Your salary came only a few days ago; you’re already running short on the monthly budget. If you haven’t tried taking out payday loans in Singapore, this must be the right time to consider it.

But before you take out a cash advance loan, you must know crucial information about it. Loans are excellent in resolving monetary problems. Yet, if you’re still a newbie in the moneylending industry, you need to learn the basics first.

For one, you have to understand what payday loans are. Also, before you do apply for one, it’s crucial to weigh the pros and cons before you apply for it. Find all these necessary details here and learn where to use this type of loan.

What are Payday Loans?

Payday loans are also known as cash advance loans in Singapore. It’s an unsecured loan, like a personal loan. But, these are specifically designed short-term loans to offer financial assistance to borrowers looking for quick cash.

Due to its concise repayment term, it mostly doesn’t last more than a month. An individual approved for the cash advance loan has to repay it with interest rates a few weeks after approval or on their next payday.

Do you have a poor credit history or cannot offer any collateral? Then this is the type of loan that would fit any individual who couldn’t gain access and qualify for traditional loans.

It’s important to remember that licensed moneylenders are the financial business to go to. But, some specifically specialise in providing this type of loan in Singapore.

Thus, make sure you choose the right lender. Moreover, moneylending business operators are regulated by the Ministry of Law and ensure all transactions are fair and legal.

Licensed moneylenders who offer payday loans in Singapore guarantee the process is easy to understand and analyse. To assist you in making a wise and informed decision, here are the pros you need to know about cash advance loans.

Pros of Payday Loans in Singapore

Do you need convincing whether getting a payday loan in Singapore is a good idea? Aside from the fact it’s a suitable loan to bridge financial gaps, here are the other essential factors obtainable from a cash advance loan:

Payday Loans are Accessible

These days, people have been busy trying to attain a work-life balance. Sometimes due to the hectic schedule, setting a day for visiting and applying for a loan from a lender can be challenging.

Also, have you ever tried applying for a traditional loan? If you did, you must have gone through a long and tedious loan application process, not to mention the extensive paperwork, collateral, and a gruelling assessment if you have a good enough credit score.

It’s pretty known that people have to go through many procedures before they’re considered eligible for a loan. Sometimes, lenders would say you are eligible, but due to lacking requirements and other issues, they’d ultimately reject the loan request.

That’s rarely the case when you apply for a payday loan in Singapore from a licensed moneylender, as they’re granting an online loan process. You don’t have to wait in line for a loan application.

You must ensure you’ve filled out the questions, provided documentation and passed it online. Waiting a few minutes is all it takes. That’s the kind of accessibility that borrowers deserve.

You’ll gain a significant pro by opting for a payday loan. It’s the advantages of ease and accessibility, particularly on loan application and disbursement.

Note that offering and granting online loan procedures are by the Moneylenders Act. It’s as the Ministry of Law recognises the helpful technological assistance a lender attains when giving financial services to their customers.

Impressive Speed of Approval and Disbursement

Traditional financial institutions in Singapore follow the standard operating procedures for all loan application processes. Aside from the stringent system before getting approved, the disbursement timeframe is from a few days to weeks.

However, working with a licensed moneylender is a similar yet different journey. Yes, you do have to be 100% sure you’re eligible for the payday loan. Of course, you must provide all the requirements as it’s SOP.

Yet a significant pro to acquire when doing business with a registered lender is the speed of cash advance loan approval. Traditionally, borrowers would know they’re approved for the loan a few days after applying. Licensed moneylenders aim to make the approval as stress-free as possible.

Upon completing eligibility and requirements, like identification and proof of income, the approval period is frequently within the same day.

An impressive aspect that is accessible is that the loan amount can be disbursed on the same day of application and approval. If the scheduled disbursement isn’t within the day, the most days to wait is the day after.

The speed is all thanks to the registered lenders having a streamlined application process in which borrowers can apply for the loan online or in person. This benefits individuals who need the funds as soon as possible.

No Need For Credit Score Checking

Traditionally, banks and financial institutions often evaluate a person’s credit score to assess their creditworthiness. If they are creditworthy, thus, they’ll be eligible for the loan.

On the other hand, if the borrower doesn’t meet the expected credit score, they’re eventually denied the loan. Or, the lender may propose less favourable terms, like obtaining a higher interest rate.

