The definition of a financial crisis differs from person to person. There are situations wherein significant events should be in complete preparation, but more funds could be needed to hold back these critical occasions. Thus, people would wonder how much maximum loan amount you can take.

Maximum Loan Amount Considerations

Every person faces diverse financial issues. For instance, you got involved in accidents, were injured, and needed healthcare assistance. How much maximum loanable amount can you get to pay for such expenses?

Some monetary problems could be related to employment, like a broken laptop, personal computer, or smartphone. Whether the need for money’s associated with gadgets, healthcare and medications, or bare essentials doesn’t matter. What’s important is finding a quick and suitable solution to ease the burden and stress of the financial crisis.

The answer to these monetary dilemmas is simple. It is by borrowing money or taking out a loan. Along with it is considering the possible max amount you can take home.

It’s critical to consider the maximum loan amount accessible from a loan. But first, you need to know the type of loan and where you can apply for it. Also, you have to ensure you’re eligible.

Do you need this relevant information about loans in the country? Read more on the details below.

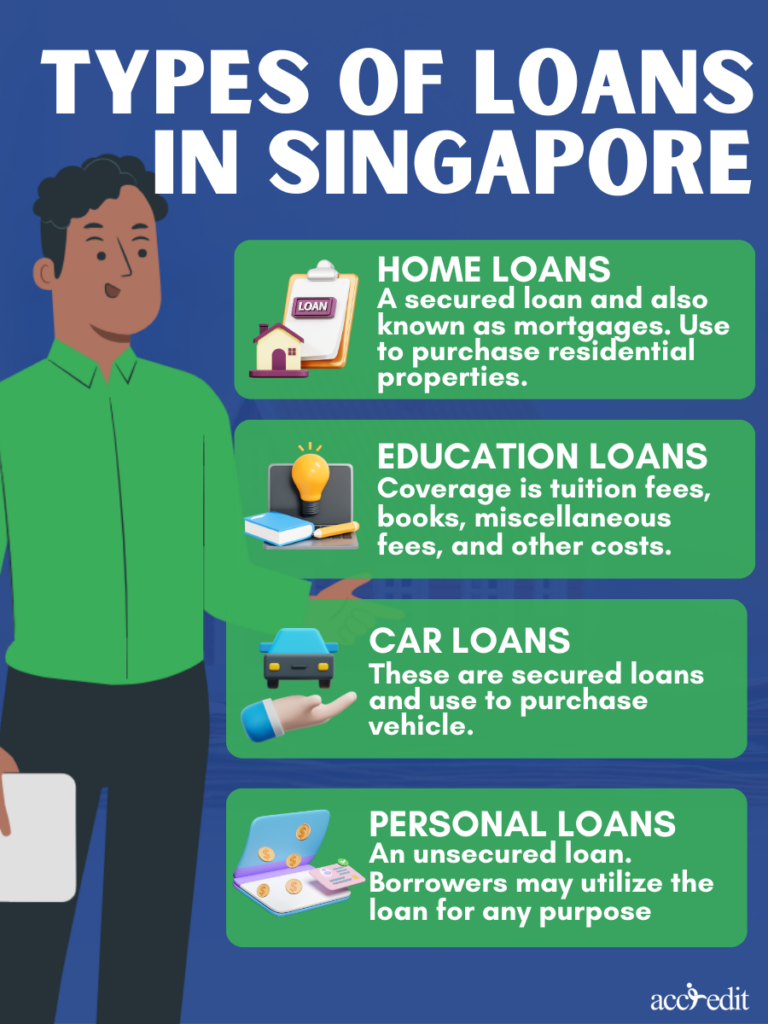

Types of Loans in Singapore

Singapore has a distinctive fame and reputation for trade and commerce. The economy’s resilience is impressive due to the country’s finance industry.

Financing businesses are bustling throughout Singapore. These companies offer an array of loans to their communities. These loans vary specifically to the needs of a borrower.

A borrower in Singapore may apply for the following;

1. Home Loans

These are loan-term loans. You need this loan to finance your plans to purchase properties. You may also use it to refinance your existing mortgage.

The estimated interest rates range from 1.6% to 2.3% per annum.

2. Education Loans

These loans are ideal for individuals pursuing higher education in Singapore. It’s an effective loan in Singapore to finance education-related expenses, such as accommodations, books, tuition fees, living expenses, etc.

