It’s natural to find yourself in situations wherein you’re in dire need of extra funds. These circumstances mostly happen unexpectedly; thus, you have to gain access to instalment loans in Singapore.

These loans are currently a popular option for people living and working in the country, mainly because of their convenience in financing the borrower’s personal and business expenditures.

You may apply for it from banks, financial institutions, and licensed moneylenders in Singapore. If you want to learn more about these seven easy instalment loans, let this article guide you. You’ll understand these straightforward instalment debts, how they work, and factors to consider when applying for one.

What are Easy Instalment Loans in Singapore?

These types of debts permit borrowers to obtain specific loan amounts. Also, debtors have to repay it monthly at a fixed rate. As a result, the selected repayment method over a certain period promotes the easy instalment platform borrowers can take advantage of.

The designated repayment period from these loans may range between twelve to sixty months. Also, the seven deferred payment loans accessible for borrowers in Singapore are typically unsecured. Thus, you don’t have to pledge any collateral to qualify for the loan.

How Do Instalment Loans Work?

These manageable instalment debts in Singapore work well by permitting borrowers to acquire a lump sum of funds from the lender. Borrowers must repay it within a specific and fixed period in regular payments, thus, considered as instalments.

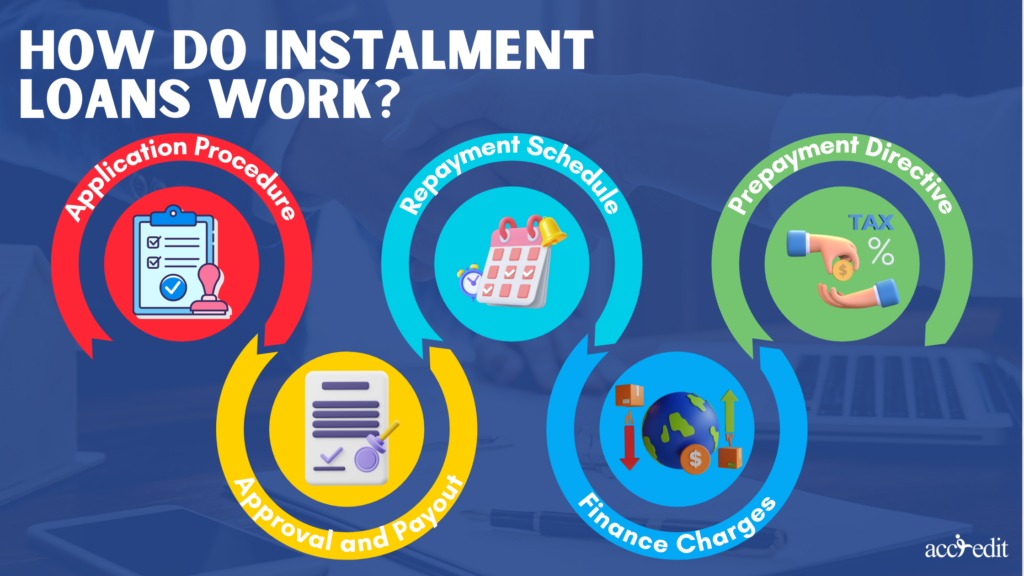

Here are some quick and easy facts on how instalment loans work:

- Application Procedure:

Like other traditional loans, you must fill out a particular application form for each financial product that fits your needs. You may do this in person by visiting the lender’s office or online through the lender’s official website.

Borrowers must comply with their legal obligation to fill out the form for their personal and monetary information. This includes your name, contact details, employment status, and income.

- Approval and Payout:

Once borrowers pass the application form, lenders will then assess and decide whether to endorse for approval or reject the request altogether.

Loan disbursement follows if the request is approved. The funds shall be disbursed to the borrower’s bank account on the same day or within a few business days.

- Repayment Schedule:

Borrowers have to fulfil and repay the lent loan amount within the designated fixed monthly instalments. The typical repayment schedule period is organised from six months to five years.

Calculations of the loan amount, interest rate, and borrower’s creditworthiness are considered to uncover the repayment period and overall amount.

- Finance Charges:

The borrower acquires debt with finance charges, particularly interest rates and fees. These are appended to the total repayment amount.

Extra fees, such as processing, late repayment, or prepayment fees, could apply.

- Prepayment Directive:

Lenders may allow borrowers to pursue early loan repayment without dealing with penalties. Others would charge for the prepayment.

To verify whether it’s an accessible option from your loan, read the fine print regarding the loan terms and conditions.

Which are the seven instalment credit borrowers in Singapore you may apply for?

