What to do when you want to get a loan but have bad credit? Give up? It’s a common reality that lending institutions are hesitant to extend loans to individuals with poor credit.

This is because a low credit score often indicates a history of late bill payments or excessive spending, which can make the individual a higher credit risk. But don’t worry too much about it, as there are a few loan providers that will work with people like you.

Understanding Personal Loans

A personal loan is a form of borrowed funds intended for personal use – weddings, home renovations, travel, etc. Typically unsecured, meaning no collateral is required, personal loans offer flexibility. However, failure to repay the loan can negatively impact your credit score, making it crucial to stay vigilant with debt repayment.

Understanding Credit Scores

In Singapore, a credit score is a four-digit number that shows a person’s financial situation. It ranges from 1000 to 2000, which 2000 being the highest score. Lenders leverage your credit score as a key factor in determining loan approval.

A strong credit score signals to the lender that you have a history of responsibly paying back debts, making you a more attractive candidate for loan approval. But if your credit is low, you’re likely to get a loan with unfavorable terms or, worst, get rejected.

Determining your credit score: Good or Bad?

It is important to check your credit score before engaging yourself in a financial commitment. This is because it plays a major role in your loan approval in Singapore.

If you have a credit score between 1911 to 2000, you are seen as an excellent borrower. You are more likely to get your loan approved and receive favorable terms. But if your credit score is somewhere from 1000 to 1723, you are a risky borrower. You can expect your loan to get turned down.

Here’s a table showing a variety of credit ratings together with the associated default risk.

| Score range | Risk grade | Probability of default (Min) | Probability of default (Max) |

