Attention, foreign workers in Singapore! Have you ever found yourself facing an unexpected emergency that calls for a significant amount of money, leaving you feeling helpless and alone?

Don’t despair, for there’s a glimmer of hope shining in the distance. That hope? A personal loan. But perhaps you’re wondering, “Am I even eligible for one?” Don’t worry; in this article, you’ll be to find out the answer regarding this matter.

Personal Loans: The Versatile Financial Tool You Need to Know

What exactly is a personal loan? Well, it’s not like the loans that require you to pledge your beloved car, house, or jewelry, as collateral. Instead, your creditworthiness and repayment capability are the determining factors.

But wait, there’s more!

What makes personal loans even more appealing is their flexibility. You can utilize them for a wide array of purposes, whether to address unexpected expenses or fund your long-awaited travel plans. With a personal loan, you can embrace new opportunities and handle unexpected challenges with ease.

Can a foreigner apply for a personal loan?

The answer is yes – you most certainly are!

To begin the process, you need either an S-Pass or an E-Pass, which establishes your legality to work and reside in Singapore. But that’s not all – it’s crucial to provide evidence of your financial stability and capacity to repay the loan. By demonstrating your fiscal responsibility to the lenders, you increase your chances of getting the personal loan you need.

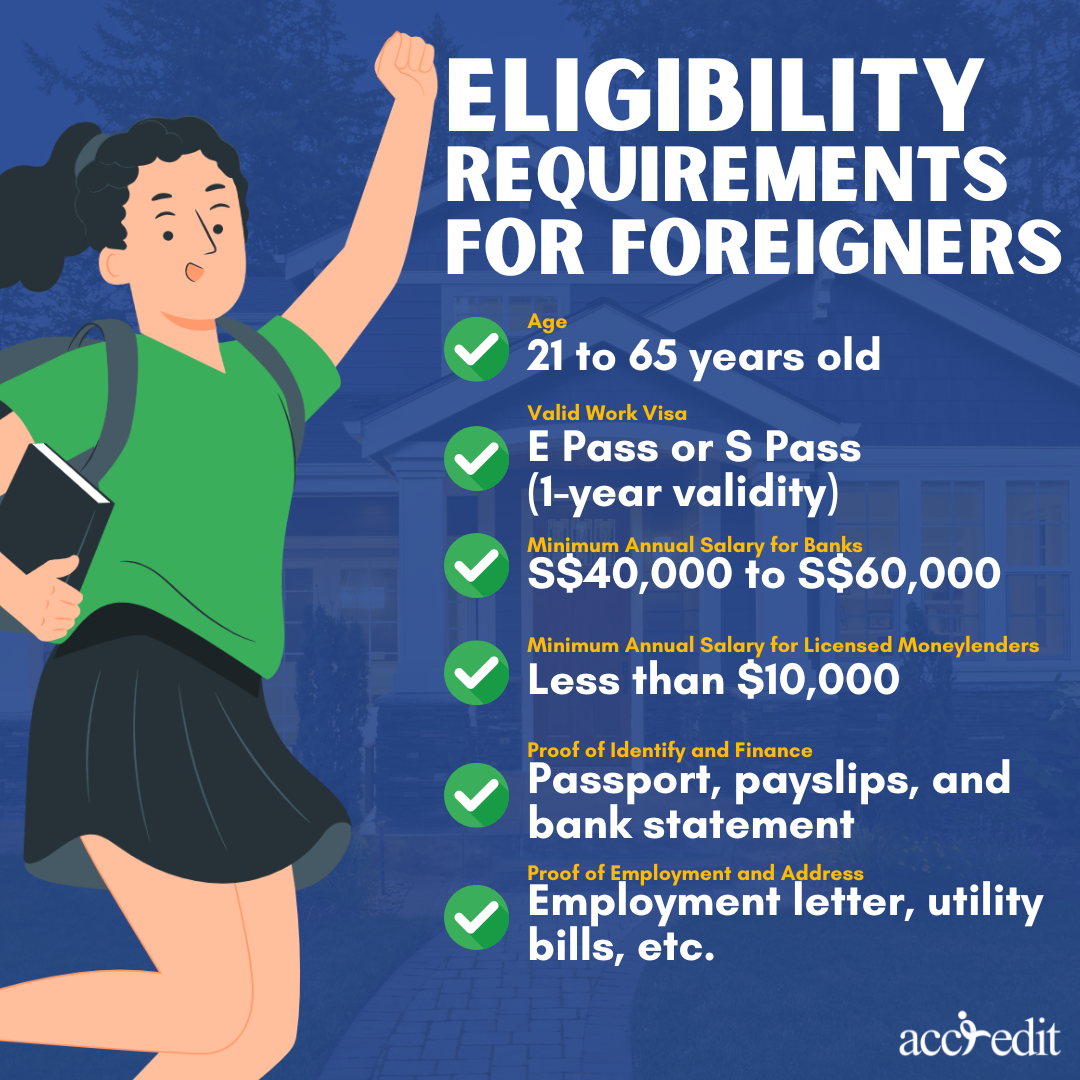

Eligibility Requirements for Foreigners

It’s important to remember that the eligibility criterion for a personal loan might vary based on the lender you choose, but in general, you should meet the following criteria.

