Living away from your comfort zone can be a great and fun adventure for anyone living and working in Singapore. Imagine exploring new places, being with new people, and living through a different blend of culture and heritage is practically a dream come true for most people. But when monetary trouble arises, personal loans for foreigners and ex-pats- are ideal choices.

As much as it’s fun and a great adventure to be an ex-pat and foreigner, a sudden shift changes when a demanding situation happens and you find yourself in a financial crisis. But suppose you’re a foreigner or ex-patin the country. In that case, this guide on personal loans in Singapore can help you understand the process, prepare your documents and requirements to qualify for a personal loan and finally obtain the funds you need.

What are Personal Loans?

First, it’s vital to understand what a personal loan is. It’s the kind of loan a borrower can utilise for specific purposes. A borrower may apply for it whenever they have plans to go on a trip and travel out of the country, to purchase personal essentials, use it for health and medical purposes, or to consolidate debts.

It comes in an array of terms. In Singapore, it isn’t only known as a personal loan. It’s also called a consumer loan. In many cases, it’s referred to as an unsecured loan as it does not have any collateral requirement for the request to be granted.

It isn’t like a credit card because personal loans have a special fixed rate and a repayment period. The revised rates are implemented mainly by the Monetary Authority of Singapore and the Ministry of Law – Registry of Moneylenders. Singapore’s banks, financial institutions, and licensed moneylenders are bound to these laws and regulations.

A foreigner and ex-pat be naturalised citizens in Singapore, but it doesn’t mean you won’t be qualified to request and be approved for a personal loan. In truth, the country has excellent regard for foreigners and ex-pats. As a result, a slightly diverse process and easy-to-provide requirements were included in the regulations for a foreigner and ex-pat ex-pate out an unsecured loan.

Types of Personal Loans for Foreigners and Ex-pats

Personal loans are Singapore’s financial ex-pats allowing many borrowers access to funds. Personal loans for foreigners and ex-pats are designed especially for the distinctive situation. This’ll help all foreigners and ex-pats In the country manage monetary requirements and improve their quality of life.

Various types of personal loans are accessible to foreigners and ex-pats in Singapore. Here are e most common types you can apply for today:

1. Unsecured Personal Loans

These types of people don’t require any security or collateral. You can easily access cash without having to provide any assets.

Expect higher interest rates compared to secured loans. It’s primarily because lenders encounter a higher risk when granting unsecured personal loans.

2. Secured Personal Loans

These personal loans require security or collateral. Thus, you must provide assets, such as vehicles or property, to secure the loan and access the funds.

Anticipate lower interest rates than unsecured personal loans as there’s less risk. Moreover, the collateral guarantees repayment if you fail to repay the loan in full.

3. Payday Loans

Payday loans are Singapore’s well-recognised short-term loans. It’s designed to assist foreigners and ex-pats encountering urgent financial needs.

These loans have high-interest rates and must be paid on the next payday.

4. Debt Consolidation Loans

These loans allow you to consolidate your existing debts, which becomes a single loan. As a result, you now have a personal loan with a lower interest rate.

It’s efficient in assisting you to manage your debts and even saving more money on interest charges.

Personal Loans for Foreigners and Ex-pats Application

Personal loans for foreigners and ex-pats have a specific application process that borrowers must learn and apply. The procedure entails the essential element when requesting approval for monetary transactions like these, and it’s connected to providing and fulfilling the requirements imposed by a bank, financial institution, or moneylenders in Singapore.

Personal Loans for Foreigners and Ex-pats Requirements

Before obtaining the funds from the approved personal loan request, a foreigner and ex-pat in Singapore must meet the necessary criteria. Notably, banks, financial businesses, and moneylenders in the country do have their specific scope of requirements. Nevertheless, here are the general preconditions foreigner and expatriate borrowers have to fulfil such as;

- Belonging within the minimum age level of at least 21 years old

- Providing a legitimate and validated employment pass or work permit

- Having proof of their annual income of less than $10,000

- Having a good to impressive credit score and background

For expatriates in Singapore, there may be some additional or different requirements to satisfy. Among these is the time you have been employed in the country, usually six months minimum.

However, it could be entirely at odds with other financial businesses, banks, or moneylenders. In such a way, it is best to ex-patch the specific requirements for personal loans for foreigners and ex-pats first. You can research by visiting the monetary businesses’ official website to send an inquiry or to check out the comprehensive list of licensed moneylenders in Singapore on the Registry of Moneylenders’ website.

