Many people in Singapore have different aspirations, whether to become a successful professional or a business tycoon. All motivations are diverse, yet lacking funds can alter one’s choices. So, choosing between banks vs licensed moneylenders would be best to attain your financial goal.

These businesses grant financial assistance are the primary options for people in Singapore. But you may need clarification about where you should borrow money from.

Let’s discover more about the loan transaction distinctions between banks vs licensed moneylenders in Singapore below.

Lender Choices for Loans in Singapore

It’s true that Singapore’s among the prime countries that grant excellent professional and business opportunities to its communities. Thus, many people desire to visit the country.

But along with the country’s exceptional fame, the concerns regarding the high standard of living are also growing. So you need cash yet cannot decide which lender you must choose?

Two specific financing and moneylending services can assist in solving your money problems. You are welcome to visit and compare banks vs licensed moneylenders when you require cash.

Both of these establishments belong to the industry of finance. And both have distinct loan approaches in providing their services to you.

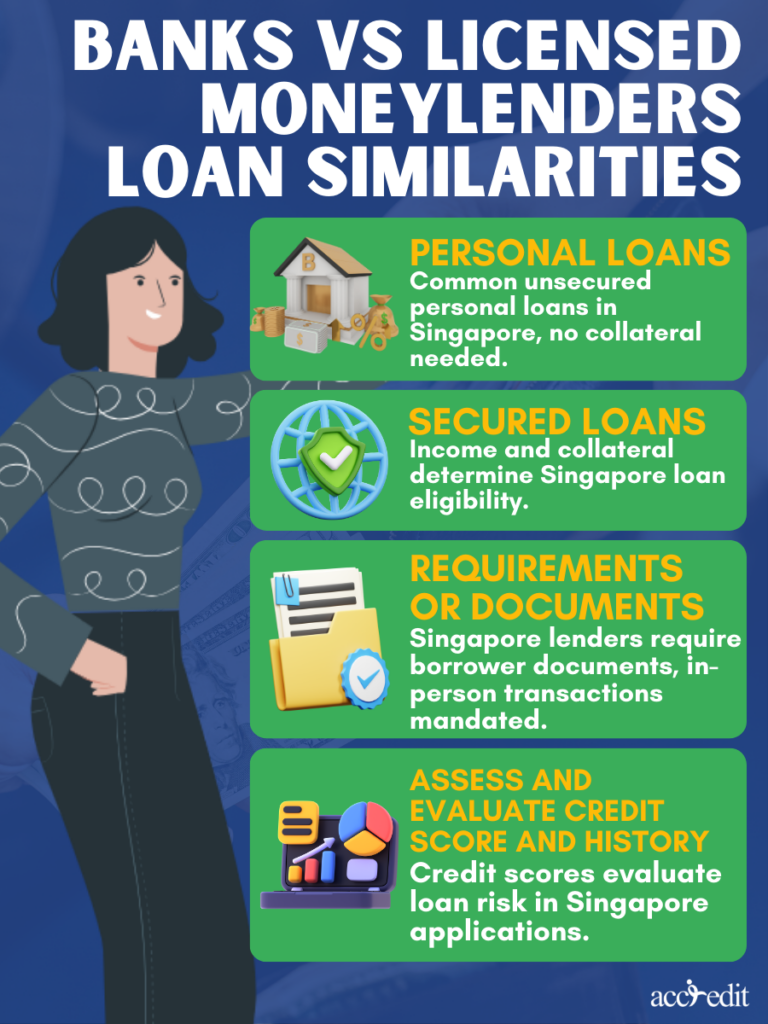

Banks VS Licensed Moneylenders Loan Similarities

Banks and moneylenders in Singapore are often the “go-to” financial businesses for different types of loans. Although these enterprises have definitive diversities, these have similarities you can consider.

Personal Loans

Personal loans are considered the most common categorisation of loans many Singaporean communities apply for. It’s because the funds accessible from a personal loan are noticeably smaller than other credit brackets.

Banks and licensed moneylenders in Singapore provide personal loans to interested borrowers. Personal loans in Singapore are the same as unsecured loans. The notion for this financing approach is that borrowers like you have no obligations to collateralise the personal loan.

What falls under the collateral classifications?

These would be properties, precisely, real estate, different types of vehicles, assets, investments, etc. Banks and licensed moneylenders approve personal loans without such collateral.

Secured Loans

It is a fact that banks and licensed moneylenders in Singapore can proffer secured loans to their clients. It usually depends on the annual income of the prospective borrower. For instance, a debtor has to provide proof that they have a yearly income of at least $20,000 to be qualified for secured loans.

In addition to the annual income, borrowers must supply the collateral for the loan approval to push through.

Requirements or Documents

Most banks and licensed moneylenders in Singapore require documents from their borrowers. These documents could differ depending on the financial business a debtor’s applying for a loan. Nevertheless, most of these prerequisite documents are personal data of the borrower like name, address, work pass, proof of employment and income, SingPass, etc.

What’s more, an additional yet crucial requirement is the presence of the borrower at the bank or the licensed moneylender’s office.

Due to the law, all debtors must make and fulfil their business transactions with banks or licensed moneylenders in Singapore in person. Failure to do so could lead to sanctions on everyone involved in the transaction.

Assess and Evaluate Credit Score and History

Everyone in Singapore is subject to having their credit scores and history assessed and evaluated as they apply for a loan from banks and licensed moneylenders. The standard operating procedure profiles the probability that the borrower might be a high-risk or low-risk loan defaulter.

Who is a loan defaulter?

These individuals cannot commit to their legal responsibilities and repay what they owe to banks or licensed moneylenders in Singapore.

A person’s credit score and history are under the Personal Data Protection Act 2012. Credit history and scores are subject to fair use and disclosure, especially when the individual wants to borrow from banks and licensed moneylenders.

