Applying for a personal loan after a mortgage in Singapore seems like a changeling task, but it is still doable. The trick is to understand the responsibility of managing multiple loans and to make sure you are financially capable of paying on time.

Defining the differences between a mortgage and a personal Loan

Personal loans offer an array of financial possibilities for consumers seeking to fund their dreams, whether it’s home renovations, a shiny new engagement ring, or a globetrotting adventure.

Unlike a mortgage, personal loans usually don’t require collateral as security. However, expect to pay a high-interest rate and repay the loan within one to five years (and sometimes 7 years, depending on the lender).

Conversely, a mortgage, often known as a house loan, gives you the ability to acquire your ideal home without tapping into your funds. In contrast to personal loans, mortgages are secured loans where the residence itself acts as security.

Should you default on your mortgage, the lender has the authority to seize control of the property. Mortgages normally have lower interest rates than personal loans and give a longer payback term, often spanning over 25 to 30 years.

| Loan | Personal Loan | Mortgage |

| Security | Usually unsecured | Secured by property |

| Interest Rate | High | Low |

| Loan Term | 1-5 years (sometimes 7) | 25-30 years |

| Purpose | Flexible (home renovation, travel, etc.) | Home Purchase |

| Collateral | Not required | The property acts as collateral |

| Default | No property seizure but has an impact on credit score | Property seizure in case of default |

| Amount | Lower maximum amount than mortgages | Higher maximum amount than personal loans |

| Approval | Easier to get approved for smaller amounts | More stringent |

Can I apply for a personal loan after a mortgage?

To apply for a personal loan after a mortgage, your current financial situation is critical. Applying for another loan too soon after taking out a large one may harm your credit score.

Also, taking out multiple loans might have additional negative effects, as it might adversely impact your debt-to-income ratio and other factors.

Lenders pay close attention to your DTR when evaluating personal loan applications, so it’s important to be mindful of the impact of multiple loans on your financial standing. They need to see if your income can cover not only one but two debts at the same time. If your DTR is high, you’ll definitely get your personal loan denied by your lender.

In addition, handling multiple loans might raise a red flag for the lender’s attention due to the fact you have a high potential to make missed payments or, worst, default on your loan.

Such action can lead to hefty consequences for your credit score and future credit plans.

But don’t lose hope just yet. For the most sensible outcome, you should wait more than three months before applying for a personal loan. This gives you breathing room to get your financial affairs in order.

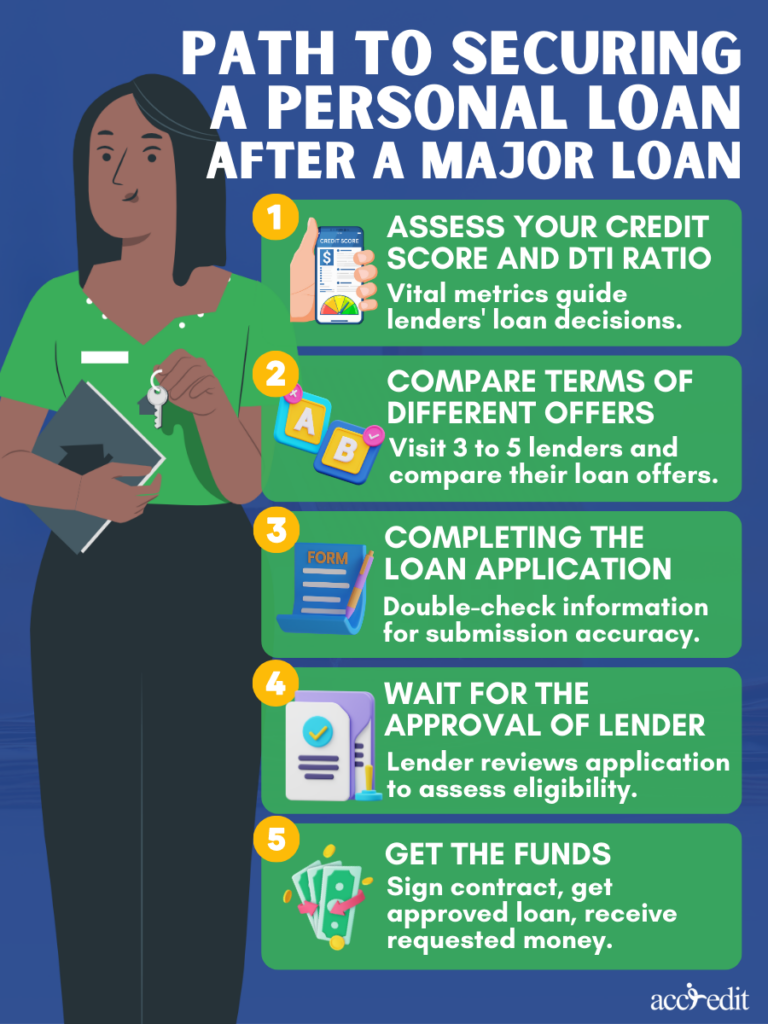

The Path to Securing a Personal Loan After a Major Loan in Singapore

Steps to follow if you desire to apply for a personal loan after securing a mortgage in Singapore are as follows:

Step 1: Assess Your Credit Score and Debt-to-Income

Before setting out to obtain a personal loan, it’s essential to assess your eligibility by scrutinizing your credit score and debt-to-income ratio. These crucial metrics provide lenders with the vital data they require to make an informed decision on your loan application.

Step 2: Compare the terms of different loan offers

It is important to spare some time to search for the best personal loan in Singapore. To do this, you should visit at least 3 to 5 lenders and compare their loan offers. It is in your best interest to look for a loan with cheap rates and affordable loan amounts.

Step 3: Completing the Loan Application

After finding a suitable loan, the next step is to complete the loan application form. Ensure you double-check all information before submitting to guarantee accuracy.

Step 4: Wait for the announcement of the lender

Once you’ve handed in your loan application, the lender will commence their review of your details and supporting documents to determine your eligibility for the loan. This period of evaluation may take anywhere from one day to several, depending on the lender’s processes.

Step 5: Get the funds

If the lender approves you for a loan, you will need to sign the contract detailing the interest rate, repayment schedules, and other fees. After you affix your signature, you will receive the money you requested.

Thoughts

To apply for a personal loan after securing a mortgage in Singapore is an option, but it is important to consider your financial situation carefully. Can you manage multiple debts at the same time? Seeking the advice of a financial counselor is wise, as taking on a personal loan should be a well-informed decision, not a rash one.

The Ideal Source of Funding in Singapore – Accredit Pte Limited

When it comes to sourcing funds, you can never go wrong with Accredit Moneylender. The top choice for anyone in need of a personal loan, Accredit prides itself not only as a trusted but also as a licensed moneylender with flexible loan options.

Our staff treats each client like a dear friend, offering the best possible advice to suit your needs. We ensure that all our staff fully comprehend the regulations governing money lending so that we can serve you better.