Taking out a loan in Singapore has been common in past and modern eras. Yet for someone like you who’s never done it, the idea of a loan application is scary.

As daunting as it is, your need for extra funds is a priority. Thus, getting a loan is the best approach to resolving your monetary requirements.

So, what must you do then? First, do not worry because this article will teach you the nine easy steps to apply for a loan in Singapore.

1. Establish Your Loan in Singapore Purpose

The first step you have to take when applying for a loan is to establish your loan purpose. Then select what type of loan you need.

Of course, you could want specific loan products. However, it doesn’t guarantee that the loan product you will choose will suit your monetary necessities. For one, the main loan types in Singapore are secured and unsecured debts.

Lenders that offer unsecured debts are likely to grant it to you with a much higher interest rate. It’s because financing companies recognise unsecured loans as a risky loan type as it lacks collateral.

Secured loans, on the other hand, require the borrower to present their vehicles, properties, and assets as loan security. As a result, the loan would have lower interest rates and fees.

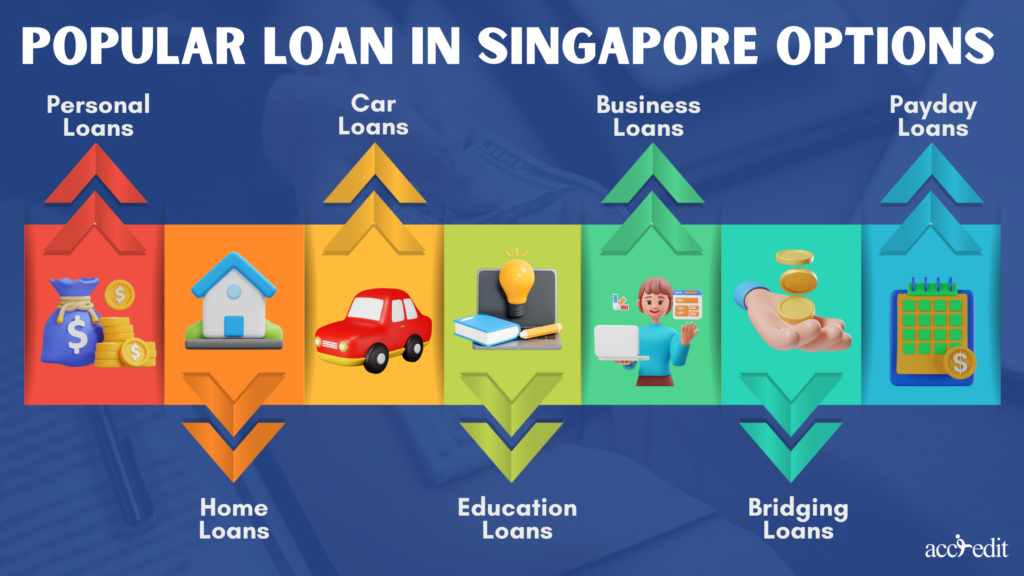

Popular Loan in Singapore Options

In addition to whether the loan is secured or unsecured, here are some of the various and popular loan choices in Singapore:

Personal Loans

Personal loans are significantly among the country’s most recognised types of loans. Many people would seek it because, regardless of the purpose, lenders usually approve the application for a personal loan.

It is, however, an unsecured loan. So, expect the interest rates to be higher from banks and financial institutions, ranging between 3.50% per annum and up. Licensed moneylenders in Singapore can impose a maximum interest rate of 4% per month, abiding by the Moneylenders Act.

Home Loans

Do you want to buy a new house or an HDB in Singapore? Maybe you’ve been yearning to start your home renovation project but lack the extra funds. Taking out a home loan can make those financial worries disappear.

It’s a secured loan; the property you own or will buy shall be the loan’s collateral. Anticipate a lower interest rate than personal loans that may start from 1.20% up to 2% per annum for fixed-rate home loans. It’s 1.35% to 2.25% for floating-rate home loans.

Home loans can cover the expenses for labour, permit fees, materials, design fees, and even much-needed contingency funds.

Car Loans

Are you feeling excited about purchasing your dream car? Or are you ready to repair, build up, and customise a used vehicle you’ve been eyeing for a time? Whatever the case is, for financial situations like this, car loans would suit your monetary requirements perfectly.

The estimated interest rates for car loans may range from 1.68% to 2.78% per annum for new cars and 1.88% up to 3.28% per annum for used cars.

Education Loans

Students in Singapore can rely on education loans. Its design explicitly fits the needs of students, particularly in terms of paying for overseas studying, tuition fees, living expenses, miscellaneous fees, and personal expenses.

It’s another loan that can either be unsecured or secured. The interest rate charged for education loans typically starts at 2.5% to 4.5% per annum from banks and financial institutions. Licensed moneylenders are legally allowed to charge higher interest range from 6% to 18% per annum.

