If you’re a Singapore resident and got cash cravings to cover your expenses, from debts to home revamps, you’re in the right place. But here’s the rub – you may wonder if any banks in Singapore can offer you personal loans without a cap. The truth is, it’s unlikely to find a bank in Singapore that provides personal loans without borrowing limitations.

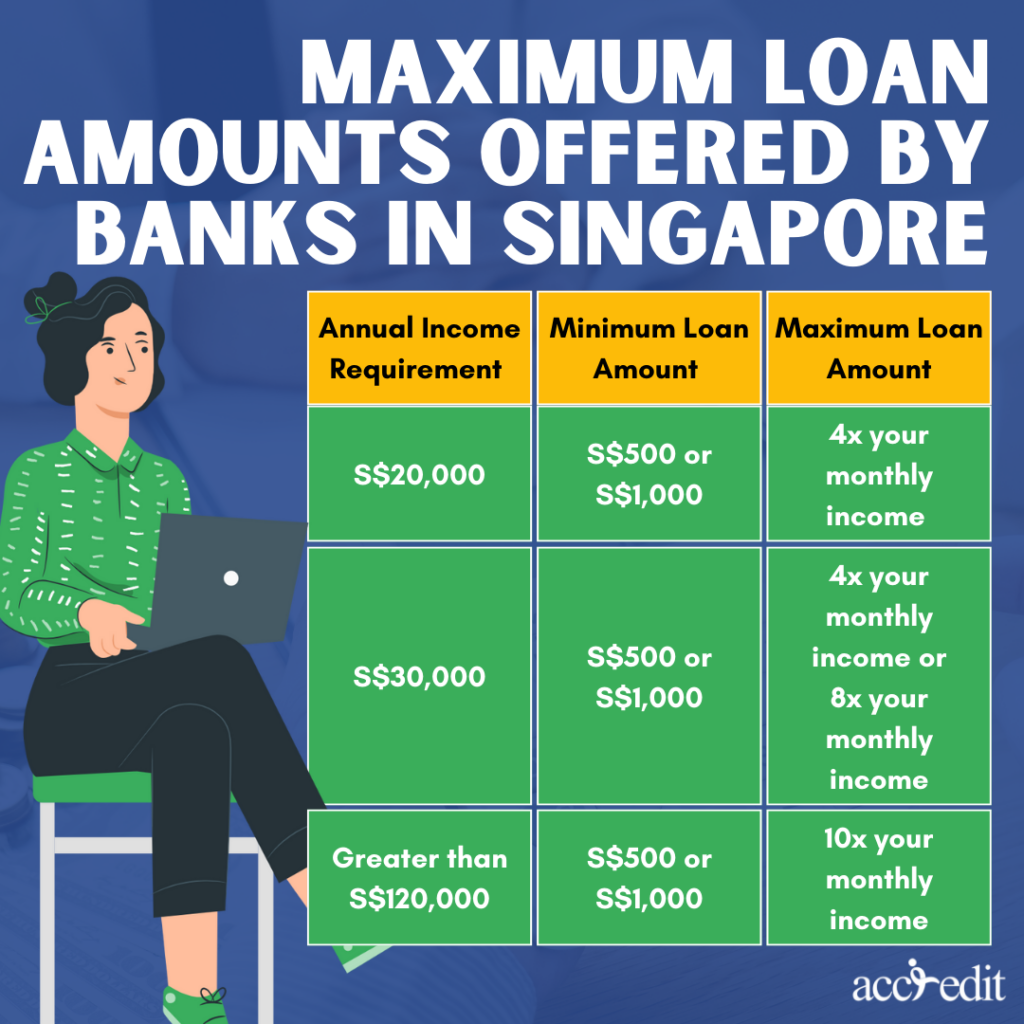

Maximum Loan Amounts Offered by Banks in Singapore

While the exact loan amounts offered by banks in Singapore will vary depending on the lender, most banks have a maximum loan amount that they are willing to offer borrowers.

For those earning an annual income between S$20,000 and S$30,000, lenders generally permit a loan amounting to up to four times their monthly earnings. Conversely, if one’s yearly compensation exceeds S$120,000, the loan limit can skyrocket up to 10 times their monthly pay.

| Annual Income Requirement | Minimum Loan Amount | Maximum Loan Amount |

| S$20,000 | S$500 or S$1,000 | 4x your monthly income |

| S$30,000 | S$500 or S$1,000 | 4x your monthly income or 8x your monthly income |

| Greater than S$120,000 | S$500 or S$1,000 | 10x your monthly income |

Comparison of Banks in Singapore

If you’re seeking a large loan, personal loans may not offer the amount you require. Fortunately, several banks in Singapore offer high loan amounts to meet your financial needs. Consider the following banks for their competitive offerings:

Standard Chartered CashOne Personal Loan

The Standard Chartered Bank presents a personal loan package that could be the answer to your financial needs. This loan offers a range of loan amounts, from SGD 1,000 to SGD 250,000, depending on your income requirements.

