With its repayment options in Singapore, moneylending has become famous for people who need quick cash for different purposes. Whether for home or vehicle repairs, medical bills and medications or personal expenses, moneylenders offer various loan products to assist individuals in overcoming their current monetary challenges.

It’s a fact that borrowing money from a moneylender can be a big help for financial matters. But, it’s crucial to realise the financing concept of moneylending, along with payment arrangements available, and to choose the most suitable for different financial circumstances.

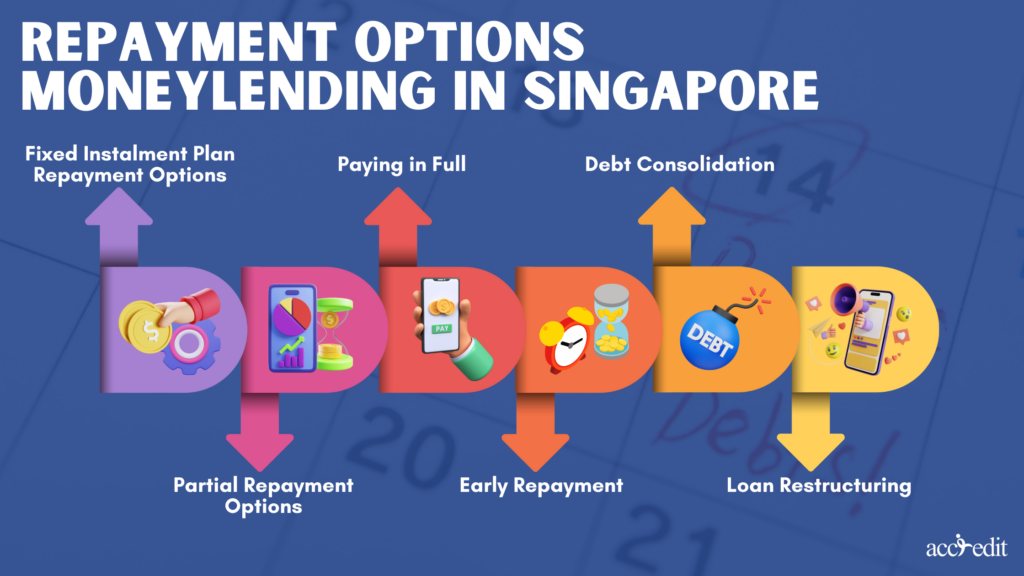

Do you plan to take a loan and consider how to repay it efficiently? In this article, you’ll learn further information about moneylending. In addition, you’ll get the opportunity to explore the different repayment plans for moneylending in Singapore.

What is Moneylending in Singapore?

Moneylending is the financing method where registered lenders in the country provide monetary assistance to their clients. The operations of the industry in the country are straightforward.

A borrower would seek their services to proffer financial assistance. First, the client must comply with various eligibility criteria and requirements before they can apply for the loan product they desire. The process also involves the borrower disclosing their personal details, documents, credit score, loan purpose and amount.

The borrowers must fill out the application, be assessed for their eligibility, and once approved, the loan amount is disbursed to their account. But, before disbursement, borrowers and lenders discuss the loan terms and conditions linked to the loan.

This is where the repayment options in Singapore are usually discussed. Repaying the loan is undoubtedly a significant responsibility a borrower has to complete. Thus, borrowers must know and understand their repayment plan strategies that fit their best abilities.

Before finalising your loan from the moneylender in Singapore, check out these repayment alternatives that’ll help you manage finances and pay the debt:

1. Fixed Instalment Plan Repayment Options

It’s among the most commonly suggested repayment options in Singapore. You are encouraged to make fixed payments at regular monthly intervals.

The payments a borrower has to fulfil are already predetermined monthly and over a certain period until the loan is fully repaid. These are mainly under the loan terms and conditions.

Fixed Instalment Plan Advantages:

Because it’s a predictable plan of how small the monthly repayment amount will be with specific schedules, it makes repayment duties much more accessible. Borrowers can also manage their budget finances better, as they know what expenses to expect in the coming months.

Due to the clear timeline for when the loan has to be repaid, it’s possible to avoid missing payments and incurring late fees. As convenient as it is, you must consider the dividend and loan terms.

