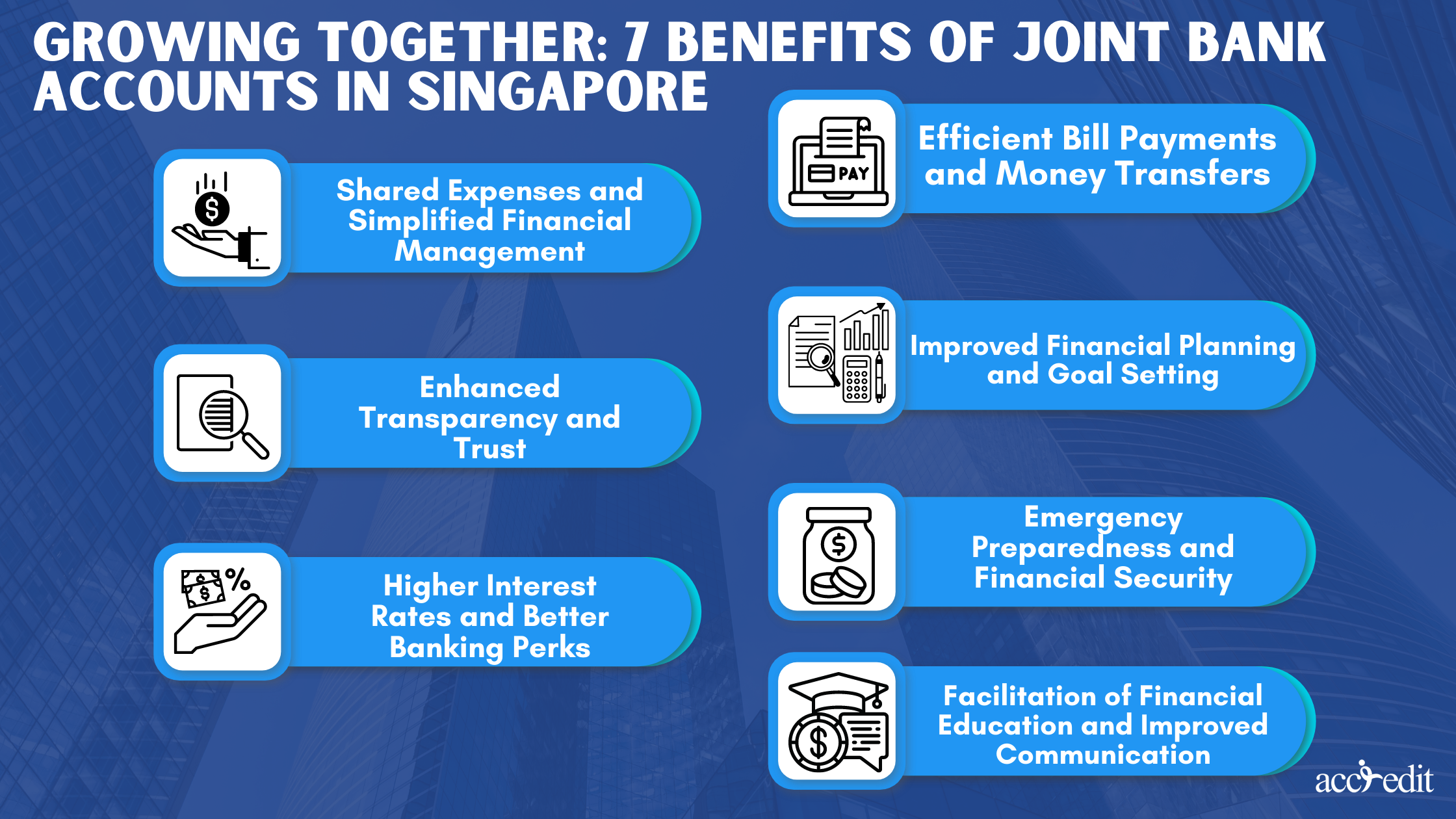

Have you ever considered opening a joint bank account in Singapore? Sharing a bank account with your partner, family member, or roommate can offer numerous advantages that make managing finances easier and more efficient. In this article, we’ll explore the top 7 benefits of having a joint bank account in Singapore. From simplified financial management to enhanced transparency and improved financial planning, a joint bank account can bring you and your loved ones closer to your shared financial goals.

1. Shared Expenses and Simplified Financial Management

Let’s talk about the perks of having a joint bank account. It’s like having a magic tool for effortlessly handling shared expenses. Whether you’re living with a roommate, sharing bills with your partner, or saving up for something big together, a joint account makes it all a piece of cake. Instead of dealing with multiple individual accounts, you can bring everything together in one cozy place. This means everyone chips in their fair share, with no more confusion, and definitely no missed payments.

Imagine this: You and your partner decide to plan a vacation. With a joint bank account, it’s a smooth ride. Both of you can effortlessly contribute to a special “vacation fund.” No more headache of coordinating separate transfers or keeping tabs on who owes what. It’s all simplified, so you can focus on what really matters—enjoying your time together without financial worries.

2. Enhanced Transparency and Trust

When it comes to nurturing a healthy relationship, be it with your loved ones or your hard-earned money, transparency plays a vital role. By opting for a joint bank account, you create an environment of openness and trust between all account holders involved. This means that everyone can easily see the ins and outs of each other’s finances – the money flowing in, the expenses, and even the savings.

