Getting a loan is already challenging, and seeking a loan for unemployed Singapore. But, even if you’re currently unemployed, it doesn’t necessarily imply you won’t be eligible to apply and acquire a loan.

Obtaining a loan can ease your financial worries and help you cover expenses during this particularly challenging time. Thus, it’s fortunate to learn that debt options are available for needy individuals.

In this article, you’ll discover the diverse types of loans an unemployed individual may apply for, eligibility requirements, alternatives for unemployed borrowers, steps to amplify debt approval chances and excellent tips for borrowing responsibly.

Understanding Loans in Singapore

Before exploring loan options available for unemployed borrowers, a basic understanding of Singapore’s loans is crucial. These debts come in different forms, such as personal loans, payday loans, education loans, secured loans, and choices. Each one has its specific eligibility requirement, risks and benefits.

Generally, a loan’s eligibility requirement mainly involves credit score, income, age, and employment status. Lenders utilise these crucial factors when assessing a borrower’s capacity to reimburse the loan.

Aside from complying with the eligibility requirements, out-of-work individuals should understand the risks and benefits of borrowing money before getting a loan.

These are the interest rates, reimbursement terms, and penalties. Such loan specifics are crucial when evaluating debt options, especially when you’re out of a job.

As you’ve acquired the basics of loans in Singapore, now it’s time to explore the different debt types for the unemployed in the country.

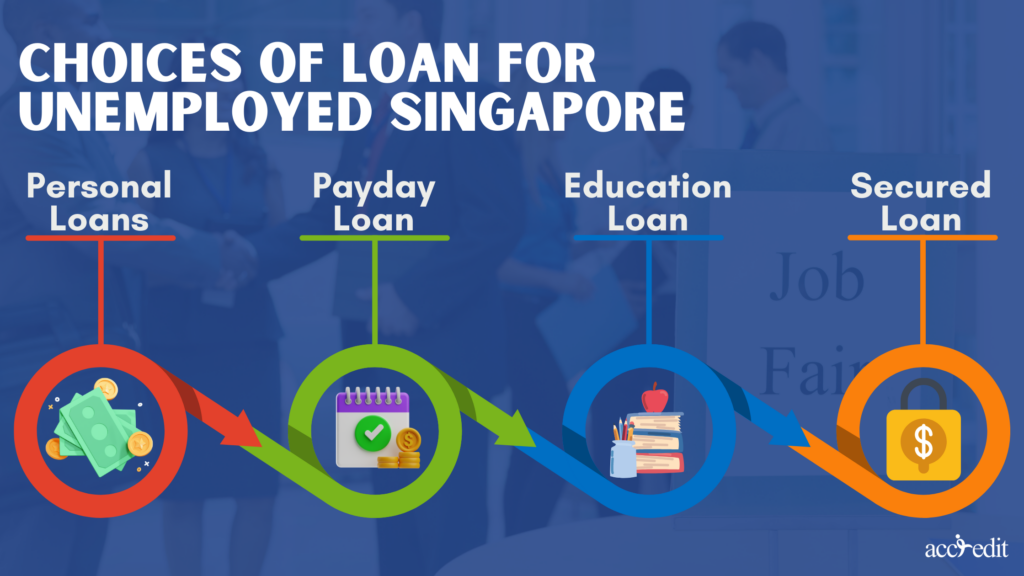

Choices of Loan for Unemployed Singapore

Losing your job can be a big blow to handle. Initially, anyone would feel helpless, especially concerning monthly bills, rent, and expenses. Although it seems like an impossible financial situation to be in, unemployed individuals in Singapore have a diverse set of loan options to choose from.

There are types of debts people in need may apply for:

1. Personal Loan for Unemployed Singapore

Personal loans can provide additional cash for those who require financial resources to make ends meet. It’s true that most lenders in Singapore require their borrowers to be employed and show proof of stable income for loan requests to be approved.

Nonetheless, options are still open for those without a job and require a personal loan.

Here are essential factors to contemplate when requesting a personal loan, even when you are unemployed:

Credit Score

Credit scores are among Singapore’s most crucial factors in obtaining personal loan approval. In truth, even if you’re currently out of work, a good credit score and history will boost the possibility of getting approved.