3. Car Loans

It’s the best loan in Singapore for individuals interested in purchasing a used or new car. Car loan interest rates would range from 1.5% to 2.5% annually.

4. Personal Loans

The best and most recognised loan in Singapore is personal loans. These are unsecured loans. Many people prefer a personal loan over others because it’s flexible to use according to your needs.

You can apply for it when you must pay off credit card debts, finance your wedding, repair a broken car, renovate your home, or cover unexpected expenses. The estimated interest rates for a personal loan range from 3.88% to 8.5% per year from banks and 1% to 4% per month from licensed moneylenders.

These types of loans also vary in purpose and classification. For instance, some are secured, and others are unsecured loans.

Secured credit grants a borrower a bigger loanable receivable. But, a borrower has to deliver suitable collateral in exchange for the massive amount.

Unsecured credit grants a smaller amount and does not require a pledge. Due to it lacking specific property to secure loan repayment, the loan provider may impose a higher interest rate to ensure a reasonable ROI for the transaction.

It’s best not to take out a secured loan when you only require minimum funds. Thus, the kind of loan I should take in Singapore is a personal loan.

Maximum Loan Amount from Various Lenders in Singapore

Personal loans are the popular choice by most Singapore Citizens, Permanent Residents, and foreigners residing in the country. It’s understandable why it’s the primary loan choice. But how much maximum loan amount can you acquire from various lenders in Singapore?

Here are some of the maximum loan amounts offered by various lenders in Singapore:

Banks grant personal loans and other loans. The maximum loan amount they provide for financial assistance range from $1,000 to $200,000. It’ll vary on the loan type.

Licensed moneylenders in Singapore offer small and short-term loans. The maximum loan amounts range from $300 to $10,000 or could reach six times the borrower’s monthly income.

Where to Apply for a Personal Loan in Singapore?

Now that you’ve settled on the loan you’ll take, you must search for a loan provider in the country. The particular selections in the finance industry are banks and licensed moneylenders in Singapore.

Banks do offer personal loans to their clients. Yet these monetary businesses are stern with their qualifications on who can request a loan from them. Your maximum loan amount depends on your creditworthiness and annual income.

On the other hand, moneylenders in Singapore have considerate and more flexible borrower guidance upon taking a personal loan. The max loan amount you can handle could also rely on your annual income and credit score, yet these lenders are more forgiving on those qualifications.

All these financial businesses will screen your credit history and score. It assesses your eligibility to repay the personal loan you’re about to take. Suppose you feel hesitant to pursue a personal loan from the bank due to credit score or other relevant concerns. In that case, you can proceed with a licensed moneylender in the moneylending industry instead.

Moneylending in Singapore

Moneylending in Singapore is lending cash or supplying services and goods to its clients. The loaned money is subject to be repaid by the borrower at a specified and higher interest rate within a particular time frame.

The concept of moneylending in Singapore began a few centuries back when the country was economically motivated by trade and commerce. It didn’t take long before Singapore fully adapted to the financing strategies of moneylending from moneylenders and soon flourished.

An essential fact about moneylending in Singapore is that its implementation may be similar to banks and other financial institutions. But it doesn’t mean its scope of responsibilities and functions are the same, particularly with loan caps, process speed, credit assessment and availability to its clients.

All clients or borrowers must go to a moneylender’s office to apply for a loan. Setting an appointment early on through the licensed moneylender’s business URL is possible. It’s highly encouraged by the Ministry of Law that all transactions should be done personally, but you may apply online.

Licensed Moneylenders in Singapore

A moneylender in Singapore is an individual whose business is focused on lending money to borrowers. Those who engage in loan transactions with a moneylender in Singapore can obtain lump sums with higher interest rates, fees, and charges.

All moneylenders in Singapore must acquire their licence from the Registry of Moneylenders. They shall enlist in the Registry once they’ve earned their licences. Furthermore, every licensed moneylender you can take a max loan amount from in Singapore must comply with the commitment to the Moneylenders Act and Rules.

Maximum Loan Amount You Can Get in Singapore

Requesting a loan is to use the funds for your transactions. You must know the maximum loan amount you can take from a licensed moneylender in Singapore.

