Are you in the market for a personal loan from a Singapore bank? The good news – there are numerous banks that offer competitive rates and flexible terms. From higher borrowing limits to longer repayment periods, the benefits are numerous. Don’t let this opportunity pass you by! Follow our comprehensive guide to learn everything you need to know about securing a personal loan from a Singapore bank.

Top Picks for Personal Loans in Singapore in 2023

Looking for the best banks in Singapore that offer personal loans? Here are our top picks for 2023. Take your time to compare the options and choose the one that fits your needs and preferences.

| Personal Loan | Interest Rate (p.a.) | EIR (p.a.) | Loan Amount | Processing Fee |

| HSBC Personal Loan | 4% | 7.5% | S$1,000 – 8x monthly salary | S$0 |

| SCB CashOne Personal Loan | 3.48% | 7.99% | S$1,000 – 8x monthly salary | S$0 |

| CIMB CashLite Personal Loan | 3.38% | 6.38% | Up to 90% of your credit card limit | S$0 |

| UOB Personal Loan | 3.99% | 7.49% | S$1,000 to 95% of your available credit limit | S$0 |

| DBS/POSB Personal Loan | 3.88% | 7.9% | S$500 – 10x your monthly salary | 1% processing fee |

| Citi Quick Cash Loan | 4.55% | 8.5% | S$1,000 – 4x your monthly salary | S$0 |

| OCBC Personal Loan | 5.43% | 11.47% | S$1,000 – 6x your monthly salary | S$100 |