Where Can a Foreigner Get a Personal Loan in Singapore?

As a foreign resident in Singapore, securing a personal loan may seem like a daunting task. But there are lenders that provide the best offers if you look hard enough.

Banks

For those in need of a secure place to stash away their hard-earned cash, banks are a natural choice. Their extended repayment periods and reduced interest rates make them a crowd favorite, offering financial peace of mind.

Licensed Moneylenders

During moments of financial hardship, conventional banks may pose an obstacle, but take heart, licensed moneylenders offer a solution to your woes by providing speedy access to the funds you need. Their adaptability means that loan requests from individuals earning less than $S10,000 per year are approved, providing a glimmer of hope for those who are struggling to stay afloat.

Personal Loan Options in Singapore for Foreigners

Numerous lenders extend their services to foreign nationals seeking personal loans in Singapore. Refer to this comprehensive list to identify the ideal loan provider that caters to your specific financial requirements.

| Personal Loan | Interest Rate | Minimum Yearly Income | Loan Amount | Loan Tenure |

| Accredit Personal Loan | Up to 4% per month | S$10,000 or less | S$500 for individuals earning S$10,000 or less per year S$3,000 for individuals earning between S$10,000 and S$20,000 per year 6x your monthly income for individuals earning over S$20,000 per year | 12 Months |

| HSBC Personal Loan | 4% (EIR 7.5% p.a.) | S$40,000 | 4x your monthly salary, up to $100,000 | 1 to 7 years |

| DBS/POSB Personal Loan | 3.88% (EIR 7.9% p.a.) | S$45,000 | 4x your monthly salary; 10x if your income is $120,000 and up | 1 to 5 years |

| Standard Chartered CashOne | 3.48% (EIR 7.99% p.a.) | S$60,000 | 4x your monthly salary; cap at S$250,000 | 1 to 5 years |

| OCBC ExtraCash Loan | 5.43% (EIR 11.47% p.a.) | S$45,000 | 6x your monthly wage | 1 to 5 years |

Which Loan Provider is the Most Suitable for Foreigners?

HSBC Personal Loan is one of the leading banks that can work well with foreigners. It has one of the lowest required incomes of S$40,000 and the cheapest rates of 4% (EIR 7.5% p.a.) in the market. It also offers the longest loan term in Singapore at seven years, which makes getting a high loan amount more affordable.

If obtaining a personal loan from a traditional bank is not an option, you may consider Accredit. They offer loans to those with lower annual incomes, often below S$10,000. With interest rates as low as 4% and loan amounts reaching up to six times a borrower’s monthly income, Accredit provides a path to securing the funding you need.

Moneylenders are Not “Ah longs” nor “Loan Sharks.”

In Singapore, licensed moneylenders turned out to be operating for many years. With their help, many people are easing their financial difficulties. However, people tend to misunderstand “money lenders” once they hear it. They usually associate moneylenders with “ah longs” or loan sharks.

To avoid misunderstanding, the Singaporean Government is making efforts. They’re managing the conditions of getting a loan from licensed moneylenders. They set a monthly interest rate cap of 4% to protect the borrower and lender’s rights.

Additionally, you can find a list of registered moneylenders in Singapore on the Ministry of Law website. This not only ensures a fair and transparent lending environment but also helps to identify unlicensed lenders.

The Bottom Line

Singapore welcomes foreigners who seek personal loans to manage their financial needs. The process may seem overwhelming with multiple lenders vying for your attention, but with proper qualifications and documentation, you can access the funds you need.

To obtain the desired funds, you can peruse different alternatives, including authorized moneylenders, banks, or financial establishments. The choice of lender ultimately lies in your hands, and with the right approach, you can secure a personal loan that meets your unique needs.

Best Foreigner Loan Provider– Accredit Moneylender

In search of a swift financial boost? Accredit Moneylender is the ultimate solution for foreign personal loans. We take pride in our reputation as a trustworthy moneylender and offer the most affordable interest rates in the metropolis. Say goodbye to financial constraints hindering your progress.