The 7 Easy Instalment Loans in Singapore

In Singapore, these instalment credits are popular for both individuals and businesses. It’s due to the convenience and flexibility in terms of accessing funds for a wide variety of purposes.

Explore the seven types of the most straightforward instalment financing choices available in the country:

1. Personal Loans

It’s a popular financing choice for borrowers in Singapore and is recognised as an unsecured loan which borrowers can repay during a fixed period with specific fixed payments or instalments.

More details on this loan choice are as follows:

- Eligibility:

- Applicants must be Singaporean Citizens, Permanent Residents, or foreign work pass holders to apply for a personal loan.

- Must be between the ages of twenty-one to sixty-five years old

- Applicants must show proof of earning a minimum yearly salary ranging from S$20,000 to S$30,000

- Borrowers must have a good credit score

- Loan Tenure:

- It may range from one to five years.

- Repayment Options and Methods:

- Fixed monthly repayment, which includes principal and interest rates

- Automatic repayments are available through GIRO.

- Online banking and cheque

- Estimated Interest Rates and EIR Per Annum:

- Interest rates may range between 3.5% to 7% per annum, while it’s a maximum of 4% per month from licensed moneylenders

- EIR per annum may start from 6.5% up to 14%

- Target Market:

- It fits the needs of individuals, particularly requiring funds for personal expenses, home renovations, debt consolidation, etc.

- People who have a steady income and meet the repayment requirements

- People who feel most comfortable with fixed repayment schedules with lower interest rates in comparison to credit cards

2. Education Loans

With rising tuition fees and other education-related expenses, students must seek solutions regarding their educational financing needs. And an education loan can provide monetary relief against accumulating expenditures to ease financial worries.

Here is detailed information on these specific financing options:

- Eligibility:

- Applicants must be Singaporean Citizens or permanent residents between the ages of twenty-one years and up.

- Foreigners may apply for this loan choice by presenting their validated Student Pass.

- Loan Tenure:

- The tenure ranges between twelve months to ten years, which depends on the lender and overall loan amount.

- Repayment Options and Methods:

- Monthly instalments

- Lenders may grant flexible repayment options, which allow borrowers to pay more significant amounts and pay off the loan earlier without incurring any extra penalties.

- Estimated Interest Rates and EIR Per Annum:

- The interest rates for this loan range from 3.5% up to 8% per annum.

- EIR includes processing fees and additional charges within the loan and may charge between 5.8% to 10.8% per annum.

- Target Market:

- It’s the instalment debt for students pursuing higher education or vocational training.

- Parents and guardians supporting the student’s education

3. Debt Consolidation Loans

Managing debts can be highly challenging for most individuals. Thus, introducing debt consolidation loans as a viable refinancing option is worth considering.

Here is some helpful information on this specific debt choice:

- Eligibility:

- Applicants must earn a minimum yearly salary of SGD 30,000

- Individuals requesting the loan should be Singapore Citizens or Permanent Residents

- They should be aged between 21 years old up to 65 years old

- Applicants must also have outstanding debts from two financial institutions

- Loan Tenure:

- The typical loan tenure may be between one year to five years.

- Repayment Options and Methods:

- Monthly instalments may be repaid manually or automatically deducted from the borrower’s bank account or salary.

- Prepayment is allowed without penalty.

- Estimated Interest Rates and EIR Per Annum:

- Usual estimated interest rates could start from 3.5% up to 7% per annum.

- EIR may range between 76.95% to 14.46% per annum, relying primarily on the loan amount and tenure calculations

- Target Market:

- Ideal for borrowers with various outstanding debts, such as personal loans, credit card debts, and other unsecured debts.

- Borrowers who need assistance with managing their debts should simplify monthly payments.

- Individuals struggling with high-interest rates from existing debts and pursuing to refinance it to a single loan obtaining lower interest rates.

4. Car Loans

Moving quickly around the country is imperative; a car can provide that advantage. Yet, only some have enough funds to purchase a vehicle upfront. Car loans have become an excellent choice in this situation.

Here is information worth learning about this debt in Singapore:

- Eligibility:

- Borrowers must be at least twenty-one years of age and below sixty-five years old.

- Applicants must provide proof of annual earnings at S$30,000 minimum

- Borrowers should have stable employment with a minimum tenure of six months

- A good credit score is required to request approval

- Loan Tenure:

- It typically ranges between one to seven years.

- Repayment Options and Methods:

- Lenders grant several repayment options and methods, such as fixed monthly instalments, balloon schemes, and flexible repayment.