Credit score significantly impacts all monetary transactions in Singapore, specifically when applying for a loan.

But, another incredible and unique experience a borrower will go through when seeking a payday loan in Singapore from a registered lender is there’s no need to check their credit scores. It’s a critical feature that many borrowers with poor credit scores or no credit history will find significantly advantageous.

The law does not require licensed moneylenders to check a borrower’s credit score when seeking a cash advance loan. Even if these accredited lenders assess one’s credit history, they’re still forgiving and open to loan approval.

These are the main three pros you’d experience first-hand if you pursue a cash advance loan. Yet indeed, not everything is as good as it seems. Evaluating the cons of payday loans in Singapore is wise to weigh your options better.

Cons of Payday Loans in Singapore

As everything has pros and cons, so does getting a cash advance loan. These cons are still helpful for a borrower as they’ll bring more awareness regarding what you can anticipate if you get the payday loan.

Aside from the added knowledge, you’ll also gain motivation to prepare for the possible cons that’ll come your way. So, if you’re interested in requesting a payday loan, here are the cons you need to prepare for:

High-Interest Rate and Fees

One of the main drawbacks a borrower would encounter from a cash advance loan is the high-interest rates and fees. Although a licensed moneylender can impose a maximum interest rate of 4% a month, it will accumulate to an annual percentage rate (APR) of 48%. It’s a much higher interest rate compared to what traditional banks or credit unions charge.

There’s also a 10% administrative fee from the principal loan amount, a late interest rate of 4% per every missed payment, and a maximum of $60 for late repayments. These charges are legally imposed under the Moneylenders Act.

With all these high-interest rates and fees, a borrower may find it hard to repay the loan. It’s possible to fall behind on payments with the outstanding balance balloon because of these factors.

Short Repayment Period for Payday Loans in Singapore

Tradition-wise, other loans have lengthier repayment terms. It’s to help the borrower commit to their obligations and fully repay to its scheduled completion.

Yet, that setup wouldn’t be possible with this type of loan. It’s because a cash advance loan is meant for quick cash and fast repayment structure. Thus, another notable con associated with this type of loan is its short repayment period.

If traditional loans take a year or up to a twenty-year repayment period, a payday loan in Singapore must be repaid within the next few weeks. Other times, it must be paid upon the borrower’s upcoming salary.

As it’s within a shorter timeframe, it can pose a challenge to individuals who have yet to estimate their financial situation. They could end up repaying the loan but would get another one to end it.

Predatory Lenders

Unscrupulous lenders in the moneylending industry are still rampant today.

A person seeking a payday loan may fall into their traps, especially with their promise of an easy and quick loan process. Yet it’s far from the truth.

These individuals operate outside the Ministry of Law’s regulations, so they wouldn’t follow the capping imposed on licensed moneylenders. They demand exceptionally high-interest rates of 10% to 20% per month and charge exorbitant fees beyond the legal limit.

These individuals usually take advantage of their borrowers. They prey on people who are in dire need of cash and would offer a payday loan as a financial assistance option.

Also, they’d often trick borrowers into taking larger loans even when unnecessary. It’s the ah long’s tactic to trap the borrower in a debt cycle. They’re aggressive and manipulative, especially when collecting their money.

Be mindful of any contact you could encounter with these predatory lenders. File a report or complaint to the Registry of Moneylenders or Singapore’s Police Force.

These cons seem somewhat intimidating. Nevertheless, a borrower with enough knowledge can assess situations better and not fall into such traps.

How can you achieve it? It’s by selecting a reputable lender in Singapore.

