Calling all brave and ambitious SME owners in the enchanting Lion City of Singapore! Prepare yourself, my dear friend, because with the best SME bank account in Singapore, your startup dreams will become business triumphs!

Impossible? Nothing is impossible, especially when you finish this exhilarating journey of unravelling the hidden treasures of the finest bank accounts proficiently tailor-made for small and medium-sized enterprises!

Say goodbye to all those mundane financial solutions and steady yourself for a whirlwind adventure with the best banks in Singapore that offer the best SME bank account that fits your entrepreneurial dreams like a glove and many a personal loan option too. Get ready to be empowered and enlightened!

The Best SME Bank Account in Singapore for New SMEs: DBS Business Multi-Currency Account

In this age of modern technology, an SME owner has to come prepared by being knowledgeable and using the best tools you can get your hands on. Now, imagine stepping into a digital wonderland where banking meets magic.

There can be one SME bank account in Singapore that’ll fit your needs, and that’s the DBS Business Multi-Currency Account. It welcomes fledging entrepreneurs with open arms and offers an extraordinary realm of banking innovations.

You will have real-time account access and the power to conquer online payments effortlessly, managing your finances delightfully. But what’s more exciting is that’s not all! You gain:

- The world because you hold SGD and twelve other currencies with one account!

- Singaporean citizens or PR with companies in Singapore, you’re instantly eligible for an account once approved.

- 50 GIRO and 50 free FAST monthly

- Unlimited Free GIRO and FAST for Starter Bundle

- On the anniversary of opening your account, annual account fees are debited.

- Telegraphic Transfer, GIRO, and fast transactions are debited on the 22nd month.

OCBC Business Growth Account: Best SME Bank Account in Singapore for Nurturing Startup Success

Do you see yourself as a visionary SME owner?

It’s no rocket science that nothing is more thrilling than seeing your startup bloom like your favourite flower as it flourishes. For an SME oracle like yourself, and you seek to nurture your growing business, the OCBC Business Growth Account is your golden ticket to success.

With this SME bank account, you acquire a comprehensive suite of banking services. You will genuinely love and enjoy the experience with this bank account for your SME because:

- FAST and GIRO are up for grabs, and all-you-can-use transactions are on the house.

- Once you open an account, you can instantly enjoy the “Exclusive Welcome Offer”, which includes cashback and free perks!

- You can now monitor the business trends hassle-free and effortlessly through your OCBC business app!

- With your SingPass, you can open the best SME bank account in Singapore with OCBC instantly online.

- Free debit card and get 1% cashback!

With the OCBC Business Growth Account, you can rely on it having your back every step of the way. Imagine the possibilities when you combine flawless banking transactions with valuable bonuses and rewards designed exclusively for enthusiastic SMEs!

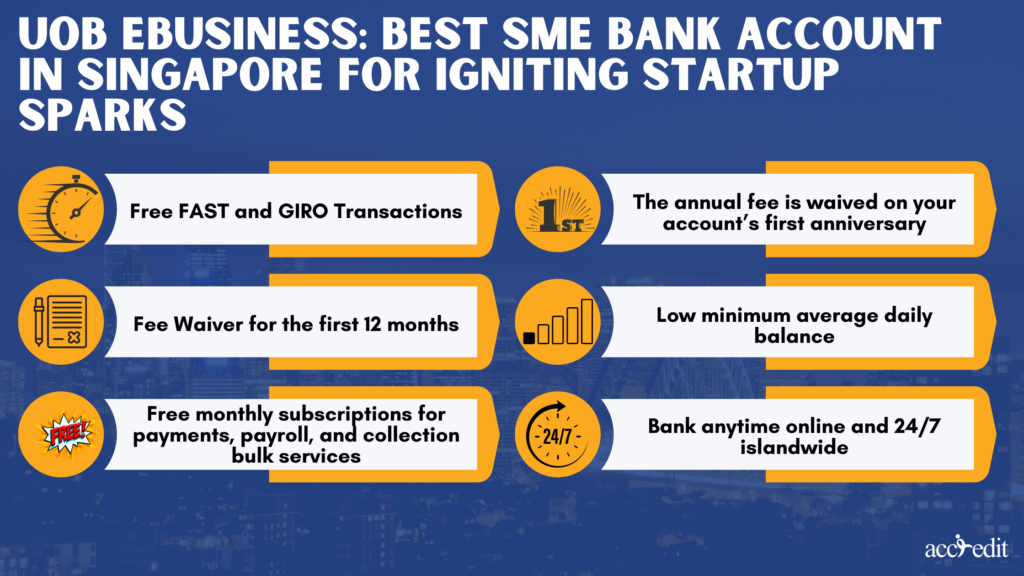

UOB eBusiness: Best SME Bank Account in Singapore for Igniting Startup Sparks

The realm of startups has many diverse challenges. That is given; thus, you must always go beyond what’s expected and surpass even your expectations. For an ambitious SME like yourself, you deserve the best SME bank account in Singapore that matches your soaring endeavours.