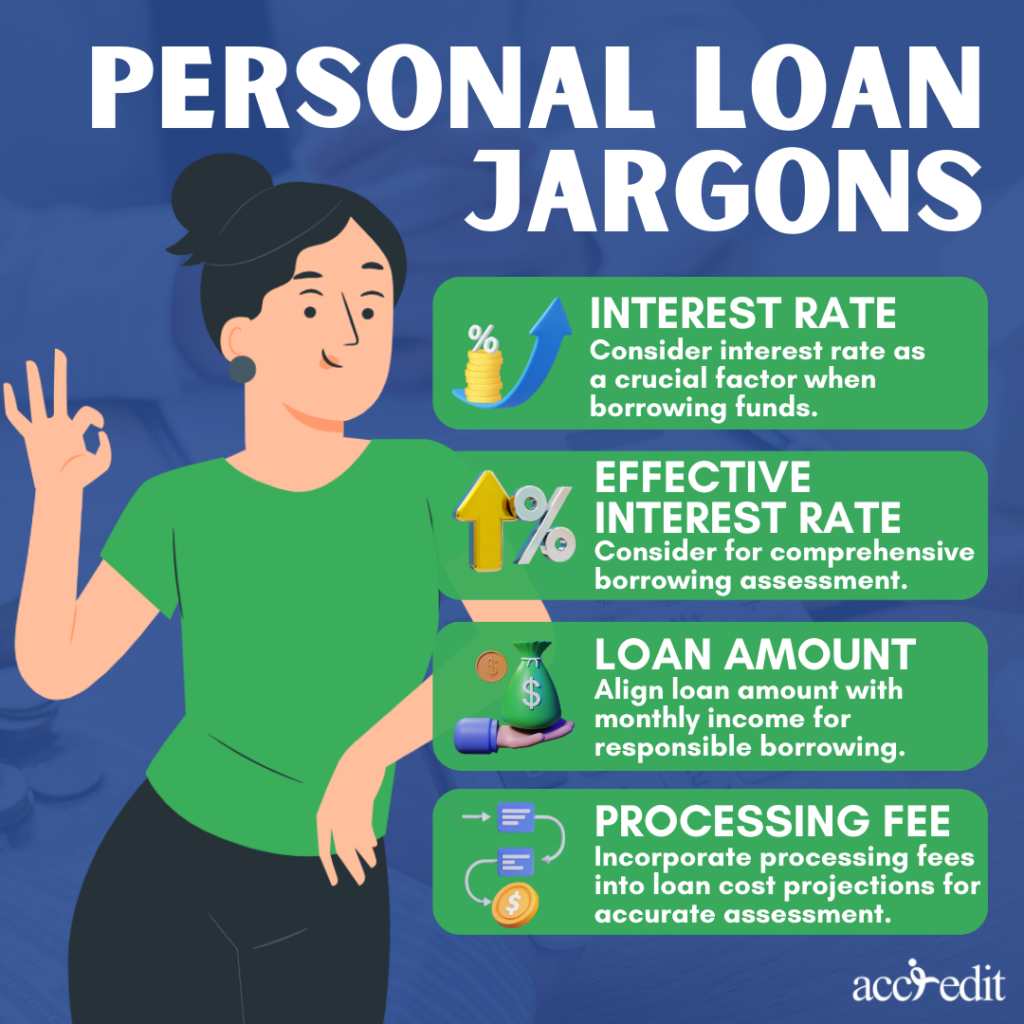

Personal Loan Jargons

Interest rate

Obtaining funds from a financial institution requires careful consideration of various factors, and the interest rate is a critical metric that should never be overlooked. This essential factor represents the percentage of the borrowed amount that must be repaid, plus the additional interest charge. In other words, it signifies the cost of borrowing funds and should be considered as such.

EIR

When obtaining a loan, don’t solely rely on the interest rate as a basis for decision-making. It’s imperative to examine the effective interest rate (EIR) to get an accurate understanding of the total cost of borrowing. The EIR covers more than just the interest rate, including ancillary fees like processing fees and origination fees. To avoid any unpleasant surprises and make an informed decision, it’s essential to consider the EIR.

Loan Amount

When seeking financial assistance from a lender, it’s essential to consider the loan amount you need. This represents the sum of funds you wish to obtain, which can significantly impact your financial standing. However, simply obtaining a loan amount isn’t enough. You must ensure that the loan amount aligns with your monthly income for prompt, full repayment. This is crucial in avoiding financial distress and the accumulation of debt.

Processing fees

Processing fees are also a critical aspect to consider when acquiring a loan. This fee is intended to reimburse the lender for their time spent assessing and overseeing your loan application. Although the processing fee may seem trivial relative to the loan’s total cost, it’s wise to incorporate it into your overall loan cost projections. If ignored, this fee can add up over time and potentially affect your financial objectives.

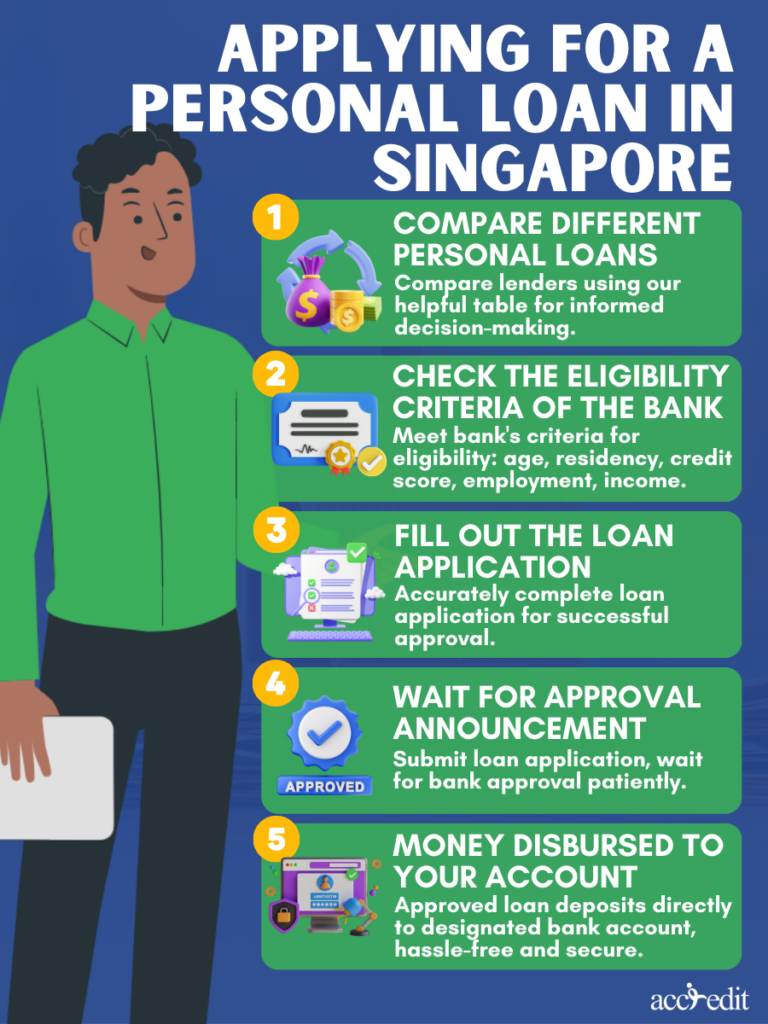

Applying for a Personal Loan in Singapore

If you’re feeling overwhelmed by the prospect of applying for a personal loan in Singapore, take heart. This all-inclusive manual has got you covered.

