For Singaporeans in need of a financial boost, a personal loan can provide a much-needed solution. These loans are a popular option for covering unexpected expenses, consolidating debt, or financing a long-desired trip. This article will reveal the key steps to securing a S$10,000 personal loan in Singapore quickly and effortlessly.

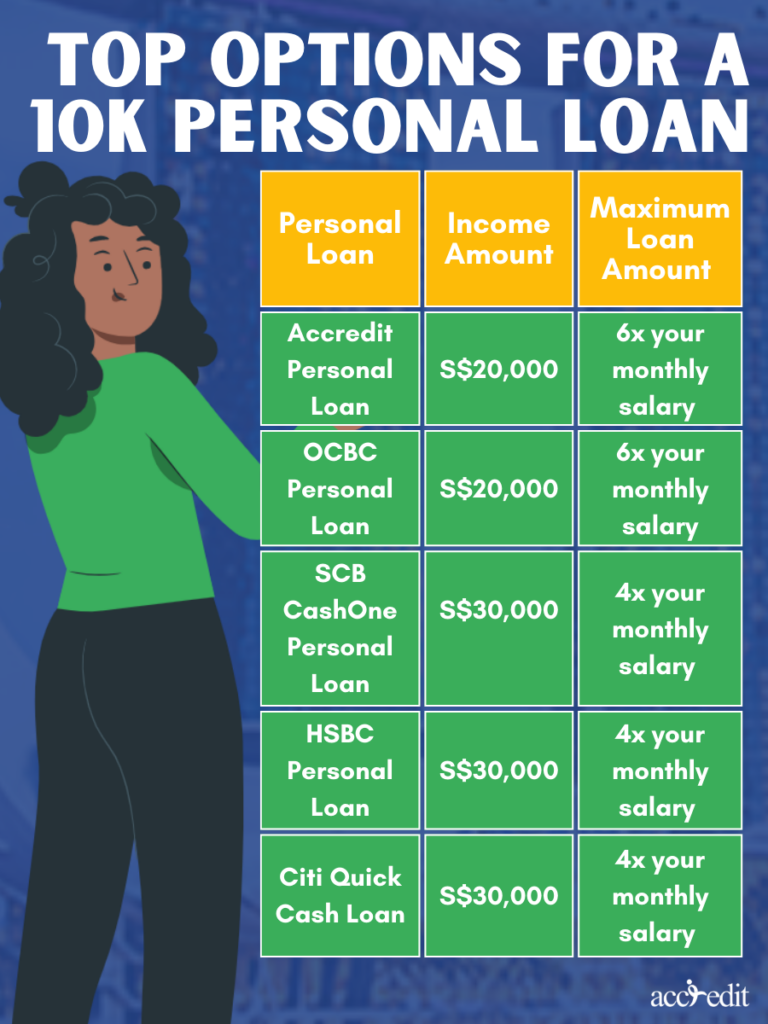

Top Options for a 10k Personal Loan

| Personal Loan | Income Amount | Maximum Loan Amount |

| Accredit Personal Loan | S$20,000 | 6x your monthly salary |

| OCBC Personal Loan | S$20,000 | 6x your monthly salary |

| SCB CashOne Personal Loan | S$30,000 | 4x your monthly salary |

| HSBC Personal Loan | S$30,000 | 4x your monthly salary |

| Citi Quick Cash Loan | S$30,000 | 4x your monthly salary |

Accredit

Accredit is one of your best choices with seeking a personal loan in Singapore. With an annual income of S$20,000 and the ability to borrow up to 6 times your monthly salary, you can access a total of S$10,000. Even better, you could enjoy a low-interest rate of 4%, and up to 12 months to repay the loan. What sets Accredit apart is its hassle-free and speedy loan processing, which means you can get the funds you need in no time.

OCBC Personal Loan

Another option you should consider is OCBC Personal Loan. This loan option is hailed as one of the best in town and for a good reason. With an incredibly low-interest rate of 4.7% (9.46% EIR p.a.) available exclusively to existing OCBC loan customers, it’s an unbeatable deal. And with a minimum income requirement of S$20,000 and the flexibility to borrow up to 6 times your monthly salary, you can receive a total of S$10,000 with ease.

SCB CashOne Personal Loan

Standard Chartered CashOne is the best option for a personal loan in Singapore if you need ten thousand Singapore dollars at a reasonable interest rate. To qualify, you need to make at least S$30,000 per year, and you may borrow up to four times that amount each month. Also, borrowers searching for a large sum of money at a cheap rate will like the 3.48% (6.95% EIR p.a.) interest rate.

HSBC Personal Loan

Get the best of both worlds with HSBC Personal Loan. With a low-interest rate of 3.2% (EIR 6% p.a.) and a loan tenure of up to 7 years, it’s the perfect solution for long-term borrowing. And with a minimum annual income requirement of S$30,000 and the ability to borrow up to 4 times your monthly salary, you can access S$10,000.