You can only attain it through the UOB eBusiness Bank Account. It’ll boost your agility further, which is essential in the SME game. If you’re searching for a true game-changer, especially in the earlier stages of your business journey, this is it!

UOB particularly understands the unique obstacles that are faced mainly by startups. As a result, the bank crafted and dedicated a remarkable bank account for you where you can enjoy the benefits of:

- Free FAST and GIRO Transactions

- Fee Waiver for the first 12 months

- Free monthly subscriptions for payments, payroll, and collection bulk services

- The annual fee is waived on your account’s first anniversary

- Low minimum average daily balance

- Bank anytime online and 24/7 islandwide

With the UOB eBusiness bank account, you can thoroughly relish the convenience of online account management and access a dedicated relationship manager who will guide you on the path to success. Let your entrepreneurial spirit take flight as you reap the advantages of UOB’s enchanting rewards program.

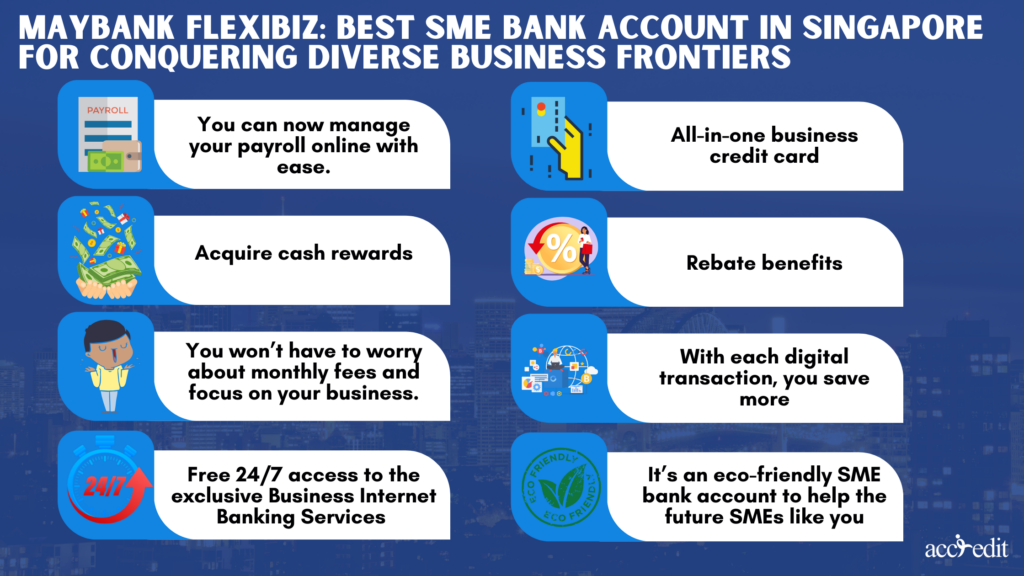

Maybank Flexibiz: Best SME Bank Account in Singapore for Conquering Diverse Business Frontiers:

There’s no other way to disprove it; diversity reigns supreme when it comes to business. Sit back and relax because you will now meet the Maybank Flexibiz. It’s possibly the most versatile ally that can suit your multifaceted SME like yourself.

Like a chameleon adapting to its surroundings, Maybank Flexibiz presents a comprehensive range of banking services that can accommodate your business as your brand and span various industries. With the Maybank Flexibiz, you can unleash your entrepreneurial powers of:

- You can now manage your payroll online with ease.

- Acquire cash rewards

- You won’t have to worry about monthly fees and focus on your business.

- Free 24/7 access to the exclusive Business Internet Banking Services

- All-in-one business credit card

- Rebate benefits

- With each digital transaction, you save more

- It’s an eco-friendly SME bank account to help the future SMEs like you

With the Maybank Flexibiz Account, you have the power to focus on your business while enjoying effortless account management, international payments, and trade financing. This user-friendly online platform equips you with the tools to conquer any business frontier and revel in the boundless possibilities.

Personal Loans: A Helping Hand for SMEs in Singapore

Running an SME is no small feat, and sometimes, a financial boost is much-needed to tackle unexpected challenges and fuel growth. Regarding personal loans, seeking proficient moneylending services from Accredit Licensed Moneylender can be a wise choice.

Accredit understands Singapore’s SMEs’ unique needs and offers customer-centric loan solutions that align with your business objectives. Reliable and trustworthy, Accredit acts as a helping hand during critical; moments in your entrepreneurial journey.

Conclusion

Congratulations, dear entrepreneurs, on completing this whirlwind adventure through the world of Singapore’s best SME bank accounts! As you’re now armed with insights and knowledge, you’re equipped to make a conscious decision that will propel your business to new heights.

So, go forth, conquer the business world, and remember, your story’s success starts by choosing the best SME bank account in Singapore for you!