Singapore has the lowest 1,000 to highest 2,000 scoring system. The highest scores mean a lower risk of loan defaults.

Connect to the Credit Bureau Singapore’s (CBS) site or via your bank to check and acquire a copy of your credit score and overall report. If you plan to request a personal loan from a licensed moneylender, get your credit score and information from the Moneylenders Credit Bureau (MLCB).

Collateral

Personal loans can also be secured debts which require collateral, such as properties or cars. Even if you’re unemployed, presenting these valuable possessions will increase your chances of loan approval.

However, be mindful when utilising collateral to secure the loan, as you can lose your assets if you fail to repay the debt.

Guarantor

Guarantors are people who agree to assume responsibility for the loan and repay it if you cannot do so.

Choosing a guarantor with a good to excellent credit score will not only improve your loan opportunities. They’ll also assist you in repaying it when necessary.

Also, before requesting a personal loan, there are additional factors associated with it that you must think about first.

These interest rates generally range from 3% to 10% and higher rates for unsecured debts. Reimbursement terms mainly vary between one year to five years. Expect late payment penalties between 1% to 5% acquired from the outstanding balance and 1% up to 3% prepayment penalties of the original loan amount if imposed by the lender.

These liabilities are incorporated within the loan terms and conditions. Be sure to read, review, and re-evaluate the fine print before you sign the agreement.

2. Payday Loan for Unemployed Singapore

Short-term debts like payday loans are due upon the next payday. It delivers quick cash disbursement, which is ideal for financial assistance. But these are linked with higher interest rates and fees.

The loan amount accessible from payday loans varies between $100 to $1,500. These amounts are a massive help to relieve monetary issues.

The lack of a regular income source is the primary challenge in getting approved for a payday loan. Yet, some specific factors would help improve approval chances for the loan, such as:

Valid Identification

NRIC or passport as proof of valid identification will boost your chances for payday loan approval. Also, it’s the standard requirement to fulfil regardless of current employment status.

Active Bank Account

Active bank accounts are necessary for receiving loan disbursements and accomplishing repayments. This ensures lenders may easily withdraw loan amounts and apply fees or interest during due dates.

Regular Income Source

Unemployment may strip individuals from their monthly salary. But some lenders do consider other income sources as possible loan eligibility. These can be rental income or government benefits.

Good Credit Score

Credit scores enhance approval chances and potentially lower interest rates and fees. It can also indicate you’re a responsible borrower and pay dues on time.

Loan Amount

Smaller loan amounts are mostly approved because it’s easier to repay, even if the timeframe is shorter. It also helps prevent the accumulation of extra interest and fees.

In Singapore, payday loans’ interest rate would range from 1% to 4% monthly. Yet, some lenders may impose higher rates and charges. Thus, carefully review the loan agreement and contact the Registry or Singapore Police Force to file a complaint or report.

Repayment terms are relatively short, and lenders require repaying the loan within 30 days. Late payment fees would range daily from 10% of the outstanding balance for penalties.

3. Education Loan for Unemployed Singapore

Pursuing higher education isn’t only challenging due to the standards you need to meet; it can also be a financial burden. However, education loans will significantly lessen the monetary issues of tuition fees, living costs and accommodations, and other academic-related expenses.

It’s a loan worth considering if you’re a student without an extra income source or a part-time job.

To improve your chances of obtaining an education loan for unemployed Singapore, you should take these factors into account:

Credit Score

All businesses aligned to financing will assess and evaluate a borrower’s creditworthiness. This also means whether they’re employed or not.

Individuals without a job but a good credit score and background will likely be considered for loan approval. Check your credit score at the Credit Bureau of Singapore’s official website to ensure you qualify for an education loan.

Co-Signer

A guarantor or co-signer with a good credit score may increase the chances of getting an education loan approved as they’ll assume their obligations and repay the loan if the borrowers fail to reimburse it.

Collateral

Presenting collateral such as investments, properties, cars, or other assets can enhance education loan approval probabilities. The collateral will secure the loan, and lenders may seize it upon the borrower’s failure to repay it.

Repayment Plan

Showing the lender a solid and feasible repayment plan will indicate your responsible mindset and commitment regarding repaying the loan. It must include a detailed budget and financial plan to accomplish the loan repaid in full.