| 1911-2000 | AA | 0.00% | 0.27% |

| 1844-1910 | BB | 0.27% | 0.67% |

| 1825-1843 | CC | 0.67% | 0.88% |

| 1813-1824 | DD | 0.88% | 1.03% |

| 1782-1812 | EE | 1.03% | 1.58% |

| 1755-1781 | FF | 1.58% | 2.28% |

| 1724-1754 | GG | 2.28% | 3.46% |

| 1000-1723 | HH | 3.46% | 100% |

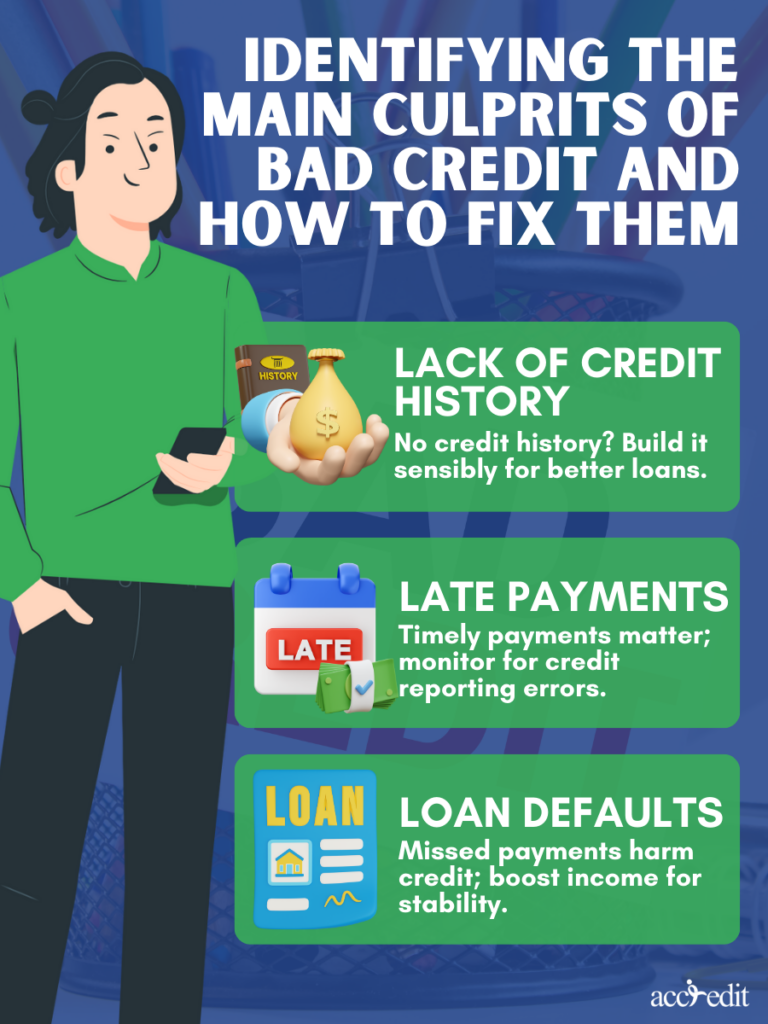

Identifying the Main Culprits of Bad Credit and How to Fix Them

Lack of credit history

When someone has never taken out a loan or used a credit card, they don’t have a credit background, which makes it hard for them to get good loan terms. To improve your credit score, you need to take money in a sensible way.

The first step is to sign up with a bank you can trust. Then, apply for something that involves credit and pay on time every month. By being responsible with money over time, a person will be able to get loans with terms and rates that are more in line with what they can afford.

Late payments

Your payment history speaks volumes about your creditworthiness, as lenders often communicate this to credit bureaus. Late payments, unfortunately, do not bode well for your credit score.

However, sometimes, errors in reporting can lead to a timely payment being inaccurately recorded as a late payment, which can cause an unwarranted blow to your credit score. It’s critical to remain vigilant about your financial activity and credit score to identify and rectify any such inconsistencies.

Loan Defaults

Missing loan repayments can severely damage your credit score, leading to prolonged consequences that may impede your ability to acquire credit. Your loan accessibility could remain limited for a substantial period, causing significant financial distress.

One effective strategy to steer clear of defaulting on loans is to seek methods to increase your income. This can involve requesting a raise from your employer or engaging in a part-time gig to augment your earnings. By fortifying your income streams, you’ll be better equipped to handle loan payments, enhancing your financial stability and credit rating.