- Estimated Interest Rates and EIR Per Annum:

- Interest rates borrowers may acquire from this loan range between 2.78% to 3.5% per annum.

- EIR will range from 3% up to 9%

- Lenders may offer lower interest rates for new cars starting from 2.78% and 2.98% for used cars.

- Target Market:

- This loan is suitable for first-time car buyers, individuals who lack enough savings for car purchases, or to spread out costs for extended periods.

5. Medical Loans

It’s another type of unsecured debt that assists applicants in financing their rising medical expenses. Diverse financial institutions and licensed moneylenders in Singapore provide these loans.

Here are helpful details to take into account about this loan:

- Eligibility:

- Applicants should be Singapore Citizens or Permanent Residents.

- Borrowers must be at least twenty-one years old

- Applicants should show proof of gaining a yearly salary of S$20,000

- Borrowers must present a good credit score and history

- Loan Tenure:

- The typical tenure for this loan is between six months to five years.

- Repayment Options and Methods:

- Borrowers may repay the loan via monthly instalments through automatic deductions from their bank accounts

- Prepayment without penalty is accessible from other lenders

- Estimated Interest Rates and EIR Per Annum:

- Possible interest rates would range from 3% up to 12% per annum

- EIR will usually range between 6% to 18% per year

- Target Market:

- Individuals who need medical treatment or surgeries but lack sufficient funding to cover the probable expenses

- Applicants who may not have access to medical or insurance coverage aren’t enough.

- People who have to pay for medical expenditures upfront but prefer to pursue monthly instalments instead

6. Wedding Loans

No celebration can compare to the momentous union of two people. Thus, weddings require sufficient financing to help couples attain the wedding of their dreams.

Here are the comprehensive details to think about when considering this loan:

- Eligibility:

- Applicants should be at least twenty-one years of age and at most sixty-five.

- Singaporean Citizens, Permanent Residents, and foreigners residing in Singapore with valid employment passes may request this loan.

- Applicants must provide proof of obtaining annual income ranging from S$30,000 minimum. However, it may vary from specific lender’s requirements.

- Loan Tenure:

- The loan tenure usually ranges from twelve to sixty months.

- Repayment Options and Methods:

- Borrowers have several repayment choices, such as monthly instalments, bi-monthly, or quarterly instalments

- Flexible repayment schedules are possible

- Estimated Interest Rates and EIR Per Annum:

- The interest rate for an instalment loan like this would start from 3% up to 8% per annum

- EIR may estimate between 3.5% to 9% per year

- Target Market:

- Perfect for couples in need of extra financing to cover some of the overall wedding expenses

- Ideal for couples who prefer to pay incurred wedding expenses via monthly instalments or don’t wish to incur high credit card debt

7. Business Loans

The specific financing option aims to assist businesses in obtaining the necessary funding for expansion, operations, or any business-related expenses.

Here are the details essential to understand this type of loan choice:

- Eligibility:

- Applicants must show proof of owning a registered business entity in the country.

- Borrowers must have a good credit score and a history

- Applicants must meet the minimum annual income requirements ranging from S$30,000 to S$100,000 or more.

- Lenders will also consider the business’ revenue, profitability, credit score, and industry risk.

- Loan Tenure:

- Initially, lenders in Singapore grant tenure ranging from twelve months to sixty months. But longer terms are possible and would reach up to ten years.

- Repayment Options and Methods:

- Manual monthly instalment or automatic deduction from borrower’s bank account

- Estimated Interest Rates and EIR Per Annum:

- The interest rates would range from 6% up to 15% per year

- EIR may range between 11% to 30%

- Target Market:

- This loan is ideal for Singapore’s small and medium-sized enterprises seeking additional funds to support their company’s operations and expansion projects.

- Start-up business owners in the country in need of working capital for their businesses

Use Instalment Loans to Fulfil Financial Goals

Every financial product in Singapore has an advantage to offer. Nevertheless, instalment loans became among the primary choices because of their flexibility, accessibility, and convenience. It’s suitable for any individual’s needs, whether for educational purposes, medical bills and expenses, purchasing a new or used car, or assisting SMEs in financing their businesses.

Before applying for a loan, contact the country’s best bank, financial institution, and licensed moneylenders, such as Accredit. Search for customer reviews, and compare their reputation, customer service, and interest rates before deciding on the lender and instalment loan you choose.

When borrowers use these loans responsibly, it won’t take long before individuals and their businesses attain their financial goals and fulfil their aspirations. It’s a powerful tool created to manage finances and accomplish financial stability.