Ready to seize control of your financial destiny? When it comes to effectively handling your wealth, finding the perfect ally is crucial. In Singapore’s thriving wealth management landscape, numerous choices abound for those yearning for expert advice and tailored solutions. Join us as we embark on an exciting quest into the realm of wealth management, uncovering the leading banks in Singapore that truly shine in this domain. Together, let’s set sail toward a future of financial triumph.

What is Wealth Management?

To fully grasp the significance of the top-notch wealth management banks in Singapore, it’s crucial to comprehend the essence of wealth management itself. Wealth management goes beyond traditional banking services. It encompasses a comprehensive approach to managing your finances, investments, and assets.

Specialized in catering to individuals with substantial net worth, wealth management banks offer an array of services meticulously designed to meet their unique needs. These encompass investment counsel, strategic financial planning, tax optimization, estate organization, and more. Armed with their expertise, these banks empower individuals to cultivate and safeguard their wealth, paving the path toward their financial aspirations.

How does Wealth Management Work?

Now that we’ve grasped the fundamentals of wealth management, let’s delve into its mechanics. Wealth management operates as a team effort, with financial advisors and relationship managers collaborating closely with clients. These professionals invest time in comprehending clients’ financial goals, risk tolerance, and individual situations. They then craft bespoke wealth management strategies that harmonize with these aspirations.

By blending financial analysis, market research, and specialized expertise, wealth management banks construct investment portfolios tailored to their client’s needs. Regular assessments and adjustments ensure investments remain on course, accounting for market shifts and personal circumstances. The client-bank relationship thrives on trust, open communication, and a mutual dedication to achieving enduring financial triumph.

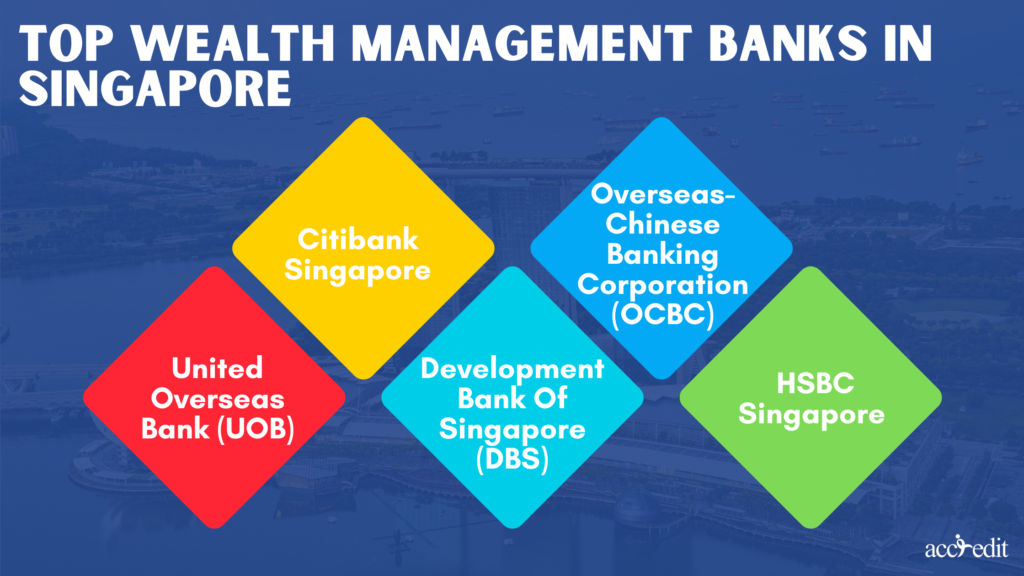

Top Wealth Management Banks in Singapore

United Overseas Bank (UOB)

When it comes to wealth management banks, UOB sets itself apart with an impressively low minimum qualifying AUM. With just S$100,000, you gain access to their personalized investment solutions, estate planning services, and a wide range of investment products. But that’s not all. UOB pampers its clients with an exceptional set of benefits.

Enjoy the expertise of a dedicated relationship manager, receive wealth advisory services, skip the queues with priority treatment, and receive preferential treatment at UOB branches throughout the island. Their team of relationship managers is devoted to providing valuable insights and guidance, ensuring your financial goals are not just understood, but also achieved.

Perks at a Glance:

- Get VIP treatment with priority queues and special services at UOB branches.

- Immerse yourself in a world of knowledge and connection through exclusive events, seminars, and workshop invitations that extend to your entire family.

- Celebrate your birthday in style with exclusive privileges and a handpicked selection of personalized offers and promotions.

