Moneylending in Singapore, is it legal or illegal? Many people understand that borrowing money from people or institutions isn’t new. Financial services were accessible during ancient times, especially these days.

Lending money and its process is straightforward. When someone borrows money, they have to repay it. However, the sum of the money for repayment should be more than what was initially borrowed. Here’s where the interest comes in, with different fees, chargers, etc.

Lucrative Moneylending in Singapore

As a result, borrowing and lending money has formally become a business worldwide. These industries promise significant and favourable profits.

It’s because moneylenders can earn well from their capital. The business venture might be riskier compared to banks and other financial institutions.

Yet, licensed lending companies have the lawful right to impose higher monthly interest on their borrowers. The higher the risk, the higher the interest rates, and the better the profits. Still, knowing the legal laws tied up with moneylending is essential.

Is Moneylending Singapore Legal or Illegal?

The Ministry of Law ensures that moneylending in Singapore is legal. Businesses that operate such financial services have permission to do so.

However, some still need to submit to the regulations, particularly about getting a license to lend money legally in Singapore.

The Ministry of Law states that lending money could be illegal when individuals or businesses lack licensing and legitimate documents for operations. So, it’s clear that not everyone or any company can lend money to someone else in Singapore.

Today, you’ll acquire relevant details on becoming licensed moneylenders in Singapore. Find out the truth when moneylending becomes illegal and the laws that state it. More importantly, uncover the traits to recognise illegal moneylending in Singapore.

Legal Moneylending in Singapore

Indeed, the culture of offering funds for those who genuinely need it continues today. Such is the motivation of the thriving moneylending industry in Singapore.

The Singaporean Parliament created legislation explicitly focusing on the Moneylenders Act with a clear purpose of granting protection and justifiable amendments from which the communities in Singapore and moneylenders may benefit.

The Moneylenders Act was initially enacted in 1936 as the “Moneylenders Ordinance.” It was shaped by the English Moneylenders Acts of 1900 and 1927.

As years pass, the Ministry of Law Singapore pursues better and more modernised legislation that best fits the country and its people. As such, the Moneylenders Act 2008 made a point to implement its recent amendments in 2018,

From the Moneylenders Act 2008, it is stated that individuals who are either exempt, excluded, or licensed moneylenders are illegal to lend money in Singapore. In strict accordance with the law, all licensed or legal moneylenders must follow the Moneylenders Act and submit their details to the Registry of Moneylenders in the country.

Legal Moneylenders in Singapore

An individual or group may express their interest in operating as a licensed moneylender company and be legal to lend money in Singapore. There are steps to fulfil to be granted their business permit and legitimately establish their companies, such as:

- They need to reach out and apply to the Registry of Moneylenders in Singapore.

- Complete the requirements of undergoing and passing the Moneylender’s Test. It crucially gets hold of the Moneylender’s Test Booking System to acquire a slot for the test. The test entails a non-refundable fee of S$130, with GST as an inclusive, and is due per attempt.

- Upon passing the Moneylender’s Test, the person is yet to be considered a Test-Qualified Manager.

- To become a Test-Qualified Manager, individuals have to satisfy particular criteria;

- Passing the Moneylender’s Test

- Having a proper, fit, and good character

- Having earned a minimum of four GCE ‘O’ Levels passes which includes the English Language, or equivalent

- Applying to the Ministry of Law via GoBusiness to attain a Test-Qualified Manager appointment.

Other people permissible by the Moneylenders Act to legally lend money in Singapore are:

- Excluded moneylenders certified by the law under the Co-operative Societies Act, Pawnbrokers Act, etc.

- Exempt moneylenders who are permitted an indemnity from holding a license.

However, the Registry of Moneylenders has temporarily put a hold on the licensing for moneylending businesses in Singapore.

Types of Loans Available from Legal Moneylending in Singapore

Upon receiving their current licenses or license renewal, legal moneylending in Singapore may proceed to grant various loan products to its borrowers.

