Are you staring at your empty wallet, wishing for a miracle to help you out of your financial rut? The good news is that personal loans are the ultimate financial savior for many folks in Singapore. With the ease and speed of securing a personal loan, you may be wondering, “How many personal loans can I take?”

The burning question is, can you take multiple personal loans? Before you dig any further, allow this article to spill the beans and put your curiosity to rest.

Can I Take More Than One Personal Loan in Singapore?

Securing multiple personal loans in Singapore is a possibility, but it’s not always straightforward. Your ability to obtain additional loans will be influenced by a range of factors, including your repayment capacity, loan type, and purpose.

Moreover, Singapore’s Monetary Authority (MAS) sets a ceiling on unsecured loans, which includes personal loans. This borrowing limit is set at 12 times your monthly salary.

However, taking out loans beyond this threshold for more than three months may result in restricted access to unsecured loans in the future. The MAS aims to prevent overborrowing and encourage responsible financial conduct through this regulation.

Is it Smart to Take Out Another Personal Loan?

Well, it actually depends on your situation really.

Even if you have a high income, it is advisable to borrow again only if you truly require the funds for an emergency. And if you can afford to repay many debts in time and in full.

In addition, to secure the most advantageous personal loan deal available, it’s highly recommended that you scour the market thoroughly. You want to ensure that you find a loan with terms and rates that are feasible for you to manage.

Can I Take Another Personal Loan from the Same Lender?

Although obtaining another personal loan from the same lender is possible, it’s not a certainty. Lenders exercise caution when lending to individuals with pre-existing debts as it carries inherent risks they may not be keen on.

But fear not, for some lenders are open to extending additional loans even with outstanding debts. However, they will only entertain your application if you can demonstrate your ability to repay your debts within the loan term.

If you wish to increase your chances of obtaining a second loan, consider exploring new lenders with better terms. The process will be similar, but you must fulfill specific income requirements to heighten your probability of success.

What Should You Consider Before Taking Out Another Personal Loan?

