Step into the realm of modern finance, where credit cards reign supreme, offering a world of ease, adaptability, and countless rewards. Within Singapore’s vibrant landscape, credit cards hold a cherished place, showering cardholders with a plethora of advantages. Whether you’re a resident or a foreigner, understanding the ins and outs of credit cards is crucial for making informed financial decisions. In this article, we embark on a journey to unravel the mysteries surrounding Singapore credit cards, leaving no stone unturned.

What is a Credit Card?

Step into the world of plastic payment cards—credit cards, to be precise. They allow you to borrow money from a bank or lender for purchases and cash withdrawals. Here’s how they work: you have a set credit limit and can spend up to that amount. Later on, you repay what you borrowed. These cards come with unique features like a card number, security chip, expiry date, and magnetic stripe for easy in-store transactions. They offer a range of benefits to make your financial transactions smoother.

How Do Credit Cards Work?

Credit cards work by establishing a credit limit, which is the maximum amount of money you can borrow from the issuing institution. As you engage in transactions with your trusty plastic, the issuing bank swoops in to settle the merchant’s dues on your behalf. Once the billing cycle nears its end, a comprehensive statement arrives, showcasing your purchases and the ensuing debt.

You can choose to pay the full outstanding balance or make a minimum payment, which carries over the remaining balance to the next billing cycle, along with interest charges. The ever-changing interest rates on these cards demand careful comprehension before venturing into its realm. Fail to make the monthly settlement, and brace yourself for a formidable interest rate of approximately 25% per annum.

The Benefits of Having a Credit Card in Singapore

Owning a credit card in Singapore comes with a range of advantages:

Convenience and Ease of Use

Experience unparalleled convenience and effortless transactions with credit cards in Singapore. Say goodbye to bulky wallets and cumbersome checkbooks; a simple swipe or tap is all it takes to complete your purchases. Not only does this save precious time, but it also minimizes the potential hazards of losing cash or falling victim to theft.

Building and Improving Credit Scores

A credit card holds the key to constructing and elevating your creditworthiness. By consistently and prudently utilizing this financial tool, you pave the way for a stellar credit score. In Singapore, a favorable credit rating is a passport to securing loans, mortgages, and even rental agreements, opening doors to a wealth of opportunities.

Rewards and Cashback Programs

When you own a credit card in Singapore, you unlock a world of perks. The best part? Rewards and cashback! Countless credit cards offer tempting reward points, ready to be exchanged for discounts, vouchers, or even luxurious treats like access to airport lounges or fancy hotel upgrades.

Travel Benefits

Singapore credit cards have a wealth of travel benefits in store. From protecting your trips with travel insurance to granting access to swanky airport lounges, these cards add a touch of opulence to your adventures. Bask in the excitement of free air miles that take you to new horizons while enjoying discounted hotel stays that keep your budget intact. With these enticing perks, your travel experiences will reach new heights as you effortlessly save time and money.

Eligibility for Obtaining a Credit Card

While credit cards offer enticing benefits, it’s important to note that not everyone is eligible to obtain one. In Singapore, credit card applications have specific eligibility requirements, which usually encompass the following:

- Singaporean citizens, Permanent Residents, or Foreigners

- Age of 21 years or older

- Secure employment and meet the minimum income criteria

- Demonstrating a solid credit history and maintaining a healthy credit score

How to Get a Credit Card in Singapore?

