firmly established banking industry pioneers.

UCO Bank Singapore Helps Fuel the Country’s Financial Growth

As the bank continues to serve its clients in Singapore, it also fuels the country’s financial growth and economic success. Among its robust business features are:

- Supporting SMEs Through Business Expansion and Investment:

UCO Bank Singapore have high regard for the SMEs in the country and provides well-tailored banking solutions for entrepreneurs to expand operations, invest in new ventures, and seize growth opportunities.

The bank’s customised business loans empower SMEs to attain their business goals faster.

- Facilitating International Trade and Commerce:

The bank’s facilitation of international trade and commerce contributes to the country’s status as a global financial hub.

If you plan to obtain the bank’s banking services, expect comprehensive trade finance solutions, bank guarantees, letters of credit, and import-export financing.

- Empowering Individuals to Reliase Financial Aspirations:

The UCO Bank Singapore recognises the significance of empowering individuals to attain their financial aspirations through its various financial products and services like savings and current deposit accounts, deposit insurance schemes, trade and finance, personal loans and more.

These services ensure clients accessible access to funds responsibly. Thus, the bank enables its customers to fulfil their dreams and improve their quality of life.

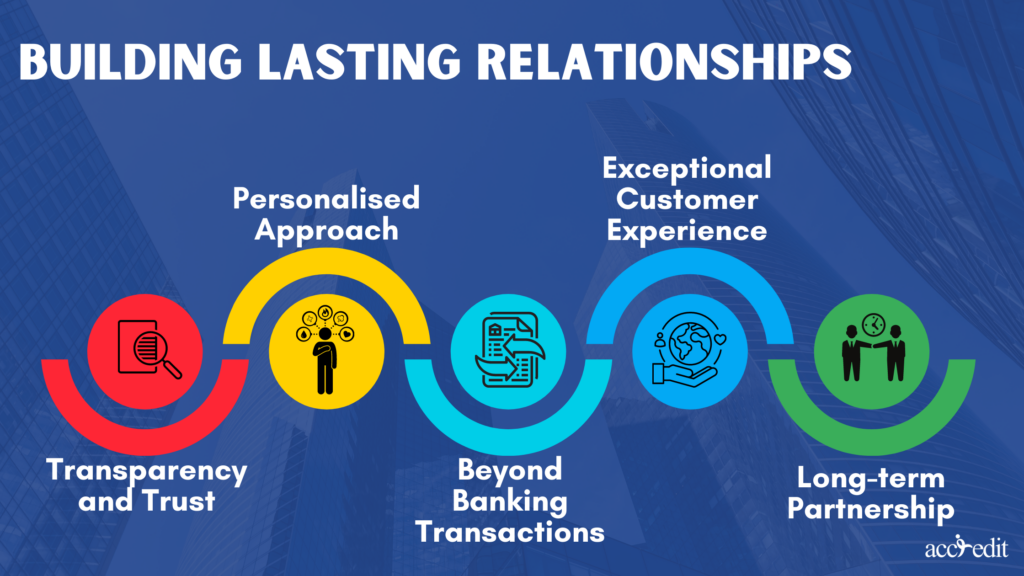

Building Lasting Relationships

The UCO Bank Singapore prides itself on fostering lasting relationships with its customers, as they often prioritise the human touch in every interaction.

Such advocacy and mission are a reflection of the bank’s motto, which is “Honours Your Trust”.

As a result, the bank often goes beyond traditional banking transactions and treats each client as a valued partner. The approach leads customers to an exceptional banking experience that resonates with their needs and demands.

UCO Bank Singapore focuses on the following:

- Transparency and Trust

It’s at the forefront of the bank’s customer relationship, as they believe open and honest communication is a sturdy foundation for building strong connections.

- Personalised Approach

The bank acknowledges all customers have diverse financial needs and aspirations. Thus, it grants a personalised approach to interactions and services!

- Beyond Banking Transactions

The bank also offers financial guidance and connects with clients while providing value-added services. As a result, clients acquire support beyond the scope of traditional banking services!

- Exceptional Customer Experience

To deliver the most exceptional customer experience, the bank focuses on providing knowledgeable, courteous, and prompt staff service. Also, with digital banking, online banking platforms, and mobile application, UCO Bank Singapore help clients efficiently manage their finances.

- Long-term Partnership

UCO Bank Singapore connects with customers by seeking feedback and proactively addressing concerns or issues.

UCO Bank Singapore’s Logo and Motto

UCO Bank Singapore Logo:

Have you ever seen UCO Bank Singapore’s logo?

What do you see from the logo?

It’s a lot simpler than it seems, as the logo of the UCO Bank Singapore represents a pair of clasped hands covered by an octagonal structure.

The bank’s brand colours of blue and yellow have remained the same since the organisation’s establishment. Blue is the ideal representation of the Bank’s national obligation.

Also, here is a quick trivia for you. The current UCO Bank Singapore logo resembles life insurance in South Africa, company Sanlam.

UOC Bank Singapore’s Motto:

The bank’s motto is “Honours Your Trust”.

UCO Bank Singapore Embraces Diversity

One of the most outstanding robust features of the bank is embracing cultural diversity. The bank takes great pride in its talented and passionate diverse workforce.

The blend creates a harmony of expertise and cultural perspective that many customers will benefit from.

Nurturing Financial Literacy and Empowering the Community

Knowledge is the key to financial empowerment, and UCO Bank Singapore believes in that. Thus, the bank takes proactive measures to motivate and promote financial literacy within the Singaporean community. Such an approach guarantees educational initiatives and resources to enhance financial awareness.

So, you can see that if you partner with UCO Bank, you’re not only with a bank but a massive gateway to the realm of extraordinary financial experiences. You can be sure that when it’s business loans or opening accounts, you’ll receive the bank’s total commitment to customer-centric services that are genuinely a part of the crowded banking industry.

However, if you need quick access to funds, you can check out Accredit as your excellent option for personal loans in Singapore. The application is seamless, and the experience is hassle-free. Accredit Licensed Moneylender complements UCO Bank Singapore’s mission to provide intelligent and personalised financial assistance and services.

So, if you’re ready to obtain the services of UCO Bank SIngapore, it’s all here. Transform your financial dreams into reality because the bank honours your trust.