Citi Quick Cash Loan

Citi Quick Cash Loan also provides a low-interest rate of 4.55% (8.5% EIR p.a.) for existing loan customers and 3.45% (6.5% EIR p.a.) for new customers; it’s a great option for a cost-effective borrowing solution. In addition to this, if your annual earnings surpass S$30,000, you can secure a loan that is four times your salary – up to $10,000.

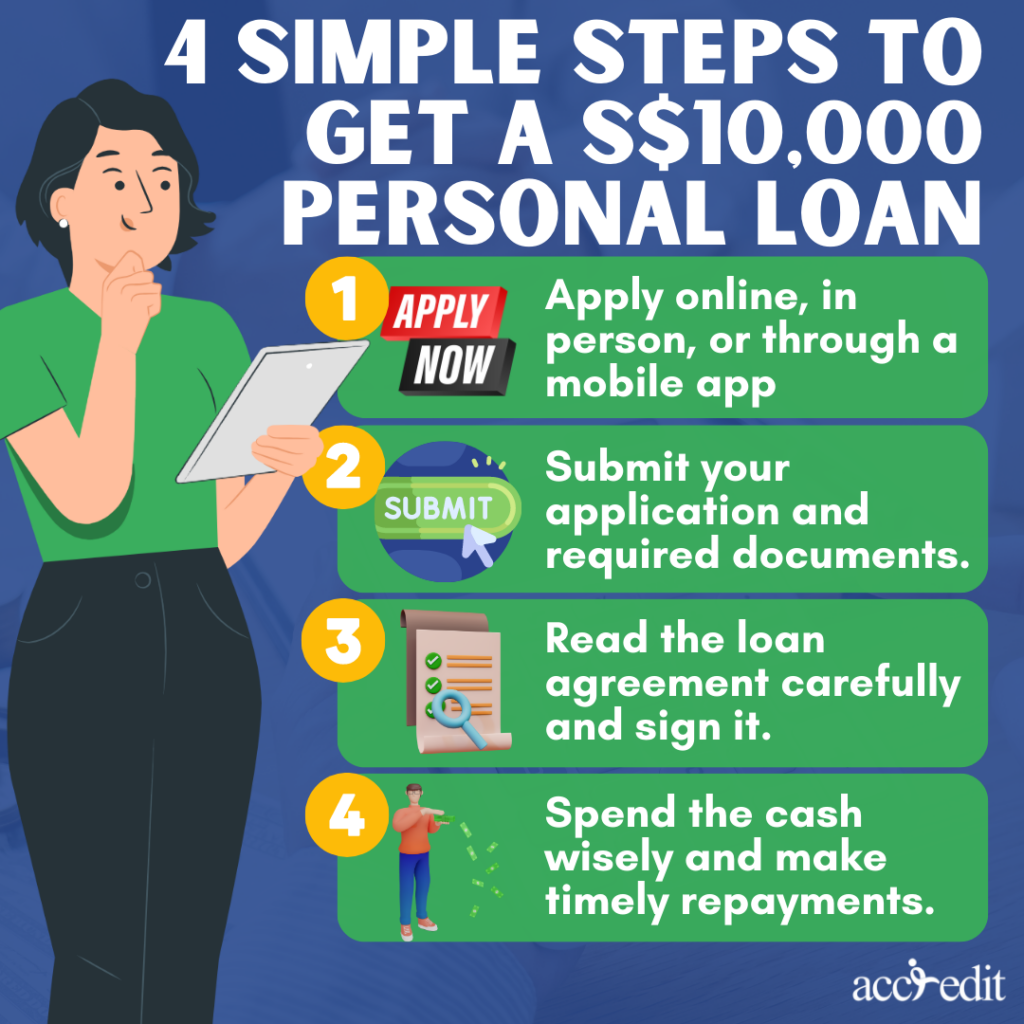

4 Simple Steps to Get a S$10,000 Personal Loan

Looking for a quick financial solution? Here are four easy steps to get a personal loan:

Thoughts

When pondering a $10,000 personal loan, take a moment to assess your financial capabilities. It’s crucial to confirm if you possess the means to pay back the loan on schedule. Seeking guidance from your lender can be a great aid in appraising your financial standing and obtaining expert recommendations. Don’t miss the chance to tap into their proficiency to guarantee a smooth loan repayment strategy. Act now and take control of your financial future.

Get Personal Loans up to 6x Your Monthly Income with Accredit Moneylender

Struggling to find the cash you need in a hurry? Look no further than Accredit Moneylender. Our effortless personal loan application process guarantees you fast access to funding. Plus, if your yearly earnings exceed S$20,000, you can borrow up to six times your monthly income. No more fretting over unexpected expenses or money woes.Ready to take control of your financial situation?

Put your mind at ease by submitting your personal loan application to Accredit Moneylender now.