Do you need cash in Singapore but don’t want to be slapped with high-interest rates? Consider secured personal loans as a possible option. The beauty of these loans is that they require collateral for security, leading to lower interest rates and the potential for larger loan amounts.

Nonetheless, before you begin your search for a lender, it’s critical to familiarize yourself with the intricacies of secured personal loans and what to weigh before making a commitment.

Understanding Secured Personal Loans

Are you curious about secured personal loans in Singapore? These loans require collateral to be put up as security, which can include property, shares, or fixed deposits, among other things. The value of the collateral pledged will determine the amount you can borrow.

The repayment period for secured personal loans is usually from one to five years, with the requirement of regular monthly payments that cover both the principal amount and interest. Your creditworthiness and the value of the collateral you provide will undergo evaluation by the lender to obtain the loan’s approval.

What Qualifies as Collateral for a Loan?

In general, collateral is any asset that you pledge to a lender as a form of security in case you are unable to repay the loan. Common types of collateral include:

Pros and Cons of Secured Personal Loans

Discover the benefits of secured personal loans in Singapore and how they can provide you with greater financial flexibility. Not only do secured personal loans offer lower interest rates, but the higher loan amount and longer repayment terms can empower borrowers with more options to fulfill their financial goals. The approval process is also easier compared to unsecured loans since lenders are more receptive to lending when they have security.

However, with the perks comes a potential downside. The risk of default exists in secured personal loans, which can lead to the loss of collateral by the borrower. Thus, borrowers should exercise prudence by providing collateral of good value and ensuring they can keep up with the repayments. With careful planning and a clear repayment strategy, secured personal loans can be a useful financial tool.

| Pros | Cons |

| ✔️ Lower interest rates ✔️ Higher loan amounts ✔️ Longer repayment terms | ❌ Risk of losing collateral on default ❌ Collateral requirement limits flexibility ❌ Late payments damage credit score |

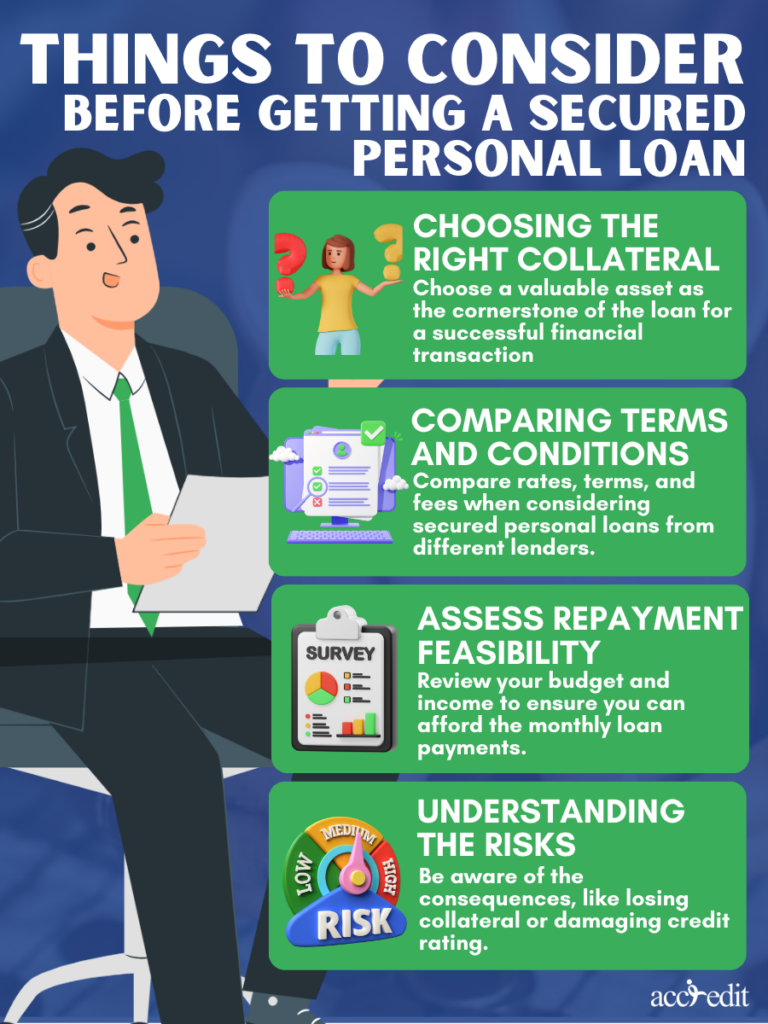

What You Should Know Before Committing to a Secured Personal Loan

Before you take the plunge and apply for a secured personal loan, there are crucial factors that you must mull over.

- Choosing the right collateral: The worth of the collateral serves as the cornerstone of the loan, and it is vital to choose a valuable asset that can guarantee a successful financial transaction.

- Comparing terms and conditions: Lenders can vary significantly in the terms they offer for secured personal loans, so it’s essential to compare rates, repayment terms, and fees.

- Assessing repayment feasibility: It’s important to ensure that you can afford to make the monthly payments required by the loan, so take a close look at your budget and income before committing.

- Understanding the risks: One must remain conscious of the potential repercussions, such as the risk of forfeiting the collateral or impairing one’s credit rating.

By considering these essential aspects, you can steer clear of making hasty decisions and guarantee that you arrive at an informed verdict that is tailor-fit to your financial circumstances.

Secured Personal Loans: A Simple Application Process

Getting a secured personal loan in Singapore doesn’t have to be a stressful experience. While there may be slight variations in the application process depending on the lender, it’s typically straightforward and hassle-free.

| Step 1: Loan Preparation | Step 2: Fill out the application form | Step 3: Get the funds |

| • Research and compare lenders • Determine collateral • Gather essential documents | • Submit all the required documents • Provide correct personal & financial information • Wait for loan approval | • Review loan terms and conditions • Sign the loan agreement • Receive loan amount |

The Bottom Line

Secured personal loans in Singapore can offer borrowers substantial advantages, such as access to higher loan amounts, lower interest rates, and lengthier repayment terms. Nevertheless, borrowers must remain mindful of the risks that come with pledging collateral and defaulting on payments.

Selecting the appropriate collateral, comprehending the loan terms and repayment timeline, and exploring alternate options are crucial steps to take before committing to a secured personal loan. By doing so, borrowers can avoid potential pitfalls and make sound financial decision that aligns with their unique needs and circumstances.

Get Your Personal Loan Without Pledging Collateral with Accredit Moneylender

If you’re not keen on tying up collateral to get the funds you need, Accredit Moneylender has got you covered. Our Singapore-based moneylender provides quick approvals and attractive interest rates, ensuring you get the best unsecured personal loan deal.