Here are the types of loans available from moneylenders in Singapore:

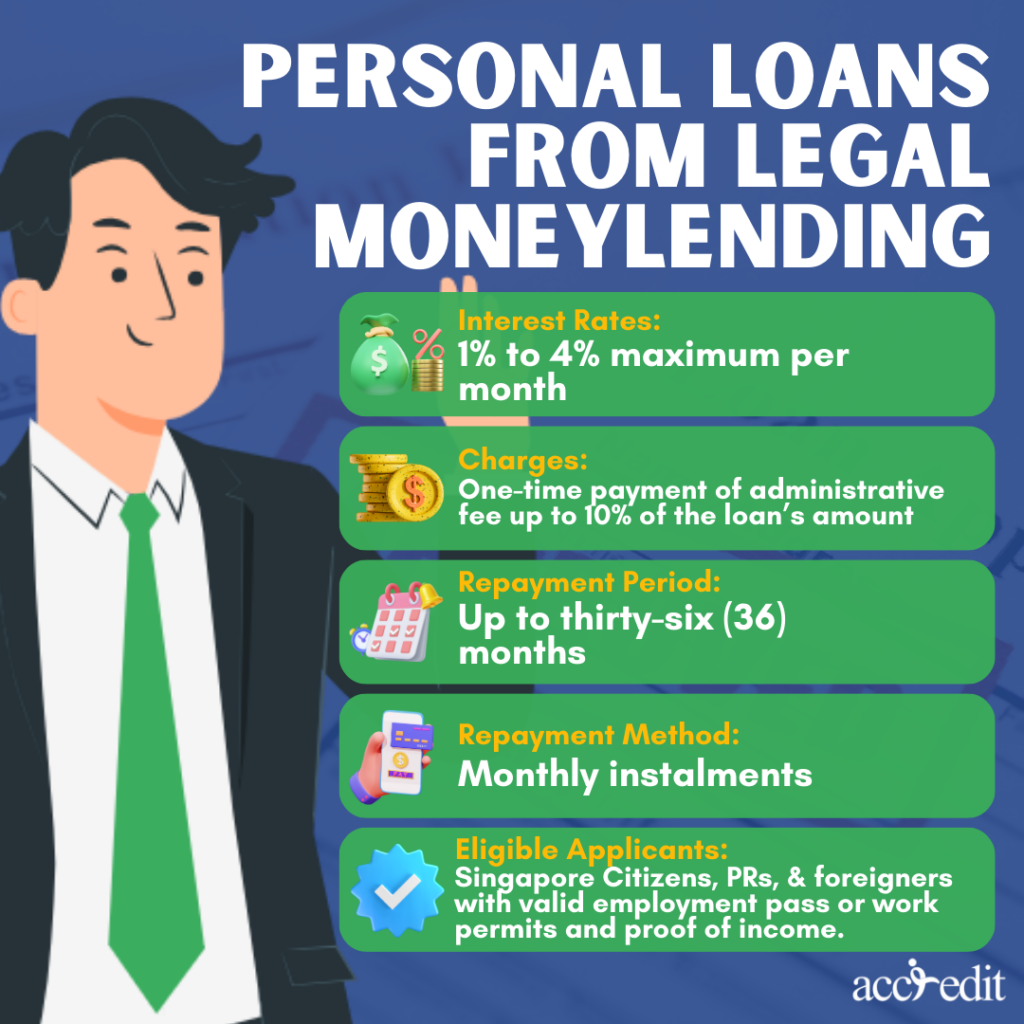

Personal Loans

Legal moneylenders provide the country’s most common and popular type of loan. These loans are primarily unsecured, thus, requiring no collateral for debt security. A personal loan is a valuable financial product as applicants may apply for various purposes, whether for personal use, covering unexpected expenses, or assisting business growth.

- Interest rates: 1% to 4% maximum per month

- Charges: One-time payment of administrative fee up to 10% of the loan’s amount

- Repayment period: Up to thirty-six (36) months

- Repayment method: Monthly instalments

- Eligible applicants: Singapore Citizens, permanent residents, and foreigners with valid employment pass or work permits and proof of income.

Business Loans

Singapore’s licensed moneylenders provide business loans to small and medium business owners and entrepreneurs. It’s the type of loan SMEs may utilise to assist funding for startup costs, inventory purchases, expansion, and other business-related expenses.

- Interest rates: Up to 4% monthly

- Charges: Administrative fee of up to 10% of the loan’s amount and one-time payment only.

- Repayment period: Up to 36 months

- Repayment method: Monthly instalments

- Eligible applicants: Registered businesses in Singapore with valid business registration and proof of income.

