Unlocking one’s potential and achieving success on both personal and professional fronts heavily rely on education. Yet, the skyrocketing expenses associated with higher education in Singapore present formidable financial hurdles. Nevertheless, fret not, for education loans emerge as a beacon of hope for those yearning to chase their academic dreams. In this article, we shall delve into the rationale behind embracing an education loan in Singapore and how it empowers students to conquer financial roadblocks.

Understanding Education Loans in Singapore

Money can be a significant stressor for pupils when it comes to furthering their education. Thankfully, education loans can be a godsend, as they provide financial relief for expenses like textbooks, workshops, and other academic essentials. Unlike secured loans, these loans are unsecured, which means that borrowers do not need to risk their assets.

Education loans have the potential to revolutionize the educational landscape in Singapore by empowering students to pursue their academic aspirations without financial anxiety. These loans give students the ability to prioritize their education and minimize money concerns.

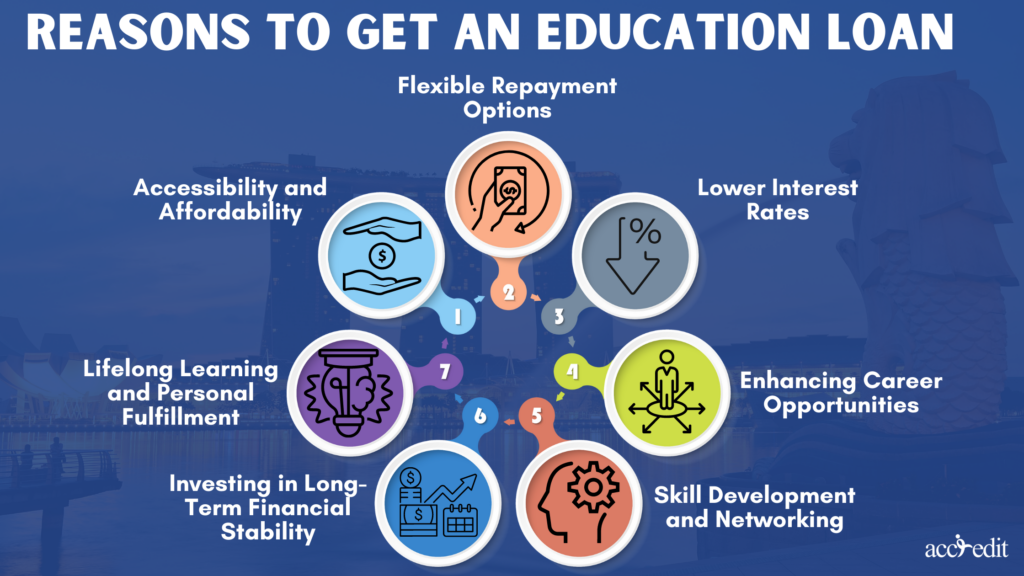

Reasons to Get an Education Loan

Having acquainted yourself with the concept of an education loan, let us explore the compelling reasons that advocate obtaining this financial assistance.

1. Accessibility and Affordability

In Singapore, the pursuit of higher education brings forth considerable financial challenges. The costs encompass tuition fees, accommodation, and the overall cost of living. Overcoming these formidable expenses can seem like an insurmountable endeavor. However, an essential solution emerges in the form of education loans. By extending financial aid to students, these loans break down the barriers to accessibility, enabling individuals from all walks of life to embark upon their chosen academic paths at their preferred institutions.

2. Flexible Repayment Options

One of the captivating aspects of education loans in Singapore is their remarkable adaptability to suit individual borrowers’ needs. These loans provide a distinct advantage by presenting tailored repayment options that correspond harmoniously with the borrower’s financial position. Through the customization of monthly installments, borrowers can effortlessly manage and alleviate the burden of loan repayment.

Additionally, select education loan providers offer grace periods, granting borrowers the flexibility to delay repayment until after graduation or upon acquiring stable employment. With such accommodating features, education loans empower borrowers to navigate their repayment journey with ease and peace of mind.

3. Lower Interest Rates

When it comes to financing higher education, education loans present a unique advantage due to their more affordable interest rates. These favorable rates make education loans a cost-effective option for funding academic endeavors. By opting for an education loan instead of other credit alternatives, students can minimize their long-term financial commitments through decreased interest payments. Essentially, choosing an education loan results in significant savings over an extended period. This allows students to allocate their resources wisely and achieve their educational goals without excessive financial burden.

4. Enhancing Career Opportunities

Investing in higher education through an education loan can open up a world of career opportunities. Employers frequently hold candidates possessing advanced degrees or specialized certifications in high regard, recognizing their heightened proficiency and unwavering commitment. By obtaining a higher education degree, students enhance their knowledge and skills, making them more competitive in the job market. An educational loan, therefore, represents an investment toward future vocational expansion and the augmentation of earning capabilities.

5. Skill Development and Networking

Apart from acquiring academic knowledge, higher education presents avenues for honing skills and establishing networks. Colleges and universities create an environment that fosters the development of crucial abilities like critical thinking, problem-solving, and effective communication. Moreover, these educational institutions are often home to a diverse student community, facilitating the formation of valuable connections and networks that can prove advantageous in one’s professional journey.

6. Investing in Long-Term Financial Stability

When considering education loans, it’s essential to see them as an investment aimed at securing long-term financial stability. The pursuit of higher education opens up doors to lucrative employment prospects and upward career mobility. Through the acquisition of a degree or specialized certification, individuals boost their income potential and enhance their overall financial well-being. Although education loans involve initial debt, the returns they yield can surpass these liabilities, paving the way for a solid and prosperous financial future.

7. Lifelong Learning and Personal Fulfillment

Education extends far beyond the boundaries of traditional schooling, embracing a lifelong odyssey. Engaging in higher education permits individuals to immerse themselves in their passions, delve into uncharted territories, and perpetually broaden their reservoir of knowledge. Through the aid of an educational loan, students can pursue degrees or courses that resonate with their personal aspirations and deep fulfillment. By committing to the enrichment of their education, individuals embark on an enduring voyage of learning, attaining personal contentment, intellectual maturation, and a profound sense of satisfaction.

The Bottom Line

When it comes to financing higher education, securing a loan in Singapore brings a host of benefits. These loans not only make education more accessible and affordable, but they also come with advantages like flexible repayment plans and reduced interest rates. Beyond the financial aspect, education loans foster personal and professional growth, broaden horizons on a global scale, and foster a sense of community. By exploring the option of an education loan, students can overcome financial obstacles and open doors to a promising future brimming with possibilities for advancement and achievement.

Embrace the Best in Education Financing with Accredit Moneylender in Singapore

Education is an essential part of your journey, and it’s not something you want to compromise on. Whether you’re nurturing your kids’ growth or pursuing your own advanced studies, finding outstanding courses and prestigious institutions is absolutely crucial.

But here’s the thing, sometimes those regular study loans just don’t cut it. That’s when you need to pull out your secret weapon: personal loans specifically designed to finance your education and cover those school-related expenses. And guess what? Accredit Moneylender in Singapore has got your back, offering you the absolute best solution for funding your education.

So don’t let financial barriers stand in the way of your dreams. Take control of your future and start exploring the incredible possibilities that await you today.