As a devoted homemaker in Singapore, your plate is already full of household chores and other duties. There are expenses that require financial support, from paying bills to putting food on the table, and personal loans may just be the perfect solution to your financial woes. But pause for a moment, can you even qualify for one?

Maybe you’re thinking, “Can a housewife secure a personal loan in Singapore?” Fear not, for in this piece, we will delve into the various factors that can influence your eligibility for a personal loan.

Understanding Personal Loans

Let’s define terms before we get into how stay-at-home moms in Singapore might obtain personal loans. A personal loan, in its most basic definition, is an unsecured loan that may be used for anything from consolidating debt to funding home improvements.

One attractive feature of personal loans is that no collateral is usually required to get one. If you have a high credit score and consistent income, you have already cleared one major hurdle in being authorized for this loan.

Eligibility Criteria for Personal Loans

Before you take the leap and apply for a personal loan in Singapore, it’s important to ensure you meet the necessary eligibility requirements. Here are the key criteria that lenders usually look for:

- You must be a citizen of Singapore or have permanent residency.

- You must be at least 21 years old.

- Most lenders require a minimum annual income of between S$20,000 to S$30,000, but this may vary.

- A good credit score and history are essential to increase your chances of approval.

Can a Homemaker Get a Personal Loan?

Now that you’re up to speed on personal loans, let’s address a pressing matter: Can a homemaker successfully secure a personal loan in Singapore? The answer, in short, is yes—but it’s no easy feat. Lenders may hesitate to green-light a homemaker’s loan application due to the lack of a steady income. Furthermore, a homemaker may have a less-than-stellar credit history (or none at all), which could further diminish their chances of approval.