A fixed instalment plan is low-risk due to the structured payment method. Default risks are minimised as well. But if a borrower does miss a payment or defaults on the loan, lenders will charge late repayment fees and other penalties.

Interest Rates for Fixed Instalment Plan:

Moneylenders in Singapore, under the regulations of the Ministry of Law, follow the interest rate caps. As of January 2022, the current fixed interest rates caps for instalment plans in Singapore are:

- 1% to 4% maximum interest rates per month for secured and unsecured loans

Types of Loans with Fixed Instalment Repayment Options:

You have several loan choices that offer fixed instalment repayment options: These loans include:

- Personal Loans

- Business Loans

- Renovation Loans

2. Partial Repayment Options

If you’re interested in repaying a portion of the loan amount you owe, then you can opt for the partial payment. It’s a good alternative for individuals who can’t make a full payment but are eager to reduce their current debt.

The expected outcome of a partial payment is that the loan’s remaining balance accrues interest. It could also incur fees, which mainly depend on the terms of the loan agreement.

Thus, please communicate with the moneylender about their flexible repayment options in Singapore to help you understand the interest coverage and fees applicable to the remaining balance.

For instance, you owed $10,000 from a lender with a monthly interest rate of 2%. You get to decide to make a partial payment of $5,000 towards the loan. The remainder of the loan is $5,000 and would continue to accrue interest at 2% monthly.

Partial Repayment Options Advantages:

- The monthly payments have become more affordable than before, as it’s lower compared to the initial agreement.

- It grants lesser financial strain to the borrower’s repayment plan and budget as a massive amount has been paid off.

- The loan can be paid off earlier than expected, which helps the borrower lessen their financial burdens.

Partial Repayment Interest Rates

As per the Moneylenders Act, there’s a specific interest rate capping on loans and repayments in Singapore, which is:

- Up to 4% maximum interest rates for secured and unsecured loans

Types of Loans with Partial Repayment Options

Here are the types of loans that you may pay your partial payment to:

- Personal Loans

- Education Loans

- Business Loans

If you do move forward with the partial payment, it might be considered a form of early repayment. It’s a risk you need to consider and think over first.

Talk with the lender you’re working with to acquire clarification on a repayment option like these, mainly whether there are additional fees to settle.

3. Paying in Full

A repayment option a borrower can opt for when repaying their existing debt is paying in full. This’ll include interest rates and fees associated with the loan, all in a single payment.

Traditionally, when paying a loan, a borrower usually makes smaller instalment payments over a more extended period. Although more minor, you’d pay more with the interest charges as time passes.

Paying the entire loan at once is more rewarding as you wouldn’t have to tire away paying the interest charges; it also reduces your overall debts. It’s one of the many advantages attainable when paying in full, allowing the borrowers to save big money, particularly associated with interest payments.

If you’re seeking a direct financing repayment choice, that’ll be the most straightforward in the book.

Paying in Full Advantages:

- Faster repayment time

- The lower overall interest paid

- No lingering debts to worry about

Interest Rates when Paying in Full:

The Ministry of Law encourages all licensed moneylenders in Singapore to follow the interest rate capping for every loan and repayment option, such as:

- 1% to 4% maximum interest rates for unsecured and secured loans.

Loan Types with Paying in Full Options:

If you like to pay a loan in full, here are some loans that offer repayment options:

- Unsecured loans like a personal loan

- Renovations Loans

- Short-term loans like payday loans

- Business Loans

Settling the debt immediately is an excellent choice, but it isn’t for everyone. Before proceeding with this repayment approach, assess your budget, deficits, monetary obligations, and overall financial situation.

Also, technically you’re about to repay the debt earlier than the agreed term. It can be a risk; it’s wise to discuss with the lender you’re working with early repayment fees if there are any. Moreover, you’ll be subjected to legal pursuits if you lack the funds to pay in full.

4. Early Repayment

Another payment arrangement you can pursue as a borrower is early repayment. It’s also referred to as prepayment or prepayment penalty.

How can a borrower pursue an early repayment structure? You can pay the loan in full or do it partially. The purpose is to pay the loan before the agreed due date fully.