Singapore’s education loans’ general interest rates to consider are between 4% to 6% per annum. Repayment terms will vary between repayment fulfilled while still studying or offering a grace period several months after graduation. Discuss it further with your chosen lender to create a concrete repayment plan.

Regarding late payment fees for education loans, it ranges between 1% up to 5% of the outstanding balance. Some lenders do charge a flat fee for such penalties.

4. Secured Loan for Unemployed Singapore

Secured loans in Singapore typically require borrowers to pledge their properties, cars, investments or assets to secure the loan. It’s among the highly recognised types of loans for unemployed Singapore.

Here are notable factors that could increase approval probabilities regarding secured loans applications:

Collateral

The best way to secure a loan for this type of debt is to provide collateral. The rarer, more authentic, luxury branded, or more valuable the assets are, the higher chances of loan approval ensues.

The lenders will first appraise the collateral you’ve offered them before they’ll set the specifics on interest rates, repayments, and terms and conditions to guarantee loan security.

Anticipate lenders to seize your collateral if you do fail to repay the loan in full.

Creditworthiness

Indeed, unemployment can negatively impact your credit score. However, a good credit score will still improve the chances of loan approval, especially when the score is near 2000.

If you aren’t confident with your creditworthiness, consider seeking a co-signer with a good credit score to their name.

Income Sources

Being out of the job lessens the possibility of being granted the secured loan request. Nonetheless, if you have additional income sources, such as rental income, investments, or businesses, these factors can help you attain approval for the debt.

Singapore’s secured loans have approximate interest rates of 2.88% up to 5.5% per year. However, some banks and financial institutions may grant promotional rates for a limited timeframe and would be as low as 1.5% a year.

Reimbursement terms may range between one year to fifteen years. Penalties would accumulate due to late payment fees of around 1% up to 2% associated with the overdue amount. Prepayment fees are not always charged but are likely a percentage or fixed price.

Defaulting a secured loan will land you a default fee as well.

What if you are still looking for a loan for unemployed Singapore?

Do you have alternative options to apply for?

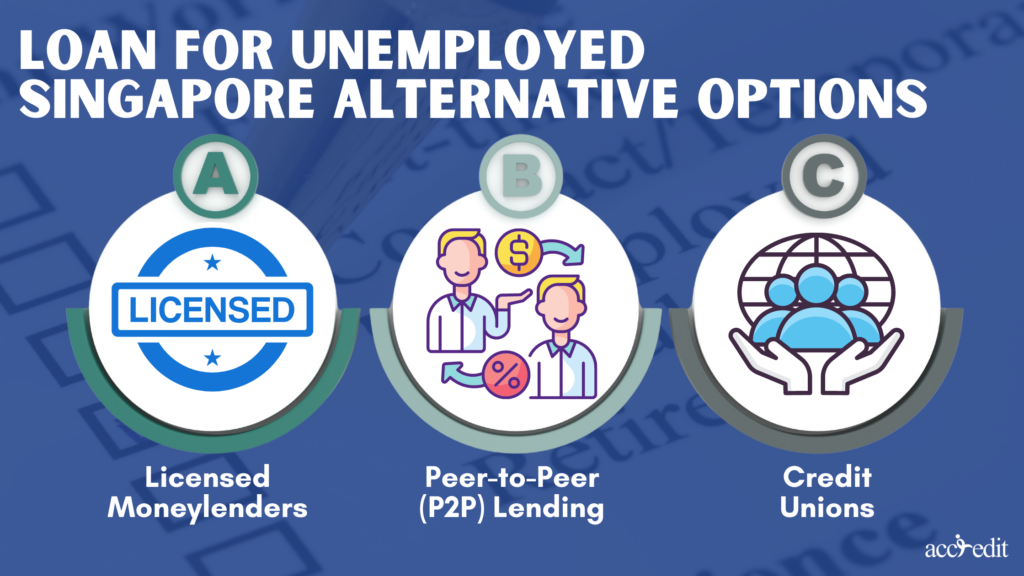

Loan for Unemployed Singapore Alternative Options

As someone currently struggling with their finances, it doesn’t hurt to broaden your knowledge and choices when seeking loan choices.

Singapore is known for its stable financing industry. Thus, you can find alternative, legitimate debt options that help lessen your monetary burdens until you find a new job.