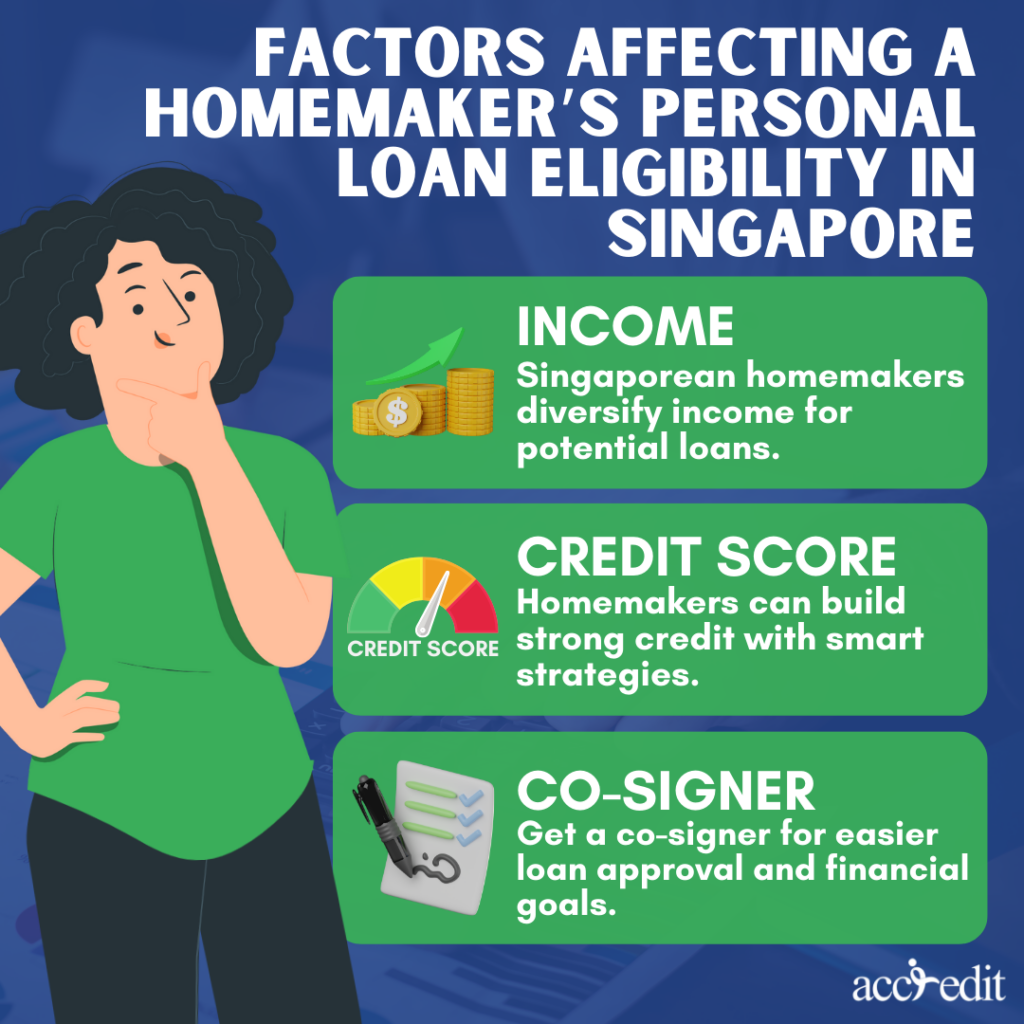

Factors Affecting a Homemaker’s Personal Loan Eligibility in Singapore

If you’re a homemaker in Singapore seeking a personal loan, there are several crucial factors that can make or break your eligibility. Let’s delve into what these are:

Income

Sure, Singapore’s homemakers might not receive a steady paycheck, but that doesn’t mean they’re completely devoid of income. In fact, rental income, investment income, and freelance income are just a few of the viable income streams they may be tapping into. And if you can provide concrete proof of a reliable income source, lenders just might be willing to entertain your personal loan application.

Credit Score

Despite not having a regular paycheck to rely on, homemakers can still have a rock-solid credit history. In fact, there are numerous methods to establish a credit profile that exudes reliability. For instance, consistently paying bills, loans, and credit cards punctually can make a huge difference. Another technique is to jumpstart your credit by becoming an authorized user on a credit card belonging to a family member..

Co-signer

Securing a loan can be a challenging feat, but there is a way to increase your chances of approval. The solution? A co-signer. This individual is financially reliable and will vouch for your loan application, giving lenders the confidence needed to approve your request. The result? Your financial goals become a reality. With a co-signer, you can rest assured that your loan is secured and your dreams are within reach.

Loans Available to Homemakers in Singapore

Financial assistance is within reach for homemakers in Singapore, thanks to a variety of loan options. Singapore’s trusted licensed moneylenders extend loans to homemakers in various forms, including co-signed loans, secured loans, and informal income-based loans.

If a homemaker opts for a co-signed loan, a trustworthy family member or friend acts as the guarantor for their loan application. A secured loan, on the other hand, necessitates collateral such as property or assets to secure the loan. Lastly, an informal income-based loan can be granted based on a homemaker’s earning potential from various sources.

Risks of Borrowing from Loan Sharks

When it comes to obtaining funds, steering clear of loan sharks is imperative. These unregulated lenders often target individuals, particularly housewives, who fail to meet the criteria for loans from legitimate sources. The penalties for being indebted to these nefarious characters far outweigh the benefits of their monetary assistance. Thus, it’s best to avoid such hazardous transactions altogether.

