Unemployment is an unwelcome and often unexpected curveball in life. With expenses piling up and unforeseen costs lurking around the corner, taking out a personal loan may seem like a last resort. But what options do you have as a jobless individual in Singapore?

Fear not, for there are still loan opportunities available to you, even without a steady source of income. While traditional banks may have stringent requirements, including a steady job, alternative solutions are available. One of the most popular among jobless individuals in Singapore is obtaining a personal loan from a licensed moneylender.

An Explanation of Licensed Moneylenders in Singapore

Licensed moneylenders are financial institutions that provide loans to individuals and businesses without the constraints of strict regulations. This flexibility makes them an attractive option for borrowers who may not meet the qualifications for a loan from a traditional bank.

Additionally, licensed moneylenders offer prompt approval and disbursement of funds, a critical advantage for those in need of money quickly but without a job.

In Singapore, the Registry of Moneylenders oversees the operations of licensed moneylenders to ensure the protection of borrowers. Before considering a loan from a licensed moneylender, due diligence is crucial to choose a reputable lender who abides by all necessary regulations.

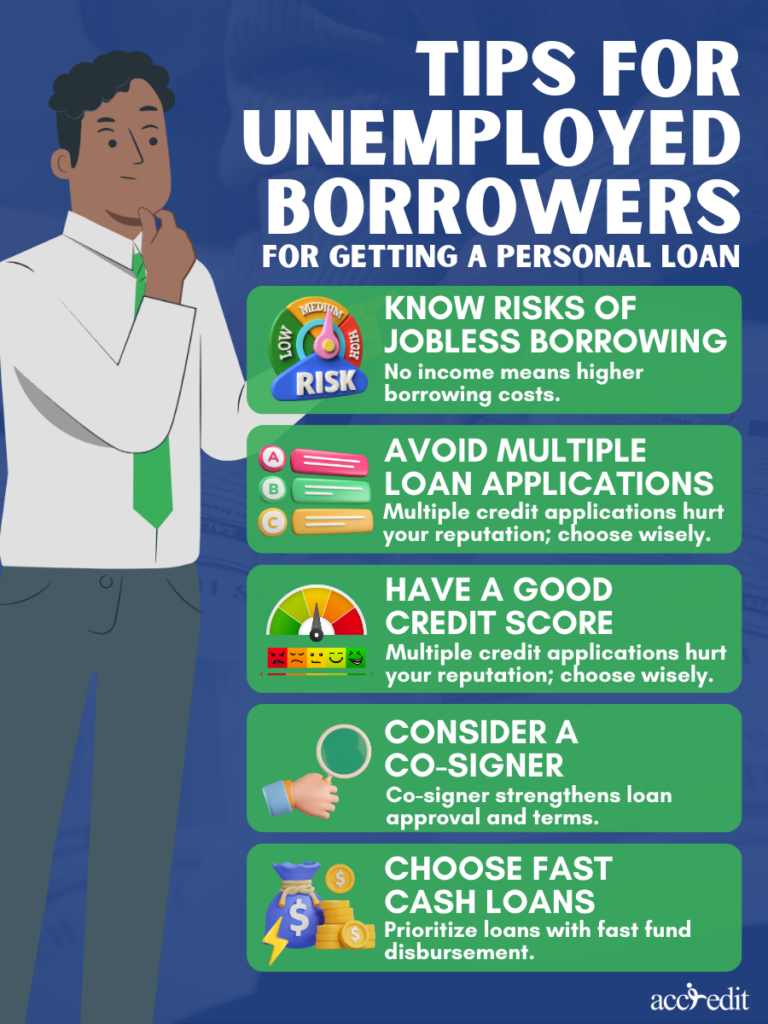

Tips for Unemployed Borrowers for Getting a Personal Loan

If you’re considering a personal loan as an unemployed individual, there are a few things you should keep in mind to increase your chances of approval:

Know the risks of borrowing money without a job. The absence of a steady income source can result in the imposition of elevated interest rates and fees, multiplying the already substantial risk associated with borrowing money. It is imperative to be fully aware of these potential consequences and to proceed with caution.

Avoid making multiple loan applications. Making multiple applications for credit can tarnish your reputation, as each inquiry is recorded on your credit report and can bring down your score. This, in turn, lessens your likelihood of being approved for a loan, so choose wisely.

Have a good credit score. Your credit score is a testament to your financial responsibility, and with a score that shines, you can unlock a world of opportunities in loan approval. From favorable loan terms to increased chances of approval, a sterling credit score is key to unlocking the door to your financial future.

Consider a co-signer. By joining forces with a financially secure co-signer, you present a united front of stability and increase your chances of securing a loan. Not only does this increase the odds of approval, but it may also lead to better loan terms, making your financial journey that much smoother.

Pick loans with quick cash disbursement. For those with pressing financial needs, finding a loan that promises quick disbursement of funds is critical. Consider this a priority in your search and make it a requirement in your loan agreement.

How to Secure a Loan When You’re Unemployed?

Acquiring a personal loan sans a steady cash flow may seem like an insurmountable challenge. Yet, fret not, for here are some measures that you can undertake to augment your chances of obtaining loan approval.

| Step 1 Search for a Personal Loan | Step 2 Complete the Loan Application Form | Step 3 Await Loan Approval |

| Start by researching licensed moneylenders that extend loans to those without jobs. Be sure to compare interest rates, terms, and conditions before settling on a lender. | Accuracy and comprehensiveness are key when filling out your loan application. Any inaccuracies can result in rejection. | If your loan is approved, it’s critical to make timely payments to safeguard your credit score and make future loan approvals more accessible. |

Thoughts

Even if you’re jobless, obtaining a personal loan from conventional banks might be more challenging. Nonetheless, Singapore has other possibilities available via authorized moneylenders that provide more flexibility, prompt disbursement of funds, and fewer prerequisites.

However, borrowing money without a steady income has risks, so proceed with caution. By performing your due diligence, preserving an excellent credit score, contemplating a co-signer, and selecting loans with rapid cash disbursement, you may boost your odds of obtaining a personal loan as an unemployed person in Singapore.

The Best Choice for Personal Loans – Accredit Moneylender

Need a financial lift? No worries – Accredit Moneylender has got you covered. Our crew of authorized specialists provides the most cost-effective solution for short-term loans in Singapore. Plus, we cater to Singaporeans and foreigners alike who are 21 or older, employed, and have income proof – no need for a solid credit rating.

Reach out to us today to kick off your application and pave the way to financial independence.