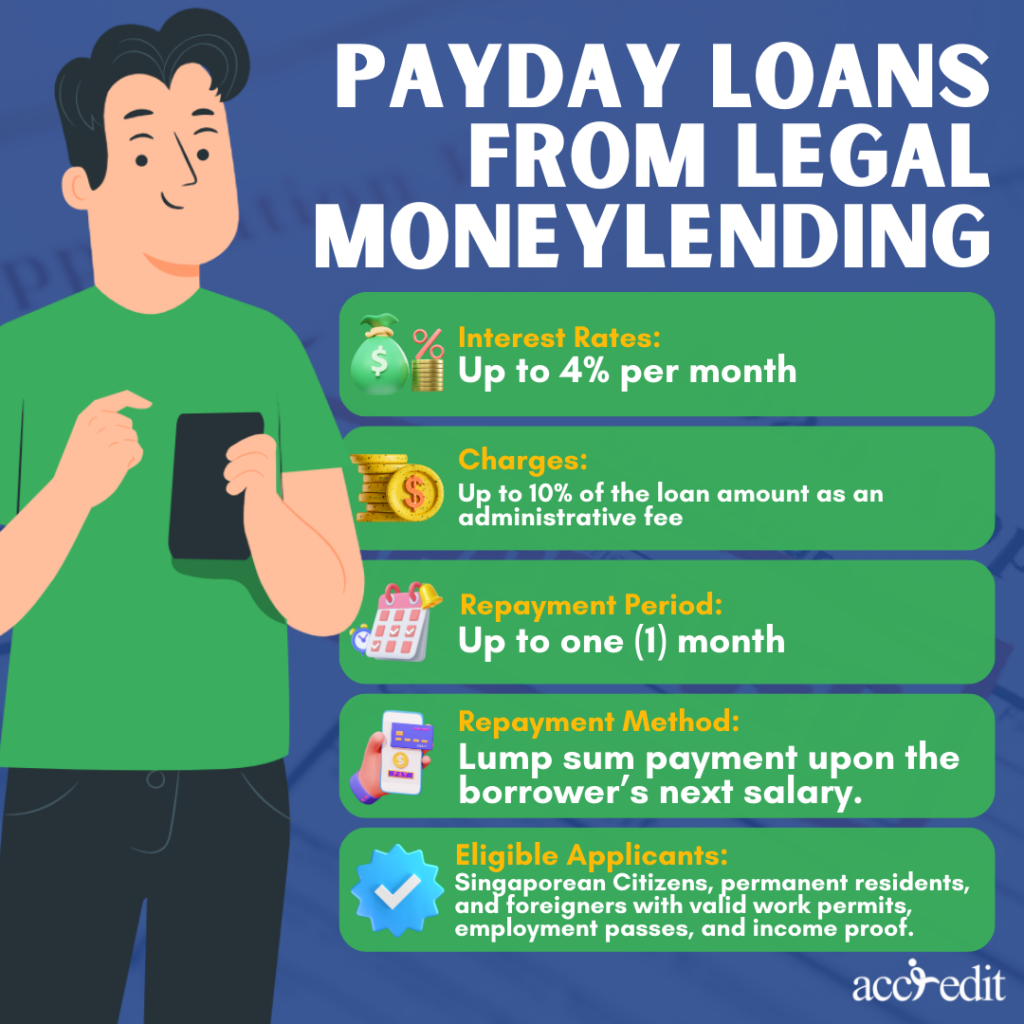

Payday Loans

These are short-term loans legal moneylenders grant to assist borrowers cover monetary needs. The loan tenure is more often on the borrower’s next payday.

- Interest rates: Up to 4% per month

- Charges: Up to 10% of the loan amount as an administrative fee

- Repayment period: Up to one (1) month

- Repayment method: Lump sum payment upon the borrower’s next salary.

- Eligible applicants: Singaporean Citizens, permanent residents, and foreigners with valid work permits, employment passes, and income proof.

Bridging Loans

Another type of short-term loan licensed moneylenders provides are bridging loans. It’s particularly useful for property owners as they can obtain the funds to help them bridge the financial gap while buying and selling properties.

- Interest rates: 1% to 4% monthly

- Charges: Administrative fee of up to 10% of the loan amount

- Repayment period: Up to twelve (12) months

- Repayment method: It should be in a lump sum upon the sale of the current property

- Eligible applicants: Homeowners with valid sales agreements for the current property and income proof.