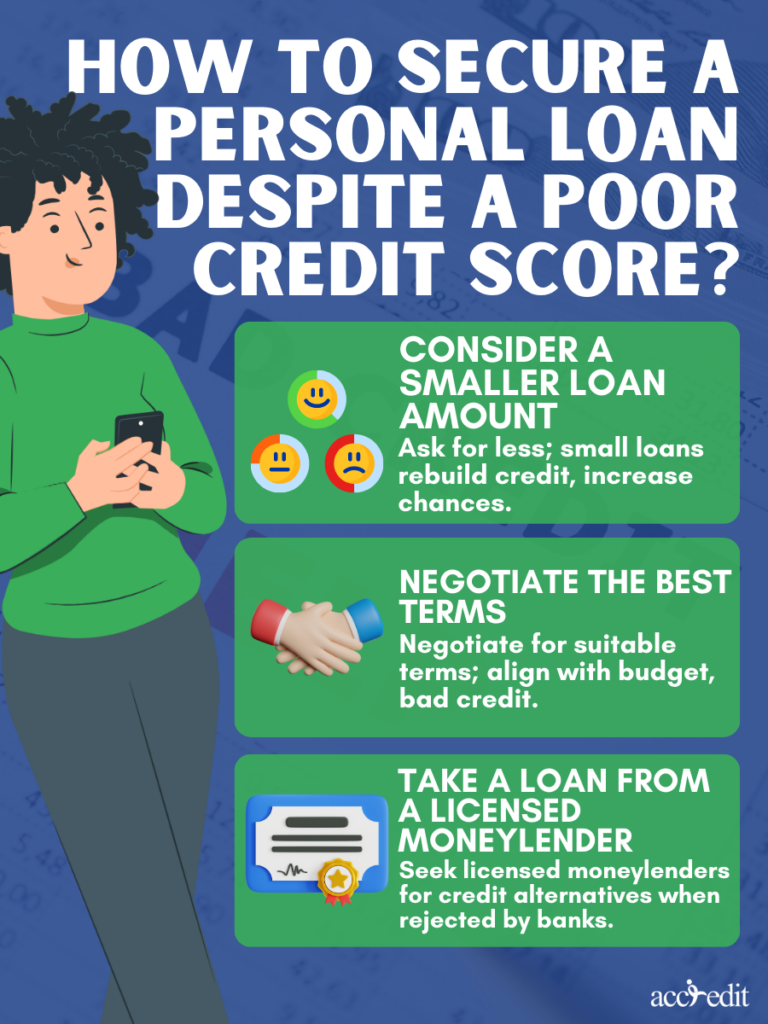

How to Secure a Personal Loan Despite a Poor Credit Score?

It may look impossible to get a personal loan with bad credit. However, even the word “impossible’ says, “I’m possible.” So, buck up, and let’s learn how to improve your credit score with the following advice.

Consider a smaller loan amount

You’re more likely to get a personal loan if you ask for a smaller amount. Financial institutions undoubtedly deny bigger loan applications for people with bad credit. This is due to the fact that your credit history may indicate missed payments, unpaid bills, or other financial missteps.

However, obtaining a smaller loan may serve as a stepping stone toward improving your credit standing. Regular payments and responsible loan management can help rebuild your credit score and increase your chances of securing larger loans in the future.

Negotiate the best terms

Negotiating for the most advantageous loan deal that aligns with your budget is a wise step to take, especially if you are looking to secure a personal loan with a bad credit score. By being candid with your lender regarding your financial situation and the funds, you need, they may be able to provide you with terms and rates that better suit your ability to repay the loan.

Take a loan from a licensed moneylender

If the traditional banking route has proven fruitless for you due to a less-than-ideal credit score, fear not. A licensed moneylender may be your solution. Unlike banks, they place emphasis on your ability to repay the loan rather than your credit history, offering an open door for those who have been turned down by the bank.

Where to Get a Personal Loan With Bad Credit in Singapore?

Borrowers with bad credit can still get a personal loan in Singapore. There are a few banks that offer the most affordable loan, so it is important to shop around.

| Personal Loan | Interest Rate (p.a.) | EIR (p.a.) | Loan Amount | Processing Fee |

| HSBC Personal Loan | 4% | 7.5% | S$1,000 – 8x monthly salary | S$0 |

| SCB CashOne Personal Loan | 3.48% | 7.99% | S$1,000 – 8x monthly salary | S$0 |

| DBS/POSB Personal Loan | 3.88% | 7.9% | S$500 – 10x your monthly salary | 1% processing fee |

| Citi Quick Cash Loan | 4.55% | 8.5% | S$1,000 – 4x your monthly salary | S$0 |

Licensed Moneylender

Most licensed moneylenders in Singapore provide personal loans for people with bad credit scores. This is because they care more about your financial ability to repay the loan than your credit score. Accredit is a good choice for borrowers with bad credit and low-income earners.

| Borrower’s annual income | Singaporeans and PRs | Foreigners residing in Singapore | Interest Rate | Loan Term |

| Less than S$10,000 | S$3,000 | S$500 | Up to 4% | 12 Months |

| Between $10,000 to $20,000 | S$3,000 | S$3,000 | Up to 4% | 12 Months |

| Greater than $20,000 | 6 times the monthly income | 6 times the monthly income | Up to 4% | 12 Months |