Here are the alternative options to consider in getting the financing assistance you need:

1. Licensed Moneylenders in Singapore

Traditional banks are the standard options for taking a loan. But, due to the stringent policies and regulations imposed by the Monetary Authority of Singapore, it’s challenging to acquire a loan for unemployed Singapore.

But, you can still obtain the money you need by seeking reliable and credible licensed moneylenders in Singapore, like Accredit. Licensed moneylenders lend cash to their borrowers, particularly personal loans, so long as they meet their criteria and requirements.

To successfully improve your loan application approval from a licensed moneylender, you must follow these steps:

Prepare Credit Report

Credit scores are an essential factor when taking out a loan in Singapore. Even if the borrower’s not employed for some time but with a good credit score, they’ll be eligible for loan approval. Thus, borrowers must prepare their credit report by requesting it from the Moneylenders Credit Bureau.

Disclose Loan Intention

Licensed moneylenders comply with the regulations of the Ministry of Law, and these businesses are committed to the laws at all costs. To assess a borrower’s credibility, they must always honestly disclose the intention behind the loan.

In this manner, the licensed moneylender can evaluate the reason behind loan urgency and requirements.

Singapore’s licensed moneylenders are known for offering personal loans. Discuss your eligibility with your chosen legal lender to process your loan in your times of financial need.

2. Peer-to-Peer (P2P) Lending

P2P lending is a well-recognised loan where people may borrow directly from investors. It’s mostly an online platform which connects borrowers with lenders, apparently cutting the traditional financial institutions in Singapore like banks.

It’s becoming increasingly popular in the country as a loan unemployed individuals could apply for due to lower interest rates. To obtain P2P, boost your approval chances by:

Ensuring Good Creditworthiness

A borrower with good creditworthiness is the primary priority of the P2P lending platforms. The credit score indicates that lenders may rely on the borrower’s responsible commitment to repay dues without delay.

Loan for Unemployed Singapore

P2P lending platforms prefer borrowers who honestly disclose their reasons for pursuing the loan.

Losing your job is, without a doubt, a massive struggle. Be transparent and explain your current financial situation. Also, don’t hesitate to include your specific repayment plans.

Interest rates tied up with a P2P lending platform may start from 6% up to 18%. They offer flexible repayment terms between six to sixty months. Expect penalties for late payments starting at 1% up to 10% of the outstanding balance.

3. Credit Unions

Its members own, manage, and administer Singapore’s non-profit financial cooperatives. It’s an ideal alternative to traditional banks. It also offers lower interest loan rates and higher interest charges on savings.

For an unemployed individual in Singapore, credit unions are viable options for financing. They also are considerably lenient regarding requirements compared to banks and other financial institutions.

To boost your loan approval chances from a credit union, it’s essential to:

Become a Member

These financing institutions require a membership that typically includes specific affiliations, such as location, profession, or association.

Financial Health

People with good financial health are the priority members of credit unions. You must show proof of a good credit score and a stable income source.

Loan Purpose

Declare and accurately disclose your specific loan purpose. Credit unions are particularly keen on this requirement, which could involve education loans, housing, and other loan types.

Interest rates associated with credit unions are lower and may range between 3% to 8%. Reimbursement terms are flexible and would range from twelve to eighty-four months. Credit Unions also impose penalties for late payments from 1% to 5% of the outstanding balance.

Choose the Best Loan Option and Borrow Responsibly

Borrowing money when you are currently out of work can be risky, nevertheless, when it’s essential. Borrowing responsibly is another crucial factor, as it’ll prevent you from falling into a debt trap.

Even if you’re out of work, you may face obstacles to getting a loan, but it’s not impossible. Consider every option accessible to you and choose the best loan for unemployed Singapore to attain your goals and satisfy your needs.

Read the terms and conditions cautiously and carefully to avoid confusion. Be realistic regarding your loan repayment capacities, and create a feasible plan to manage your finances accordingly.

Keep in mind that borrowing money should be the last resort. It’s still imperative to focus on other avenues for monetary support, such as seeking new employment, cutting unnecessary expenses, or accessing government assistance programs.

By fulfilling the factors that can help navigate the borrowing process as an unemployed person seeking financial assistance in Singapore, finally work towards attaining financial stability.