Personal Loans Foreigners and Ex-pats Procedure

If you are an ex-pat or foreigner in Singapore and haven’t had the opportunity to apply for a loan before then, it can be an overwhelming experience. Still, you shouldn’t worry too much because this comprehensive guide is specifically made to assist you with obtaining the correct details on requirements, procedures, and information associated with personal loans in Singapore.

It is straightforward and effortless to follow. The general procedure that occurs when you apply for an unsecured loan is as follows:

1. Compare Banks, Financial Businesses, and Moneylenders Via Research

Singapore is currently Asia’s financial hub. With this detail in mind, it’s easier to comprehend that the country has a wide selection of loan providers.

It will be good for you to do diligent research on banks, monetary businesses, and licensed moneylenders to compare the entirety of the financial assistance and service they’re willing to offer you as their client. This will give you more opportunities to weigh your needs and which financial business can provide them.

Ensure you have checked out and understood the diversities in interest rates, flexibility on repayment terms, and other factors.

2. Gather and Prepare Your Documents

Documents are crucial to businesses, and it’s also the same case when a foreigner or ex-pat as you applies for a personal loan. Thus, when you have selected the best personal loan provider for you, make sure to gather, prepare, and hand over the following papers;

- A valid employment pass or work permit

- Certified proof of income could be your payslips, tax statements, etc.

- A legitimate proof of your residency such as tenancy agreements, utility bills, etc

- Verified Identification documents like NRIC, passport, driver’s licence, etc

Always keep in mind to ensure that you are completing the documents by the requirements of the bank, financial institution, or moneylender to whom you’re planning to apply for a personal loan from. Double-check the list accessible for you to avoid hassles for both parties.

3. Application Submission

When you have gathered and prepared all the necessary documents for a loan application, it is time to submit it to your preferred bank, financial institution, and moneylender in Singapore.

Be sure you are present upon applying for a personal loan regardless of your financial business choice. As a foreigner or ex-pat, face-to-face encounters with the people you’re about to borrow money from are better. However, with recent technological advancements, you may apply for a personal loan online from a licensed moneylender.

This way, they can explain the loan terms and conditions more comprehensively and informally. Moreover, you can communicate and understand the regulations more appropriately. In particular, inquire about the fine points on the loan amount, interest rate, fees, charges, and the repayment period.

4. Patiently Wait for your Loan’s Approval

When you submit your application, the financial institution or licensed moneylender will review and assess your documents to determine whether you are eligible for a personal loan. The waiting game is on set.

But always remember that it could take a while before the bank or financial institution finally approves your loan application, for instance;

- For banks, loan approval may take a few days to a few weeks. If you applied on Thursday or Friday, you would need to wait until the weekends are over before getting an update on the loan application.

- The process may be much faster with licensed moneylenders or financial institutions compared to a bank. It depends on which monetary business you’ve sent your loan request to and whether you possibly acquire same-day approvals.

- Licensed moneylenders in the country prove to be the fastest when approving a foreigner and expat’s loan application. Once you’ve provided the necessary documents and information, getting the necessary funds may not even take a day.

How will you know that your loan is currently being processed? Banks and financial institutions often send letters or emails to confirm approval. Licensed moneylenders will inform you personally since they can provide faster and hassle-free transactions on weekdays and weekends.

5. Personal Loans for Foreigners and Ex-pats Disbursement

After all the needed paperwork and loan approval are completed, fund disbursement follows. The process could depend on which financial institution or moneylender you’ve filed for the personal loan. But usually, the funds are transferred to your bank account.

Expect a one-time charge on the disbursement fee, which covers the processing and loan disbursing. It may range from 1% to 3% of the loan’s amount.

Also, the maximum interest rate charged on personal loans in Singapore is 4% monthly, stipulated in the Moneylenders Act.

Now that you have the required funds, you may use them according to their purpose. Regardless if you’d use it to pay debts, purchase essentials, and extra cash for travelling or medical expenses, it’s okay. So long as your activities are not illegal.

In a different scenario, is it possible that a foreigner or ex-pat will get denied for the request for a personal loan? When does it usually occur?