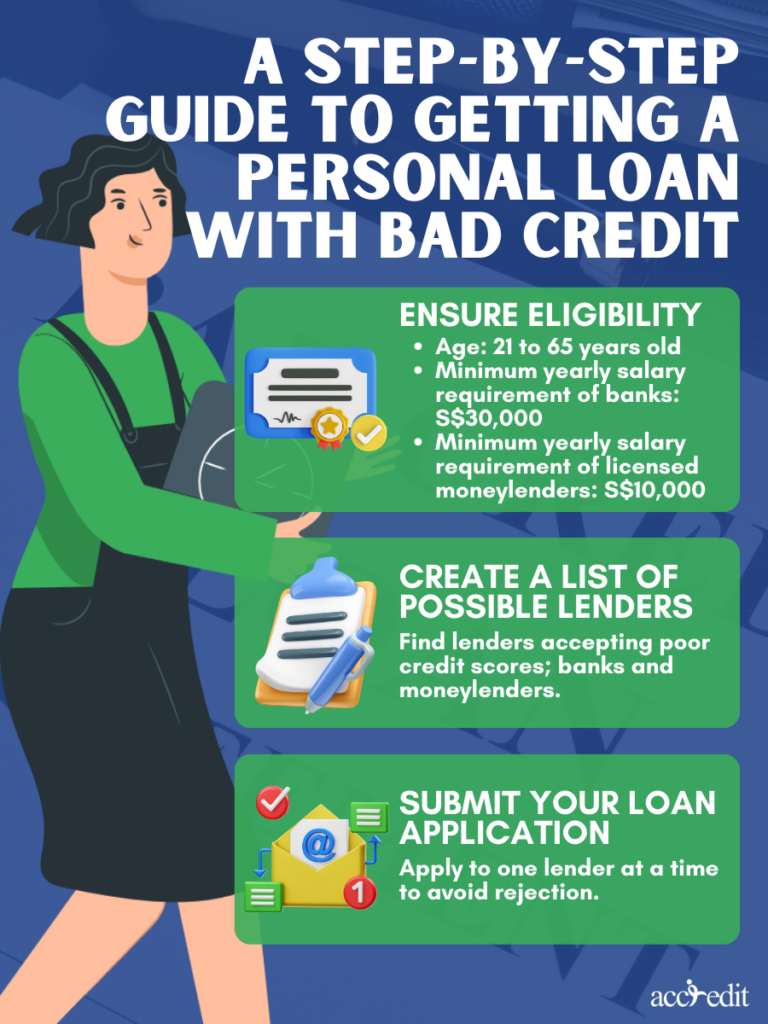

A Step-by-Step Guide to Getting a Personal Loan with Bad Credit

Applying for a loan with poor credit requires no special steps, yet the danger of loan rejection is a persistent concern. But fear not; by utilizing a well-crafted strategy, you can significantly increase your chances of obtaining a personal loan, despite being seen as a potentially risky borrower.

Step 1: Ensure Eligibility

Before getting yourself into a financial commitment, it’s essential to make sure you meet the eligibility criteria set by the lender. Every lender may have a different set of criteria, but here are some of the most commonly expected qualifications:

- Age: 21 to 65 years old

- Minimum yearly salary requirement of banks: S$30,000

- Minimum yearly salary requirement of licensed moneylenders: S$10,000

Step 2: Create a list of possible lenders

To locate a fitting lender for borrowers with poor credit scores, it’s recommended to compile a list of lenders that accept such scores. Fortunately, a few banks do accept such scores, as do licensed moneylenders.

Step 3: Submit your loan application

Once you have selected a couple of lenders, you can submit a loan application. But it would be best to apply to one lender at a time. This is because if you apply for a loan from multiple lenders at the same time, you may be seen as credit hungry. And you might get your loan application denied.

Overcoming Bad Credit: A Path to Financial Stability with Accredit

Accessing loans with bad credit is a daunting task that limits your options. To overcome this challenge and attain financial stability, partner with Accredit. Our platform offers swift and hassle-free personal loans, even for those with less-than-perfect credit.

However, it’s crucial to prioritize credit enhancement by consistently settling your bills promptly or even before the due date. By taking this proactive step, you not only bolster your credit rating but also set the stage for effortless access to loans in the future.

Ready to take control of your finances and secure your future? Join Accredit today!