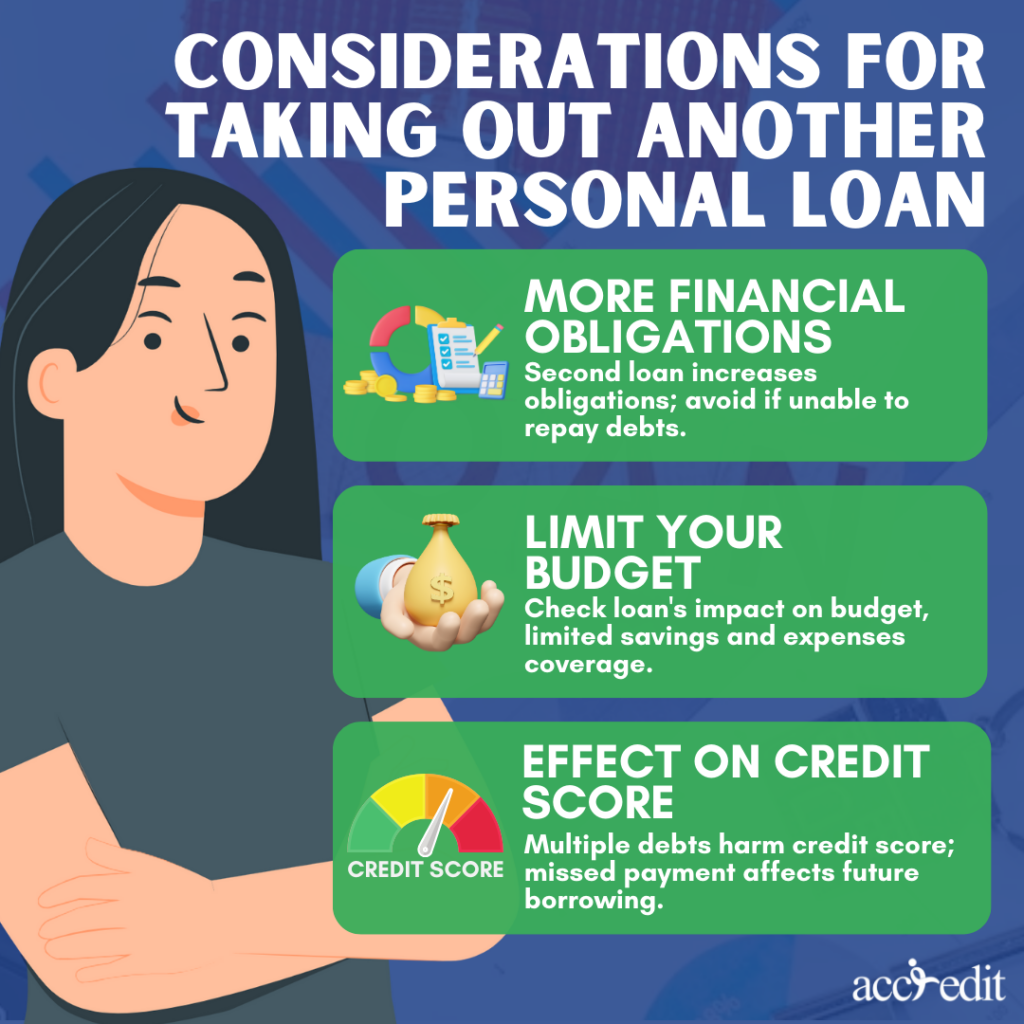

Before you apply for another loan, here are some factors you should consider:

- More financial obligations: Obviously, getting a second loan can increase your financial obligations. You’ll be in a tough spot as you will pay more money to repay your debts. If you don’t have the financial means to repay such enough debts, then it is better not to borrow more money.

- Limit your budget: Before you plan to get another loan, you should check if your monthly payment will affect your budget. And if it did, the money you have left after paying is very little. With that, you won’t be able to save much and be able to cover your daily expenses.

- Effect on credit score: Having to manage multiple debts can take a toll on your credit score. The moment you happen to miss out on a payment, your credit score will decrease. And such action will also affect your ability to borrow in the future.

Boost Your Chances of Securing a Second Loan

Securing a second loan may seem daunting when you already have outstanding debts. However, there are several strategies you can employ to increase your chances of approval.

✔️ Having a good credit score. In Singapore, the credit rating scale goes from 1000 to 2000. So, if your credit score is 1911 and above, you’ll most likely get a loan with favorable terms. Improving your credit score before applying for a loan is important.

✔️ Increase your source of income. To handle numerous debts simultaneously, a substantial source of income is essential. But if your current job falls short, seeking additional revenue streams can save the day. Perhaps consider taking up a part-time gig or kick-starting a small-scale business venture.

✔️ Borrow only what you need. Borrowing the maximum amount of a loan can be quite tempting. But as a responsible borrower, you should match the loan amount with your capacity to repay the debt.

✔️ Look for a cosigner. Another approach to boost your chances of getting another loan is to search for a co-signer. You can ask your parents or partner to be your cosigner for your loan so you can increase the getting your requested loan to get approved.

✔️ Shop for the best lender. There are a lot of personal loans being offered in Singapore and many of them have different terms and conditions. So, to save such precious time, it is best to visit at least 3 to 5 lenders. While doing so, compare their offer and pick the best personal loan for you.

Thoughts

Your financial standing is the key determinant of how many personal loans you can acquire. In Singapore, you’re allowed to take out unsecured loans for up to 12 times your monthly income. This regulation has been established to safeguard you against excessive borrowing.

As a borrower, it’s crucial to have the ability to repay your loans in full and on time. Only borrow what you genuinely require, whether it’s to cover unanticipated medical expenses, car repairs, or other significant life events.

Secure the Best Personal Loan Rates with Accredit Moneylender

Need a financial lifeline? Accredit Moneylender has got you covered. Get in touch with our licensed team to apply for the most affordable short-term loan in Singapore. At Accredit, we pride ourselves on being a reliable and above-board lender, committed to providing you with the lowest possible interest rates.

Choose Accredit for your personal loan needs and take control of your finances today.