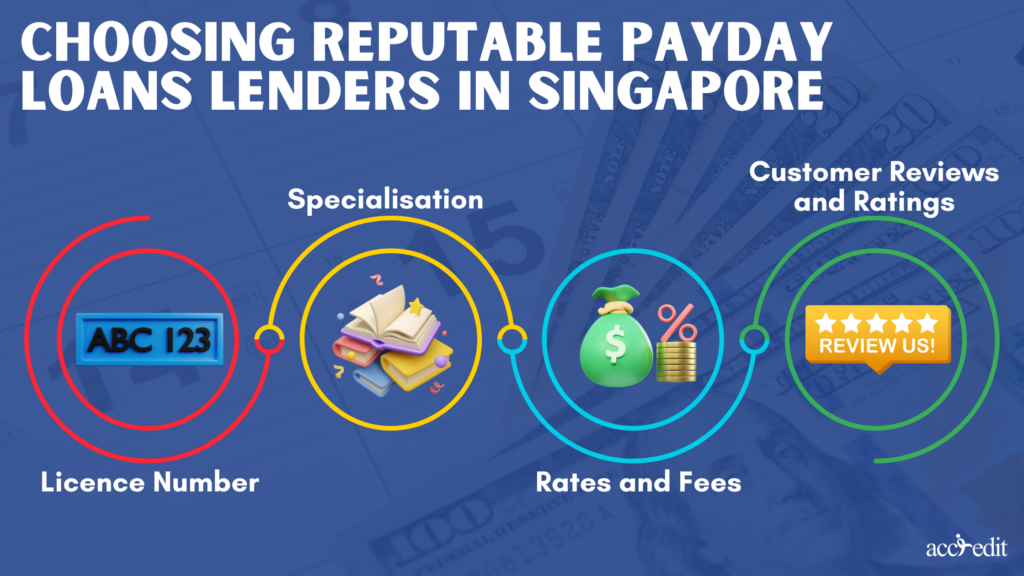

Choosing Reputable Payday Loans Lenders in Singapore

There are currently more than a hundred lenders in Singapore. All of these are registered with the Registry of Moneylenders. They are legally allowed to approve different types of loans to their borrowers, such as the payday loan.

But, not all registered moneylenders offer cash advance loans. It’s because these financial institutions focus on diverse debt specialisations. It’s the best professional method to proffer unparalleled financial service and assistance to their customers.

To choose a reputable payday loan lender in Singapore, here’s our foolproof approach you can take:

Licence Number:

An important step you can take when selecting a reputable payday loan Singapore provider is ensuring they’re licenced and duly registered with the Ministry of Law.

To assess their legitimacy, you can check their licence number, accessible via the Ministry of Law’s website. Search for all licenced moneylenders in Singapore or the Registry of Moneylenders.

You won’t only acquire the licensed moneylender’s number, but you’ll also get access to their business name, address, website and contact number.

Specialisation:

Registered moneylenders in Singapore offer a wide range of loan products. Since you focus on getting a payday loan in Singapore, ensure you work with a lender with specific specialisations.

Lenders like them are more likely to have a better experience and the required professional expertise. Moreover, it’s possible to anticipate competitive rates and favourable terms.

Rates and Fees:

Before you choose a payday moneylender, don’t hesitate to inquire about their rates and fees. Note that as they are under the Ministry of Law’s jurisdiction, they may only demand a 4% max interest rate per month and specific fees within the law’s legal limits.

Pick a lender who offers reasonable interest rates and fees that align with the industry’s standards.

Customer Reviews and Ratings

Another way to gauge the registered moneylender’s reputation is by reading about customer reviews and comparing ratings.

These customer reviews and testimonials are helpful when assessing the lender’s capacities. Feedback from previous borrowers broadens a prospective borrower’s expectations of the lender’s level of service and reliability.

As you research more on these moneylenders, you’ll better understand their reputation. Note lenders with a stable and robust credibility record for providing quality moneylending services that are well-regarded in the industry.

As your objective is to obtain reasonable financial assistance, it’s critical to be cautious when selecting the lender you’ll work with. Assess the lenders who offer and specialise in payday loans to ensure you get the best loan terms and services possible.

Payday Loans Pros and Cons Go Well Together

A payday loan may not be the same as other traditional loans; it’s still a debt. Debts will impact your credit score and may affect your quality of life.

As the pros and cons regarding a cash advance loan have been laid out, it can be overwhelming to choose by picking only the pros or the cons.

For one, the pros help you see the favourable outcomes, while the cons assist you in avoiding becoming entangled with it in the first place. By taking these factors together, you can develop a stronger resolve about getting a payday loan.

Furthermore, when you have reliable and credible licensed moneylending guiding you, your payday loan experience will be easy and hassle-free. To help you bridge the financial gap until the next salary, apply here for a payday loan today!