Step 1: Start comparing different personal loans

Before committing to a personal loan, it’s imperative to conduct a thorough comparison of different lenders. Luckily, our handy table facilitates this process by presenting a clear overview of various bank offerings.

Keep in mind that each lender has its own unique selling points, which may make a significant difference in your decision. Factors such as interest rates, repayment terms, and additional fees can vary substantially, so it’s essential to consider them all.

Step 2: Check the eligibility criteria of the bank

Now that you’ve discovered a personal loan offer that meets your needs, it’s essential to verify that you fulfill the bank’s eligibility standards. Keep in mind that each bank has its specific set of requirements, so it’s essential to become familiar with the most prevalent criteria:

- Age & Residency: In order to qualify for a personal loan, applicants must be within the age range of 21 to 65 years. As for residency, the loan is available for Singaporeans, Permanent Residents, and occasionally, even foreigners.

- Credit score: To increase your chances of getting qualified for a loan, you should have a score of 1,900 or above.

- Employment Status: It’s also crucial to ensure that you maintain a minimum of one to two years of employment or self-employment. This is to show your lender that you have a stable source of income.

- Monthly Income: Singaporeans and PRs should have a minimum monthly income of S$30,000. For foreigners, they should earn a minimum monthly income of S$40,0000 – $60,000.

Step 3: Fill out the loan application

After deciding to pursue a personal loan, the next crucial step is filling out the loan application. Whether you prefer applying online or visiting a branch in person, make sure you provide accurate information and include all the necessary documentation.

Your attention to detail is critical when completing the loan application as it can determine whether you get approved or denied. Don’t overlook even minor mistakes or missing information as they can lead to a declined application. Take your time, and double-check your work to ensure accuracy.

Step 4: Wait for an approval announcement

Completing and submitting a loan application is just the beginning of the waiting game. You must now await notification from the bank regarding your loan approval. The bank’s careful review of all of your documentation may take days, weeks, or longer. Be patient and refrain from excessive contact with them, as this may cause further delays. Remember to stay calm and positive during this period of waiting.

Step 5: Money disbursed to your account

After obtaining approval for your loan request, your designated bank account will be credited with the funds directly. You won’t have to deal with the inconvenience of waiting for a check in the mail or physically visiting a lending office. This method is not only quicker but also safer, guaranteeing that you receive your funds without any delays or complications.

When Banks Don’t Work Out: Consider a Loan from a Licensed Moneylender

When you hit a roadblock with traditional bank loans, it can be quite disheartening. The good news is that you have other financing alternatives to explore. One such option is to consider working with a licensed moneylender in Singapore. Their eligibility criteria are relatively straightforward: you must be 21 years old or above and earn an annual income of S$20,000 or less.

It is important to keep in mind that every lender has their own set of unique terms and conditions. Nevertheless, it is comforting to know that the Singapore Ministry of Law imposes a cap on the monthly interest rate, which cannot exceed 4%. This makes choosing a licensed moneylender over loan sharks a much more sensible and financially viable decision.

| Borrower’s annual income | Singapore Citizens and Permanent Residents | Foreigners residing in Singapore |

| Less than S$10,000 | S$3,000 | S$500 |

| Between S$10,000 to S$20,000 | S$3,000 | S$3,000 |

| Greater than S$20,000 | 6 times the monthly income | 6 times the monthly income |

Thoughts

As the digital age progresses, securing a personal loan has become a simple and convenient process with its availability online. A visit to the official website of your bank and submission of requested information and documents is all it takes. But what if traditional banking options aren’t a feasible solution? A licensed moneylender like Accredit provides efficient and speedy services for those who are unqualified for a bank loan.

Don’t hesitate to take advantage of their services by applying now!