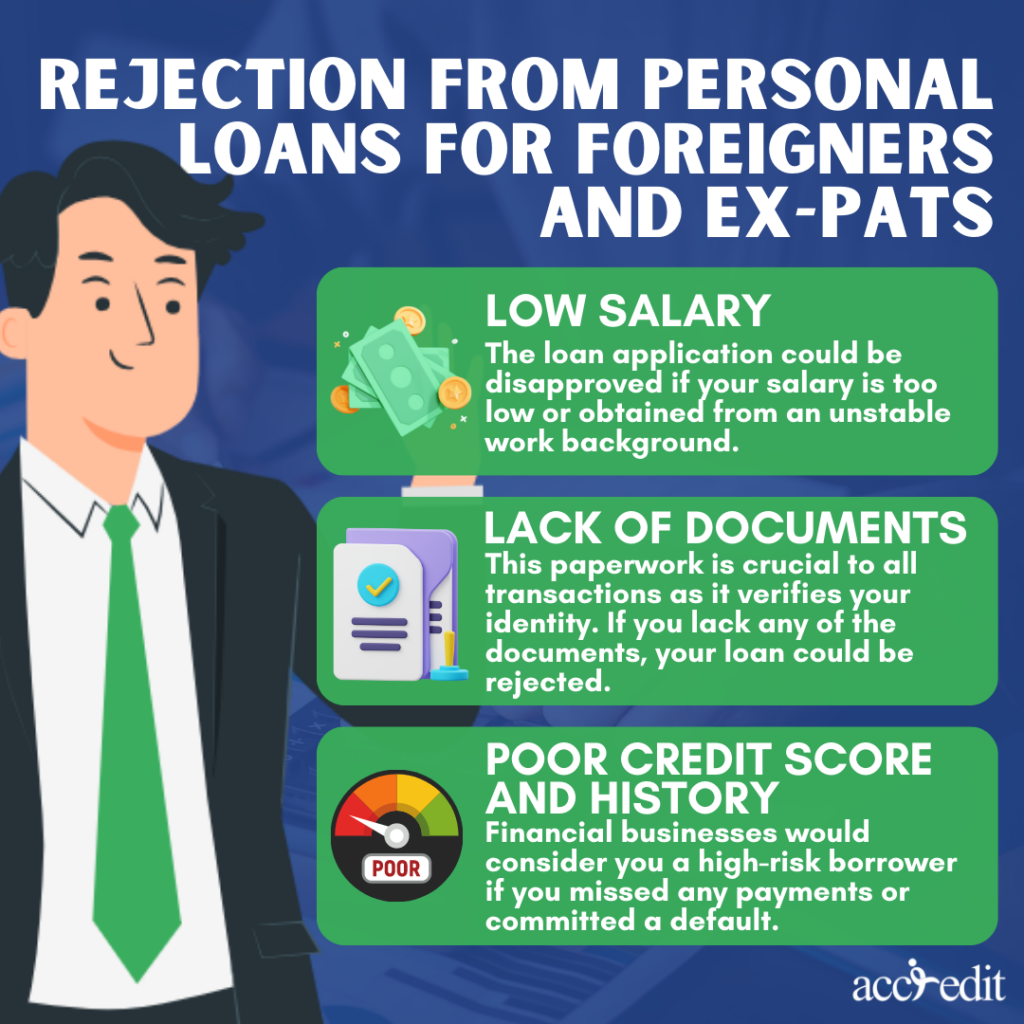

Rejection from Personal Loans for Foreigners and Ex-pats

Nobody wants to get rejected. Much more on personal loans for foreigners or ex-pats that you require. Thus, here are a few quick yet comprehensive details which could lead to a loan rejection.

- Low salary: Financial businesses need to know you’ll be able to repay the loan you owe. The loan application could be disapproved if your salary is too low or obtained from an unstable work background.

- Lack of documents: This paperwork is crucial to all transactions as it verifies your identity. Also, your residence, income, and other essential information. So, if you lack any of the documents, your loan could be rejected.

- Poor credit score and history: Credit scores are vital information in Singapore. All businesses linked to the finance industry will evaluate and assess their client’s credit scores and histories. Financial businesses would consider you a high-risk borrower if you missed any payments or committed a default. It’ll eventually lead to your loan application’s rejection application.

Yes, licensed moneylenders in the country are more understanding regarding credit assessment. So, a foreigner or ex-pat like you who doesn’t have a great credit history may still obtain the funds. But, you must provide a valid work pass or employment and proof that you have a decent income.

Conclusion

It’s obvious why a foreigner and ex-pat would feel intimidated when applying for a personal loan in Singapore. Of course, who can deny the most nerve-wracking is the waiting period? Do proper research and follow this comprehensive guide to personal loans for foreigners and ex-pats.

It’s guaranteed that the process will be less nerve-wracking and hassle-free with your newly acquired personal loan knowledge.

If you’re a foreigner or ex-pat needing a personal loan, you need not look any further. All you have to do is click here and be assisted by the best-licensed moneylender in Singapore!