Foreigner Loans

Foreigners living and working in Singapore may apply for foreigner loans. These loan products require additional documentation to prove the borrower’s current income, including residency status.

- Interest rates: 1% up to 4% per month

- Charges: Administrative fee may be up to 10% of the loan amount

- Repayment period: Up to 12 months

- Repayment method: Monthly instalments

- Eligible applicants: Foreigners with valid employment passes, work permits, and income proof.

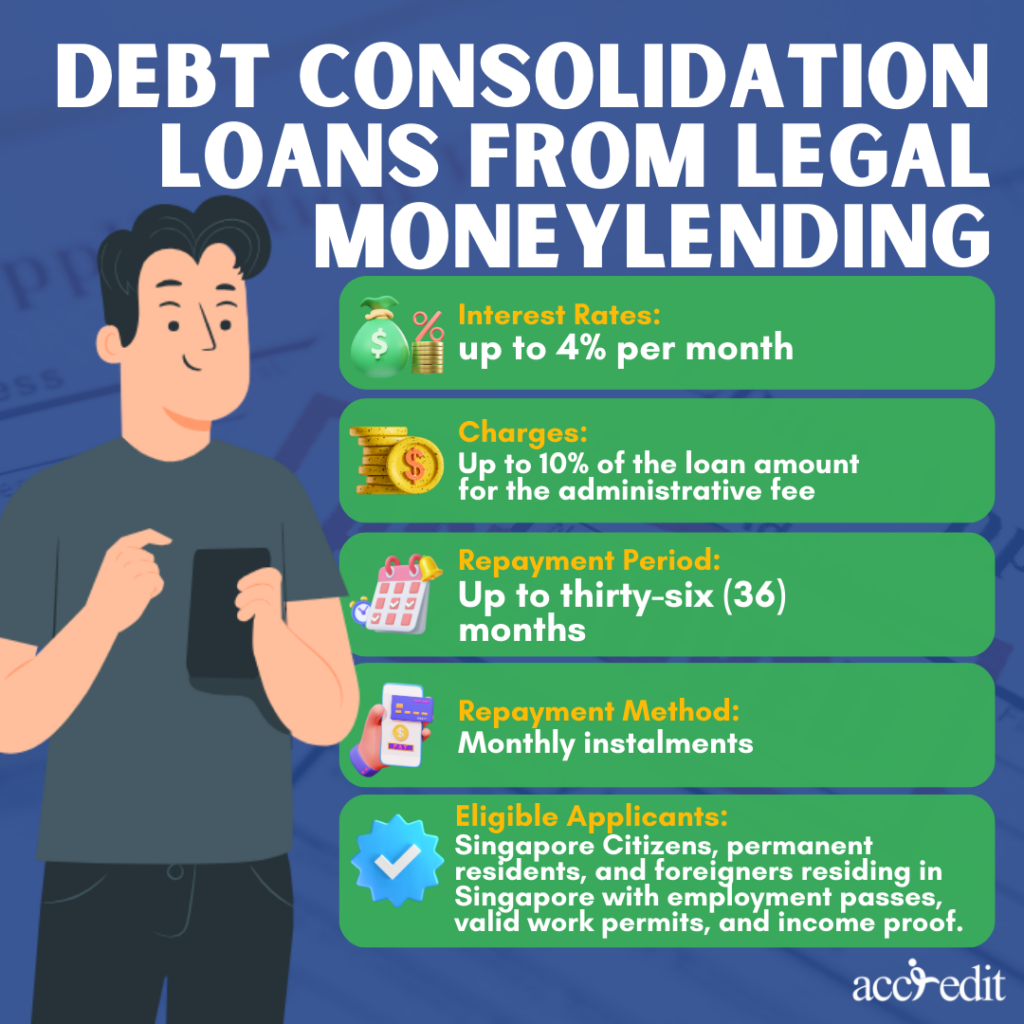

Debt Consolidation Loans

Legal moneylenders provide these financial products to assist borrowers in successfully consolidating multiple debts, converting them into one loan. As a result, lower interest rates may apply versus multiple interest rates to pay within a month.