You’ll enjoy a competitive interest rate of 3.48% (EIR 7.99% p.a.), which allows you to repay the loan comfortably. Plus, you can choose a flexible loan tenure of up to 5 years, giving you ample time to settle the loan.

| Interest Rate | From 3.48% p.a. |

| EIR | From 7.99% p.a. |

| Minimum Annual Income | S$20,000 |

| Maximum Loan Amount | 2X your monthly salary for a yearly income of S$20,000 4X your monthly salary for a yearly income of S$30,000 8X your monthly salary for a yearly income of S$120,000 and above |

| Loan Tenure | 1 – 5 Years |

UOB Personal Loan

UOB presents a fantastic solution for those seeking personal loans with a credit limit that can go up to 95%. The interest rate, an affordable 3.99%, makes the loan an attractive option, with an effective interest rate of 7.49% per annum. Also, the loan term can be extended to 5 years.

| Interest Rate | 3.99% p.a. |

| EIR | 7.49% p.a. |

| Minimum Annual Income | S$30,000 |

| Maximum Loan Amount | 95% of CashPlus credit limit |

| Loan Tenure | 1 – 5 Years |

OCBC Personal Loan

OCBC’s Personal Loans offer a powerful way to achieve financial independence. You can borrow up to six times your monthly salary, providing you with the flexibility to pursue your aspirations. Take advantage of the attractive interest rate of 5.43% (EIR 11.47% p.a.) and utilize our personal loans to fulfill your financial needs without draining your bank account.

| Interest Rate | 5.43% p.a. |

| EIR | 11.47% p.a. |

| Minimum Annual Income | S$20,000 |

| Maximum Loan Amount | 6x your monthly salary |

| Loan Tenure | 1 – 5 Years |

HSBC Personal Loan

A compelling solution to your financial needs, HSBC’s personal loan presents a flexible option for individuals seeking a maximum loan amount of 8 times their monthly salary or up to SGD 200,000. With an interest rate of 4% (EIR 7.5% p.a.) and a loan term that can stretch up to 7 years, this loan offering promises to be a reliable solution to address your financial concerns.

| Interest Rate | 4% p.a. |

| EIR | 7.5% p.a. |

| Minimum Annual Income | S$30,000 |

| Maximum Loan Amount | 8X your monthly salary, up to $200,000 |

| Loan Tenure | 1 – 7 Years |

DBS/POSB Personal Loan

DBS/POSB offers an impressive loan cap of up to 10 times your income; if you earn over $120,000, you can access the funds you need for various purposes. At an attractive interest rate of 3.88% (EIR 7.9% p.a.), you can repay the loan with ease without breaking the bank.

| Interest Rate | 3.88% p.a. |

| EIR | 7.9% p.a. |

| Minimum Annual Income | S$30,000 |

| Maximum Loan Amount | 10X your monthly salary, if your income is $120,000 and up |

| Loan Tenure | 1 – 5 Years |

Factors Affecting Personal Loan Amounts and Eligibility

Numerous factors are considered by banks when evaluating personal loan applications. These factors include your credit score, income level, employment history, and existing debts. Familiarizing yourself with these elements can assist in identifying the most suitable loan package that meets your financial requirements.

Income Level

A borrower’s income level serves as a critical factor that can either make or break their chances of obtaining the desired amount. Typically, lenders perceive higher income levels as an indication of a borrower’s capacity to repay loans, thus increasing the likelihood of being granted larger loan sums. Conversely, lower income levels could lead to reduced loan amounts or even loan application rejection.

Credit History

Your creditworthiness is an ever-present concern, and the ability to tell a captivating credit story can enhance your chances of obtaining a personal loan with favorable interest rates. Demonstrating a history of punctual payments and sensible borrowing habits can play a significant role in gaining access to the finances you require.

Existing Debt Obligations

When contemplating a personal loan application, it is vital to acknowledge the impact of your current debt obligations on your likelihood of being approved. Credit card debts and unsettled loans may raise concerns for lenders, who assess your debt-to-income ratio to ascertain your capacity to accommodate added repayments.

Loan Tenure

The duration of your loan is a critical factor that requires careful consideration. Your monthly payments and the total interest incurred will be significantly influenced by the loan term. Although extending the loan tenure may reduce your monthly payments, it will inevitably result in a higher overall interest cost during the loan’s lifespan.

Interest Rates

When it comes to personal loans, interest rates wield immense power. They determine the cost of borrowing and can significantly impact your finances. It is imperative to carefully evaluate and compare interest rates in order to identify the most cost-effective and budget-friendly loan option available to you.

The Bottom Line

Although it may seem like there are no banks in Singapore willing to offer personal loans without a cap, there are still several alternatives for borrowers looking to secure a large sum of money. By delving into the realm of personal loan alternatives such as licensed moneylenders, you can discover a financing option that perfectly suits your requirements and aids you in attaining your monetary targets. However, always bear in mind the crucial elements we’ve highlighted, and conduct thorough research to guarantee that you’re making an informed borrowing decision.

Accredit Moneylender – Your Solution for Alternative Lending Options

In Singapore, if you require a loan that exceeds the maximum amount offered by banks, you don’t have to worry. There are alternative lending options available that you can explore. Licensed moneylenders are one such option that you can consider. They are authorized by the Ministry of Law to provide loans to borrowers.

At Accredit Moneylender, we offer an effortless personal loan application process that guarantees you fast access to funding. As long as your annual earnings exceed S$20,000, you can borrow up to six times your monthly income. This is a great option if you’re facing unexpected expenses or money troubles.