Business Loans

It’s the type of loan for small and medium-sized enterprises in Singapore. It mainly fits small businesses or startups to fund their company’s operations or to expand it all together.

It’s utilised for various purposes such as financing inventory, purchasing equipment or machine, or staff salaries and business expenses. The interest rates for this loan vary from 3.25% to 7.5% per annum from banks and financial institutions. Licensed moneylenders in Singapore could have higher interest rates, between 6% to 18% per annum.

Bridging Loans

It’s the type of loan that can assist individuals who plan to purchase a new property while waiting for their existing properties to be sold or acquired the sales. As a result, it helps bridge the financial gap that may occur during the said transaction.

The interest rates for bridging loans have diverse structures, such as fixed or floating, which may range from 1.38% to 2% per annum for banks and financial institutions.

Payday Loans

Another short-term loan that is accessible for borrowers in Singapore is a payday loan. It’s a convenient type of loan if you need the quickest and easiest fund access.

But since it’s a short-term debt, you must repay on the next payday or the following month. The interest rates and fees associated with this loan type are much higher. Licensed moneylenders in Singapore may charge between 1% to 4% maximum per annum.

So, although it grants easy cash, it should be the last option to consider. Now that you’ve settled what’s your purpose for taking a loan and uncovering which one fits your needs, you have to check your credit score.

2. Find Out Your Credit Score’s Status

Before applying for a loan in Singapore, you must determine your credit score status. It’s an essential aspect of debt application in the country as it’s your numerical representation signifying your creditworthiness. Lenders assess and evaluate the credit score and whether the application should be approved.

You can learn more about your credit score by checking with the Credit Bureau Singapore (CBS) for your credit score report. CBS collects credit data from individuals and businesses in the country.

To obtain your credit score report, which you may use for loan appeal, is by following the steps below:

- Visit www.creditbureau.com.sg

- Search for the “Consumer Credit Report” and click and select “Credit Score Report.”

- You may then input all the necessary personal information, such as your name, NRIC number, and contact details.

- Pay the fee of SGD 6.42 with your debit or credit card

- You may receive a notification to your registered mobile number and verify your identity via a one-time password (OTP).

- You can now easily access your credit score report when you’re verified.

- Review the report meticulously from history to outstanding loans

Singapore’s credit score system ranges between 1000 to 2000. If you find any errors or discrepancies, contact CBS immediately to have it settled. Never hesitate to monitor your credit score, even whenever possible, before a debt request.

Your creditworthiness relies heavily on your credit score. Thus, the slightest error or discrepancy will pull down your eligibility. You also can’t apply for a loan if you’re not deemed eligible.

How can you prepare for your eligibility?

3. Loan in Singapore Eligibility

Lender also evaluates a borrower’s eligibility. If you do not meet any or even one of these eligibility requirements, there’s a big possibility you won’t be permitted to apply for a loan.

Thus, you must first review whether you’re equipped and eligible for debt. You may do this by reviewing the checklist below:

- You must be of legal age, at least twenty-one years old, to be allowed for a loan application.

- Borrowers must have a stable income to verify their capacity to repay the loan. The general minimum income requirement would be an annual salary of S$10,000 up to S$20,000.

- Determine whether you’re creditworthy by re-assessing your updated credit score from CBS.

- Interested debt applicants must be Singapore Citizens and Permanent Residents. But, foreign nationals residing in Singapore are legally permitted to apply for loans by presenting a verified and legit work permit or employment pass.

- Employment status is essential when seeking loan approval as it demonstrates you have a stable income to repay the debt. In many cases, lenders prefer full-time employees.

But, part-time employees and self-employment are still granted the loan. Review the designated employment history, such as being employed for at least six months or a year before the loan petition.

- The debt-to-income ratio measures your current monthly debt repayments relative to your income. Lenders mostly choose applicants who have a lower debt-to-income ratio because it indicates a much lower risk of loan default to occur.

Loan requests can be a lengthy process. But that’s alright. Focus on preparing yourself and putting together certifications and proof of your eligibility; it will speed up the procedure.

4. Loan Document Requirements

You deem yourself eligible based on your eligibility checklist. Now, it’s the ideal time to inspect if your documents are updated before the loan request proceeds.

These documents are the generally required paper works that most lenders in Singapore will ask from you. Nevertheless, here’s a list to help you assemble the crucial documents for your transaction, such as:

- Identification documents will include a passport, NRIC, and work permit for foreigners.

- Income proof such as payslips, bank statements, and CPF contribution history. Provide the latest financial statements or tax assessments for those who are self-employed.

- Employment letter confirming your employment status, position, and salary. It’s usually prepared or certified by the employer.