- Interest rates: up to 4% per month

- Charges: Up to 10% of the loan amount for the administrative fee

- Repayment period: Up to thirty-six (36) months

- Repayment method: Monthly instalments

- Eligible applicants: Singapore Citizens, permanent residents, and foreigners residing in Singapore with employment passes, valid work permits, and income proof.

Borrowers must review loan terms and conditions carefully before accepting a loan offer. It’s to ensure the borrowers clearly understand repayment schedules and possible fees associated with the loan.

Illegal Moneylending in Singapore

Moneylending in Singapore becomes illegal when the Moneylenders Act is breached. The law designates clearly that no individual is allowed to perform a business of moneylending practices in Singapore, particularly without a moneylender’s license.

The only people permitted by the Moneylenders Act to maintain their practices are when they fall under the “excluded moneylender” or “exempt moneylender” specifications.

Traits of Illegal Moneylending in Singapore

Illegal or unlicensed moneylenders in Singapore are also known as Ah Longs. These Ah Longs operate like scandalous loan sharks who have no trouble pestering and harassing their targets.

As a result, the Singaporean government and authorities, along with the general approach of the Ministry of Law, the characteristics of an unlicensed moneylender are disseminated everywhere.

How can people recognise these traits? It’s easy to differentiate the characteristics of legal moneylenders from those who illegally lend money in Singapore as;

- Individuals who do illegal moneylending activities mostly initiate contact with their targets. They’d often do it via social media or WhatsApp.

- They promote their advertisement online to attract victims. Be aware that licensed moneylenders are not prohibited by the Ministry of Law and the Moneylenders Act to endorse their services to any prospect via text messages or online ads.

- To obtain the trust of their victims, they’d act like licensed moneylenders. When they fooled their target, they began digging into the personal and work details. Next is the victim willingly surrendering their documents, information, photos of their IDs, and more due to desperation to be granted the loan.

- They’ll give excuses to get upfront payments from their targets to process or activate the loan.

- They’d advertise an incredibly low-interest rate but will immediately shoot up when they start the transaction with their victim. The interest rates would often reach up to 10% to 20%, which causes a big blow to the borrower.

- These are the type of people who constantly harass, threaten, and abuse their targets, whether online or physically. They’d even go to the lengths of ruining, vandalising, or burning properties to demand payment from the victims.

Reasons Behind Victims Falling into Illegal Lending Activities

To understand the effects and modus operandi of these Ah Longs, market researchers in Singapore provided a quick but elaborate notion of why people still fall prey to loan sharks.

As everyone acknowledges, Singapore is strict with its laws. The legislation applies to the intended qualifications of anyone wishing to borrow money from banks, financial institutions, and licensed moneylenders in Singapore.

Sometimes, an individual must catch up to the standard because of bad credit scores, history, and other issues. When they fail to do so, victims become desperate to resolve their monetary troubles.

Loan sharks comprehend the dire need for funds and set out to filter their targets with ease. Their target market mainly consists of individuals belonging to workers with a meager income, foreign domestic workers, or gamblers. Financial despair can push people to accept the loan shark’s proposals even though lending money in Singapore is illegal.

Reporting Illegal Moneylenders

The communities in Singapore must recognise the grave threat of these illegal moneylenders in the country. These individuals encourage an unbalanced outcome to Singapore’s economy and severely damage their victims’ moral and honest livelihood.

Reporting events related to illegal moneylenders or their activities will force a better approach to halting their presence in the country. Moreover, it provides the authorities with further information on catching and legally punishing them according to the law.

As such, the Registry opens its lines for people who want to report illegal lending activities at 1800-2255-529 or a hotline for X-Ah Long at 1800-924-5664. People may also dial 999 to reach the Singapore Police Force.

Get the Best Loan Experience with Legal Moneylending Singapore

As per the Ministry of Law, moneylending in Singapore is legal and grants various loan products. However, illegal moneylending does exist. Borrowers should be extra cautious when seeking to resolve financial issues.

Applicants sometimes feel discouraged due to loan criteria and qualifications. Solving financial problems by illegal moneylenders may become tempting, but any involvement with them can result in further financially-tied problems.

Avoid illegal lending entanglement by recognising their traits. Understand the reasons for falling into their traps, and prevent it from occurring. Report any illegal lending activities to ensure additional safety for you and the community.

Remember, applicants can attain loan approval from legal moneylending in Singapore by discussing their options with a loan that fits their needs and financial status.