When it comes to your creditworthiness in Singapore, ignorance is not bliss. A wise borrower knows what influence their credit score, and one of those factors is their credit report. Today, we delve into the depths of personal loans and how they can impact your credit report. If you’re a borrower in Singapore, don’t miss this enlightening read.

What is a credit report?

Your credit report speaks volumes about your creditworthiness. From your payment habits to your credit utilization, it’s all in there. This detailed report is what lenders rely on to decide whether you’re a safe bet or not. Credit bureaus like Credit Bureau Singapore (CBS) collate information from banks, financial institutions, and utility companies to create these reports.

What is a personal loan?

For those personal expenses that demand quick funding, personal loans are the ultimate panacea. From home renovations to medical bills, a personal loan offers you the flexibility to utilize the funds as per your requirements. The best part? You don’t have to put your home or car on the line as collateral. But beware, personal loans can come with higher interest rates compared to secured loans.

Is it true that personal loans are reflected in your credit report in Singapore?

Yes, it’s true – personal loans can show up on your credit report in Singapore. Lenders will closely examine your credit history when you apply for a loan, using it as a measure of your reliability. An impressive credit score can improve your chances of approval and secure lower interest rates.

Your credit report lays bare the nitty-gritty details of your personal loan, disclosing vital information such as repayment history, loan duration, and principal amount. Timely repayments can elevate your credit score, but any defaults can harm it.

How do personal loans affect credit scores?

Understanding how personal loans affect your credit score is crucial in today’s lending landscape.

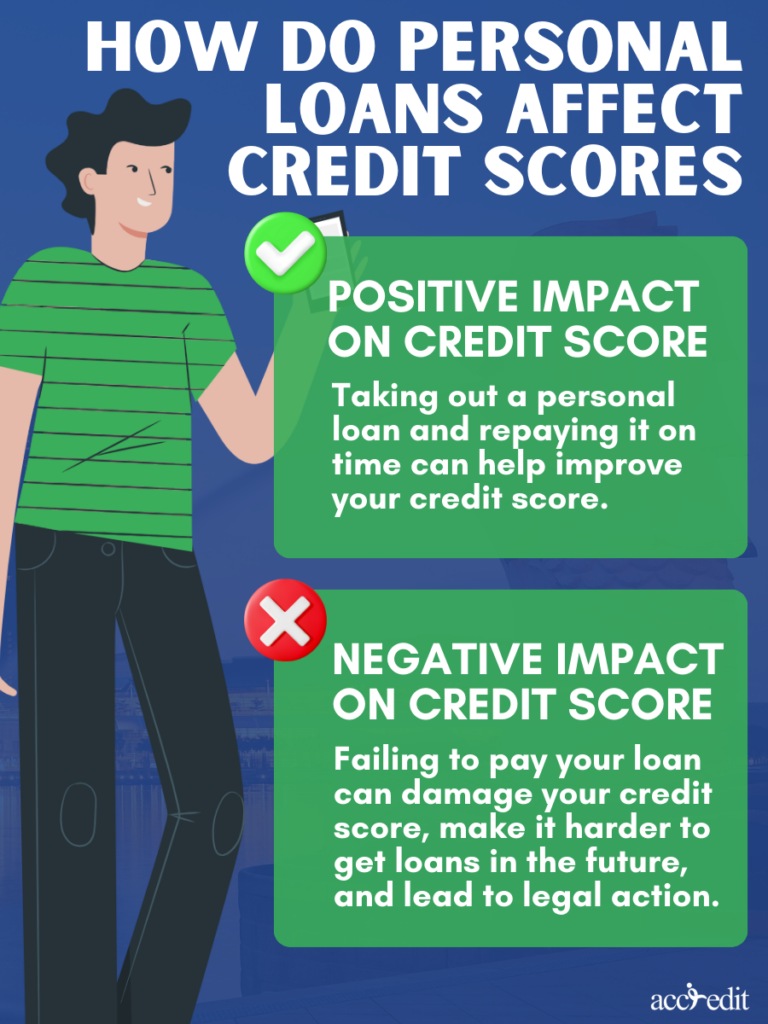

The positive impact of personal loans on credit scores

Are you tired of feeling like your credit score is working against you? Here’s some good news: taking out a personal loan and repaying it in a timely manner can actually have a positive impact on your creditworthiness. When you exhibit responsible borrowing behavior, lenders sit up and take notice. As your credit score climbs, you gain access to better loan and credit card opportunities.

The negative impact of personal loans on credit scores

The consequences of neglecting to pay your personal loan aren’t pretty. Missed payments and defaulting on the loan can bring down your credit score and signal a lack of accountability, which can hurt your chances of being approved for loans and credit cards in the future. But the harm doesn’t stop there. Defaulting can lead to legal action and debt collection efforts that make your life difficult.

Tips for managing personal loans and credit reports

To maintain a solid credit score and improve your prospects of being approved for loans, managing your personal loans and credit reports efficiently is a must. The following advice will help you become a credit management pro:

- Make timely payments: Delay or default in payments can adversely affect your credit rating. Hence it’s important to ensure timely remittance to avoid accruing unnecessary charges and fines. One effective approach is establishing automatic payment arrangements, guaranteeing you never overlook any payment deadlines.

- Manage your credit utilization: The credit utilization ratio is the proportion of credit you use relative to the credit available to you. Keeping a low credit utilization ratio can boost your creditworthiness. As a general rule, refraining from using over 30% of your available credit is recommended to preserve a good credit standing.

- Monitor your credit reports frequently: With regularity, carefully examine your credit reports for any misstatements, inconsistencies, or unauthorized transactions. This empowers you to resolve any inquiries or discrepancies expediently.

- Use credit wisely: Avoid taking on more debt than you can afford to repay. If you have multiple loans, contemplate merging them into a single loan to simplify your payment obligations.

Thoughts

The truth is crystal clear: in Singapore, your personal loan is visible on your credit report. Timely payments are vital if you want to avoid sabotaging your credit score. To maintain a positive credit score and boost your chances of future loan and credit card approvals, keep tabs on your credit report and rectify any inaccuracies. As a borrower, taking responsibility and managing your debt with care is imperative to keeping your credit score in tip-top shape.

Accredit Moneylender: The Key to Unlocking Your Credit Score Potential

Ready to unlock the full potential of your credit score? Look no further than Accredit Money Lender. Our application process is hassle-free, ensuring speedy approval so you can start making timely payments and watch your credit score soar. Our short-term loans are accessible to all, regardless of credit history, making us the go-to lender for those in urgent need of cash. Don’t let poor credit hinder your progress any longer.

Choose Accredit Money Lender and take the first step towards financial freedom today.