- Property documents are needed for property loans or collateral purposes, usually the purchase and sales agreement with the valuation report.

- A credit report comprises your credit score, history, and existing debts. Obtain it via CBS or from TransUnion or Experian.

- Other supporting documents may be necessary depending on the loan, such as car loans needing a vehicle registration invoice or card.

As these are the typical documents a borrower requires, some specifics may be lacking from the list. It would mainly be associated with supporting documents.

So, as you try to complete your documents, discuss paper works that are crucial to the process. Also, choose the best lender in Singapore.

5. Choose The Best Loan in Singapore Provider

Choosing the right lender can significantly make a massive difference in the borrowing experience. With tons of options, anyone would feel overwhelmed.

But don’t worry; here are some easy-to-follow steps to help you choose the best lender in Singapore:

- Evaluate your loan needs regarding loan amount, purpose, and term. This’ll assist you in narrowing down your choices and finding the lender that meets every aspect and specifics regarding borrowing requirements.

- Don’t be afraid to research more about the lenders, especially their specialisations and whether they align accordingly with your borrowing needs. Prioritise checking interest rates, fees, and loan terms and compare them to the rest of the best lenders that proffer competitive terms and rates.

- Check the lender’s reputation, particularly whether they have an exemplary track record and provide excellent customer service. Investigate if these lenders offer transparency on loan terms and timely disbursement. You may read online reviews or check out Singapore’s Ministry of Law for licensed moneylenders.

- Never be afraid to evaluate the lender’s terms and conditions, as it’ll provide a better vision of their services aligning precisely with your borrowing requirements. Specifically, be mindful of fees, repayment options, and tenure.

These are incredibly easy steps to choose the best lender in Singapore. Always remember to do your research, so you’ll make informed decisions fitting your financial goals.

6. Determine the Loan Amount and Repayment Method

As you go with your research, settle the loan amount you need and uncover the repayment method that could fit your monetary status.

You can uncover this essential information by:

- Assessing your monetary needs by reviewing how much you need, what’s your current financial situation, and how much you can afford to repay monthly. Consider your income, expenses, and debts for a sensible budget plan.

- Various lenders offer diverse repayment methods, and this information is accessible via loan terms and conditions. The typical repayment methods for loan application in Singapore are:

- Monthly instalments

- Flexible payments

- Lump-sum repayment

- Be mindful of the interest rate because it may change due to credit score, loan amount, and the repayment period. Thus, if you’re unsatisfied with the overall loan equation, seek a different lender with the best deals.

- Calculate the total cost, including principal amount, fees, interest rates, and charges. To fulfil this, you can use a loan calculator online for a better estimate regarding total loan cost.

Remember that no matter how tempting it is, only borrow what you need and can repay. Be sure to select the flexible repayment method that will allow you to adjust repayment schedules if financial difficulties happen.

7. Fill out the Loan in Singapore Application

You’re about to finish the application process, but first, you must fill out the loan claim. Here, you must be accurate and honest with the details you’ll disclose.

The lender will offer you the form; you must provide your personal details and identification documents. Financial information such as income, expenses, and debt obligations are also relevant.

Don’t forget to present your supporting documents and essential paperwork to encourage a smooth loan request process. When you’re done filling out the application form, present it to your lender or send it if you’re applying online.

8. Assess and Sign Loan in Singapore Agreement

Once your chosen lender has successfully reviewed the application and documents, they’ll assess your creditworthiness. Soon, they’ll decide whether to approve your loan request.

If you get the approval, they’ll present you with the loan agreement, which outlines the terms and conditions regarding the debt. Take your time reading through the agreement; if you need any clarification, ask immediately.

When you’re satisfied with the interest rate, repayment method and schedule, sign it and return it to the lender.

9. Audit Loan Disbursement

Loan disbursements vary from diverse loan options and lenders. But you can anticipate the same day to a few weeks disbursement schedule.

Once you receive notification that the loan amount has been disbursed to your bank account, ensure it’s accurate. Verify the amount disbursed if it’s the same amount that was agreed upon stipulated in the loan agreement.

Audit it by rechecking if there are no extra fees or charges not disclosed within the agreement. Also, confirm the repayment method and schedule so you won’t miss any payments.

Loan in Singapore Can be Complex But Not Impossible

Applying for a loan in Singapore can be overwhelming and complex. As a result, only those who genuinely require the funding would go through the process.

Nonetheless, following these nine easy steps will make the experience much easier and faster, and the loan application is far less stressful.

Always remember the key steps, such as researching, choosing the best lender, and carefully reviewing the loan agreement before penning your name.

As you follow these steps and become more involved and diligent with handling your finances, the financial assistance you require is attainable.

Are you ready to apply for a loan in Singapore? Click here now!