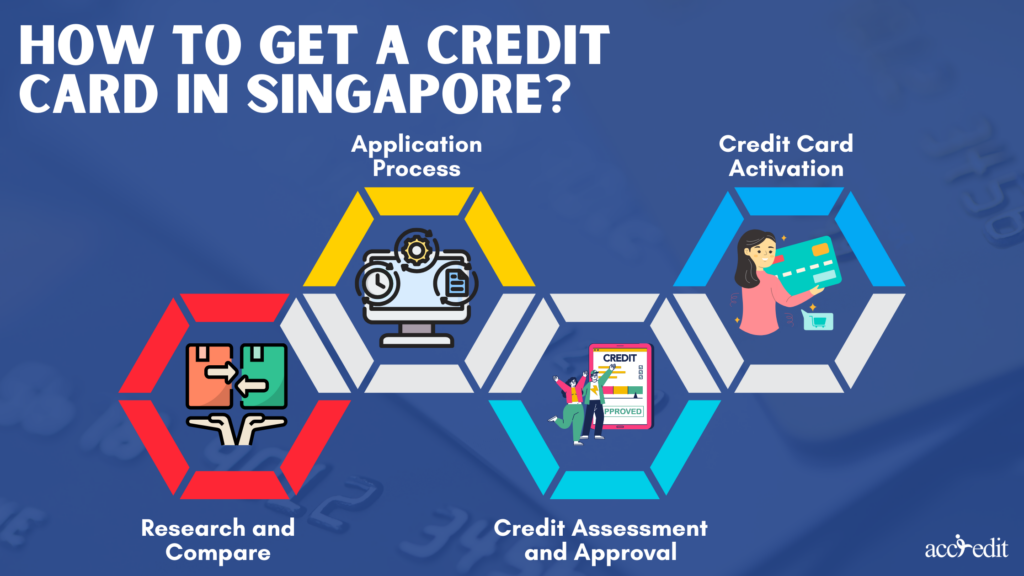

Obtaining a credit card in Singapore involves a straightforward process. Here are the steps to follow:

- Research and Compare: Start by researching the various credit card options available in Singapore. Consider factors such as interest rates, annual fees, rewards programs, and additional benefits.

- Application Process: Once you have identified a credit card that suits your needs, proceed with the application process. You can typically apply online or visit the bank’s branch in person. Prepare the necessary documents, including proof of identity, income statements, and employment details.

- Credit Assessment and Approval: Upon submitting your application, the bank will review your credit history, income, and other relevant factors to assess your creditworthiness. This process may take a few days, and the bank will inform you of the approval or rejection of your application.

- Credit Card Activation: If your application is approved, you will receive your credit card by mail. Activate the card by following the provided instructions, such as calling a designated number or using an online activation portal.

How Much Money is Required to Open a Credit Card?

The amount of money required to open a credit card in Singapore varies depending on the card issuer and the type of card you choose. Generally, the majority of credit cards require a minimum annual income of S$30,000 for Singaporeans and Permanent Residents, while non-residents must meet a higher threshold of S$40,000.

Yet, for those seeking exclusive privileges, a more substantial annual income of S$80,000 or above is coveted. Remember to gather supporting evidence of your income when submitting your application, ensuring a smooth process ahead.

How Do I Choose a Credit Card?

With numerous credit cards available in Singapore, choosing the right one can be overwhelming. Here are some factors to consider when selecting a credit card:

Assess Your Spending Habits and Needs

Evaluate how you spend your hard-earned cash and identify the areas where you allocate the most. Certain credit cards present elevated rewards or cashback percentages tailored for particular categories like dining, groceries, or travel. Opt for a card that harmonizes with your spending tendencies, amplifying the advantages you reap.

Compare Interest Rates and Annual Fees

When it comes to credit cards, the interest rates and annual fees wield immense influence over your financial outlay. It’s crucial to carefully evaluate and contrast these rates and fees across various cards to discover the ideal match that not only presents competitive terms but also harmonizes seamlessly with your budgetary considerations.

Consider Rewards and Benefits

Delve into the realm of rewards and benefits as you assess the offerings of different credit cards. Seek out cards that present enticing perks tailored to your preferences, such as coveted discounts at beloved stores or exclusive privileges for your journeys across the globe.

Thoughts

In the vibrant realm of Singapore’s financial landscape, credit cards stand tall, wielding their power of convenience, rewards, and abundant advantages for those who hold them. Equipping yourself with the fundamental knowledge of credit cards, including eligibility criteria and the art of card selection, becomes paramount when navigating the intricate world of finance.

By delving into the vast array of credit card options and pinpointing the one that harmonizes with your unique requirements, you open the doors to mastering the credit card realm and unleashing a treasure trove of Singaporean benefits.

Unlock Financial Ease: Discover Personal Loans with Accredit Moneylender in Singapore

Ah, the magic of credit cards! We rely on them for our day-to-day expenses, like groceries, shopping sprees, and exciting trips. But what about those unexpected moments when life throws a curveball, and you need a decent chunk of cash for things like car repairs or home renovations? Fear not, because personal loans have got you covered.

Now, if you’re in Singapore and on the lookout for a personal loan, look no further than Accredit Moneylender. They’ve got your back with their hassle-free personal loan options. They specialize in lightning-fast approvals and fair interest rates. And guess what? They make it super easy for you to choose a repayment plan that suits your lifestyle, eliminating any stress or headaches from the entire process.

So, why wait? Take the plunge and seize the financial support you need today from Accredit Moneylender. Your wallet will surely thank you in the long run! Act now!