Early Repayment Advantages:

A borrower’s public benefit by making early repayment is the lower interest charges. As borrowers have repaid the loan earlier than expected, they’re also debt-free ahead of schedule. For each debt cleared, a borrower’s credit score improved as well.

Early repayment is an excellent option to save money on interest charges.

Interest Rates for Early Repayment:

Early repayment interest rates are as per the Ministry of Law’s capping at:

- 1% to 4% maximum monthly for secured and unsecured loans

Loan Types with Early Repayment:

Early repayment options may be accessible from these specific loan types:

- Business Loans

- Education Loans

- Personal Loans

Then again, be sure to discuss this with the lender. It can be a risk when lenders charge an early repayment fee. It’ll affect and negate any potential savings.

Understanding and calculating the levies that apply to the early repayment plan is better. Consider that you must have the funds ready for early repayments, or you’d face penalties and could push the lender to take legal action.

5. Debt Consolidation

Another financing repayment choice you can communicate with your lender is debt consolidation.

Debt refinancing is unique because it allows you to combine all your current debts into a single loan. As the debts are merged, the interest rate is relatively lower and becomes an easily manageable monthly payment.

Debt Consolidation Advantage:

It specifically simplifies the overall repayment process. This helps borrowers miss out on payments or acquire late fees.

But, it’s a significant advantage considering you’ll manage multiple loans into a single payment plan. It still helps you reduce the interest paid rather than paying different interest rates simultaneously.

Interest Rates for Debt Consolidation:

By the Moneylenders Act, the interest rates for debt consolidation are capped at:

- Up to 4% max per month for all secured and unsecured loans.

Loan Types with Debt Consolidation Repayment Options:

Several loan types may offer debt consolidation in Singapore:

- Business Loans

- Personal Loans

- Renovation Loans

Don’t hesitate to discuss the repayment option with your lender. Also, there are some risks to consider. If you fail to keep up with the refinanced loan repayments, you’ll likely face penalties and fees from the lender.

6. Loan Restructuring

If a borrower feels they’re struggling immensely with repaying their loans, they may communicate with the lender and negotiate to have their loan restructured. Restructuring is one of the repayment options Singapore offers to a borrower.

The process to obtain restructuring is the borrower has to contact the lender, especially when they realise they’re having difficulties making payments. This act shows the proactive behaviour of the borrower and commitment to find a solution to the problem.

Loan Restructuring Advantages:

The lender will then assess the borrower’s financial situation and determine the extent of the issue and the likelihood the borrower can then repay the loan. Both parties will negotiate new terms that best fit the borrower, including alteration to the repayment schedule, interest rate, or principal loan.

Interest Rates for Loan Restructuring:

As per the Moneylenders Act and Rules, all loans will follow an interest capping of:

- 1% to 4% max monthly interest rate

When the new terms are agreed upon, the lenders will prepare new loan documents outlining the restructuring terms. Afterwards, the borrower must adhere to the new repayment schedule, repay the loan in time, and avoid defaulting at all costs.

Loan Restructuring Repayment Options:

Here are some notable loan restructuring options from licensed moneylenders in Singapore:

- Moneylender Debt Management Programme

- Debt Restructuring by Accredit Money Lender

The risk borrowers would face possibly paying more interest over the loan period or facing penalties. Furthermore, not all lenders grant this repayment plan. Thus, always communicate with the registered lender regarding repayment options concerns.

Repayment Options Singapore Are Credit Score and Life Saver

It immediately reflects on your credit record whenever you take out a loan. Every detail that’s associated with the loan you took is inscribed in your data. If you miss a payment, delay the repayment, or default on the loan, it’ll be recorded in your credit history.

All the data obtained will be a reflection of your capacities to repay loans and credibility as well. It’s a waste of opportunities if you don’t care about your credit score because your creditworthiness for future loans relies heavily on your data.

Thus, there’s no shame in contemplating which repayment options in Singapore best fit your capacities and needs. In truth, it’ll be your lifesaver in the future.

So, don’t hesitate to review which repayment method works well with your budget and finances. Discuss it immediately with the lender; perhaps they’ll offer you a more comprehensive option.

Are you searching for flexible repayment options in Singapore? You can count on Accredit Money Lender! Apply today for a comprehensive and customer-focused loan experience and service.