You can effortlessly access information from the Registry of Moneylenders for the borrower’s web page. Secured loans from financial businesses are flexible in terms of the loan amount.

Still, unsecured credit, like a personal loan in Singapore from a moneylender, has a fixed maximum loanable amount for borrowers like you.

Maximum Loan Amount for You

- Singapore Citizens and Permanent Residents earning up to $10,000 annual income can obtain up to $3,000 maximum loanable amount. Foreign work pass holders with the same yearly income can also accept $500.

- Singapore Citizens, Permanent Residents, and foreigners residing in the country with annual income ranging from $10,000 and less than $20,000 are approved to get as much as $3,000.

- Individuals living and working in Singapore, SCs, PRs, and foreign nationals who earn an annual income of at least $20,000 can obtain up to six times the sum based on their monthly income.

The maximum loan amount for each community helps me understand how much you can take. Still, aside from this available information, you also need to know the loan caps imposed by the Ministry of Law and Ministry of Manpower.

Importance of Maximum Loan Amount Caps

What are loan caps? These are the limitations imposed on interest rates variable-rate credit products can charge.

The loan cap’s primary objective is to ensure that, as a borrower, you will only go up to the amount you can pay for. It is about being conscious of your options as a borrower and being responsible for enforcing your legal responsibilities.

In addition, the loan caps further restrict unfair and abusive intent from some moneylenders in Singapore that will illegally demand higher rates, fees, and charges.

The regulated loan caps currently implemented on moneylending in Singapore are;

- The administrative fee shall be collected only once and must not surpass the 10% modulated loan principal.

- 4% per month is the modulated interest rate for all borrowers, regardless of whether they get a secured or unsecured loan. It is fixed, and anyone who blatantly charges a higher percentage will be penalised according to the law.

- Sometimes, borrowers like you could be in tight financial situations or overwhelmed with daily hustle. With this, it’s crucial to remember the repayment schedule.

The Moneylenders Act emphasises that late payments are acceptable but for the inconvenience caused to the moneylender. You have to pay 4% as a late interest rate. A licensed moneylender in Singapore can charge up to what the Act and Rules stipulate.

- Additionally, moneylenders in Singapore can levy late fees on borrowers like you. However, they can only collect $60 per month and not a cent more.

Illegal Moneylending Activities

Even though Singapore is revered as an amazingly beautiful and among the most livable countries in Asia, it does not mean there are no threats within. In the finance industry, scammers and unlicensed moneylenders are prowling the country.

These groups or individuals operate with extreme malice as they lure in their victims by pretending to be licensed moneylenders in Singapore. The typical modus operandi is to scout communities in the country struggling with finances, mostly foreign domestic workers or those with meagre incomes.

Unlicensed moneylenders usually instigate illegal moneylending activities. These moneylenders were not granted their licences for different reasons. As they lack the authorisation to carry on or function as a moneylending service provider, they threaten the economy and the borrowers.

Unlicensed Moneylenders Red Flags

Unlicensed moneylenders in the country are also called Ah Longs or loan sharks. They are ruthless and won’t hesitate to physically cause disturbances or hurt their targets. Furthermore, they will continue to intimidate, scare, and harass their victims until they get their money or are reported to the authorities.

The most accessible red flag a borrower would notice when dealing with a loan shark is that they’d usually initiate the communication. They do this by buying the personal data of possible victims and contacting them via text messages, messaging apps, social media apps, or calls.

It is against the Moneylenders Act for a moneylender to endorse their loan services through other methods besides posting information via official business URLs, business offices, and Yellow Pages.

Another tell-tale sign you’re talking to an unlicensed moneylender is the provided information they offered on their legitimacy is not accessible on the Registry of Moneylenders. Be cautious, though, as they could pretend to be from the licensed moneylending business.

The best way to counter the scheme is to contact the numbers, Ah Long gave. Or you could reach the URL or go to the office personally and inquire if the said individual is affiliated with the moneylending business.

Reporting Illegal Moneylending Activities

When any of these events happen, or you find yourself in an unsafe conversation with a person posing as a licensed moneylender, do not hesitate to call the anti-scam helpline at 1800-722-6688, the X-Ah Long hotline at 1800-924-5664, or the Singapore Police Force hotline at 1800-255-000. Online submissions for complaints are accepted via www.police.gov.sg/iwitness.