The credit scores’ risk range is usually from AA to HH. Those noted as the lowest-risk defaulters belong to the AA group and have a score range 2000. Individuals considered high-risk defaulters fall to the HH risk grade with a score range of 1000.

Banks VS Licensed Moneylenders Loan Differences

Now it’s time to discuss the loan transaction differences between banks vs licensed moneylenders in Singapore. These two financial businesses have varying approaches, which play a big part in getting new clients or loyal borrowers.

Banks VS Licensed Moneylenders Regulations

Banks are under the sector as institutions that specialise or operate as deposit-taking, merchant, entire banks, wholesale, and finance companies. The Monetary Authority of Singapore, or MAS, regulates and authorises banks in Singapore. In addition, all banks are motivated to honour and abide by the Banking Act of 1970.

Institutions in the banking sector have a crucial role in Singapore’s local and regional financial growth, trade, and infrastructure.

Licensed moneylenders in Singapore belong under the Ministry of Law Singapore and abide by the Moneylenders Act 2008 and its Rules. The practice of moneylending in Singapore is to give or supply different kinds of services, goods, and cash to debtors. The debts are mostly repaid in a specific yet high-interest rate percentage over a shorter period of repayment contract.

The Ministry of Law has since regulated the Registry of Moneylenders to list all licensed moneylenders in Singapore. You can access the licensed moneylender’s business name, address, contact number, official website, and licence number. You can easily find Accredit Money Lender there, one of Singapore’s most reliable and trustworthy licensed moneylenders.

The Registry commits to assisting borrowers in choosing legitimate moneylending companies in the country. It’s a practical approach to lessen the troubles related to unlicensed moneylenders, Ah Long, or loan sharks.

Banks VS Licensed Moneylenders Loan Interest Rate and Charges

The numerous differences between banks and licensed moneylenders loans in Singapore include interest rates and charges.

Currently, the interest rate banks can impose ranges from 3.46% and may reach more than 10% per annum. The interest rate and charges depend entirely on the bank’s calculations, creditworthiness, minimum income, and supporting policies.

For the licensed moneylenders in Singapore, the Ministry of Law and Moneylenders Act has stipulated that from the 1st of October 2015, the monthly interest rate they may charge you is 4%. The application of the regulation shall be the fixed maximum interest rate regardless of the debtor’s monthly income and whether it is a secured or unsecured loan.

The fees licensed moneylenders in Singapore are permissible to implement should be at most $60 monthly for late payments. Also, it mustn’t exceed 10% of the principal loan when granted. The court designates the legal costs in response to the licensed moneylender’s loan recovery and successful claim.

Banks VS Licensed Moneylenders Loan Speed Transaction

One of the most crucial aspects borrowers consider when searching for a suitable loan provider is transaction speed. Of course, it may depend on personal needs. Nevertheless, most borrowers in genuine need of cash prefer a faster process and loan transaction.

For banks in Singapore, the timeframe for loan approval could take a few days. It might fall from between five or up to a week, solely on business days.

Banks are also stern when it comes to a borrower’s qualifications. If a bank finds the slightest discrepancy, the loan might be declined or won’t be approved the soonest time possible.

On the contrary, licensed moneylenders in Singapore can provide a same-day loan process and transaction. In truth, it won’t even take a whole day.

Sometimes, some moneylenders can approve the borrower’s request for a loan in 45 minutes or less. But, it usually happens when the borrower has prepared all the necessary documents.

Smaller Loans

Banks provide loans to their clients, but these business institutions usually prefer giving out bigger or secured loans. These would entail collateral and a more significant ROI. The average maximum loan amount accessible from banks is up to twelve times the borrower’s monthly salary.

Licensed moneylenders in Singapore focus on modest loan amounts, like personal loans. As the amount is smaller, borrowers can get the funds they require more accessible and repay it faster. The maximum loan amount licensed moneylenders disburses is up to six times the borrower’s monthly wage.

Banks VS Licensed Moneylenders Loan Credit Assessment

A troubled credit score or history is a plague for anyone who necessitates cash for personal or business needs.

Banks are stringent on credit assessment and evaluation. When credit reports are acquired, and they see the borrower as an ideal match to their policies and pose as a high-risk defaulter, loan rejection may happen.

Although credit scores have a massive role in assessing a person’s capacity for repayment commitments to financial institutions, licensed moneylenders are more forgiving.

However, they would require the borrower to have at least significant proof of decent income or be associated with a reliable guarantor to approve the loan request.

Banks VS Licensed Moneylenders Loan Accessibility

Banks are accessible for one to five business days. But they may cut banking transactions short because of holidays, national events, and other occasions that would persuade banks to pause their operations officially. Due to this, banks can only process loans after on specific time frame.

For licensed moneylending in Singapore, these businesses are mostly open on weekends. In addition, they may hold operations even on certain national holidays, events, or occasions. So, prospective clients and borrowers may obtain the money they need.

Final Thoughts

Regardless, borrowing funds requires you to be responsible for your obligations. Assess banks’ vs licensed moneylenders’ loan similarities and differences.

Remember the diverse interest rates, speed of transaction, maximum loan amount, credit score evaluation and accessibility. Compare all these details to guarantee you’re pursuing a loan transaction process that fits your preference more.

Also, remember that failure to pay either of these financing businesses could lead to punishments that’ll rob you of a better future and future loan transactions. Be a responsible borrower; these companies will grant you the loan assistance you need.

Choose wisely between banks vs licensed moneylenders loan transactions in Singapore. But, if you need a personal loan, you can always turn to Accredit Money Lender. Expect a loan transaction that’s quick, customer-focused, and transparent service. Apply now and obtain the cash you need!