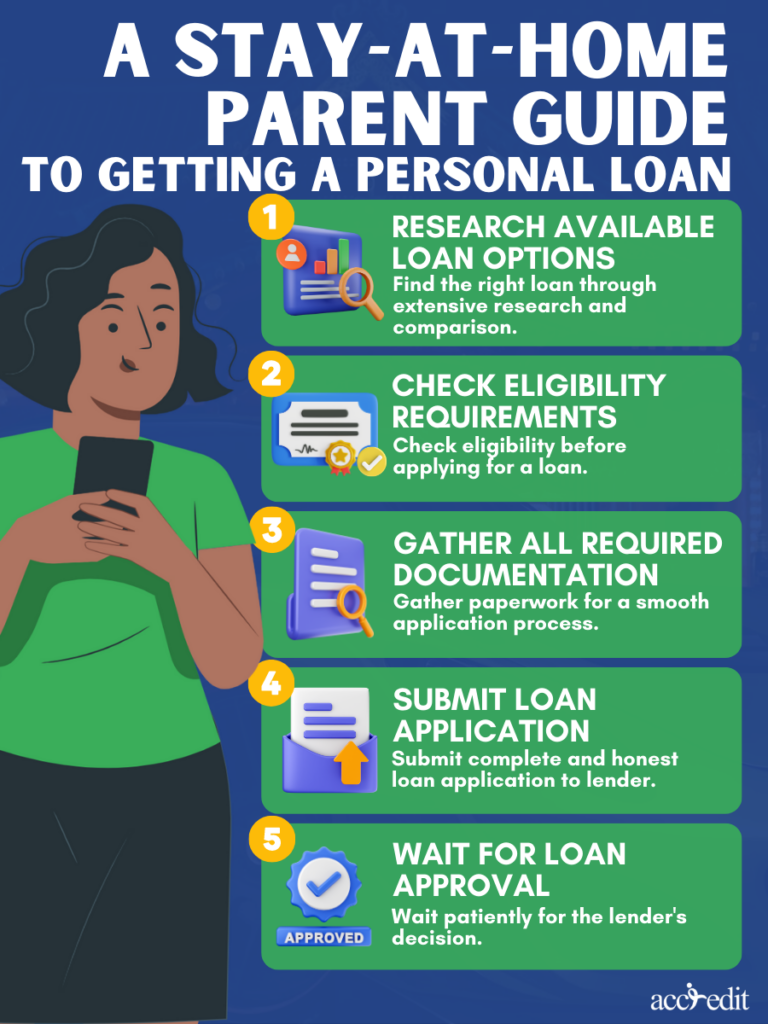

A Stay-at-Home Parent Guide to Getting a Personal Loan

If you’re a homemaker who needs a personal loan in Singapore, follow these steps to increase your chances of approval:

Step 1: Research available loan options

The key to finding the perfect personal loan for your specific financial needs lies in conducting thorough research on the available options. By delving deep into interest rates, fees, and terms offered by various lenders, you can make an informed decision about which loan suits you best. It’s worth exploring lenders who cater to low-income or credit-challenged borrowers as they may be more amenable to approving your application.

Step 2: Check eligibility requirements

To prevent needless application denials and expedite the loan process, you need to ascertain that you satisfy the lender’s eligibility criteria before submitting your personal loan application. The minimum requirements are being at least 21 years old, being a Singapore citizen or permanent resident, and having a minimum income.

Step 3: Gather all required documentation.

Collect all the essential paperwork, including your personal details, credit history, and other pertinent documents, to expedite a smooth and hassle-free application process. Lenders prioritize financial accountability in their clients; therefore, having all the relevant data readily available demonstrates your competence and reliability.

Step 4: Submit loan application

Having successfully located a lender and assembled all the requisite paperwork, it’s time to submit your loan application. The application may be submitted electronically or in person, depending on the lender’s specifications. Be sure to complete the application precisely and honestly.

Step 5: Wait for loan approval

After the exertion of submitting your loan application, there comes a time for stillness and anticipation. It’s a moment to exercise patience and trust in the lender’s decision-making process. All you can do now is to await their final verdict.

The Bottom Line

Do not let the fact that you are seen to be a parent who stays at home prohibit you from exploring the possibilities of receiving a personal loan.

Maximize your chances of loan approval by showcasing a strong credit score, a dependable source of income (like from a small business), or having a trusted co-signer.

Because of the variety of personal loan products out today, it’s wise to do some comparison shopping before committing to one. With some planning and research, you can find get the funds you need to reach your financial goals.

Personal Loans Made Affordable by Accredit Moneylender

Struggling to keep up with financial obligations? No sweat – Accredit Moneylender has got you covered. Our team of licensed experts offers the most economical solution for short-term loans in Singapore. We welcome both Singaporeans and foreigners over the age of 21, employed, and with proof of income – without requiring a spotless credit record.

Get in touch with us now to initiate your application and unlock the path to financial autonomy.