Transparency brings immense benefits, especially when it comes to making financial decisions together. It allows for open discussions about your monetary aspirations, enables efficient budgeting, and provides mutual support in reaching those goals. The act of managing finances as a team cultivates trust and strengthens the bond you share, as you work hand in hand towards shared objectives.

3. Higher Interest Rates and Better Banking Perks

When it comes to having a joint bank account, there’s more to it than just convenience. You see, here in Singapore, banks often offer higher interest rates for joint accounts compared to individual ones. This means your hard-earned savings can grow at a faster pace, all thanks to these competitive rates designed especially for joint account holders.

But wait, there’s more! Many banks also shower joint account holders with exclusive benefits and perks. Imagine having those pesky fees waived, getting special rates for loans, and even gaining access to top-notch financial planning services. And that’s not all! You might also enjoy discounts on other banking products. By opting for a joint account, you open the door to a whole range of advantages that can truly enhance your overall banking experience.

4. Efficient Bill Payments and Money Transfers

Paying bills and sending money can be such a hassle, especially when you have multiple separate accounts. But guess what? If you have a joint bank account, you can make everything so much easier and quicker.

Imagine this situation: You and your roommate are in charge of paying the utility bills every month. Instead of each of you transferring money back and forth and then making the payments separately, you can both contribute directly to the joint account and settle the bills with just a few clicks. It saves you time, lowers the chances of forgetting or messing up payments, and keeps your financial flow smooth.

And that’s not all! When it comes to transferring money between joint account holders, it’s a breeze. Whether you’re repaying your partner for a shared expense or lending money to a family member, you can instantly transfer funds without any extra fees or annoying delays. This simple money transfer feature makes financial transactions a piece of cake and strengthens your financial relationships at the same time.

5. Improved Financial Planning and Goal Setting

Imagine this: you and your future business partner have this amazing idea of starting your own company one day. Now, having a joint bank account can actually simplify things for both of you. It allows you to set aside some money each month specifically for your “business fund.” This shared financial space becomes a convenient way to keep track of your progress, plan for the future, and ensure that both of you are actively working towards making your business goals a reality.

But wait, there’s more! Having a joint account also makes short-term goal-setting a breeze. It’s the perfect opportunity to start saving for that dream vacation you’ve always wanted. Maybe you’re putting money aside for your child’s college education or picturing yourself cruising in a shiny, new car. By regularly checking the progress of your joint account and setting clear goals, you can stay motivated and accountable for turning those dreams into reality.

6. Emergency Preparedness and Financial Security

Life has a way of surprising us, doesn’t it? It’s like going on a rollercoaster ride filled with unexpected twists and turns. But guess what? Even while it may not first seem all that exciting, there is a clever tip that might help you find some much-needed calm. Imagine this scenario: out of the blue, either you or your partner experiences a sudden job loss or a health crisis. Tough times indeed. However, if you have a shared bank account, both of you can immediately access your combined savings. It’s like having a safety net ready to catch you when life throws obstacles your way. By sharing the responsibility, both of you contribute to building a solid financial cushion.

7. Facilitation of Financial Education and Improved Communication

Having a joint bank account goes beyond managing money—it’s a gateway to financial education and better communication. It creates an environment where you can learn from each other, exchange financial insights, and make well-informed choices together.

Imagine this scenario: one partner knows a thing or two about investments or financial planning, while the other partner is still finding their way around. Through the joint account, the knowledgeable partner can share their wisdom, guiding their companion to develop their financial know-how. This shared learning experience not only deepens your bond but also equips both of you with crucial money management skills for the long haul.

But that’s not all. A joint account demands open communication about your finances. Regular discussions about budgeting, savings goals, and spending habits allow you to synchronize your financial values and make decisions that benefit you both. This improved communication ensures that everyone’s needs and aspirations are considered, leading to a more solid and prosperous financial journey together.

The Bottom Line

Having a joint bank account in Singapore can bring you a bunch of advantages that can really make a difference in your finances and strengthen your relationships. It’s all about making things simpler and more transparent when it comes to managing your money, as well as helping you plan for the future and reach your goals together. By pooling your resources, you can make the most out of interest rates, enjoy better banking perks, easily handle bill payments and money transfers, and the list goes on.

Of course, it’s important to think about the specific dynamics of your relationship and the financial goals you have in mind. If these benefits sound appealing and align with what you want to achieve, then opening a joint bank account could be a big step towards a secure and prosperous financial future together. Take some time to check out the options available from different banks in Singapore and find the one that suits your needs the best.

Introducing Accredit Moneylender: The Top Moneylender in Singapore

Listen up, folks. When it comes to securing your financial stability and staying ready for those unexpected curveballs life throws your way, having a shared account with your partner or buddy is just the starting point. But let’s be real, sometimes your budget just won’t cooperate with life’s surprises. That’s why it’s wise to have a backup plan, right alongside your main one.

Now, in the realm of financial affairs in Singapore, there’s one name that outshines the rest: Accredit Moneylender. Whether you need a business loan, want to consolidate your debts, or are after a short-term credit fix, our wide range of financial solutions has got you covered. And here’s the kicker, folks: our personal loans are in high demand and worth checking out.

So, what are you waiting for? Take a leap and explore the financial possibilities with Accredit Moneylender today.