Citibank Singapore

Behold Citibank Singapore, a mighty powerhouse among wealth banks in the Lion City. Boasting a staggering $282 billion in assets under management as of 2022, this financial titan commands respect with its colossal global footprint and expansive array of wealth management services. Melding an intimate grasp of local and international markets, Citibank Singapore harmoniously fuses worldly wisdom with a tailored touch.

Brace yourself for a diverse smorgasbord of investment choices, spanning access to global markets, structured products, and alternative investment avenues. Begin your investment journey with the coveted Citigold account, requiring a minimum of S$250,000 in investible assets.

Perks at a Glance:

- Experience the luxury of tailored guidance from a dedicated wealth manager

- Access a dedicated 24/7 customer service hotline for assistance and support

- Unlock exclusive access to lavish perks at the prestigious Citi Wealth Hub

Development Bank Of Singapore (DBS)

Say hello to DBS, the bank that not only ensures your financial safety but also unveils the finest wealth plans for esteemed high-net-worth clients. With a wide range of services that cover investment guidance, portfolio management, and financial planning, DBS offers a holistic approach to wealth management. Their team of experts crafts tailor-made strategies, taking into account the unique needs of each client.

Plus, DBS’s cutting-edge iWealth app grants you real-time access to your investments and financial insights, all at your fingertips. Delve into their specialized programs designed for clients with investible assets ranging from S$350,000 to S$5M and witness the transformative power of DBS Bank.

Perks at a Glance:

- Round-the-clock access to a digitized account for managing your investments independently

- Personalized coaching sessions through HSBC FinFit for your financial well-being

- Enjoy exclusive lifestyle perks like lounge access and concierge services

Overseas-Chinese Banking Corporation (OCBC)

For those seeking a consolidated approach to their substantial assets, OCBC emerges as an outstanding choice. With a remarkable 27-year presence in the industry, OCBC has crafted a management platform that offers a comprehensive overview of clients’ entire wealth landscape. By depositing or investing S$200,000 in fresh funds, you can unlock a world of possibilities.

OCBC goes beyond the ordinary, providing an extensive array of wealth management services. From investment advice and portfolio management to estate planning, their solutions cover every facet of your financial journey. Their team of devoted relationship managers is committed to delivering personalized attention and expert guidance, establishing enduring connections founded on trust and shared triumph.

Perks at a Glance:

- Stay in the loop and manage your investments round the clock with your wealth account

- Enjoy a comprehensive monthly wealth report with valuable insights

- Unlock exclusive lifestyle cards tailored to your preferences

HSBC Singapore

Step into the world of HSBC, a renowned global bank that offers a comprehensive range of wealth management services right here in Singapore. With its seamless blend of global reach and local expertise, HSBC caters to a wide array of investment options, providing access to international markets and alternative ventures.

Led by experienced wealth managers, HSBC understands the unique challenges and opportunities faced by individuals with significant assets. By meeting the S$200,000 AUM threshold or its equivalent in other currencies, you can unlock the doors to the HSBC Premier account and discover a realm of international wealth support and exciting possibilities.

Perks at a Glance:

- Stay in the know with HSBC’s online Wealth Dashboard, tracking your portfolio’s performance in real-time.

- Enjoy a range of digital wealth tools at your fingertips, making it effortless to manage your finances round the clock.

- Get personalized coaching sessions through HSBC FinFit to help you achieve your financial goals.

The Bottom Line

Selecting the ideal wealth management bank in Singapore is a high-stakes decision. With UOB, Citibank Singapore, DBC, OCBC, and HSBC as the top contenders, you have plenty of options. Take a moment to assess your needs, align your financial goals, and carefully consider the advantages each bank offers.

Keep in mind that wealth management is a collaborative journey. Finding a bank that truly understands your ambitions and provides tailored solutions and expert guidance is crucial. Set sail on this expedition with unwavering confidence and let Singapore’s leading wealth management banks guide you towards financial success.

Discover the Reliable Choice: Accredit Moneylender

So, you’ve familiarized yourself with the top wealth management banks in Singapore? You’ve mastered the art of wealth strategy and protection. But what about those unexpected financial bumps on the road?

When the going gets tough, there’s one name you can trust: Accredit Moneylender. They provide hassle-free personal loans in Singapore, granting fast approvals and fair interest rates. Whether it’s an unforeseen medical emergency or an irresistible craving for the latest shiny gadget, you can rely on Accredit Moneylender for an instant solution.

Don’t let financial worries hold you back. It’s time to take charge of your circumstances and embrace the convenience and speed that Accredit Moneylender brings to the table.